After Geely-Backed Firms Surface, SAIC-Backed ShenDao Files for Hong Kong IPO! Alibaba, CATL, and Momenta Join Its Ecosystem

![]() 10/30 2025

10/30 2025

![]() 478

478

Recently, the mobility sector has witnessed a flurry of capital movements. In June, Geely's Cao Cao Mobility made its debut on the Hong Kong Stock Exchange, with its stock price soaring nearly 150% at one point. Autonomous driving stars WeRide and Pony.ai are also poised for their Hong Kong listings soon.

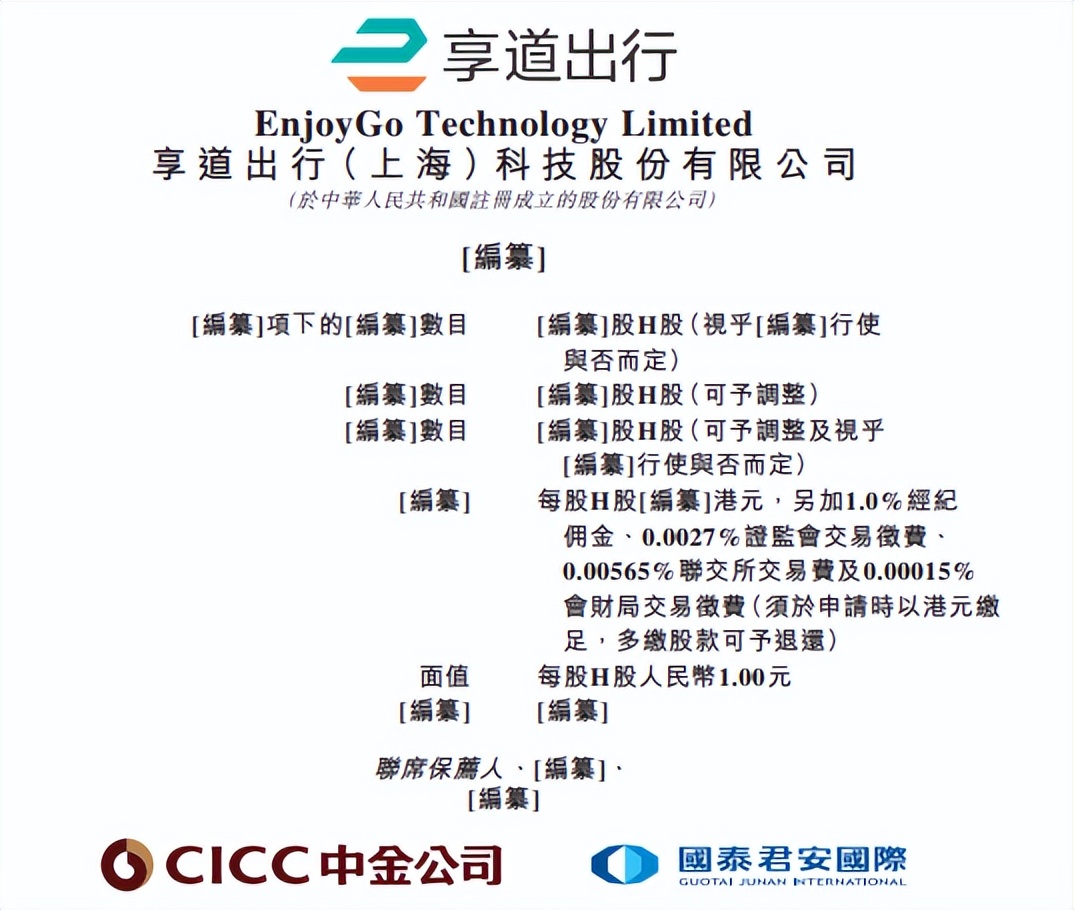

On October 28, SAIC Motor's ShenDao officially submitted its prospectus to the Hong Kong Stock Exchange, aiming to raise funds for autonomous driving R&D and Robotaxi services. This move has further fueled excitement in the mobility sector.

Backed by SAIC Motor and supported by industry giants such as Momenta, AutoNavi, and CATL, ShenDao has been branded with the labels of 'automaker DNA' and 'ecosystem' since its inception. According to the prospectus, in 2024, it ranked fifth among domestic online car-hailing platforms by total transaction value and second in the Shanghai market.

However, behind this impressive ranking lies a stark reality of persistent losses. By June 2024, cumulative losses attributable to company owners had reached RMB 4.953 billion, with revenue even declining in the first half of 2025. Fortunately, similar to Cao Cao Mobility, ShenDao's loss margins are narrowing at an accelerating rate.

