A Comprehensive Analysis of Tesla's New Strategy: Full Transition to Physical AI and a Subscription-Based Business Model

![]() 02/02 2026

02/02 2026

![]() 380

380

Recently, Tesla held its Q4 2025 financial report conference call, revealing a strategic pivot from a pure car sales model to a revenue approach centered around Physical AI and subscriptions.

Tesla has long been a leader in electric vehicle development and is now at the forefront of the Physical AI field. The information disclosed during Tesla's conference call is always significant, with various stakeholders eager to delve into the details. This article presents the key insights from Tesla's Q4 2025 financial report conference call, along with Vehicle's analysis. For a detailed, pixel-level interpretation, please refer to the complete Chinese transcript of the call, titled "Complete Transcript of Tesla's Q4 2025 Financial Report Conference Call."

Financial and Sales Performance: Tesla's Various Declines

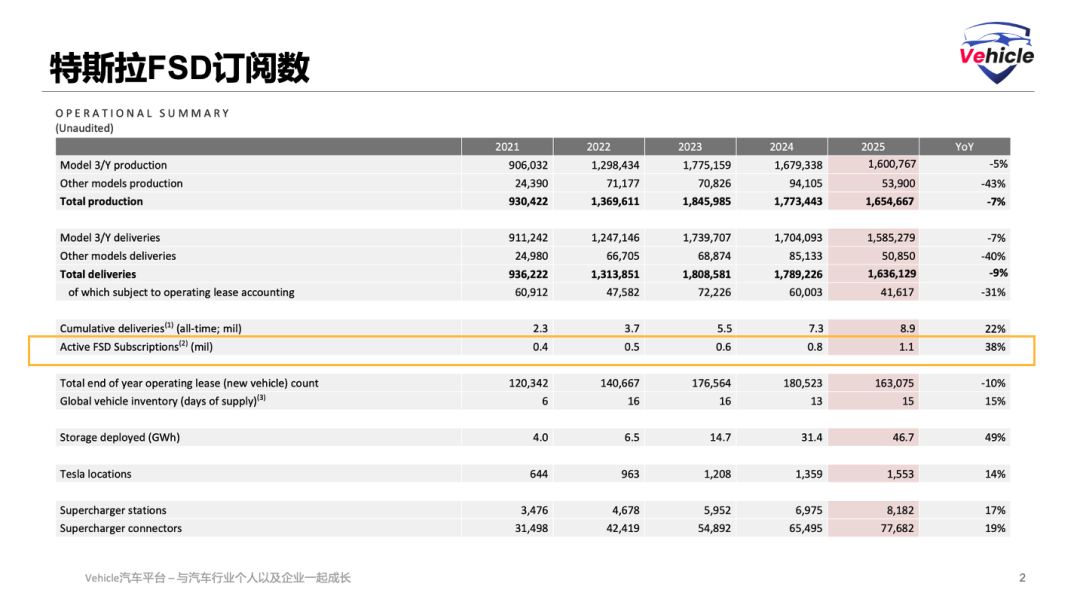

Total Annual Revenue: $94.8 billion, marking a 3% year-on-year decrease. Automotive revenue: $69.5 billion, down 10% year-on-year. However, revenue from energy storage and services saw increases of 27% and 19% year-on-year, reaching $12.7 billion and $12.5 billion, respectively.

Sales Performance: Annual deliveries reached approximately 1.636 million units, a 9% year-on-year decline. Q4 deliveries stood at 418,000 units, down 16% year-on-year, indicating a continuous downturn in deliveries for Tesla's current product lineup.

Annual Net Profit (GAAP): $3.794 billion, a 46% year-on-year decrease. Q4 Net Profit (GAAP): $840 million, down 61% year-on-year. Without a $524 million subsidy from regulatory authorities, Tesla's Q4 performance would have been even more dismal. Additionally, Q4 operating expenses surged by 39% to $3.6 billion, primarily due to increases in AI, R&D projects, and SG&A (sales and administrative expenses).

In terms of sales and financials, Tesla has experienced a second consecutive year of declining deliveries and profits, while the global electric vehicle market continues to expand. Currently, BYD has claimed the title of the world's largest electric vehicle manufacturer. Tesla's once industry-leading profit margins are also facing pressure from Chinese competitors.

These factors may have prompted Musk to accelerate the change in narrative.

Strategic Transformation and New Mission:

At the outset of the conference call, Musk set the tone by updating Tesla's mission to "Build a World of Amazing Abundance," aiming to achieve a future of high income for all through AI and robotics technology.

Tesla's previous mission was "To accelerate the world's transition to sustainable energy." This mission sought to drive a global energy structure shift from fossil fuels to clean energy through electric vehicles, solar panels, and energy storage solutions.

