Is It Financially Viable for Tech Behemoths to Dive into AI Amidst Fierce Market Rivalry?

![]() 10/27 2025

10/27 2025

![]() 589

589

Over the past three years, AI has witnessed an unprecedented surge, with domestic tech giants fearing obsolescence, hastily jumping onto the AI bandwagon.

Currently, the AI sector remains a vast, largely uncharted territory, attracting staggering investments.

Media estimates reveal that in the first half of the year, just five tech titans—Alibaba, Tencent, Baidu, Kuaishou, and iFLYTEK—poured over 90 billion yuan into AI R&D.

Beyond R&D, these tech giants have also channeled funds into promising AI startups.

In this AI marathon, the question looms: Is the massive investment in AI justified? Is it a lucrative venture?

01

The Shovel Sellers Still Reign Supreme: Evaluating AI's True Worth

With a touch of dark humor, Goldman Sachs recently announced year-end layoffs, with an internal memo from executives stating: "To fully harness the potential of our AI investments, layoffs are a necessary step in our corporate transformation to demonstrate tangible results."

Ironically, just days before the layoff announcement, Goldman Sachs released a research report highlighting that corporate management is increasingly focused on leveraging AI to cut labor costs, heralding a jobless growth era in the U.S. economy.

For the AI industry, infrastructure businesses are relatively straightforward to evaluate, as their core operations clearly reflect business performance.

Image source: NVIDIA's official website

NVIDIA, a leading seller of AI chips, reported second-quarter revenue of $46.743 billion, a 56% year-on-year increase. Its data center segment revenue soared to $41.1 billion, marking a 56% year-on-year and 73% quarter-on-quarter surge.

Cambricon, a rare domestic provider of AI chips and solutions, witnessed its stock price skyrocket from over 600 yuan at the beginning of the year to nearly 1,600 yuan, earning it the moniker "Cambricon cogongrass."

Its revenue for the first three quarters reached 4.607 billion yuan, a staggering 2,386.38% year-on-year increase, with a net profit of 1.605 billion yuan.

02

Large Models and Their Application Pull Effects

Many users are currently enjoying free AI assistants from tech giants, essentially in the user acquisition phase, making it premature to discuss monetization and ROI.

However, what about AI's role in boosting traditional core businesses and enhancing internal efficiency?

In the second quarter, Baidu's non-advertising revenue, including Baidu Cloud and intelligent driving, hit 10 billion yuan, a 34% year-on-year increase, primarily driven by growth in its intelligent cloud business.

Li Yanhong revealed during the earnings call that Baidu Cloud's revenue surged by 27% year-on-year to 6.5 billion yuan, accounting for approximately 24.8% of core revenue. Similarly, Alibaba Cloud, Tencent Cloud, and cloud services from major operators also experienced significant growth.

Image source: Tencent's social media

Previously, Ma Huateng emphasized, "In the second quarter, we continued to invest in AI and reaped the benefits."

Tencent's financial report showed a 16% year-on-year increase in value-added services revenue to 91.37 billion yuan, with its gaming business, driven by AI, seeing a 22% year-on-year revenue hike.

Besides the growth in value-added services, marketing services revenue reached 35.76 billion yuan, a 20% year-on-year increase, primarily driven by AI-driven improvements in advertising platforms and the enhancement of WeChat's transaction ecosystem, boosting advertisers' demand for WeChat Channels, Mini Programs, and WeChat Search.

Alibaba's financial report highlighted that its AI-related product revenue has achieved triple-digit year-on-year growth for eight consecutive quarters.

Alibaba CEO Wu Yongming also stated at an earlier earnings call, "Looking ahead, we will firmly invest around the two strategic focuses of consumer spending and AI + cloud, seizing historical opportunities for long-term growth."

During the recent Double 11 promotion, Taobao and Tmall leveraged AI to boost recommendation information stream click-through rates by 10%, driving purchase efficiency up by as much as 25%, further solidifying their e-commerce dominance.

Additionally, AI is empowering specific fields, such as Kuaishou's Kling AI, which expects to double its revenue this year, and Meitu's AI imaging capabilities, which have driven revenue up by 12.3% year-on-year, with paid subscription users surging by over 42% year-on-year.

In reality, the competition for large models is far from over, with all companies still in the investment phase, making direct benefits elusive. As for business pull effects, each company may need to conduct a separate analysis.

03

AI Commercialization: Still in Its Infancy

One representative company in this regard is iFLYTEK.

In 2023, after unveiling its large model, iFLYTEK fully committed to AI.

