Robot Industry in 2025: Capital Feast, Mass Production Dilemma, and the 'Eve' of Value Reconstruction

![]() 01/04 2026

01/04 2026

![]() 433

433

Showmanship, Money-Burning, and Prolonged Commercialization

If an annual 'footnote' were to be chosen for the robot industry in 2025, 'A Song of Ice and Fire' would undoubtedly be the most apt.

This year, humanoid robots made their debut on the CCTV Spring Festival Gala stage, with a 'tech-folk show' of Yangge Dance (Yangko dance) and handkerchief twirling instantly igniting public enthusiasm. However, it was also in this year that a renowned investor's sharp question (questioning) – 'All it can do is flip, where's the commercialization?' – thrust the industry into the spotlight of public opinion.

(Image Source: 2025 CCTV Spring Festival Gala)

Amidst the blend of ice and fire, the robot industry has never been so clearly exposed under the spotlight. This is no longer a mere technological competition but a multidimensional war concerning capital narrative ability, mass production delivery endurance, and real value creativity.

01

Capital 'Feast' or 'Bubble'?

In 2025, capital embraced the robot industry with unprecedented enthusiasm and intensity, particularly in the field of humanoid robots.

From the perspective of capital flow, the momentum of this capital 'carnival' is astonishing. In the first nine months of 2025, global investment transaction volume in the humanoid robot sector reached approximately $7 billion. This figure represents a 250% increase compared to the same period last year.

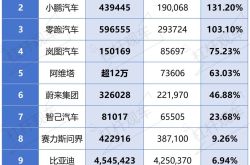

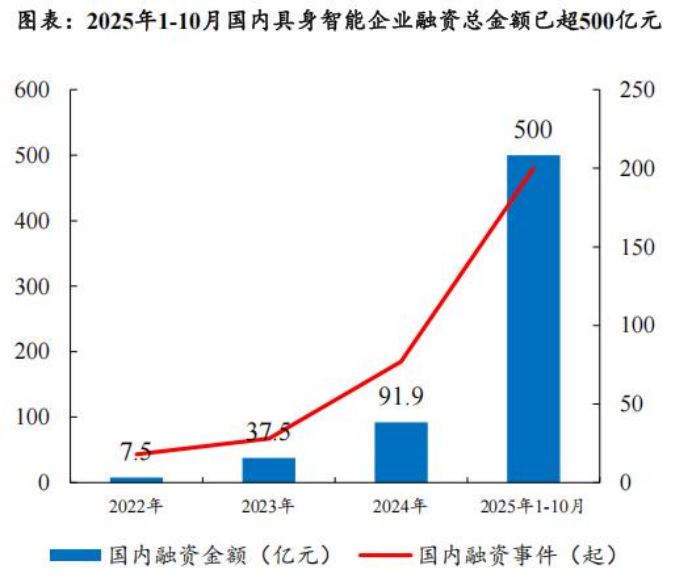

The 'prosperity' in the Chinese market is even more intense. According to statistics from 'Kaiyuan Securities', as of October 2025, the total financing amount in the embodied intelligence sector has exceeded 50 billion yuan, a more than 400% increase compared to the entire year of 2024, with over 200 financing events.

(Image Source: Kaiyuan Securities Research Institute)

At the enterprise level, Yuanli Lingji, spun off from Megvii, raised 200 million yuan in its angel round; Yishi Zhihang set a new record for angel round financing with $120 million; Galaxy General Robotics completed a new round of financing worth 1.1 billion yuan, the largest single financing in the embodied large model robot sector; Xingchen Intelligence completed a several-hundred-million-yuan A++ round financing, jointly led by Guoke Investment and Ant Group...

Faced with such a prosperous scene, the capital market has also responded positively. As of December 16, 2025, the overall increase in the A-share humanoid robot concept sector was 54.98%, significantly outperforming the market, reflecting the high expectations of the secondary market for this track (track).

Coupled with the 'green channel' (Chapter 18C of the Listing Rules) opened by the Hong Kong Stock Exchange for specialized technology companies, it provides a rare financing window for robot companies that are not yet profitable but have strong narratives.

Over the past few months, more than ten robot companies, including Xiangong Intelligence, have submitted prospectuses to the Hong Kong Stock Exchange. Leading players are also accelerating their IPOs, with Unitree Technology having completed a 132-day IPO counseling period, poised to become the 'first humanoid robot stock' on the A-share market.

