Net Profit Anticipated to Soar by 52.5%! Yutong Optics Unveils Its Inaugural 2025 Performance Forecast

![]() 01/21 2026

01/21 2026

![]() 413

413

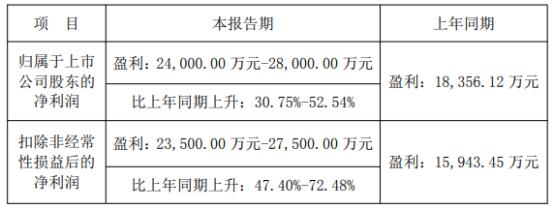

On January 20th, Yutong Optics issued its annual performance forecast for 2025. The announcement reveals that, during the reporting period, Yutong Optics anticipates its net profit attributable to shareholders to range between RMB 240 million and RMB 280 million, marking a year-on-year surge of 30.75% to 52.54%. Furthermore, the expected net profit after deducting non-recurring items is projected to be between RMB 235 million and RMB 275 million, reflecting a year-on-year hike of 47.40% to 72.48%.

Yutong Optics attributes the performance fluctuations during the reporting period mainly to a surge in business volume across traditional security lenses, vehicle-mounted lenses, glass aspherical lenses, automotive optical components, and emerging consumer sectors. This has spurred revenue growth, along with continuous enhancements in product structure, expanding application domains, and a rebound in the overall gross profit margin.

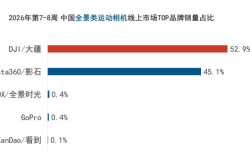

Specializing in the research, development, production, and sales of optical lenses, Yutong Optics holds an undisputed leadership position in the global security lens market. It has clinched the top spot in global shipments for ten consecutive years, boasting a 43.25% market share worldwide in 2023. Leveraging its profound optical technology amassed in the security realm, the company is successfully venturing into areas like intelligent driving and cutting-edge consumer electronics, unlocking fresh avenues for growth.

From a business structure standpoint, the 2025 mid-year report indicates that security products constitute 55% of the total, while vehicle-mounted lenses, laser radar optical components, and HUD optical components account for 17.6%.

In the first half of 2025, Yutong Optics reported revenue of RMB 1.416 billion, up 13.38% year-on-year; net profit of RMB 108 million, a 27.19% increase year-on-year; cash flow of RMB 212 million, soaring by 121.31% year-on-year; and a gross profit margin of 24.71%, up 2.72% year-on-year.

Among these, revenue from the vehicle-mounted business reached RMB 164 million, a 37.8% jump year-on-year. The company's global market share in vehicle-mounted lenses has climbed to 10.1%, ranking third globally. The machine vision business boasts an impressive gross profit margin of 46.16%. Although its current revenue contribution is modest, it harbors significant growth potential.

In terms of emerging business布局 (strategic layout), Yutong Optics has made substantial strides: in the AR/VR sector, it is collaborating with Meta to develop ultra-thin waveguide solutions and supplying Pancake optical modules for Apple's Vision Pro 2nd generation; in the semiconductor-grade optics domain, it has entered the supply chain for DUV lithography machine illumination modules, having passed ASML certification.

Notably, the company has, for the first time, penetrated the supply chain for Apple's core products, providing glass spherical lenses for the iPhone 18. Following in the footsteps of Genius Electronic Optical, it has also joined the supply chain for Apple's AI glasses, supplying molded glass. Both ventures are slated to commence shipments in the second half of 2026.

In summary, Yutong Optics' performance growth is not merely attributable to the breakout of a single business segment but rather a holistic reflection of its strategic transformation from being the 'champion in security lenses' to a 'diversified optical platform' now entering its harvest phase. Leveraging its deep-rooted optical manufacturing expertise, the company is successfully extending its capabilities to high-value sectors such as automotive, XR, semiconductor equipment, and consumer electronics.

This performance forecast not only underscores the stability of its core business but also unveils its immense growth potential as a pivotal supplier of critical optical components in the forthcoming era of intelligent vision.