Achieving profitability in just 6 quarters! Xiaomi Auto sets a record but still hasn't entered the safe zone

![]() 11/20 2025

11/20 2025

![]() 609

609

The critical test lies ahead next year.

Xiaomi sets a record for the fastest profitability among new automotive forces!

On November 18, Xiaomi Group officially released its third-quarter financial report for 2025, showcasing explosive performance in its automotive business: quarterly revenue reached 29 billion yuan, surging 199.2% year-on-year, achieving its first profit of 700 million yuan, and boosting its gross profit margin to 25.5%.

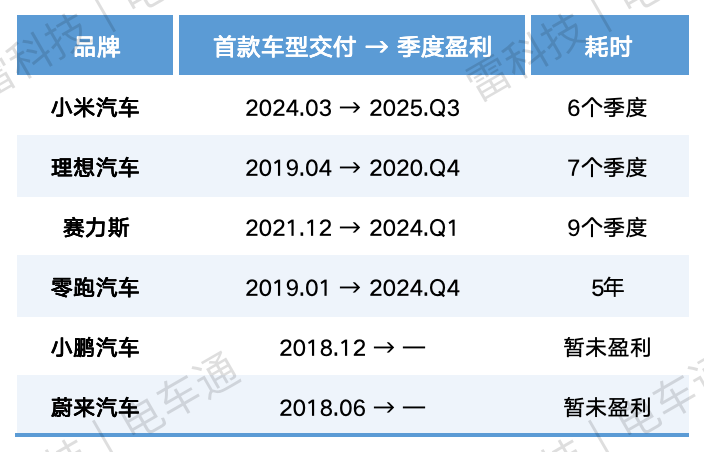

More critically, Xiaomi achieved quarterly profitability just six quarters after its first vehicle delivery, faster than rivals like Li Auto, NIO, and Leapmotor, becoming the "fastest-earning automaker" among new forces.

Chart: Dianchetong

However, what's even more surprising than "fast profitability" is "fast delivery."

During the financial results conference call, Xiaomi President Lu Weibing revealed that Xiaomi Auto will achieve its annual delivery target of 350,000 vehicles within this week.

From 136,000 vehicles last year to nearly tripling in less than 11 months this year, representing a year-on-year increase exceeding 150%. Behind this achievement lies far more than just the "dual-vehicle strategy."

Xiaomi Auto's crisis persists despite its high-profile success

For sales to soar, production capacity must lead the way.

Unlike traditional automakers' "steady production expansion" or some new forces' "production bottlenecks," Xiaomi Auto has forged a third path—leveraging a multi-factory parallel operation and supply chain collaboration strategy to achieve "Xiaomi speed" on the steep slope of production ramp-up.

Specifically:

The Phase 1 factory, designed for an annual capacity of 150,000 vehicles, has reached a monthly capacity of 24,000 vehicles under full double-shift operation, equivalent to an annualized capacity of approximately 280,000 vehicles. Equipment utilization is nearing its limit, effectively "squeezing" every ounce of production capacity.

The Phase 2 factory, also planned for an annual capacity of 150,000 vehicles, has steadily ramped up since starting mass production in August. Monthly production has increased from 8,000 vehicles initially to 20,000 vehicles, with sustained growth expected in the fourth quarter.

Thus, Xiaomi Auto has established a dual-front operational pattern ("Phase 1 at full capacity, Phase 2 accelerating") to lay a solid foundation for subsequent delivery growth.

The effectiveness of this production capacity strategy is most vividly reflected in delivery data.

Xiaomi Auto delivered 108,796 vehicles in the third quarter, including consecutive monthly deliveries exceeding 30,000 vehicles in July and August. Notably, in the last week of August, Xiaomi Auto surged to second place on the new forces' sales chart with 11,200 weekly deliveries, trailing only Leapmotor.

More "alarming" than sales volume is its profitability.

Source: Xiaomi Auto Official

Xiaomi Auto's gross profit margin has soared from 17.1% year-on-year to 25.5%, an 8.4 percentage point increase. This figure not only surpasses leading brands like Tesla (18%) and Li Auto (20.9%) but also ranks second only to Seres (28.93%).