However, beneath the revelry, currents flow. Taking the commercialization 'report cards' submitted by robot companies in 2025 as an example, Unitree Technology, which rose to fame thanks to the Spring Festival Gala, accumulated nearly 1.2 billion yuan in orders in 2025; UBTECH, focusing on industrial scenarios, accumulated over 800 million yuan in orders within a year, with shipments of industrial-grade and humanoid robots approaching 3,000 units; Leju, Yuejiang, Cloud Deep, Zhipingfang, and other leading players in the industry all exceeded or approached the 500 million yuan mark in annual cumulative amounts...

Yet, the 'gold content' of these orders has been widely questioned. A report by Morgan Stanley points out that a significant portion of the 'large orders' high-profile announced by many manufacturers belongs to framework agreement orders or intention (intent) orders, rather than definitive, irrevocable purchase contracts. The execution certainty of such orders is low, leaving room for future uncertainties.

Meanwhile, there are doubts within the industry about orders that may involve 'left hand to right hand' associated orders, meaning orders may circulate among affiliated parties or ecosystem enterprises, rather than entirely stemming from independent third-party real demand.

This model of 'capacity planning driven by order expectations rather than real demand' reflects the accommodation of some enterprises to the 'storytelling' demands of the capital market. However, while the flame of capital can rapidly heat up the track (track), the maturity of the industry ultimately requires the forging fire of endogenous value.

02

High Prices, Lack of Scenarios, and Production Capacity Dilemmas

Despite the lack of a definitive conclusion on the 'true mass production' versus 'pseudo-demand' controversy in 2025, it has not affected the long-term optimism about the prospects of the robot industry.

IDC predicts that by 2029, the global robot market size will exceed $400 billion, with China accounting for nearly half of the share and an annual compound growth rate of approximately 15%.

The expansion of demand is attracting more players to enter the market. Data from Qichacha shows that as of December 1, the number of existing domestic humanoid robot-related enterprises has reached 1,218, with the number of registrations in the first 11 months of this year exceeding the entire year's registration level last year, a year-on-year increase of 119.2%.

In addition, many internet giants are actively investing in robot companies, such as JD.com betting on projects like Zhiyuan and Zhongqing, and Meituan covering sectors like Unitree and Zibianliang...

However, behind the frenzy, the robot industry, especially the humanoid robot sector, still faces three core dilemmas hindering its large-scale popularization in 2025.

The first is high prices, making it difficult to cross the consumer market threshold. Although the price war has begun, with Unitree lowering the starting price of the R1 to 39,900 yuan and Songyan Power even launching the 'Bumi Xiaobumi' for 9,998 yuan, bringing humanoid robots into the sub-10,000 yuan range, there is still a huge gap from true consumer-grade popularization.

Products in the ten-thousand-yuan range often have limited functions, confined to companionship, education, and other limited scenarios, and are regarded by the market as 'high-end toys'; while truly complex operational potential industrial or general-purpose models still have costs in the tens of thousands or even millions.

Price acts as a solid barrier, temporarily isolating humanoid robots from the procurement lists of ordinary households and numerous small and medium-sized enterprises.

The second is the lack of practical scenarios, making it difficult to form a commercialization closed loop, which is also a major point of criticism for humanoid robots.

In 2025, demonstration videos of robots performing 'backflips', 'catwalks', and 'kicking CEOs' with high visual impact have flooded the internet, becoming low-cost marketing tools for companies to showcase their technological prowess.

However, there is a clear disconnect between these 'showmanship' abilities and the 'practical' abilities to solve real industrial or household problems. Under the impetus of capital, the industry has once fallen into the risk of short-termism, where 'performance value' outweighs 'practical value'.

Signals of a market cooling have already emerged. 'Kechuang Board Daily' once reported that the current robot rental market prices have significantly declined from the initial 'daily salary' of ten thousand yuan at the beginning of the year, with an overall drop that can be described as 'knee-cutting'. The daily rental price for basic humanoid robots has dropped to around 2,000 yuan, while the daily rental price for quadruped robots has even dropped to a starting price of 500 yuan.

(Image Source: Xianyu)

A merchant engaged in robot rental business also revealed that except for occasional temporary leases for exhibitions and commercial events, there are no stable orders.

So the core question remains: What exactly can a humanoid robot do after being purchased?

