Nvidia Joins Forces with Uber to Launch Robotaxi, with Hyperion 10 Making Its Debut!

![]() 10/30 2025

10/30 2025

![]() 490

490

Produced by Zhineng Technology

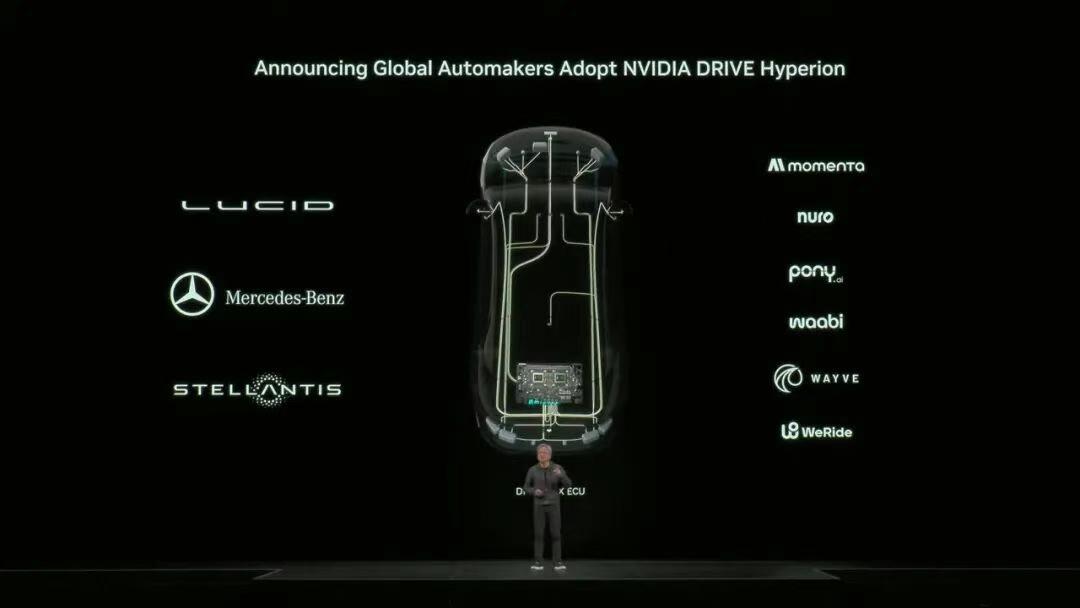

As the competition in the U.S. Robotaxi market heats up, Nvidia has officially stepped into the arena. Leveraging its comprehensive full-stack autonomous driving platform, DRIVE Hyperion 10, as its cornerstone, Nvidia is collaborating with Uber, Stellantis, Lucid, and Mercedes-Benz to propel the global adoption of Level 4 autonomous driving mobility solutions.

In the Robotaxi arena, Nvidia is broadening its horizons, evolving from a mere technology platform provider to an active participant in the mobility ecosystem. With an ambitious target of 100,000 units, the Robotaxi industry is poised to transition from the experimental stage to large-scale commercialization.

Over the past decade, Nvidia's strategic布局 (Chinese term, meaning "strategic layout" is kept for context but can be replaced with "strategic moves" for a more English-centric feel: "strategic moves") in the autonomous driving sector have revolved around the continuous enhancement of the DRIVE platform. From the inaugural DRIVE PX to the cutting-edge DRIVE AGX Hyperion 10, it encompasses a comprehensive end-to-end system, including sensors, algorithms, simulation, data closure, and cloud-based training.

Hyperion 10 is hailed as a 'reference-grade production architecture.' Its design ethos extends beyond merely aiding automakers in crafting vehicles primed for Level 4 autonomy; it also standardizes hardware and software interfaces for autonomous driving, facilitating a shift from 'customization' to 'scale' in autonomous driving system development.

At the engineering forefront, the Hyperion 10 platform amalgamates high-performance automotive-grade computing modules, omnidirectional perception sensor arrays, redundant control systems, and Nvidia's full-stack DRIVE AV software.

This implies that any automaker, mobility firm, or logistics platform can swiftly deploy a Level 4 autonomous driving system by merely adapting and validating it on this robust foundation.

This generalized architecture significantly lowers the entry barriers for Robotaxi commercialization, transforming autonomous driving from a complex R&D endeavor into an industrial capability that can be deployed on a massive scale.

Uber boasts the world's largest mobile mobility network, and its data and scenario resources are precisely the critical variables required for training autonomous driving systems. Meanwhile, Nvidia furnishes computational power, algorithms, and hardware standards. The synergy between the two equates to providing dual support for the Robotaxi industry, acting as both a 'foundational operating system' and an 'application distribution platform.'

What Jensen Huang refers to as the 'transportation transformation' aptly denotes this AI-driven infrastructure overhaul.

Uber aims to gradually scale up to 100,000 Level 4 vehicles post-2027. An entire ecosystem, encompassing hardware manufacturing, software deployment, and fleet management, is beginning to crystallize. Uber will oversee vehicle operation, maintenance, charging, and customer support. Concurrently, Nvidia's automotive manufacturing partnerships have also entered a new phase.

Stellantis, Lucid, and Mercedes-Benz have emerged as the pioneering manufacturers to advance Level 4 vehicles on the Hyperion 10 architecture.

◎ Stellantis is crafting an 'AV-Ready' platform, deeply integrating Nvidia's AI technology to supply Uber with its initial batch of approximately 5,000 Robotaxi models. Hardware and system integration will be jointly executed by Stellantis and Foxconn, with mass production slated for 2028. This also encompasses the collaborative definition of the vehicle's electronic architecture, computational power layout, and sensor redundancy design. Stellantis' Level 4 platform can be repurposed for a wider array of commercial and passenger vehicle scenarios in the future.

◎ Lucid's strategy is more geared towards the high-end market. Its forthcoming flagship model will incorporate Nvidia's full-stack DRIVE AV software to achieve Level 4 capability. This signifies that autonomous driving is no longer restricted to urban operational fleets but is expanding into the high-end passenger vehicle sector.

◎ Mercedes-Benz is also forging deep cooperation based on the MB.OS operating system and the Hyperion platform. The new S-Class model will attain Level 4 autonomous driving capability in the future, serving as a flagship project that integrates Nvidia's algorithms, Mercedes-Benz's system integration prowess, and safety redundancy concepts.

Nvidia's strategy in the autonomous driving sector for commercial vehicles is also continually deepening.

Companies such as Aurora, Volvo Autonomous Solutions, and Waabi are harnessing the DRIVE platform to develop Level 4 autonomous trucks, expanding Nvidia's computational power demand in high-value scenarios like logistics, trunk transportation, and port automation, and constructing a comprehensive product matrix spanning both Robotaxi and Robotruck.

In Summary: Nvidia's foray into this domain will undoubtedly expedite and reshape the trajectory of Robotaxi development.