How long is Huawei's L2 technology advantage period? Just 6 months left?

![]() 10/27 2025

10/27 2025

![]() 608

608

As Huawei faces increasing challengers, how long can its leading position last?

With the convening of the 32nd China Association of Automobile Engineers Annual Conference and Exhibition (SAECCE 2025) at the Chongqing Science Hall in China, the industry is rethinking assisted driving, autonomous driving, business models, and future logic.

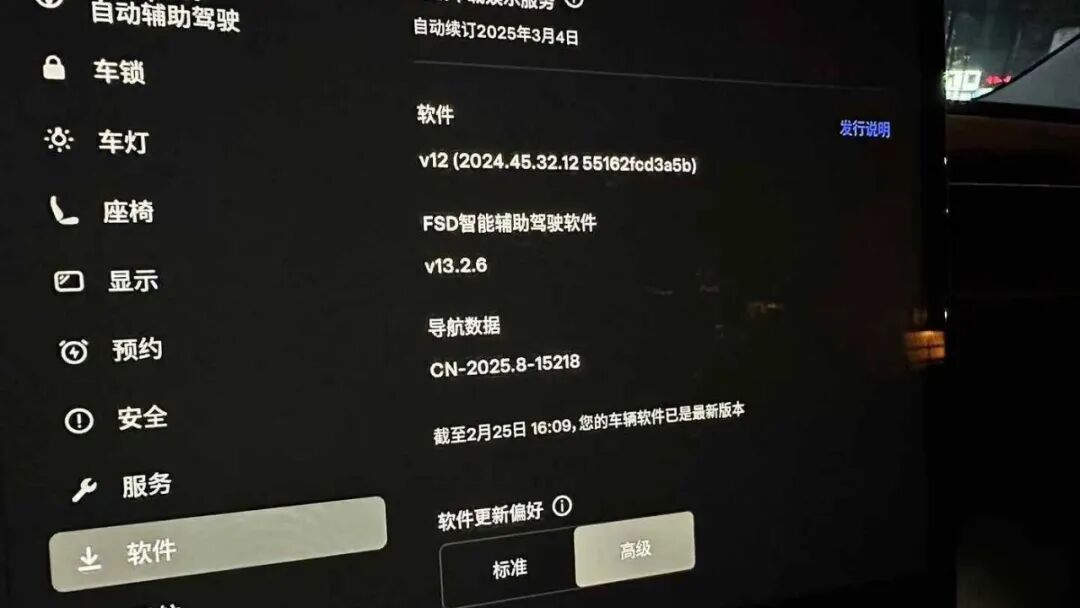

Going back a year, discussions emerged about challenging Huawei in intelligent driving assistance technology. This was triggered by Tesla's software update (version 2024.45.32.12) sent to some Chinese car owners on February 25, 2025, which included FSD assisted driving technology, cabin camera, and map package updates. Li Auto, XPENG, and other automakers with advanced technology were seen as catching up with Huawei's Qiankun Intelligent Driving Assistance rather than challenging it.

Subsequently, Huawei announced that it would launch an L3 autonomous driving highway commercial solution in 2025. The Zunjie S800 was launched at the end of May, officially mentioned as being built on an L3 architecture, and ADS3.3.2 began rolling out in June.

From various aspects, Huawei has undeniably achieved a leading position. However, as we enter the second half of 2025, with the release of more and more new technologies, clear signals of 'catching up and even attempting to surpass' have emerged.

At around the same time, competition among automakers for collaboration with Huawei intensified. The four brands under Huawei's ecosystem added Shangjie and launched its first model, the Shangjie H5. GAC Group, Wuling, Dongfeng Motor Corporation, Audi, and Toyota, among others, strengthened their cooperation with Huawei to create models like Qijing and Huajing or to launch deeply collaborative models. With more Huawei technologies, each company is attempting to create significant differences.

However, the question now is, with more and more competitors catching up, how long will Huawei's technological lead last?

Absolute advantage period: Only 6 months left?

Currently, competitors to Huawei in L2 intelligent driving assistance technology include:

Tesla's FSD is expected to enter China in 2026; Li Auto is accelerating the development of VLA; XPENG is transitioning from VLA to a world model plus high computing power; NIO's intelligent driving assistance, based on the NWM world model technology, is expected to see a major update in the first quarter of 2026.

