Weekly Stock Review | The Year of Humanoid Robots: Screwing Bolts and Rushing for IPOs

![]() 01/04 2026

01/04 2026

![]() 355

355

Reviewing the weekly automotive stocks, observing the diverse automotive market.

On December 25th, Christmas Day, investors were overjoyed as the A-share market continued its steady rise, with the Shanghai Composite Index achieving a seven-day winning streak.

By the close, the Shanghai Composite Index stood at 3,963.68 points, recording a seven-day winning streak. The Shenzhen Component Index closed at 13,603.89 points, marking a five-day winning streak, while the ChiNext Index ended at 3,243.88 points. The total turnover across the Shanghai, Shenzhen, and Beijing markets reached 1.9439 trillion yuan, up by 46.7 billion yuan from the previous trading day.

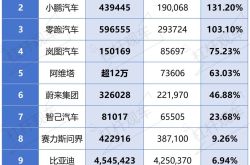

Specifically, over 3,700 stocks across the market rose, with the commercial aerospace concept sparking another wave of limit-ups. The humanoid robot concept also performed strongly, with over 10 stocks, including Chuangyuan Technology, Xusheng Group, and Fenglong Co., Ltd., hitting their daily limits.

A research report by Guoyuan Securities stated that 2025 marks a crucial year for global humanoid robots to transition from the 'technology demonstration phase' to the 'productization and order verification phase,' with distinct domestic and foreign paths emerging. Looking ahead to 2026, investment opportunities will revolve around complete machines, key components and core modules, and evolutionary paths.

Yuan Huaoming, General Manager of Huahui Chuangfu Investment, stated that the electronics industry, represented by the AI supply chain, is in an industrial expansion cycle with high capital demand. Coupled with clear policy support and a market preference for technology, funds are eager to seize industry development opportunities through private placements, focusing the private placement market on hard technology.

Among them, humanoid robots have become a key focus in the competition of advanced manufacturing industries across countries. Globally, humanoid robots are benefiting from a flurry of favorable policies.

The Trump administration incorporated them into national key strategies, with the U.S. Secretary of Commerce engaging with leading companies to formulate support policies. The Department of Transportation plans to establish a dedicated working group by the end of the year to advance technology implementation and intends to issue an executive order on robot technology in 2026, aiming to drive manufacturing resurgence through robots.

Following the Trump administration's favorable policies, Tesla accelerated its layout. The board's approval of Elon Musk's $1 trillion compensation package is directly tied to the condition of 'delivering a cumulative one million humanoid robots,' underscoring Tesla's commitment to industrialization.

Tesla's latest-generation humanoid robot, Tesla Optimus Gen 2, not only achieves a 30% increase in walking speed compared to its predecessor but also demonstrates fine operational capabilities, such as performing 90-degree squats and handling fragile items like eggs with dexterity.

In the domestic market, the Ministry of Industry and Information Technology defined humanoid robots as a new generation of disruptive products that will 'reshape the global industrial development landscape' in the 'Guidelines for the Innovative Development of Humanoid Robots.' This year, Beijing, Shanghai, Shenzhen, and other cities have successively introduced action plans related to embodied intelligence, vigorously promoting the development of the humanoid robot industry.

The competitive layout for humanoid robots began early. In 2024, Lei Jun invested millions to hire Luo Fuli, a post-95 AI genius girl, to lead the AI large model team. BYD quietly established a Future Laboratory, specializing in embodied artificial intelligence.

