Can Saudi Arabia Become a Computing Power Center Through Investment?

![]() 10/27 2025

10/27 2025

![]() 506

506

Saudi Arabia is Redefining Its Wealth Composition.

On April 25, 2016, the Saudi Arabian government (hereinafter referred to as 'Saudi Arabia') unveiled the 'Saudi Arabia 2030 Vision,' aiming to position the country among the top 15 global economies by 2030. It seeks to increase the total assets of the Saudi Public Investment Fund (PIF) from $160 billion to nearly $1.9 trillion, elevate its Global Competitiveness Index ranking from 25th to the top 10, raise the proportion of foreign direct investment in GDP from 3.8% to 5.7%, boost the private sector's GDP contribution from 40% to 65%, increase the share of non-oil foreign trade exports from 16% to 50%, and enhance government non-oil fiscal revenue from $43.5 billion to $266.7 billion.

When Money Merely Represents Numbers, Traditional Tycoons Seek 'Skill-Based Earning Methods.'

01 The Traditional Way of Making Money is So Boring

Saudi Arabia's traditional petroleum economy, controlled and dominated by the state (through Saudi Aramco), relatively weakens the domestic economy's innovative vitality on a macro level.

The Saudi Arabia 2030 Vision clearly reflects the government's determination to reduce its economic reliance on the traditional petroleum industry. With the explosion of AI large models, computing power, as the new-generation 'petroleum,' has become a crucial field for this traditional energy giant.

From the end of 2023 to the beginning of 2024, Saudi Arabia boasted 22 active data centers, with the number expected to reach 62 in the coming years.

As OpenAI unveiled its 'Stargate' plan, global data center construction surged in 2025.

In May 2025, coinciding with Trump's second visit to Saudi Arabia, AMD announced a collaboration with Humain, a Saudi AI company. (For more on Humain, refer to the previous original article 'Semiconductor Industry in the Middle East: A Bright Future' by Semiconductor Industry Vertical and Horizontal)

Numerous American tech companies have chosen to 'fly to the sands' and deploy their computing power in distant Saudi Arabia. The wealthy 'landlords' did not disappoint them. Following Trump's visit in May this year, Humain commenced the construction of its first batch of data centers in August 2025. Tareq Amin, CEO of Humain, revealed that the campuses in Riyadh and Damman in the eastern province are expected to become operational in the second quarter of 2026, with an initial capacity of 100 megawatts.

By 2030, Humain plans to add 1.9 gigawatts of data center capacity. According to currently available information, the Stargate plan aims to construct data centers with a total computing power of 4.5 gigawatts in the United States by 2030. In other words, this company will aggregate over one-third of the 'Stargate power.'

Saudi Arabia Aims to Establish Itself as an AI Powerhouse in the Middle East.

In August 2025, Saudi Arabia's newly established AI company, Humain, initiated the construction of its first batch of data centers within the country, planning to commence operations in early 2026 and utilize semiconductors imported from the United States.

02 A Desert Becomes a Blue Ocean for Data Centers

After NVIDIA and AMD announced their collaborations with Humain, Intel's CEO, Chen Liwu, met with Saudi officials this month to discuss potential cooperation in the semiconductor and AI sectors.

Companies sensing the opportunities in Saudi Arabia's data center market are not limited to the three giants.