Momenta has taken away many automaker clients from Huawei, including top brands like Mercedes-Benz and BMW; Horizon Robotics launched HSD to compete in the mid-to-high-end market above 200,000 yuan. Additionally, Qualcomm, Yuanrong Qixing, Qingzhou Zhihang, and even Zhuoyu are poised to make their move.

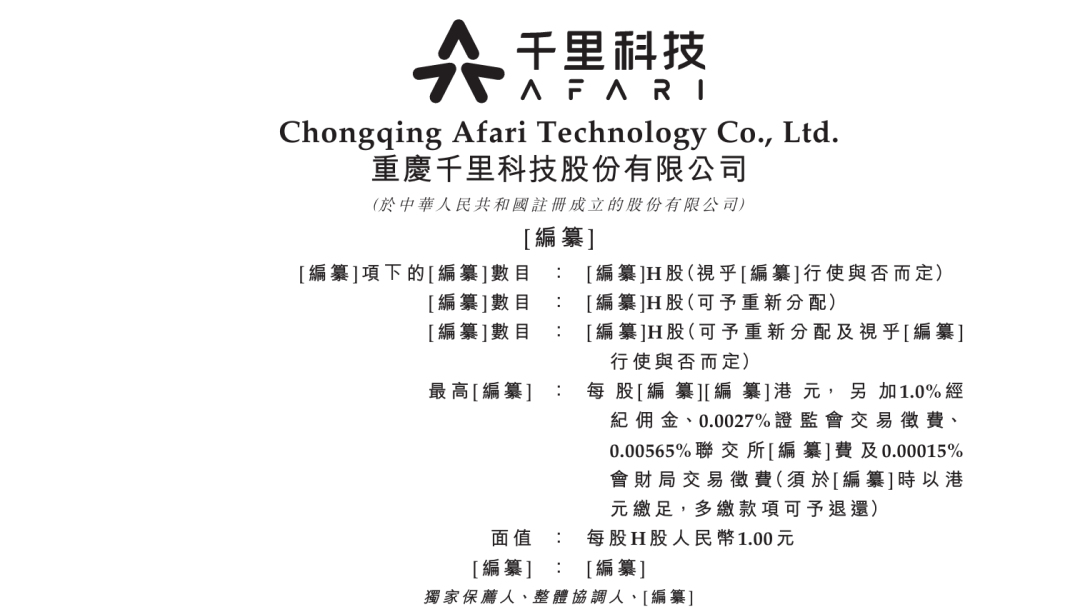

Furthermore, beyond this list, there are automakers like Geely and BYD focusing on in-house development. Qianli Technology has submitted its Hong Kong IPO application, and BYD's 'Divine Eye B and C' have successfully captured user attention. Once the 'Divine Eye A' can break out, it will have a stronger competitive edge.

The competitive landscape has formed, and expectations have emerged simultaneously. For example, Momenta's CEO, Cao Xudong, predicted that 'by 2026, the pattern of the first half of intelligent driving will be set, with possibly only two or three companies remaining in China and three or four globally.'

