Baidu Begins AI Qualitative Transformation This Q3

![]() 11/20 2025

11/20 2025

![]() 528

528

Author: Zhigang @ Internet World

“AI is a 'definite revolution.' It's not a trend but a direction.”

Duan Yongping stated this during a dialogue with Fang Sanwen, founder of Xueqiu, in California, USA.

AI has been Baidu's steadfast direction for over a decade.

Now, Baidu's AI strategy is gradually entering a 'harvest period.'

On the 18th (Eastern Time), Baidu released its third-quarter report, showing total quarterly revenue of RMB 31.2 billion. Following the release, Baidu's Hong Kong stocks rose by 3.86%, with Goldman Sachs, Citigroup, and other institutions raising their target prices for Baidu's U.S. stocks.

The reason for the target price increase lies in the strategic value of Baidu's long-term AI investment, which was validated in the Q3 financial report.

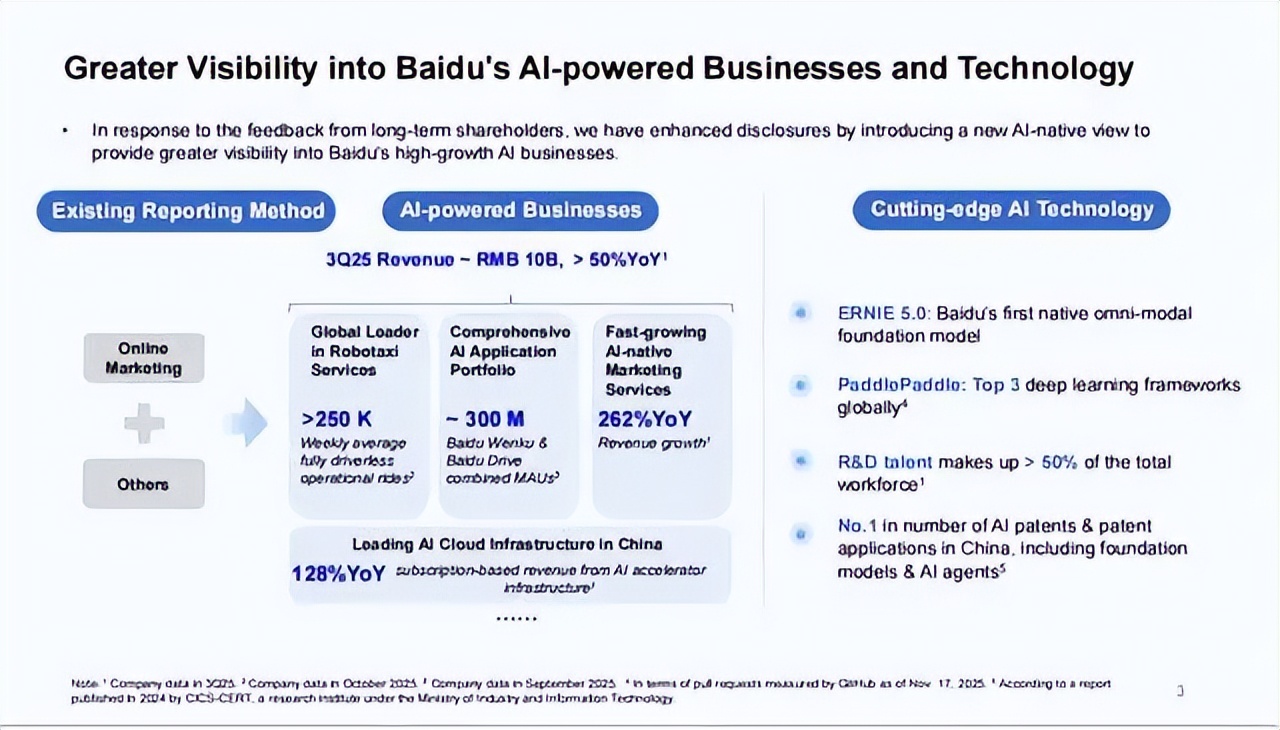

The third-quarter report disclosed business data from a new AI perspective for the first time: Baidu's AI business revenue surged over 50% year-on-year, with AI cloud revenue increasing by 33%, AI application revenue reaching RMB 2.6 billion, and AI-native marketing service revenue soaring by 262% to RMB 2.8 billion. Additionally, the financial report revealed that Baidu has invested over RMB 100 billion in the AI field since March 2023.

The third-quarter business growth confirms that Baidu's strategic choice of long-term AI investment is entering a harvest period.