Behind this high gross profit margin lies a precisely positioned product matrix. Like Seres, Xiaomi has successfully positioned itself in the mid-to-high-end market through a dual-vehicle strategy, forming a dual-vehicle matrix covering the 250,000-600,000 yuan price range. The mid-to-large SUV YU7, launched in June, has become a sales dark horse, with September sales reaching 22,369 vehicles and topping the domestic SUV sales chart in October.

The Xiaomi SU7 Ultra also demands attention, entering the high-end market with a starting price of 529,900 yuan. It secured over 10,000 reservations within two hours of launch, becoming a key pillar of brand premiumization. Product structure optimization has directly driven the average selling price (ASP) per vehicle from 238,600 yuan in 2024 to 260,100 yuan.

Source: Xiaomi Auto Official

Xiaomi's management disclosed that besides ASP increases and economies of scale from production capacity release, the decline in core component costs is also one of the reasons for the significant rise in gross profit margin.

Additionally, Dianchetong notes that Xiaomi Auto's emphasis on the "person-vehicle-home full ecosystem" has become a hidden profit engine.

As of September 30, 2025, Xiaomi's AIoT platform has connected over 1 billion IoT devices, with 21.6 million users having five or more devices connected to the AIoT platform, a 26.1% year-on-year increase. Although direct device sales driven by automobiles have not been fully disclosed, the lifetime user value unlocked by the "person-vehicle-home" closed loop, as evidenced by Xiaomi Auto APP sales data, has opened up greater imagination for Xiaomi Auto.

Despite its current stellar performance and the likelihood of maintaining stability in the fourth quarter, Lu Weibing explicitly warned during the financial results conference call: "Next year will be highly challenging, with potential declines in gross profit margins."

This statement is not deliberate modesty but a sober judgment based on two major realities: first, the halving of new energy vehicle purchase tax subsidies will directly impact price competitiveness; second, industry consolidation is entering deep waters, intensifying competition further.

The purchase tax subsidy reduction policy, set to take effect next year, looms as a "Damocles' Sword" over all automakers. Subsidy cuts mean higher consumer prices, directly testing Xiaomi users' price sensitivity.

It should be noted that Xiaomi's current gross profit margin of 25.5% heavily relies on three pillars: economies of scale, component cost reductions, and ASP increases. Xiaomi Auto's pricing is indeed high, but Lei Jun has repeatedly emphasized that "high prices come with reasons," meaning the brand has limited flexibility in pricing and promotional strategies.

Essentially, Xiaomi Auto still competes for users in the mid-to-high-end market based on a "high cost-performance" logic.

Source: Dianchetong

As subsidies decline, cost pressures will further intensify—expanding after-sales service networks requires continuous investment, and supply chains face bottlenecks in further cost reductions. Once pricing strategies are constrained and costs become difficult to optimize, a decline in gross profit margins seems almost inevitable.

More severe (formidable) is the rapidly changing battlefield environment. Starting this year, traditional brands like BYD and Geely are accelerating their new energy transitions, launching increasingly price-competitive products. New forces like NIO, XPeng, and Li Auto are also continuously improving their product matrices. Xiaomi now faces not just internal "group stage" competition among new forces but an industry-wide, no-holds-barred "knockout stage."

Automobile purchase decisions involve longer cycles, with users demanding far higher standards for battery safety, after-sales service, and software iteration speed than for smartphones. Xiaomi still has shortcomings in after-sales network coverage and charging infrastructure. How to maintain growth momentum in such an environment will be Xiaomi Auto's true "big test" next year.

Will Xiaomi Auto's production capacity reach 1.2 million vehicles next year?

The media outlet "Auto Electric Appliance Magazine" has made a rather aggressive production capacity forecast: "If production ramp-up proceeds smoothly, coupled with potential merger and acquisition plans, Xiaomi Auto's annual production capacity could reach 1.17 to 1.2 million vehicles."