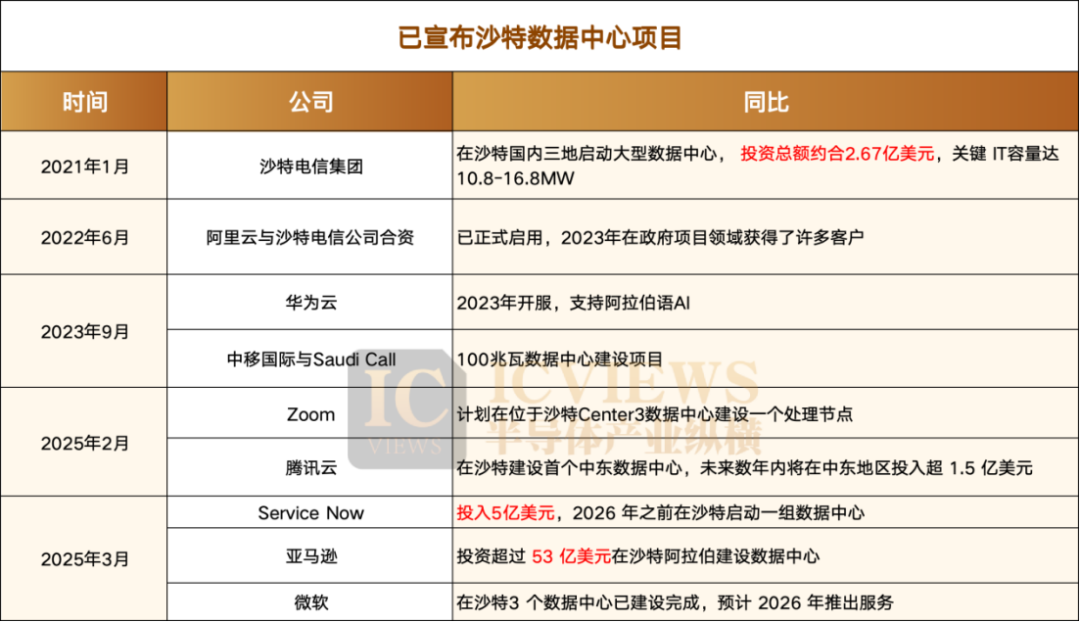

Semiconductor Industry Vertical and Horizontal has compiled a list of some confirmed data center projects in Saudi Arabia since 2021. It is evident that before 2024, most projects were collaborations between Saudi Arabia and China. These projects are currently operational and form the basic foundation of Saudi Arabia's cloud computing market, serving the retail, fintech, internet, AI, and other needs in the Middle East region centered around Saudi Arabia.

Following Huawei and Alibaba's entry into the Saudi data center market, Tencent Cloud officially announced in 2025 that it will build its first data center in the Middle East in Saudi Arabia and invest over $150 million in the region over the next few years to meet local industrial innovation needs.

03 Why Do Tech Companies Favor Saudi Arabia?

Electricity Prices 'Plummet'

Another significant issue for data centers is energy consumption. The electricity usage of data centers in the United States has become a 'thorny issue' for American tech giants. In 2023, data centers operated by companies like Amazon, Google, Meta, and Microsoft accounted for 4% of the total electricity consumption in the United States. U.S. government forecasts indicate that this proportion could climb to 12% by 2028. Since AI processing is more energy-intensive than streaming or standard cloud workloads, Amazon CEO Andy Jassy has publicly stated that power supply is the primary bottleneck limiting new data center capacity. Since 2020, the average residential electricity price in the United States has risen by over 30%. A study by Carnegie Mellon University and North Carolina State University estimates that electricity prices across the United States could increase by another 8% by 2030, with prices in states like Virginia potentially rising by as much as 25%.

In Saudi Arabia, electricity consumption is not a concern. The Saudi Electricity Company has a generation capacity of 40,858 megawatts and an annual electricity sales volume of 212.263 billion kilowatt-hours, basically meeting the electricity demands of industrial and agricultural production as well as residential life. Future plans include building 10 new gas-fired combined cycle power plants with a total installed capacity of no less than 20 gigawatts, 16 new nuclear power plants with a total installed capacity of 22 gigawatts, and a 4-gigawatt pumped-storage hydroelectric plant. Chinese companies investing and establishing factories in Saudi Arabia do not need to provide their own power generation equipment.