From the beginning of this year, Baidu's Hong Kong stock price has surged by over 60%, indicating a shift in market perception: Baidu has completed the 'engine replacement on the highway' phase.

The market reaction after the financial report also indicates that as the AI transformation enters a sprint phase, Baidu's core value has successfully shifted anchor.

Baidu Begins 'AI Qualitative Transformation'

After reading this third-quarter report, it can be summarized in one sentence:

AI has become Baidu's new growth driver.

The third-quarter report shows rapid progress in Baidu's search business AI transformation. In October, 70% of Baidu's mobile search result pages contained AI-generated content; in September, the monthly active users of the Baidu App reached 708 million.

QuestMobile's '2025 Q3 AI Application Industry Report' shows that Baidu's AI search monthly active user base grew by 18.63% quarter-on-quarter, reaching 382 million, topping the domestic AI search industry for three consecutive quarters.

The third-quarter data indicates that Baidu's AI is no longer a 'single-point breakthrough' concept but drives comprehensive business growth.

Beyond search AI transformation, AI-native marketing service revenue, including digital humans and intelligent agents, reached RMB 2.8 billion, up 262% year-on-year. Intelligent agents and digital humans are driving a second growth curve for online marketing.

Additionally, with AI capabilities, Wenku and Netdisk have over 20 million active users, and Luobo Kuaipao's global ride service volume reached 3.1 million in Q3, up 212% year-on-year.

Summarizing the performance of each business segment, Li Yanhong stated, 'It comprehensively demonstrates the transformative value AI brings to our business.'

For Baidu, the value of transformation lies not only in financial growth but also in achieving phased results from sustained AI investments exceeding RMB 100 billion.

In the AI direction, Baidu exhibits an almost 'obsessive' commitment.

With over a decade of AI layout (strategic investment), Baidu has invested over RMB 100 billion in artificial intelligence since March 2023 alone.

This resolute investment has yielded a result: Baidu's AI foundation is solid, with precise business integration and reconstruction. The AI gene, deeply rooted in Baidu's DNA through long-term investment, is activating new growth value and opportunities for the company.

In terms of business, Baidu Search is accelerating its transformation from static links to intelligent, structured, and multimodal AI answers, thoroughly reconstructing Baidu Search.

AI-native marketing services are unlocking more growth opportunities, with Q3 revenue from intelligent agents and digital humans reaching RMB 2.8 billion, up 262% year-on-year.

Additionally, Baidu AI Cloud grew by 33%, with subscription revenue for AI high-performance computing infrastructure surging by 128% year-on-year.

In future industries, Luobo Kuaipao's global ride service volume reached 3.1 million in Q3, up 212% year-on-year, with business expansion accelerating. Furthermore, Luobo Kuaipao's globalization has further accelerated, entering overseas markets such as Switzerland and Abu Dhabi. The domestically developed Kunlun Core also announced its latest progress at the recent Baidu World Conference.

Whether a company is AI-driven depends not only on its steadfast investment in AI but also, more importantly, on its revenue structure.

Baidu's financial report, interpreted from a new AI perspective, precisely demonstrates its confidence:

In Q3, Baidu's AI business revenue across three categories totaled RMB 9.6 billion, up over 50% year-on-year. Structurally, AI business revenue accounted for approximately one-third of the total Q3 revenue.

Financially, AI genuinely represents Baidu's business core. AI as a growth engine is no longer a goal but a reality.

So, what is Baidu's core advantage in the AI field?

I believe it lies not just in user numbers or business scale but in the 'AI infrastructure ecosystem' built through decades of investment exceeding RMB 100 billion.

In the past, when thinking of Baidu, people associated it with search, Tieba, and Maps. Today, keywords like digital humans, AI, RoboTaxi, and Kunlun Core come to mind. Baidu has multiple cash cow businesses in the AI field.

While various large models and AI and autonomous driving companies have emerged, with financings and IPOs, only Baidu treats AI as a decade, century, or even longer-term endeavor.

Thus, Baidu's value anchor has shifted from search engines to AI.

Today, Baidu's AI penetrates various industries, enhancing efficiency across sectors while gradually becoming the primary growth engine for Baidu's revenue.

Baidu's AI digital employees boost corporate productivity, achieving scalable benefits at minimal cost. The newly released 'Famou' at the Baidu World Conference has been implemented in industries such as transportation, energy, logistics, and ports.

Baidu's AI qualitative transformation has begun.

Three Reassessments of Baidu: Where Does AI's Value Margin Lie?

Many companies operate in the AI field, but not all possess scarcity.

There are two types of AI scarcity: one is 'scarcity' brought by technological disruptions in vertical fields.

