The Domestic Breakthrough Battle of Memory Chips Amid the AI Boom (Part II)

![]() 01/21 2026

01/21 2026

![]() 508

508

Author: Qianyanjun

Source: Bowang Finance

Key Term Explanations in This Article:

DDR: Double Data Rate Synchronous Dynamic Random-Access Memory. It is primarily used in personal computers and servers. LPDDR (Low Power DDR) is mainly applied in mobile electronic devices. DDR/LPDDR represents the most widely used DRAM types, collectively accounting for approximately 90% of DRAM applications. From DDR1 to DDR5, there has been a decrease in energy consumption, an increase in transmission speeds, and an expansion in storage capacities.

HBM: High Bandwidth Memory (HBM). It is a high-performance DRAM developed by AMD and SK Hynix using 3D stacking technology. It is suitable for applications requiring high memory bandwidth, such as graphics processors and network switching and forwarding equipment (e.g., routers, switches).

Amid the current AI craze, we find the memory industry at a rare "triple resonance" node:

First, from a technological perspective, clear generational shifts are evident. These include the transition from 2D to 3D NAND, from DDR4 to DDR5/LPDDR5, and the advancement towards HBM.

Second, at the demand level, AI has ignited a "super cycle" that is driving structural demand surges. These surges may persist for years.

Third, from a supply standpoint, international giants, in pursuit of profits in the AI high-end market, have voluntarily ceded mid-range production capacity. This has created historic supply gaps.

Based on these three factors, the author believes that Chinese domestic memory manufacturers are entering an unprecedented strategic opportunity window. Let's analyze this in detail:

01

The Core of the Super Cycle: Industrial Chain Dynamics Reshaped by AI

After understanding the historical context and current state of the memory industry in Part I, we can more clearly discern the essence of today's "super cycle." It is not a traditional mismatch of supply and demand but a profound reshaping and redistribution of the global memory industrial chain driven by generational technological shifts—namely, the AI computing revolution.

1. Demand-Side "Nuclear Fission": From Consumer Electronics to AI Infrastructure

This cycle is characterized by a fundamental shift in driving forces, with two key directions:

First, memory product prices have entered an upward cycle. NAND prices have historically exhibited sharp cyclical fluctuations. After peaking in 2017, prices declined continuously through 2022 due to oversupply and weak demand, hitting multi-year lows in 2023. The 2024 rebound marks the strongest recovery since 2017.

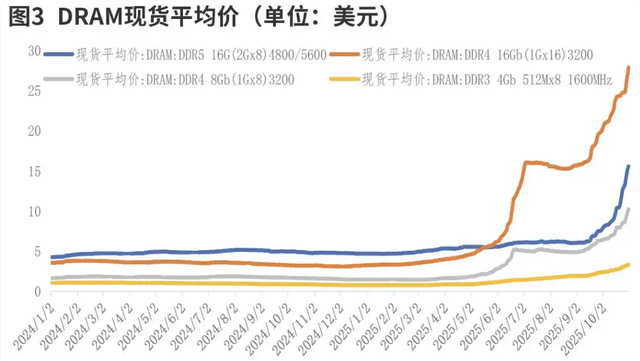

Moreover, DDR4 DRAM products, though gradually exiting mainstream production, still face supply shortages, accelerating price increases. According to authoritative media reports in December 2025, prices for 16GB DDR4 memory modules have surged over 200% year-on-year.

Figure: DRAM Spot Market Average Prices – iFinD Information, Datong Securities

DDR5 contract prices are expected to rise by 30%-50% quarterly. There is strong demand for cost-effective, stable-supply products in sectors such as consumer electronics, enterprise SSDs, and automotive electronics. Additionally, major Chinese cloud providers (Alibaba Cloud, Tencent Cloud, etc.) are making substantial AI investments, with annual memory procurement exceeding RMB 100 billion. To ensure supply chain stability, they are also increasing purchases of domestic chips. These trends indicate not just isolated product price hikes but a broad upward trend across the entire memory industry.

Second, memory chips are upgrading from being "cost components" in smartphones and PCs to becoming "strategic core modules" in AI data centers and computing infrastructure. This shift involves dual leaps in both demand volume and value:

Volume leap: An AI server requires approximately 8 times more DRAM and 3 times more NAND than a standard server. A notable example is OpenAI's October 2025 "Stargate" initiative, which secured monthly supplies of 900,000 DRAM wafers—equivalent to 40% of global output.

Value restructuring: LPDDR5 DRAM for AI servers commands prices 1.5 times higher than consumer electronics variants. TrendForce projects that by 2026, AI and server applications will consume 66% of total DRAM capacity, driving overall revenue up by 56%. This "nuclear fission"-style demand growth forces upstream suppliers to rethink resource allocation.