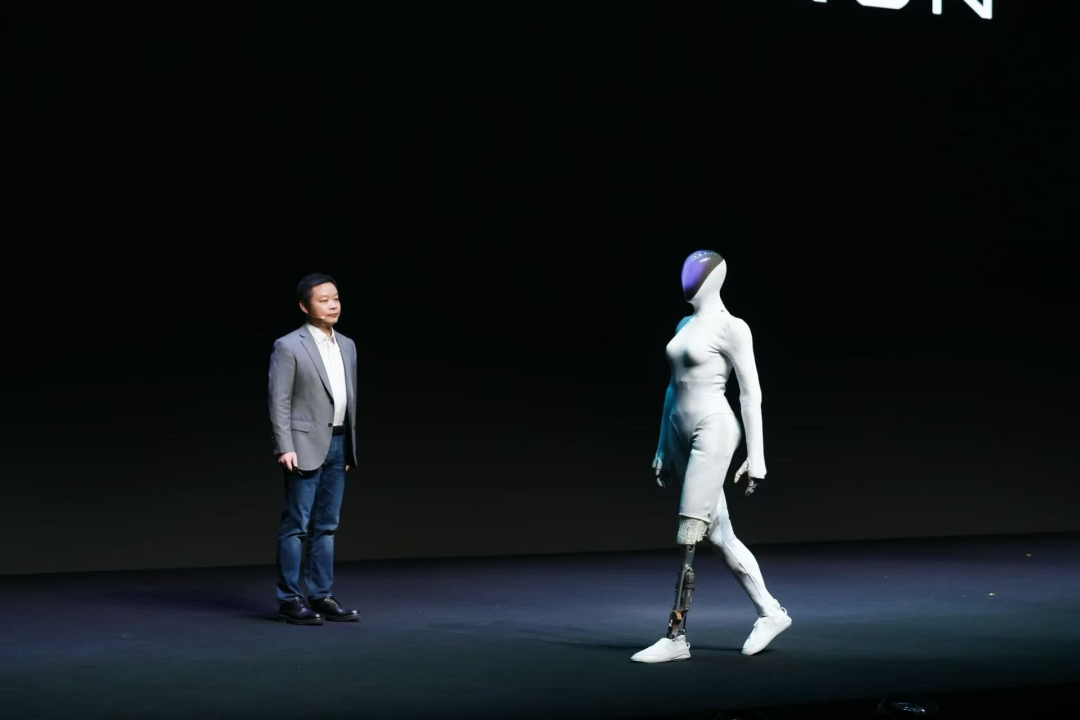

At this year's Tech Day, XPeng Motors proudly showcased its latest-generation IRON robot, which features a unique 'bone-muscle-skin' system, a human-like spine, and dexterous hands with 22 degrees of freedom. He Xiaopeng confidently claimed that this is not only the world's highest-computing-power humanoid robot but will also become one of the smartest robots next year.

Besides Tesla and XPeng, companies like GAC, Chery, Xiaomi, and BYD are also accelerating their layouts, either by releasing robot prototypes or through strategic investments.

GAC previously introduced its self-developed third-generation embodied intelligent humanoid robot, GoMate, and plans to achieve mass production of self-developed components in 2025. Chery unveiled its intelligent robot, Mo Yin, at the Global Innovation Conference in October 2025, explicitly viewing the robot business as the company's 'second growth curve.'

Currently, BYD and SAIC, two industry giants, have not directly entered the robot field but have chosen a differentiated path by investing in humanoid robot startups. Both have invested in Zhiyuan Robotics, leveraging external forces to quickly enter this track (sector).

From Tesla to XPeng, from GAC to Chery, from Seres to BYD, if an automaker lacks its own 'humanoid robot' plan, it is considered 'falling behind the trend.'

Two questions arise: Why are automakers extending their reach into the humanoid robot field? Why is the capital market optimistic about the humanoid robot sector?

Technological homology is key to the layout. Arguably, one of the biggest advantages for automakers in venturing into robotics is their mature supply chain system and scalable production capabilities.

'As automakers delve into artificial intelligence technologies through intelligent driving, they have discovered a broader space beyond car manufacturing,' industry insiders stated. Intelligent vehicles and embodied robots share the same AI technology backbone, exhibiting natural industrial synergy. The vast incremental space in the robot market is accelerating this wave of technological transfer.

Elon Musk once defined Tesla as 'effectively the largest robot, a robot on wheels.' 'We can apply the same technology to humanoid robots, making them even more useful.' 'The core components of robots highly overlap with the automotive supply chain,' BYD pointed out.

XPeng Motors wholeheartedly agrees. The AI leader at XPeng explained that both share similar perception systems (LiDAR, cameras), decision-making chips, and control systems. Even battery technology can be directly transferred.

Li Xiang has explicitly stated, 'Li Auto aims to become an artificial intelligence enterprise, not just an automobile company.' From Li Auto's perspective, L4 autonomous driving cars are essentially 'car robots' on the road. 'We are not building toys but constructing the next generation of intelligent terminals,' said Wu Jian, President of GAC R&D.

Although Roland Berger believes that 'the supply chain management experience accumulated over a century in the automotive industry is an advantage that startup robot companies find hard to match,' it is undeniable that the migration trend among component suppliers is more pronounced. For instance, Horizon Robotics incubated Diguabot, while leading automotive industry suppliers like Inovance Technology and RoboSense have also increased their investments in humanoid robots.

Furthermore, the humanoid robot sector, favored by the capital market and major tech companies, is underpinned by three investment logics.