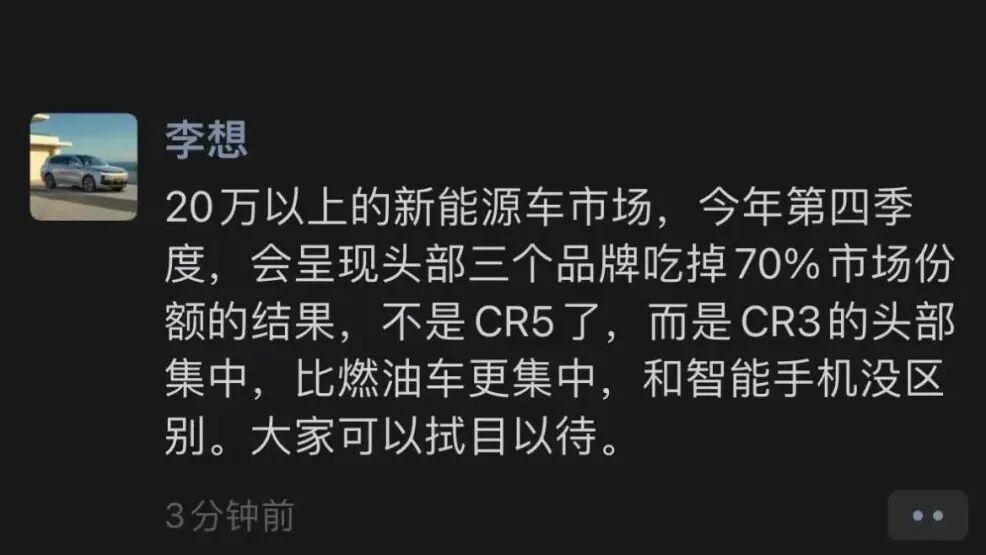

Cao Xudong's judgment is similar to Li Xiang's previous market analysis. Li Xiang once predicted that by the end of 2024, three companies would dominate 70% of the new energy vehicle market above 200,000 yuan, with subsequent trends mirroring those of smartphones.

Cao Xudong believes that urban intelligent driving assistance and high-level intelligent driving assistance will see only two or three companies (capturing the majority share) in the Chinese auto market by 2026. After 2026, entering the era of driverless technology, new 'super players' will emerge.

Whether this judgment will come true remains unknown, but it is clear that in the fourth quarter of this year and the first quarter of next year, the competitive landscape of intelligent driving assistance will change, as will the rankings of different technologies.

Considering usage rates, user experiences, word of mouth (reputation), and our practical testing conclusions, the current ranking is as follows: Huawei ADS firmly holds the first place, Li Auto using VLA ranks second, Momenta, Horizon HSD, and XPENG's XNGP temporarily tie for third, NIO ranks fourth or even lower, followed by other urban NOA assistance systems.

The reasons for Huawei's lead are self-evident. After the ADS4 update, although it cannot pass through many scenarios in urban areas that it could easily navigate a few months ago due to new safety policy requirements, it is believed that the next version will see significant upgrades. This is merely a data flywheel issue after a technology route switch, not a question of underlying capabilities. Currently, scenarios include ADS4's unprotected left turns being slower than 3.3.2. For example, in 3.3.2, Huawei ADS would not tolerate slow vehicles, would accelerate, and then merge. However, ADS4 is clearly limited by safety requirements, showing more hesitation and negotiation.

Li Auto's VLA currently exhibits some boldness and occasionally takes wrong routes. After XPENG's 5.7.8 update, users frequently report encountering systems running at extremely slow speeds, unable to reach maximum speeds. However, the sense of security has improved significantly, with fewer instances of phantom braking compared to before.

Horizon HSD and Momenta's new technologies have been experienced in the all-electric Mercedes-Benz CLA and Exeed models, with upcoming official launch versions. They can smartly make left and right turns, have minimal traffic violations, overtake slow vehicles, avoid obstacles, and accelerate and decelerate in a human-like manner. As for NIO, after the 1.2.0 update, it can generally assist well in most driving scenarios but often remains slightly slow or fails to pass certain situations, requiring intervention. However, the good news is that it has gone from unusable to usable.

This is the current situation, but significant changes are about to occur. If we take the first quarter of 2026 as the endpoint for backtracking results, Huawei's absolute technological advantage period may only last for 6 more months.

Switching lanes: L2 no longer needs to be far ahead

The 6-month judgment is based on competitors' update timelines and the inherent technological ceiling of L2.

After Li Auto rolled out OTA 8.0 on September 10, applying VLA, it achieved three-point turns, reverse extrication, and complex intersection navigation. It is expected that OTA 8.1 will arrive in December, featuring attractive capabilities like controlling the vehicle through dialogue, such as 'I want to go faster' and 'turn left ahead.'

NIO and Geely's Qianli Haohan will also enter the top competitor sequence, with visible signs. During the NIO ES8 launch event, Li Bin showcased a film of the next evolution of NWM, featuring two special scenarios. First, in an underground parking lot, through the voice command 'drive near the car wash,' the vehicle achieved autonomous driving in a small scenario. Second, when no parking space was available, telling the vehicle, 'park nearby and wait for me, don't block the way, and park when a space is available,' the vehicle would temporarily park on the roadside, yield when other vehicles departed, and then park in the space.

At that moment, the venue fell silent before erupting into noise. After all, NIO's vehicles have uniform hardware across the range. Li Bin also confirmed timely delivery of high-quality software versions at a recent meeting on fourth-quarter profitability targets. During the launch event, he mentioned that version 1.4.0, which would include the explosive features shown, was expected to roll out, with the latest estimate being the first quarter of 2026.