With its unique strategic position connecting Asia and Africa and a robust power infrastructure, the Saudi Electricity Company is implementing a five-year development plan to enhance transmission capacity. It plans to add 66,000 kilometers of transmission lines and build 290,000 kilometers of distribution lines, including two new 7-gigawatt DC high-voltage transmission lines and 259 substations. Saudi Arabia plans to invest a total of 500 billion Saudi riyals in 2,600 grid-related projects over the next 7-8 years to improve grid stability and reliability.

In September 2024, the average industrial electricity price in the United States was 8.51 cents per kilowatt-hour. According to data from the Ministry of Foreign Affairs' Investment Guide, the industrial electricity price in Saudi Arabia in 2024 ranged between 5 and 8 cents per kilowatt-hour. According to relevant agency forecasts, OpenAI requires 3,617 NVIDIA HGX A100 servers to support ChatGPT interactions, including 28,936 GPUs, corresponding to approximately 564 MWh of daily electricity consumption. If AI applications were embedded in every Google search, it would require approximately 400,000-510,000 sets of NVIDIA HGX A100 servers to support, corresponding to approximately 62-80 GWh of daily electricity consumption.

Based on the above data, data centers in Saudi Arabia can save hundreds of millions of yuan in electricity costs annually. According to forecasts, the annual electricity consumption of data centers in the United States could reach 1.2 trillion kilowatt-hours by 2030. Calculated at a price difference of 5 cents per kilowatt-hour, this would result in a staggering price difference of $6.12 billion.

From a cost-saving perspective, Saudi Arabia's electricity prices have become the most crucial factor attracting tech giants.

Simply Desert

For tech companies, data centers must meet stringent sustainability requirements. These challenges pose obstacles for companies seeking to establish data centers in Europe or the United States due to the abundance of forests and green spaces. The frequencies and waves emitted by servers, and even the heat they generate, can directly impact the surrounding natural environment. In contrast, what Saudi Arabia may lack the most are forests and green spaces. Its vast expanse of yellow sand and desolate natural environment make it an ideal location for data center construction. Data centers built outside Saudi cities, through reasonable planning, can minimize negative environmental impacts to an imperceptible level, enabling companies to more easily expand their data center scale and enhance their ability to meet global demands.

Of course, Saudi Arabia has not entirely disregarded the environment. It plans to produce 9.5 million kilowatt-hours of renewable energy electricity by 2030, aiming to reduce its dependence on oil. The Saudi Ministry of Energy is responsible for 30% of the country's renewable energy capacity targets, with plans to build 27.3 GW and 58.7 GW of installed capacity in 2024 and 2030, respectively. The Saudi Public Investment Fund (PIF) will be responsible for the remaining 70% of the renewable energy capacity targets. Saudi Arabia plans to build 16 new nuclear power plants by 2030, at an estimated cost of $100 billion, with a total power generation capacity of 22 GWh per year, accounting for 50% of the country's total power generation at that time.

Among the strategic projects of Saudi Vision 2030, one can find the Sakaka Solar Photovoltaic (PV) Power Plant Project, solar PV cell and module manufacturing plants, and PV reliability laboratories, all contributing to the development of new energy sources.

Construction Costs

The construction of data centers involves considerations such as land, building materials, cooling equipment, and even backup generators. In the United States, all these aspects are subject to currently stringent tariff policies. Industry insiders in data center construction state that U.S. tariff policies will drive up the construction, equipment, and operational costs of data centers.

Saudi Arabia also offers relatively lower construction costs. Additionally, constructing data centers in the United States may involve complex and cumbersome procedures, as well as high labor costs.

04 Can Investment Foster Technological Hard Power?

For Saudi Arabia, merely becoming a hub for numerous data centers may ultimately result in it becoming a 'computing power-rich nation.' Exporting computing power, much like exporting oil in the past, may not align with the original intent of Saudi Vision 2030. After all, relying solely on computing power would make the industry overly dependent on American chip products.

Therefore, Saudi Arabia is also enhancing its capabilities in the scientific research sector.