The logic was sound: it could leverage its traditional technological strengths, empower its hardware products, and provide industry solutions.

Due to its early All in AI strategy, iFLYTEK's market value soared to nearly 200 billion yuan in June 2023. Now, it has plummeted by a third, leaving it at just 121.4 billion yuan.

While companies like Tencent and Alibaba saw their market values soar due to AI, iFLYTEK, which boarded the AI train early, ended up being left behind.

On October 20, iFLYTEK also released its third-quarter financial report.

Revenue reached 6.078 billion yuan, a 10.02% year-on-year increase. Net profit attributable to shareholders was 172 million yuan, a 202.40% year-on-year surge. Net profit attributable to shareholders after deducting non-recurring items was 26 million yuan, a 76.50% year-on-year increase.

For the first three quarters, revenue was 16.989 billion yuan, a 14.41% year-on-year increase. Net profit attributable to shareholders was a loss of 67 million yuan, an 80.60% year-on-year decrease. Net profit attributable to shareholders after deducting non-recurring items was a loss of 338 million yuan, a 27.83% year-on-year decrease.

Although it appears the company finally turned a profit in a single quarter, when considering the 268 million yuan in government subsidies received this year, it still struggles to make money.

Why can't iFLYTEK make money?

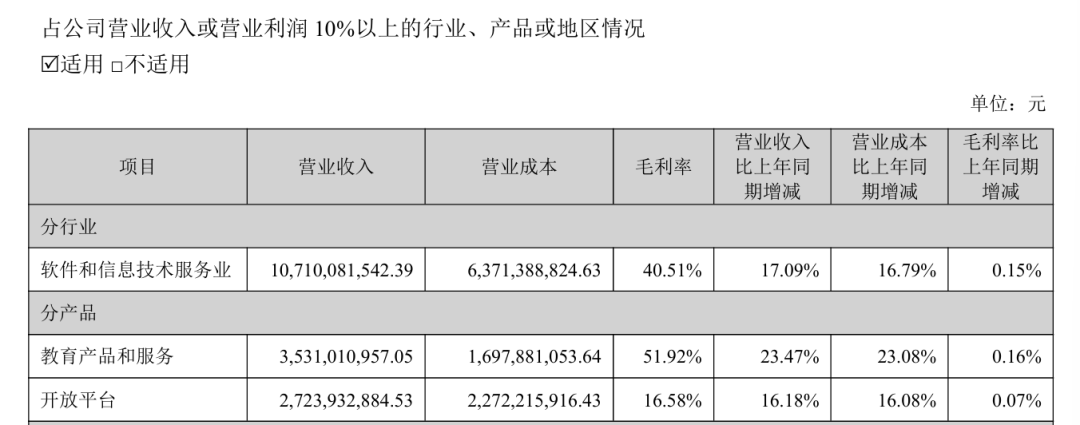

Analyzing its first-half financial report, we can see the operating conditions of its two core businesses.

Image source: iFLYTEK's financial report

Revenue from educational products and services increased by 23.47% year-on-year, while costs increased by 23.08% year-on-year, resulting in only a 0.16% year-on-year increase in gross profit margin.

Similarly, for its open platform, revenue increased by 16.18% year-on-year, while costs increased by 16.08% year-on-year, resulting in only a 0.07% year-on-year increase in gross profit margin.

This clearly indicates "increased revenue but decreased profits."

In terms of sales expenses, expanding and maintaining large clients in the G and B segments inevitably requires continuous investment in sales expenses.

For the C segment, according to Guojin Securities, to drive revenue growth for C-end hardware such as learning devices, the company has also increased channel marketing expenses.

Image source: iFLYTEK's social media

In terms of R&D expenses, investing in AI inevitably leads to an arms race.

From 2020 to 2024, iFLYTEK's R&D expenses increased from 2.211 billion yuan to 3.892 billion yuan, with the R&D expense ratio stabilizing at around 16%, which is already considered restrained.

In the first three quarters, iFLYTEK's cumulative sales and R&D expenses reached 6.4 billion yuan, accounting for approximately 37% of the company's revenue, with expense growth far outpacing revenue growth in the same period.

Ultimately, AI large models are still in the investment phase, and iFLYTEK, to avoid being left behind, has no choice but to keep up.

Moreover, even if it avoids being left behind, there are still limited paths for commercialization, and it is still somewhat premature.

Of course, companies that have gone All in AI but have not met expectations are far from just iFLYTEK.

If, like Goldman Sachs, the manifestation of improved business efficiency is layoffs, it seems rather ironic and darkly humorous.