Typical examples include DeepSeek and NVIDIA, characterized by strong barriers in AI application areas, large user bases, and technological irreplaceability.

Another type: full-stack AI technology itself is a form of 'scarcity.'

Globally, two companies have a full-stack, self-developed AI layout: Google and Baidu.

In terms of AI application directions, Baidu has more opportunities than Google.

AI is a new technology. For long-term survival and development, it needs to find a mature industry for implementation. Only by integrating with existing industries can AI technology truly grow.

Li Yanhong has repeatedly emphasized that Baidu's development philosophy is application-driven.

Today, only China has the most complete industrial system globally, covering all industrial categories, and a consumer market of over a billion people. Therefore, Baidu's self-developed full-stack AI technology naturally has a larger implementation space.

Full-stack implies two things:

First: AI businesses are vertically distributed across industrial sectors.

For example, at the World Conference, Baidu released the new-generation self-developed Kunlun Core M100 and M300, as well as the latest Wenxin 5.0 full-modal model.

Additionally, Baidu AI extends into the AI cloud computing field, with an AI layout spanning from computing power to models and applications. Baidu's full-stack AI system penetrates various chains and links.

This means Baidu offers the most comprehensive and complete AI solutions on the market.

For enterprises, this implies that during the AI transformation process, they cannot bypass Baidu's AI technical capabilities and AI ecosystem influence. For individuals, Baidu's AI technology may deeply integrate into all aspects of work, life, and learning.

Second: Full-stack AI capabilities can foster more promising new businesses.

In the market's view, vertical AI industries have a 'shelf life.'

Over the past two years, AI has gone through the Chatbot cycle and the Sora cycle. Next, who knows which direction AI will break through in?

For Baidu, AI is no longer a specific business but a systematic capability. Under full-stack AI capabilities, once an AI direction is validated, Baidu will not miss any explosive opportunities.

In other words, the margin of AI capabilities defines Baidu's value margin. The more and longer Baidu invests in AI, the larger this value margin becomes.

As for the current time node, how far can Baidu's value margin extend? It still depends on how the market judges.

From a value judgment perspective, the market has three opportunities to reassess Baidu.

The first is the discovery of the value of the chip business.

The value of Baidu's Kunlun Core has always been underestimated until it won a RMB 1 billion order. This bid win was a powerful echo.

Since then, the market's perception of Baidu's chip business has changed.

In August this year, Kunlun Core's AI service products won a RMB 1 billion-level centralized procurement project from China Mobile. From late August to early October, Baidu's stock price surged.

The changes triggered by the chip business are just the beginning. From a fundamental perspective, the value of Baidu's chips extends beyond this.

On the one hand, the development of the AI industry has been included in the '15th Five-Year Plan,' ensuring future chip demand.

On the other hand, with stable and cheap electricity supplies and greater AI computing power demand (plenty of application scenarios), Kunlun Core has significant potential under the domestic substitution logic.

The second reassessment is Robotaxi, specifically Luobo Kuaipao.

As of November, Luobo Kuaipao has accumulated over 17 million global ride service trips. Its expansion to Switzerland and Abu Dhabi is also a signal.

Switzerland and Abu Dhabi are important windows. Based on this, whether Baidu's Robotaxi business will further expand to the Middle East and Western Europe in the future is a key point to watch.

From a valuation perspective, overseas expansion means opening up global market possibilities. Referring to Uber's USD 95 billion valuation, Luobo Kuaipao may be another opportunity for the market to reassess Baidu in the future.

The third reassessment is full-stack technology, with the value of AI transforming various industries being realized.

Although the current AI wave was triggered by Chatbot, AI encompasses more than just Chatbot; it drives efficiency transformations across various industries.

As Duan Yongping said, 'AI is a 'definite revolution.''

AI is an 'efficiency revolution' across all industries.

It is almost certain that not only in search but also in intelligent mobility, e-commerce consumption, industrial manufacturing, and other fields, the 'definite revolution' brought by AI will occur successively (successively).

The latter is the key to Baidu truly realizing the value of its full-stack AI.

In Conclusion:

During the third-quarter financial report conference call, Li Yanhong stated that Baidu would continue to explore AI innovations, creating tremendous value for users, enterprises, and society while consolidating its leadership in the AI era.

The third-quarter growth is just the beginning. On the AI path, Baidu will go further and further.

Disclaimer: This article is based on legally disclosed company information and publicly available data, offering commentary. However, the author does not guarantee the completeness or timeliness of this information. Additionally, the stock market involves risks; enter with caution. This article does not constitute investment advice. Whether to invest requires independent judgment.