The logic behind Qianli Haohan is similar. Its H9 version, equipped on the Zeekr 9X, features five LiDAR sensors, dual Thor-U chips, 1400TOPS computing power, and infrared AEB. This will first iterate after the delivery of the Hyper version on November 20, with the first version receiving corresponding improvements and upgrades in the first quarter of 2026. As for basic capabilities, we can complete verification within two months.

Now, let's consider challenges from the supplier level, taking Horizon HSD and Momenta's performance in the all-electric Mercedes-Benz CLA as examples. Horizon HSD is particularly smooth; apart from waiting at traffic lights, the vehicle rarely comes to a complete stop, can merge, actively overtakes slow vehicles, and avoids obstacles. Momenta has also performed well recently, with judgment and stability on highways almost identical to Huawei ADS4, and in urban areas, it can achieve turns and find routes to avoid congested vehicles.

From a technological implementation perspective, Huawei ADS's current greatest capabilities lie in 'point-to-point' operation, 'operable in parking lots,' 'high consistency,' and 'low accident rates.' In contrast, NIO, Horizon, Momenta, and others currently require intervention before entering specific areas, while Huawei can navigate in and out of parking lots.

However, it must be admitted that in terms of minimizing human intervention, providing a sense of security, smoothness, overtaking slow vehicles, and avoiding obstacles, other automakers and companies are progressing rapidly, significantly narrowing the gap.

Moreover, an important point is that L2 remains assisted driving, not autonomous driving, with a clear technological ceiling. It does not allow hands-off operation, requires prolonged human attention to the road, and in many extreme situations, relies on human intervention rather than AI processing results. Therefore, as early as a few years ago, countless executives stated in public that L2++++ and L2.9, no matter how many plus signs are added, do not bring about essential breakthroughs and easily lead to homogeneous competition.

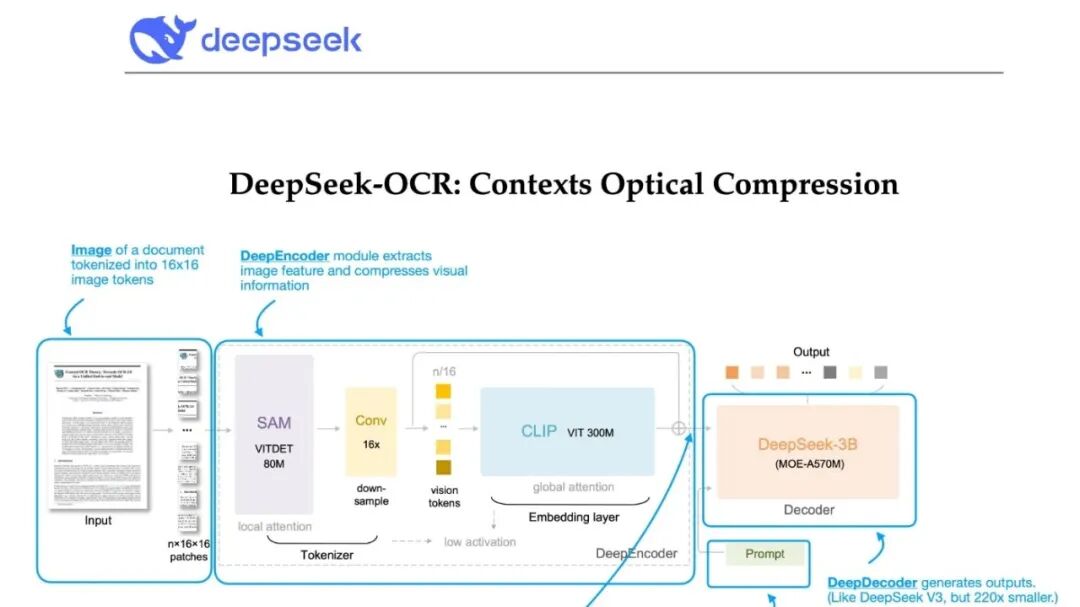

Certainly, there are still variables. Deepseek has just open-sourced its OCR large model. Its logic is to conduct a preliminary exploration of the feasibility of compressing long-text contexts through optical two-dimensional mapping technology. There is no need to delve into overly academic content. The key points to remember are that the model has a parameter count of only 3 billion, making it friendly for end-side devices and significantly reducing computational requirements. Moreover, due to its logic of visual compression of everything, it provides automakers with the possibility of bypassing technical paths such as VLM and VLA. Open-sourcing means a wide range of supply chain options are available. Under this huge variable, the period of technological advantage relying on large computational power and VLA will be significantly shortened, directly affecting the rankings in terms of technology and experience.