2. Supply-Side Strategic Choices: Decisions of the Giants

Facing lucrative AI high-end markets (e.g., HBM, high-frequency DDR5), Samsung, Micron, and SK Hynix have adopted nearly identical, profit-maximizing strategies:

(1) Capacity concentration: Shifting advanced process capacity to HBM, DDR5, and other premium products.

(2) Voluntary contraction: Phasing out or halting production of legacy products like DDR4 and DDR3.

Figure: Securities Times Coverage

Chronologically, memory chip prices began rising in April 2025 when Samsung announced it would cease DDR4 production to focus on higher-margin DDR5, LPDDR5, and HBM. SK Hynix soon followed, reducing DDR4 capacity to about 20%. Micron recently exited the consumer-grade Crucial brand business...

This contraction strategy has artificially created a massive "mid-range supply gap." As giants chase the next "gold mine," they leave vast untapped markets. Consumers in electronics, traditional data centers, and automotive sectors now face unprecedented supply uncertainty and cost pressures, with supply security anxieties at all-time highs.

3. Evolution of Industrial Chain Models

Amid these disruptions, the organization of the industrial chain is dynamically adjusting. Traditional IDM models (e.g., Samsung, Micron) leverage full-stack control over design, manufacturing, and packaging to maximize high-end product supply and profits. This approach has extremely high capital barriers, leaving little room for rapid "overtaking." For latecomers, especially Chinese firms, development paths are diversifying. Many initially entered via asset-light Fabless or Foundry models but are now transitioning toward IDM as they scale and pursue technological autonomy. Meanwhile, companies like Longsys are pioneering dual modes—TCM (Technology Contract Manufacturing) and PTM (Product Technology Manufacturing)—to build depth and flexibility in specific supply chain segments, enabling rapid responses to localized customization demands.

The "super cycle" essentially represents a violent restructuring of the global memory value chain. AI demand has created a high-profit "gravitational singularity" at the top, attracting most premium capacity while tearing open a vast market space below. This gap presents a critical battleground for domestic players to achieve scale breakthroughs and ecosystem construction.

02

Domestic Breakthrough: Scaling the Uphill Battle Amid Opportunities and Challenges

Standing before this historic opportunity window, China's domestic memory industry is no longer a bystander but a core participant with technological, production, and industrial chain capabilities.

The rise of domestic forces leverages a unique convergence of "timing, location, and synergy":

Timing: The AI "super cycle" has created a historic window—international giants' voluntary cession of mid-range supply and pricing space provides domestic chips with a precious client onboarding and capacity ramp-up period. This window may last years, representing a golden era to establish market positions.

Location: China's vast and multi-tiered domestic market provides fertile ground: mid-range consumer electronics upgrades, cloud giants' (Alibaba Cloud, Tencent Cloud) trillion-yuan local procurement for supply chain security, and smart vehicles (especially L3+ autonomous driving) driving 10 times storage demand growth collectively form a solid foundation and natural testing ground for domestic chip substitution.

Synergy: Breakthroughs in key technologies and emerging industrial ecosystems—domestic firms now "run neck and neck" in mainstream tracks, while local collaboration networks spanning materials, equipment, chip design, and module packaging are rapidly forming.

However, these advantages do not automatically translate into victory. The path to global leadership remains fraught with challenges:

The primary hurdle is the sustained technological pursuit. In cutting-edge fields like HBM, international giants have advanced to HBM4 with more advanced processes, iterating extremely rapidly. Domestic firms face generational gaps, requiring massive R&D investment—a steep, thorny climb where new technological targets come into view ahead while past breakthroughs fade behind. Pursuing the latest technology is an arduous, one-way journey.

Deeper challenges lie in the existential thresholds of scale and cost. The memory industry epitomizes economies of scale. International giants follow a "game law": massive R&D investment to capture technological high ground, industrial chain refinement, rapid market domination post-mass production, and cost dilution through global market share—only to reinvest heavily in next-gen R&D in an endless cycle. Domestic firms face relentless cost competition during capacity ramp-up.

More profound and complex challenges arise from global ecosystem and standard battles. Memory chips are highly standardized global products. Achieving true integration—let alone influence—into global supply chains, obtaining international certifications, and participating in next-gen standard-setting represents a more intricate, long-term systemic endeavor, further complicated by geopolitical uncertainties.

The rise of domestic memory is no easy substitution but a "multi-dimensional war" requiring simultaneous advances in R&D, capacity expansion, market development, ecosystem building, and global compliance. Who are the key domestic players in this field, and how are they performing? We will continue this analysis in Part III.