First is policy. Policy serves as the core support for the tech sector, with humanoid robots receiving global policy boosts. Second is technological upgrading. Industry-wide collaboration is shifting the sector from 'concept hype' to 'performance delivery,' with a solid growth logic. Third is the vast prospect. Humanoid robots can cover two core areas: industry and services. Data from the China Electronics Institute shows that by 2030, China's humanoid robot market size is expected to reach approximately 870 billion yuan.

Based on this, the strong performance of humanoid robot concept stocks is not surprising.

In the first three quarters of 2025, the domestic robot industry saw 610 primary market financing events, doubling from 294 in the same period last year. The total financing received by domestic robot startups in the first three quarters was approximately 50 billion yuan, 2.5 times that of the same period last year.

This year, over a dozen companies have flocked to submit IPO applications. Geek+, Yunji Technology have successfully listed on the Hong Kong Stock Exchange. Unitree Technology is poised to become the first A-share humanoid robot company. Zhiyuan Robotics obtained a listing platform through the acquisition of Swancor and completed a management transition.

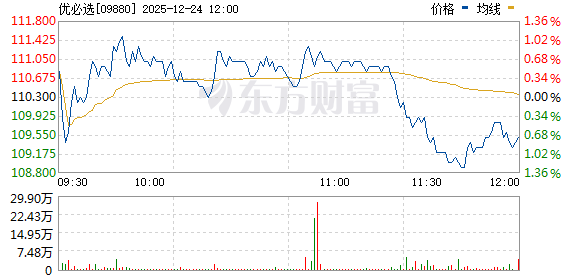

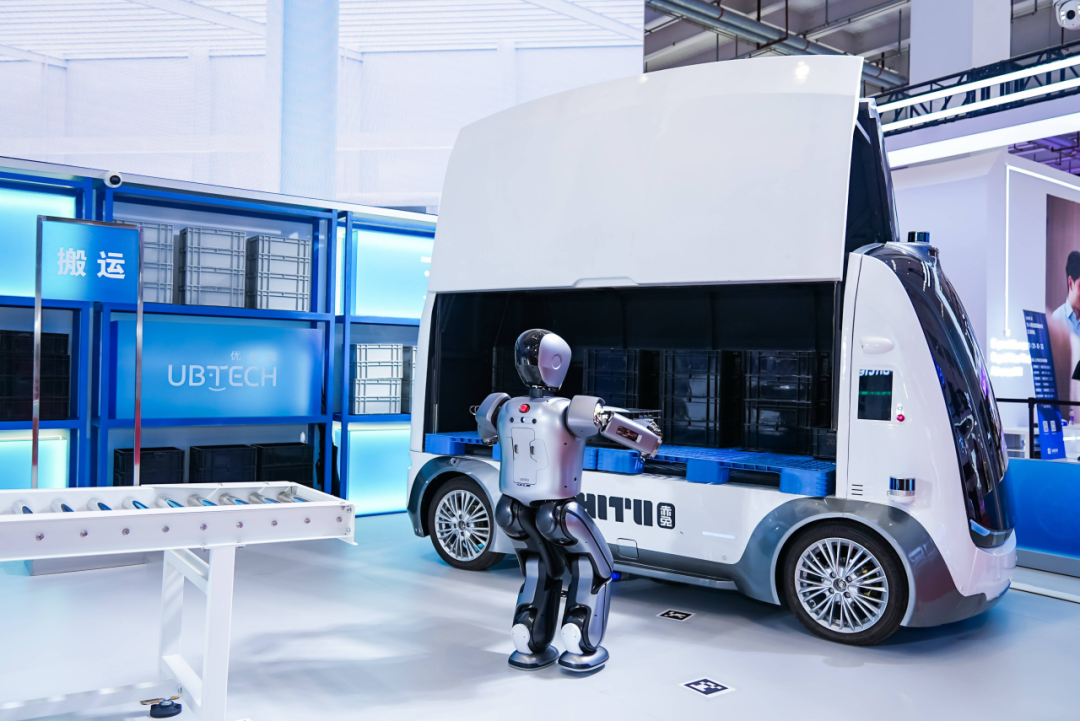

On December 24th, UBTECH, a leading stock in the humanoid robot sector, recently announced its intention to acquire approximately 43% of Fenglong Co., Ltd.'s shares through a combination of 'agreement transfer + tender offer.' UBTECH stated that this is a crucial move to improve (complete) its industrial chain layout and strengthen its core competitiveness.

Despite high capital enthusiasm and vast prospects, humanoid robots still face two major challenges. First, technological maturity is the primary obstacle, with mass production becoming a bottleneck.