In simpler terms, after the new technology is implemented in vehicles, it can further disrupt the current pricing system for intelligent driving assistance. The overall situation will become one where more and more new technologies emerge at lower prices, and they will significantly catch up with the leaders in terms of capabilities.

So, in terms of business logic, Huawei Technologies faces increasing challenges ahead. Of course, it is highly likely to remain in the lead, but whether it can replicate its overwhelming dominance remains to be seen over time. However, from another perspective, can the battle over L2-level assisted driving continue indefinitely?

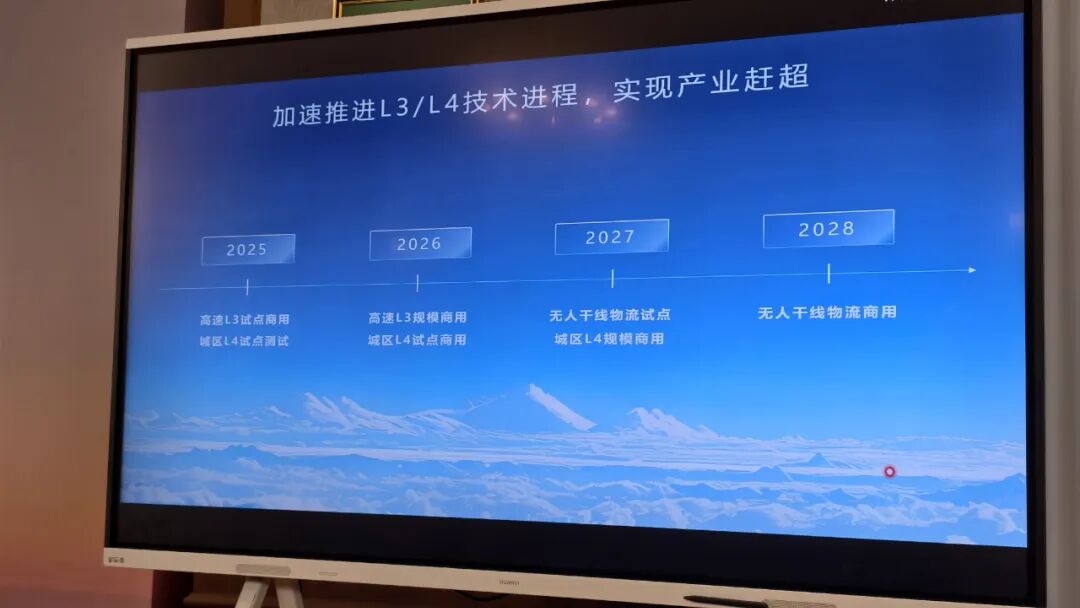

The answer is that autonomous driving at L3 and above represents the true battlefield, a truly vast expanse. Jin Yuzhi recently announced subsequent technological advancements in public. By 2026, assisted driving will possess high-speed L3 capabilities and urban L4 pilot capabilities. In 2027, there will be pilot projects for unmanned trunk logistics and large-scale commercialization of urban L4. By 2028, the goal is to achieve large-scale commercialization of unmanned trunk logistics.

In Conclusion

The situation is clear. Competing for the market before achieving L3-level autonomous driving is still competing within the existing market.

For example, Bosch recently announced a new perspective. Wu Yongqiao's logic is that intelligent driving for fuel vehicles represents a must-win high ground in 80% of the global market's existing inventory. At the same time, Huawei also announced its latest progress. The ADS 5.0 under development is already clear, with 10 billion yuan already invested. To achieve higher capabilities in autonomous driving, this figure will obviously increase further.

However, massive investments are about competing for the future. Therefore, the final conclusion is that the battle among leading companies like Huawei over L2-level assisted driving is expected to end within six months, and the next battleground will be autonomous driving and even driverless technology.