For household chores such as sweeping, organizing, and cooking, robots are far from reaching reliable, safe, and efficient levels. Therefore, the ambiguity of scenarios directly leads to the ambiguity of business models and weak user willingness to pay.

The third is the prominent production capacity dilemmas and delivery challenges. Although the industry is full of expectations, 'mass production' in 2025 remains more of a slogan and plan rather than actual delivery data.

To this day, some leading companies still face extremely difficult production capacity ramp-ups. For example, although Unitree Technology leads in shipments, the delivery schedule for its consumer-grade new product, the R1 Air, has been extended to February 2026; UBTECH secured over 1.3 billion yuan in orders throughout the year, but its Vice President, Jiao Jichao, revealed in August that the company plans to deliver 500 industrial-grade Walker series robots this year, far from meeting the potential demand revealed by the order size...

Even Tesla's Optimus, which has garnered global attention, has not yet broken through the thousand-unit mark in its trial production scale.

Behind the production capacity shortage lies a series of complex engineering issues, including core component supply, production line processes, and quality control. 'Many orders, slow delivery' has become a common pain point in the industry.

In this light, high costs constrain the scale of scenario application trials, the lack of scenario data in turn limits algorithm iteration and reliability improvement, and insufficient mass production capacity slows down cost reduction. Breaking this vicious cycle may become a 'must-answer question' for the industry next.

03

The 'Major Exam' of the First Year of Mass Production

2026 is widely expected to be the 'first year of mass production for humanoid robots', marking the true beginning of 'value differentiation' and 'major exams'. The industry will transition from noisy concept hype to a brutal stage of performance delivery and capability verification.

Firstly, some production capacity plans will face the test of real orders, including but not limited to whether Tesla's Optimus can achieve mass production of one million units by the end of 2026; whether domestic companies like Unitree and UBTECH can consistently and stably fulfill their 'thousand-unit level' delivery commitments will become core indicators for observing industry progress.

The ability to achieve stable, high-quality, and cost-controlled delivery will become the first dividing line between 'powerhouse players' and 'concept players'. Delivery data, customer repurchase rates, and product failure rates, these dull figures will be more convincing than any flashy demonstration videos.

Secondly, as more companies rush towards IPOs or enter subsequent financing rounds, the capital market's scrutiny of enterprises will shift from 'stories and potential' to a more realistic focus on 'revenue structure, gross profit margin, cash flow, and commercialization paths'.

Companies that rely on affiliated transactions to dress up orders, have only demonstration capabilities without batch delivery records, and have consistently ambiguous business models will face severe challenges of valuation corrections or even financing disruptions.

After all, the listing channel will not remain infinitely open, and regulators and investors will scrutinize 'robot concepts' more strictly. Capital will increasingly focus on segmentation (niche) leaders that have achieved commercial closed loops in specific scenarios and have clear profit paths, or 'water sellers' who have established absolute technological barriers in core components or underlying algorithms.

Finally, under the dual regulation of policies and markets, the industry will undergo a round of shakeouts and consolidations in 2026.

On November 27, at a press conference of the National Development and Reform Commission, when relevant department heads clearly pointed out that 'currently, humanoid robots are not yet fully mature in terms of technical routes, commercialization models, and application scenarios', and 'with the acceleration of emerging capital entry', there is a need to 'focus on preventing risks such as a high degree of product repetition 'clustering' onto the market and compressed research and development space'

This implies that the survival space for 'PPT robot' companies lacking core technologies and relying solely on assembly and imitation will sharp (sharply) shrink. Resources will further concentrate towards leading companies that have established solid barriers in technology, products, or commerce.

Meanwhile, the competition focus will shift from 'who can do it' to 'who can do it better, cheaper, and more reliably'. More and more companies may abandon the grand narrative of 'artificial general intelligence' and instead delve deeply into segmentation (niche) vertical fields such as logistics, cleaning, inspection, and precision assembly, taking a 'small but beautiful' differentiated route.

Looking back at 2025, the robot industry, driven by capital, has completed a nationwide market education and technological display, but it has also exposed some contradictions deeply rooted in the early stages of industrialization.

In the coming year, the industry may undergo a comprehensive stress test. Only those companies that truly navigate through the 'fog' of mass production and create value in real scenarios will truly have the qualification to lead us towards a future of 'human-machine symbiosis'.

* Images are sourced from the internet. Please contact us for removal if there is any infringement.