If that's the case, as Musk remarked, China has truly and comprehensively embraced this mission.

Tesla's new mission focuses on a comprehensive shift towards AI and robotics. The company is transforming from a pure electric vehicle manufacturer into an AI and robotics giant, with future core growth drivers coming from autonomous driving software and Optimus robots—these Physical AIs.

Major Adjustments to the Automotive Product Lineup:

To implement these strategies, Musk announced a series of product adjustments and implementation directions.

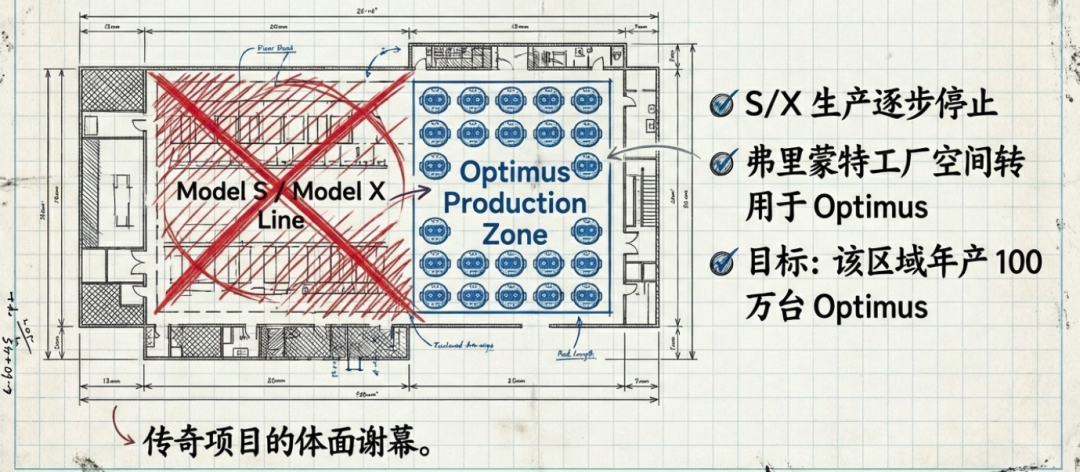

Firstly, discontinuation of Model S/X: Tesla announced that it will gradually cease production of the Model S and Model X in the first quarter of 2026. These two models, with a combined annual sales volume of just over 10,000 units, will see their production lines at the original Fremont factory repurposed into an Optimus robot factory, with a long-term goal of producing 1 million Optimus robots annually.

Accelerated production of Cybercab (Robotaxi): Musk stated that production of the Cybercab (Robotaxi) is expected to commence in April 2026. Designed without a steering wheel or pedals for high-intensity use (50-60 hours per week), it will boast extremely low costs. Production is anticipated to eventually surpass the combined total of all other models.

Next-generation Roadster: Expected to be unveiled in April 2026.

As for other products, there are no new plans for the Model 3/Y, and the Cybertruck will maintain its current form without transitioning to a more traditional pickup appearance as previously suggested.

Therefore, for automotive products, Tesla's future growth will rely entirely on the existing Model 3/Y and the upcoming Cybercab.

Physical AI: FSD and Humanoid Robot Optimus:

The highlights of Physical AI are FSD and the humanoid robot Optimus.

Autonomous Driving (FSD) and Fleet Operations, Progress in Unsupervised FSD: Tesla has achieved fully autonomous driving tests in Austin without safety drivers or follow vehicles. According to the conference call, Tesla currently has over 500 paid Robotaxis in operation. Musk stated that the number of these Robotaxis could double every month, growing exponentially. It is expected that autonomous driving will be expanded to approximately one-fourth to half of the United States by the end of 2026, pending regulatory approval.

Currently, Tesla has 1.1 million global paid FSD users. The company announced in mid-January that FSD will fully transition to a subscription model at $99 per month, with buyouts no longer supported. Additionally, on January 29, Tesla offered existing owners who had spent $6,000 on Enhanced Autopilot (EAP) an upgrade to FSD for only $49 per month (highlighting the differences between Basic Autopilot, EAP, and FSD).

Furthermore, Musk mentioned the future introduction of a fleet mode similar to 'Airbnb,' allowing owners to add or remove their vehicles from Tesla's autonomous driving fleet at any time to earn revenue.

Therefore, Tesla's FSD will fully transition to a subscription model, aligning the company with Apple's business model of integrating hardware and software. Regardless of whether it's the Model 3/Y or even the Cybercab (mobile travel tools akin to network communication tools), they serve as hardware carriers for FSD (mobile travel services akin to communication and cloud services), with hardware sales supplemented by FSD driving service subscription fees.