In fact, the mobility market is at the final stage of transitioning from scale-based to value-based competition. Players like ShenDao and Cao Cao Mobility are leveraging capital to break through profitability bottlenecks, aiming to regain early advantages and secure a foothold in future mobility directions, such as Robotaxi.

Financing Leapfrog: Alibaba, CATL, Momenta, and AutoNavi Join Sequentially

Just as Cao Cao Mobility represents Geely Holding Group's strategic investment in its 'new energy vehicle sharing ecosystem,' ShenDao is also a core carrier for SAIC Motor to implement its 'New Four Modernizations' strategy in the automotive industry.

Leveraging SAIC's resources, the company completed full-chain preparations within six months of its establishment. It launched a trial operation of premium services in Shanghai and swiftly obtained a network car-hailing license, entering the market in a compliant manner.

In its second year, ShenDao established a clear business framework. In 2019, the company pioneered the 'Omni-Scenario Smart Mobility Complex,' covering online car-hailing, corporate vehicle usage, personal car rentals, and taxis through sub-brands like ShenDao Premium and ShenDao Rentals. Within a year, it surpassed one million users.

This multi-scenario, ecosystem-driven layout laid a solid foundation for its subsequent financing. According to public data, ShenDao has completed three major financing rounds—not numerous, but highly effective each time. In December 2020, ShenDao completed its Series A funding, introducing Alibaba and CATL with approximately RMB 330 million. It collaborated with the two investors to build data capabilities and safety defenses.

In its 2022 Series B funding, ShenDao further brought in autonomous driving solution provider Momenta and AutoNavi Maps, attempting to empower ShenDao Robotaxi with technology and capital to join the top tier of commercial operations.

ShenDao's third round of financing occurred just before its Hong Kong listing. In May of this year, it raised over RMB 1.3 billion in its Series C funding, the largest single financing in the industry in nearly three years. Investors included SAIC Motor, Shanghai International Automobile City (Group) Co., Ltd., and other state-owned capitals, demonstrating dual recognition from capital markets and local governments.

The company stated that this round of financing will initiate a new model of regional coordinated development for ShenDao, paving a fast track for the implementation of smart transportation and large-scale Robotaxi operations.

ShenDao CEO Ni Licheng pointed out that the three rounds of financing correspond to the three stages of 'data empowerment, technological breakthroughs, and ecosystem construction,' forming a spiral upward path of 'technology-scenario-ecosystem.'

Over One Million Drivers, Yet Revenue Suddenly Stagnates?

With a clear strategic layout, ShenDao's financial performance reflects the common dilemmas of the mobility industry.

According to the prospectus, from 2022 to 2024, the company's revenue grew from RMB 4.729 billion to RMB 6.395 billion, with a compound annual growth rate of 16.3%, mainly driven by sustained strong business expansion.

In 2024, its daily average orders exceeded 600,000, with a Gross Transaction Value (GTV) exceeding RMB 5.5 billion. By the end of the first half of this year, its online car-hailing services covered 85 cities in China. The number of registered drivers for ShenDao also continued to grow, increasing from 341,000 in 2022 to 899,000 in 2024, surpassing one million as of June 30 this year, reaching 1.062 million.

Notably, ShenDao successfully balanced scale expansion with a reputation for compliant operations. According to compliance data released by the Ministry of Transport, from January to October 2024 and in the second quarter of this year, ShenDao achieved a monthly average driver compliance rate of 95.6% and a vehicle compliance rate of 95.7%, with an order compliance rate of 93.5% and 92.9%, respectively. These figures far exceed industry averages (70%, 73%, and 69% for vehicle, driver, and order compliance rates among online car-hailing platforms in 2024).

This indicates that the company is gradually optimizing operational efficiency by improving service quality and compliance amid stricter regulatory environments. The continuous improvement in gross margin further confirms this. Its gross profit increased from RMB 49.49 million in 2022 to RMB 448 million in 2024, with the corresponding gross margin improving from 1% to 7%, and further increasing to 11.3% in the first half of 2025.

However, in terms of profitability, narrowing losses but still large-scale losses have been the main theme of recent performance, similar to its peer Cao Cao Mobility. From 2022 to 2024, the company's annual net losses were RMB 7.815 billion, RMB 6.039 billion, and RMB 4.072 billion, respectively, with the loss rate improving from 16.5% to 6.4%, indicating enhanced operational efficiency.

Additionally, the growth stagnation in the first half of 2025 is concerning. Although its loss for the period narrowed from RMB 212 million to RMB 115 million, and the net loss was compressed to RMB 1.147 billion, the company's revenue slightly decreased from RMB 3.1 billion in the same period of 2024 to RMB 3.013 billion.