On October 22nd, 2025, during Tesla's third-quarter earnings call, Elon Musk directly declared the failure of this year's plan to mass-produce the humanoid robot Optimus, admitting, 'Optimus 2 is almost impossible to manufacture.'

Although XPeng Motors' robot garnered widespread attention after its debut, He Xiaopeng acknowledged, 'Making the robot walk steadily is no less challenging than achieving autonomous driving in cars.' Although the IRON robot can walk in a 'catwalk' style, adapting to complex terrains and performing fine operations still require extensive data training and algorithm optimization.

Second, scenario implementation poses a significant challenge. In other words, where are the genuine, Rigid demand (rigid demand) scenarios for humanoid robots? 'Technology without scenarios is a castle in the air,' Hyundai Motor stated.

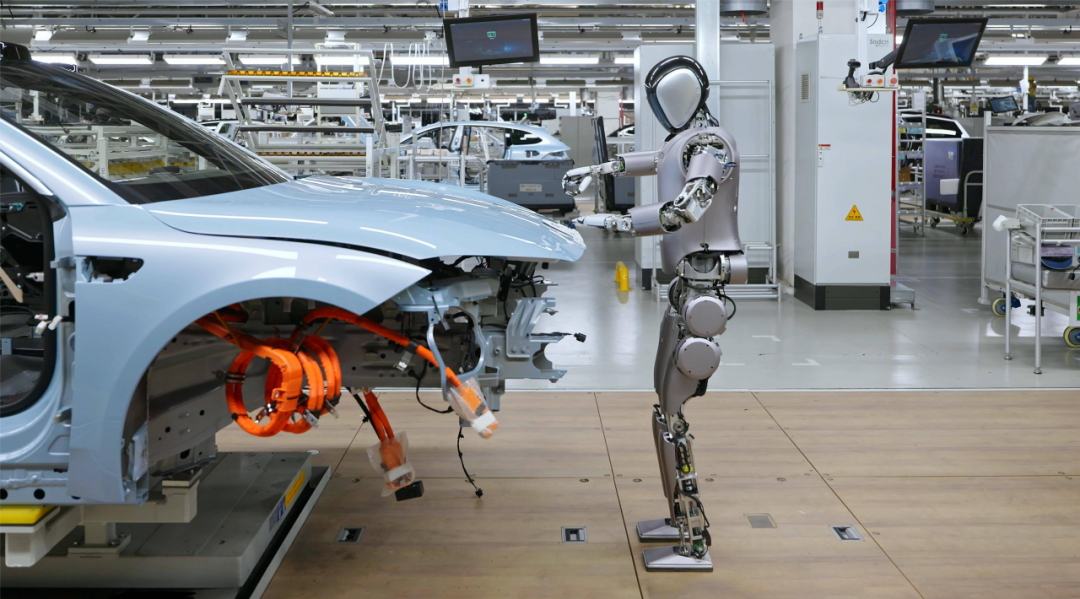

Earlier this year, Unitree Robotics' performance of the Yangko dance at the Spring Festival Gala set a precedent for subsequent robot and robot dog performances in offline malls and parks. Chery chose to start from the automotive sales scenario, while Tesla adhered to a factory-first strategy, allowing Optimus to learn from the most familiar automotive manufacturing scenario.

On the path of robots entering factories, UBTECH's Walker series humanoid robots secured over 1.3 billion yuan in total orders for the year, with the highest single order reaching 264 million yuan. In terms of delivery, over 200 industrial robots have been delivered, with an expected total of over 500 for the year, undergoing practical training in factories of companies like Geely, BYD, Foxconn, and SF Express.

Despite the capital market's fervor, the true determinant of large-scale implementation of humanoid intelligence still lies in the closed loop of technology and scenarios. From the maturity of algorithms and engineering challenges to the formulation of reliability and safety standards, there is still a long way to go.

Han Fengtao, Founder of Qianxun Intelligence, bluntly stated, 'Automotive OEMs are not ideal implementation scenarios. Combining two very early-stage technologies to undertake a highly complex task is extremely challenging.' It can be said that in the short term, humanoid robots still lack cost competitiveness in most scenarios.

However, the capital frenzy will continue. Currently, the highest-valued embodied intelligence startup globally is Figure AI from the United States, valued at 39 billion USD. In the domestic market, Unitree, Zhiyuan, and Galaxy General occupy the top three spots.

In this year of capital frenzy and industrial exploration, amidst a surge in financing and a rush for IPOs, technological curves and capital cycles are forming a disconnect.

Note: Image sources are from the internet. If there is any infringement, please contact us for deletion.

-END-