Robots (Optimus): Although Musk repeatedly emphasized that Optimus plans to produce 1 million units annually, significantly surpassing the automotive business, according to the Q4 conference call, Optimus is not yet performing actual work in factories but is being studied and learned by users.

Optimus Gen 3, equipped with general learning capabilities (according to Musk, the humanoid robot can learn by observing human behavior, through language education, or video learning), is expected to be unveiled around mid-year. If achieved, it would essentially be truly human-like, as human growth also involves continuous education and learning through observation and practice.

Regarding the production and ramp-up timeline for Optimus, there appears to be significant uncertainty based on Musk's statements. Musk has consistently emphasized that Optimus's supply chain is entirely new, with no existing components in its current supply chain. Everything is designed based on the fundamental principles of physics, and Optimus's production ramp-up curve (typically an S-shaped curve) will be much longer than products that at least partially rely on existing supply chains.

Therefore, the current focus for Optimus is to develop the product. The business model has not been mentioned, but it is estimated to follow a hardware purchase fee + software subscription fee approach.

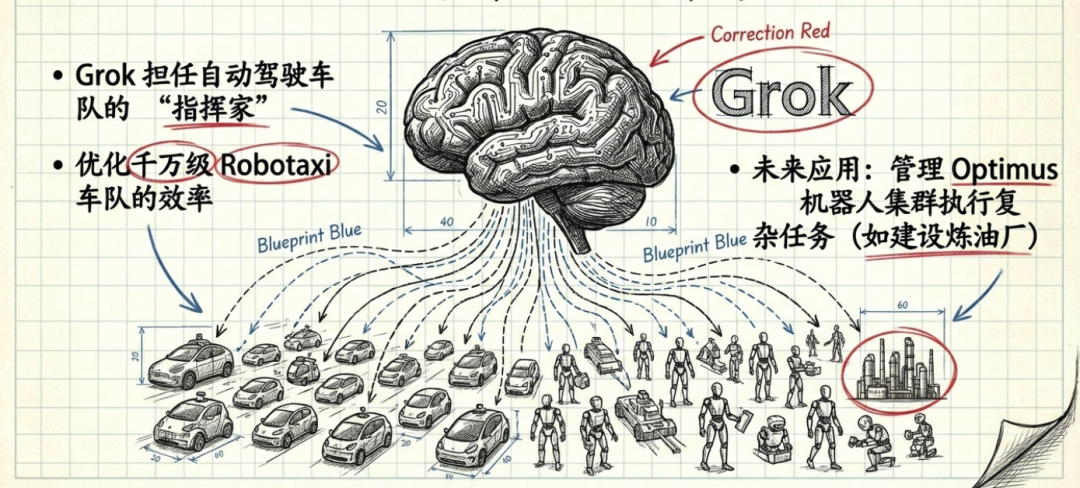

xAI Collaboration and Grok Integration: Tesla confirmed its investment in xAI as part of its strategic plan, with an expected investment of $2 billion. Why?

Recently, the integration of FSD and Grok has provided a clear experience in vehicle control. Grok not only serves as an entrance for automotive interaction but also, in the future, Tesla expects the Grok model to act as a 'conductor,' managing a vast fleet of tens of millions of autonomous vehicles and millions of Optimus robots, optimizing efficiency.

Strategic Logistical Support:

To ensure the successful transformation of its strategy, according to Musk's original words, "to ensure the mass production of autonomous vehicles and humanoid robots and to address geopolitical risks," Tesla expects to spend over $20 billion in 2026 on the construction of six factories.

Lithium Refinery: Located near Texas Robstown/Corpus Christi, Musk claims it to be "America's largest lithium refinery," targeting 30 GWh equivalent capacity.

LFP Battery Factory: Primarily in Nevada (Gigafactory Nevada), with production scheduled to begin in 2026 (Q1 or first half of the year). Tesla will localize LFP battery cells in collaboration with CATL, primarily for energy storage (Powerwall/Megapack) and low-cost vehicle models. The initial capacity is 7-10 GWh per year, with plans for expansion.

Cybercab Production Factory: Primarily in Giga Texas (Austin), with production line tooling currently being installed, aiming to produce millions of units annually (across multiple factories) using the unboxed process.

Tesla Semi Production Factory: A dedicated factory under construction near Nevada (adjacent to Gigafactory Nevada), with tooling and construction nearly complete. Production line equipment is being installed, with the first "online builds" scheduled for the first half of 2026 and mass production ramping up in the second half. Early deliveries will continue to accumulate data for clients such as PepsiCo. The target annual production is 50,000 units.

New Megafactory (for energy storage): Houston/Brookshire, Texas (the third Megafactory), under construction (ground broken, with an investment of nearly $200 million). The former warehouse is being transformed, with equipment installation initiated. Megapack 3/Megablock production is scheduled to begin in late 2026 or the first half of the year, with a maximum capacity of 50 GWh per year.