In 2009, Saudi Arabia established the King Abdullah University of Science and Technology (KAUST), an international research university and the only public university in Saudi Arabia dedicated solely to graduate education. KAUST offers scholarships for master's and doctoral students across 16 academic programs, categorized into three faculties: the Biological and Environmental Science and Engineering Faculty, the Computer, Electrical, and Mathematical Science and Engineering Faculty, and the Physical Science and Engineering Faculty.

Recently, a research team at KAUST designed a vertically stacked semiconductor chip consisting of 41 layers of different types, approximately ten times taller than previously manufactured chips, with each layer separated by insulating material. The team produced 600 chips with similar performance and reliable functionality, using some of these stacked chips to achieve basic operations required for computers or sensing devices. The performance exhibited by these stacked chips is comparable to that of some unstacked traditional chips.

The team stated that the energy consumption required to manufacture these stacked layers is significantly lower than that of traditional chip manufacturing methods. This new type of chip is not intended for supercomputers but is more suitable for common devices such as smart home appliances and wearable health devices, reducing the carbon footprint of the electronics industry while providing additional functionality with each added layer.

KAUST's strategic focus is on transforming research into economically beneficial innovations. To this end, the university has established the National Transformation Applied Research Institute, reorganized its research institutions according to national priorities in research, development, and innovation, and set up a Deep Technology Innovation Fund with a budget of approximately 750 million Saudi riyals.

05 Final Thoughts on Saudi Arabia

In 2024, Saudi Arabia's GDP reached $1.09 trillion, and its tourism market experienced rapid growth, expected to reach $110.1 billion by 2033, with a compound annual growth rate of 8.4% from 2024 to 2033. According to the '2024 Global Innovation Index' released by the World Intellectual Property Organization, Saudi Arabia ranked 47th out of 133 countries (regions), up one place from the previous year.

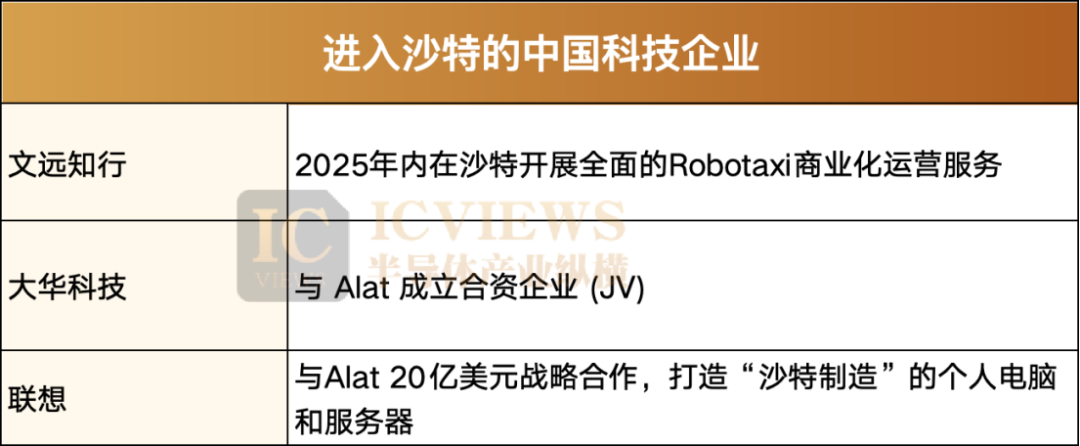

In recent years, investing in Saudi Arabia has become a popular venture domestically. Many Chinese tech companies have also entered the Saudi market to conduct business.

Opportunities come with risks. An individual with business operations in the Middle East told reporters that many investment projects in Saudi Arabia tend to generate a lot of noise but yield little results, especially those from Chinese entities. Many claim to have connections with the royal family, but ultimately, the projects fizzle out. Therefore, caution is advised when investing in Saudi Arabia.