Masayoshi Son won another bet, earning 1 trillion yuan in 8 years and becoming a big winner in AI chips

![]() 06/18 2024

06/18 2024

![]() 579

579

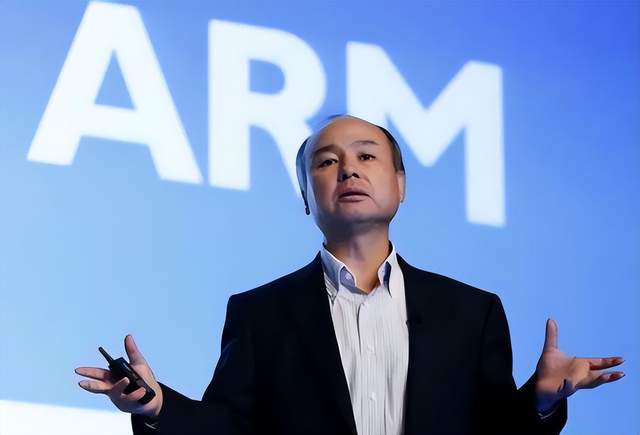

Some time ago, ARM made a bold claim to the industry that it would capture 50% of the PC market share within 5 years.

What gives ARM the confidence? Of course, it's AI PCs. Currently, the entire PC industry has begun to transform and transition to the AI stage, and Microsoft's AI PC prototype also uses ARM chips as the CPU.

Because AI PCs focus more on NPU, not just CPU and GPU, ARM has an advantage in NPU computing power compared to X86 architecture chips.

Due to the popularity of AI and ARM's promising future in AI PCs and other AI fields, ARM has been soaring in the capital market.

As of now, ARM's market capitalization has reached $168 billion, equivalent to 1.22 trillion yuan in Chinese currency.

When Masayoshi Son bought ARM, he only spent $32 billion, which means this investment has earned him about $136 billion, equivalent to nearly 1 trillion yuan in Chinese currency.

If AI PCs continue to gain popularity and ARM's market share continues to rise, ARM's performance will be even better, and Masayoshi Son is likely to earn even more.

Masayoshi Son acquired ARM in 2016, based on his belief that the next 10 years would be the era of the Internet of Things (IoT), and ARM, as the monopolist of IoT chip architecture, would have tremendous development prospects.

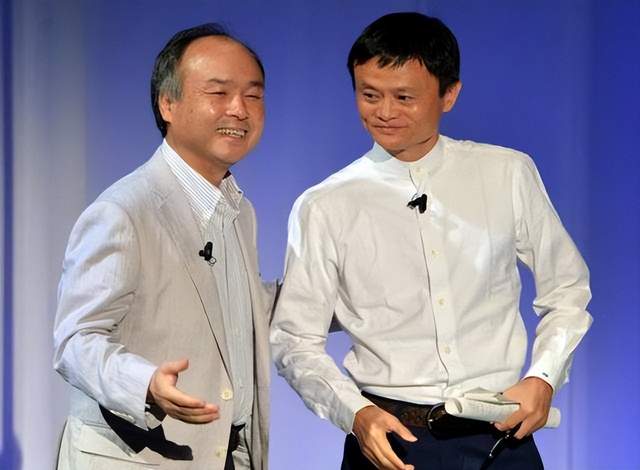

To raise the $32 billion, Masayoshi Son sold $10 billion worth of Alibaba shares and sold Supercel shares to Tencent for $8.6 billion, ultimately reaching the $32 billion mark.

However, in the years following the acquisition, ARM's development did not meet Masayoshi Son's expectations, with revenue and profits barely growing, much to his annoyance. After all, investing $32 billion with little return is a loss.

At the same time, the Alibaba shares and Supercel that were sold back then skyrocketed. If Masayoshi Son had not bought ARM and kept his original assets, he would have earned more than $20 billion.

Coupled with the internet bubble during those years, Masayoshi Son's Vision Fund suffered significant losses. Therefore, in 2020, he planned to sell ARM to make up for the fund's losses. At the time, Nvidia expressed interest in acquiring ARM for $40 billion.

However, both ARM and Nvidia are world-class chip giants, and their actions have a significant impact on the global chip industry landscape. At the time, companies like Qualcomm, Apple, and Intel all opposed this acquisition.

The UK was also reluctant to see ARM acquired by Nvidia, and the acquisition ultimately failed. Nvidia abandoned its acquisition of ARM and paid a "breakup fee" of $1.25 billion.

After failing to sell ARM, Masayoshi Son devised a plan to take ARM public and earn a fortune in the capital market.

Frankly speaking, if it weren't for the popularity of AI PCs, ARM's market capitalization would not have changed significantly. ARM's surge actually began in February of this year.

From February to now, ARM's market capitalization has increased by about 130%, making Masayoshi Son and his SoftBank Group the undisputed big winners.

It is reported that after experiencing a few years of troughs, Masayoshi Son's confidence has been greatly boosted with ARM's surge. He plans to establish an AI chip company to compete directly with NVIDIA. It is said that he intends to raise $100 billion for this venture.

In the past, investing in Alibaba created a legend, and this investment in ARM has once again made him a god. When and in which project will Masayoshi Son's next feat occur?