Optimus Factory: The Fremont factory (repurposing the Model S/X production line) is undergoing retooling. Gen 3 Optimus (with the latest hand design) is scheduled to be unveiled in Q1, marking the first mass-produced version. The initial production line is being installed, with a target annual production of 1 million units at this site. In the future, Giga Texas will build higher-capacity lines (Optimus V4, targeting tens of millions of units).

In addition to the $20 billion investment, Tesla is also investing in solar cell manufacturing plants and semiconductor chip manufacturing plants.

Self-built Wafer Fab (Terafab): Elon Musk and the executive team emphasized that to address chip capacity bottlenecks (especially memory) and geopolitical risks in the next 3-4 years, Tesla must build a trillion-dollar wafer fab in the United States that integrates logic, memory, and packaging. Musk believes that the future demand for AI memory capacity may surpass that of computing chips, similar to the current logic of chip price increases in the automotive industry. This year, the automotive industry's demand for memory will be very high.

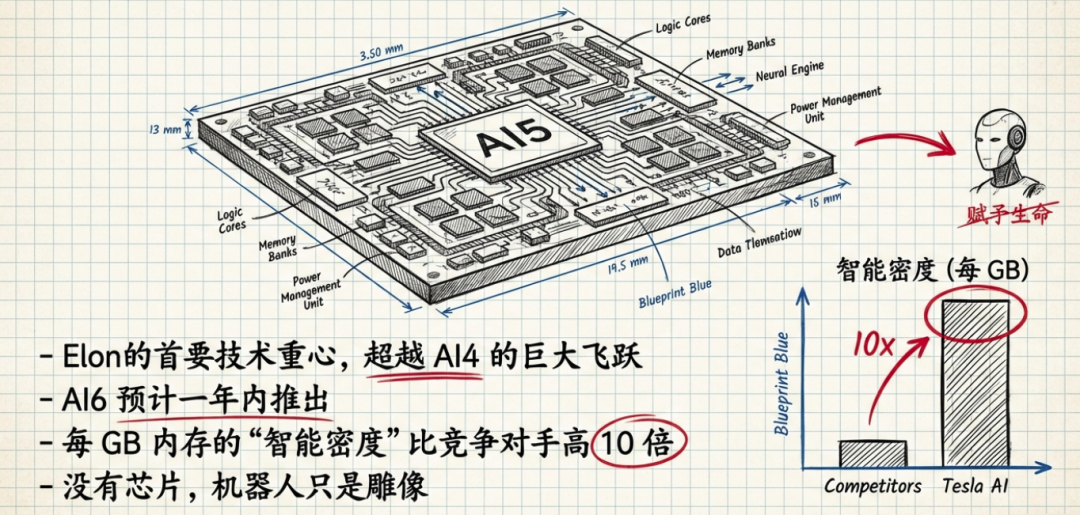

AI Chips: Currently focused on AI5 chip design, with AI6 expected to be launched within a year. In the short term, all chips will be for self-use and not for external sales. However, with AI5 yet to be released and AI6 already planned for launch within a year, it puts AI5 in an awkward position.

Tesla stated that for solar panels, it aims to achieve an annual production capacity of 100 gigawatts of solar cells and integrate the entire supply chain from raw materials to finished solar panels.

To safeguard Tesla's strategic journey, the company is focusing on geopolitically controllable product technologies such as energy batteries and computing chips. However, the components for Tesla's Optimus remain a mystery. Can North America have such a complete supply chain under geopolitical pressures?

Conclusion: A Crossroads of Divergence

For the global automotive industry, this moment may represent a historic watershed: To the left lies the path of extreme 'manufacturing logic'—like BYD, relying on strong supply chain integration capabilities to compete on cost, scale, and configuration, pushing the cost-performance ratio of industrial products to the extreme and becoming the undisputed 'king of manufacturing.' To the right lies the path of extreme 'silicon-based logic'—like what Tesla is doing now, devaluing hardware into mere 'AI containers' and selling 'computing power' and 'labor' (Robotaxi and Optimus) through subscriptions, attempting to become the 'silicon-based overlord' mastering Physical AI.

For those of us in the automotive industry, perhaps we should reconsider a question:

Will the kings of the next era be those who are still diligently practicing their 'car-making prowess', or will it be this mad gambler attempting to transform the physical world into an 'App Store'?

The outcome of this high-stakes gamble may completely redefine the term 'automotive industry.' What are your thoughts on this? Feel free to leave your opinions in the comments section.

References and Images

Tesla's Q4 2025 Earnings Report PPT

*Unauthorized reproduction or excerpting is strictly prohibited-