Anxiety still lingers. Public data shows that after completing the aforementioned Series C funding, ShenDao's registered capital reached RMB 4.106 billion. However, ShenDao announced on July 14 that it would reduce its registered capital specifically to cover company losses. Recently, according to Tianyancha data, on September 25, the company's registered capital was reduced by RMB 3.756 billion to RMB 350 million, and the share reform was completed.

As of June 2025, the cumulative losses attributable to company owners were as high as RMB 4.953 billion. This 'capital reduction to cover losses' operation seems to reveal the pressure of long-term losses on the capital structure.

Fortunately, the improvement in cash flow from operating activities indirectly reflects the sustained release of operational effectiveness to some extent. From 2022 to 2024, its net cash flow from operating activities was -RMB 741 million, -RMB 378 million, and -RMB 204 million, respectively, finally turning positive to RMB 83 million in the first half of 2025.

While expanding scale and narrowing losses, the company's revenue growth momentum has weakened. This reflects that the online car-hailing industry has entered a stage of inventory competition (market saturation), with diminishing marginal effects of subsidies. The model relying solely on scale expansion faces challenges. If the listing is successful, how to balance growth quality and speed will remain one of the key issues for ShenDao to win investor recognition.

Robotaxi Pioneer: Building a 200-Vehicle L4 Fleet by 2026

The existence of growth anxieties does not hinder ShenDao's layout and expectations for future mobility.

In fact, ShenDao can be considered the first domestic L4-level autonomous driving operation platform with an automaker background. As early as 2021, it jointly launched the country's first L4-level autonomous driving operation platform with Momenta—ShenDao Robotaxi—and established a mature Robotaxi operation network in multiple locations such as Shanghai and Suzhou.

Over nearly four years of operation, ShenDao Robotaxi has completed over 330,000 orders, traveled over 2.5 million kilometers, and achieved nearly 100% user satisfaction. In June 2024, ShenDao was selected as one of the first batch of L3/L4 autonomous driving access pilots by the Ministry of Industry and Information Technology and other three departments (only nine companies nationwide), laying a policy foundation for its technological commercialization.

The 'vehicle-technology-platform' trinity autonomous driving ecosystem closed loop based on the ShenDao platform is ShenDao's core strategy.

After the Series C funding, ShenDao announced plans to jointly build an L4-level Robotaxi fleet with shareholder Momenta in Shanghai, aiming for a scale of 200 vehicles by 2026. It will reuse mass-produced hardware from SAIC's Zhiji LS6 and Feifan MARVEL R to reduce costs and enhance stability. Momenta's Flywheel large model supports rapid adaptation across multiple cities, breaking through operational design domain restrictions and accelerating global deployment. This trinity model will propel autonomous driving from technological verification to large-scale operations.

Additionally, data feedback and industrial chain synergy constitute long-term value. ShenDao Robotaxi not only provides real-world verification for intelligent driving technology but also feeds massive dynamic data back to SAIC's full-chain capability building. According to the prospectus, the funds raised from the listing will be prioritized for autonomous driving R&D to promote high-quality commercialization of Robotaxi. Over the next five years, the company plans to drive growth through large-scale operations and customized services, making smart mobility an infrastructure of cities.

The competitive landscape of the industry is being reshaped. After going public, Cao Cao Mobility explicitly emphasized strengthening its focus on autonomous driving. Companies like WeRide and Pony.ai, which specialize in autonomous driving, are also accelerating their deployments. ShenDao's differentiation lies in its backing by SAIC's vehicle manufacturing capabilities, data accumulation from its own operational scenarios, and full-chain support from industrial capital. According to the prospectus, the funds raised will be mainly used for autonomous driving R&D and Robotaxi service expansion, aiming to achieve model upgrades through technological driving.

However, the commercialization of Robotaxi still faces challenges. Factors such as technological maturity, regulatory completeness, and user acceptance collectively constrain large-scale deployment. ShenDao needs to balance short-term performance pressures with long-term investments, orderly advancing its autonomous driving layout while maintaining the health of its existing business.

From an industry perspective, competition among mobility platforms is shifting from scale expansion to ecological gaming. The profitability dilemma of single mobility businesses forces companies to extend upstream and downstream of the industrial chain or seek technological breakthroughs to achieve cost reduction and efficiency enhancement. ShenDao's 'manufacturing + mobility + technology' closed loop, built on SAIC, represents an exploratory direction of industry-finance integration.

After listing in Hong Kong, ShenDao will face stricter market scrutiny. How to prove to investors that it can not only tell a compelling Robotaxi story but also achieve sustainable profitability will determine its performance in the capital markets. As the mobility industry transitions from scale-based to value-based competition, ShenDao's IPO journey will serve as another important window for observing industry transformation.