This forecast is not without basis: Xiaomi Auto's factory capacity utilization is nearing 200%. If both factories operate at 200% capacity utilization, annual output could reach 600,000 vehicles. Additionally, the Phase 3 factory's final assembly workshop is expected to commence production around the Spring Festival next year, while the Wuhan Phase 1 factory is planned for completion in May next year, reaching a monthly capacity of 35,000 vehicles by October. Coupled with potential capacity increases from mergers and acquisitions, the 1.17–1.2 million vehicle target seems theoretically supportable.

However, ideals are lofty, while reality is harsh.

From an industry implementation perspective, achieving million-unit production capacity still faces multiple constraints: new factory ramp-up cycles, supply chain coordination, and market demand alignment all involve uncertainties. Therefore, Dianchetong leans toward a more conservative judgment, believing that Xiaomi Auto's 2026 production capacity and shipments may align closer to Bloomberg's forecast of 782,000 vehicles.

In terms of production capacity planning, Xiaomi Auto will launch more segmented models next year. Besides facelifts for the SU7 and YU7 series, Xiaomi is expected to launch an extended-range SUV codenamed Kunlun and an "SU7L" positioned higher than the SU7.

Source: Weibo

The launch of new models will further stimulate sales, thereby driving factory production capacity. However, as previously mentioned, next year's new energy vehicle market will enter a phase of major consolidation. The domestic large extended-range SUV market already has many formidable models, with new entrants like the IM LS9 and Denza N8L joining the fray. Even without facing old rival Tesla, Xiaomi's extended-range SUV will face significant competition.

The Xiaomi SU7L, with more prominent dimensions than the SY7, may target the executive sedan market. However, competition in this segment is far more formidable than in mainstream markets, testing not just product strength but also brand premiumization, user reputation, and long-term scene-based experience. While the Xiangjie S9 series has indeed become one of the highest-selling new energy vehicles in this segment, it still lags behind the sales of luxury fuel vehicles like the Mercedes-Benz E-Class, Audi A6L, and BMW 5 Series. The market prospects for the Xiaomi SU7L remain unclear.

From an industry development perspective, achieving million-unit production capacity is no small feat for other new energy brands: BYD took three years to grow from 500,000 to 1 million annual sales, while Tesla's Shanghai factory took four years to reach 1 million annual sales from production commencement.

Xiaomi Auto's sales are expected to slightly exceed 400,000 vehicles this year. If it aims for 1 million vehicles next year, that equates to a year-on-year increase exceeding 130%, a daunting challenge amid intensifying industry competition.

In summary, the million-unit production capacity target is merely a theoretical projection based on factory expansion and current sales growth rates. However, between this ideal and reality lie multiple barriers, including market competition and industry development patterns. For Xiaomi Auto next year, the core challenge may not be " Impact millions of production capacity / sales (achieving million-unit production capacity/sales)" but finding a balance between rapid production expansion and stable operations, swiftly improving its service system to convert production capacity plans into market advantages, and securing a leading position amid industry consolidation.

Epilogue

Achieving the annual delivery target of 350,000 vehicles demonstrates that Xiaomi Auto's automotive strategy has achieved initial success. Behind this, the production capacity advantages of multi-factory layouts and supply chain coordination have played a crucial role.

However, the 2026 industry upheaval will be Xiaomi Auto's true test.

With purchase tax subsidy reductions and intensifying market competition, Xiaomi will face dual pressures of declining gross profit margins and slowing growth. Currently, Xiaomi must focus on three critical tasks: swiftly addressing after-sales and charging network shortcomings, deepening software service ecosystems for sustainable profitability, and controlling production capacity expansion to ensure development quality.

From a long-term perspective, Xiaomi Auto's core competitiveness still lies in "technology" and "ecosystem." If it can deeply integrate the extreme efficiency and user insights honed in the smartphone industry with the automotive sector, continuously improve its product matrix, and expand globally, Xiaomi still has the potential to emerge as a leading player in the industry's ultimate consolidation.

However, there are no shortcuts in the automotive industry. Xiaomi must find a balance between scale and profit, technology and market, short-term and long-term to secure its place in the final round.

(Cover image source: Xiaomi Auto Official)

Xiaomi financial report, new forces, Xiaomi Auto, Xiaomi SU7

Source: Leikeji

Images in this article are from the 123RF licensed image library. Source: Leikeji