Who Says Europeans Can’t Live Without Gasoline Cars?

![]() 02/02 2026

02/02 2026

![]() 491

491

Lead

Introduction

The turning point is not rooted in environmentalism but in the availability of better alternatives.

The European automotive market has reached a historic milestone: In December of last year, monthly sales of electric vehicles (EVs) surpassed those of traditional gasoline vehicles for the first time.

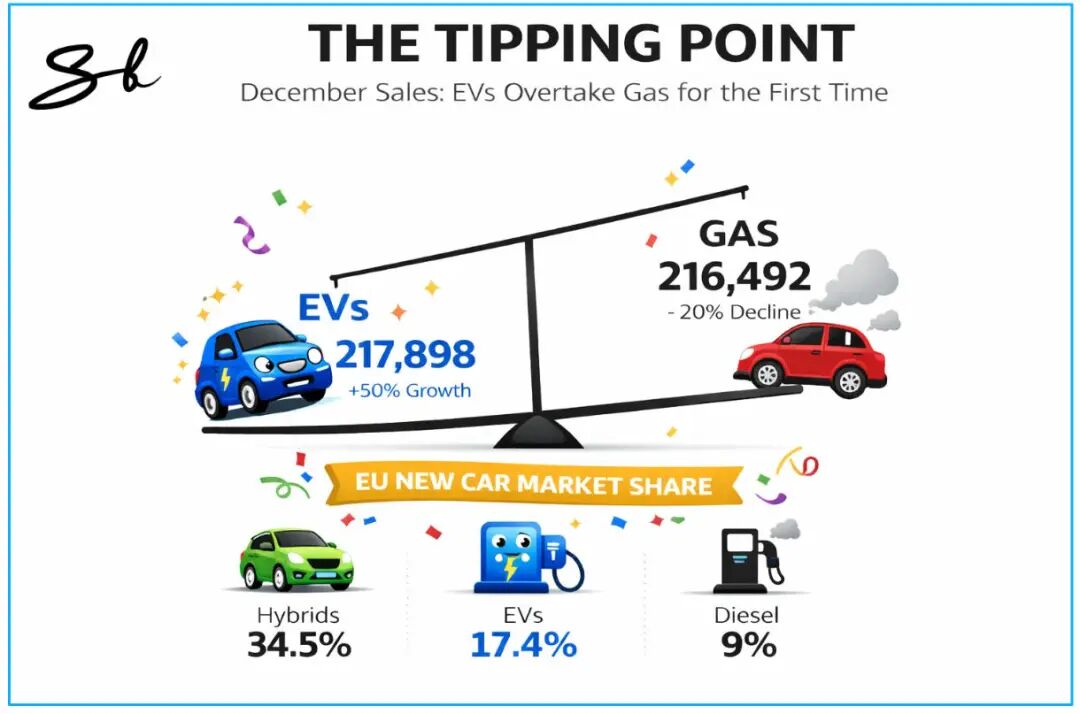

Across the EU, EV registrations reached 217,898 units in December, slightly exceeding the 216,492 gasoline vehicles sold during the same period. This achievement represents more than just a minor monthly victory; it marks an acceleration of a multi-year structural shift. Compared to the same period the previous year, EV sales surged by 50%, while gasoline vehicle sales declined by nearly 20%.

Currently, EVs account for 17.4% of total new car sales in the EU. Hybrid vehicles remain the most popular option, representing 34.5% of the market, while diesel vehicles—once a cornerstone of European automotive—continue to shrink, now accounting for just about 9%.

This transformation is also evident in the UK and other non-EU European countries, driven not by short-term promotions or seasonal fluctuations but by sustained, stable growth. Analysts note that the success of EVs stems not from the failure of gasoline vehicles but from increasing consumer readiness for change.

Europe reached this milestone earlier than the U.S., primarily due to a richer market selection. From compact urban electric cars to a growing number of Chinese-branded models, diverse offerings make it easier for consumers to find vehicles that suit their needs.

Market analysts argue that this demonstrates pent-up consumer demand for EVs, previously untapped due to a lack of suitable products. The competitive landscape has also undergone dramatic changes. Last year, Tesla's market share in Europe contracted significantly, while BYD's presence surged. Norway has become a leading example, with 96% of new car registrations being EVs.

However, EV adoption still faces challenges. The EU is reevaluating its EV policies, including considering delays to the planned 2035 ban on new gasoline vehicle sales. Additionally, how Europe addresses low-cost EV imports from China will shape its market future.

Nevertheless, December's data sends a clear message: In Europe, EVs are no longer a vision for future mobility but a present reality.

01 Electric Vehicle Sales in Europe Surpass Gasoline Vehicles for the First Time

What is certain is that this is not a policy-driven fluke but a profound transformation driven by genuine market forces. With genuinely affordable electric models like the Renault 5 E-Tech entering the market at around £23,000, EVs have moved beyond early adopters to reach a broader consumer base.

Chinese brand BYD has demonstrated remarkable market momentum, selling 129,000 units in Europe—a 228% year-on-year increase—rapidly capturing nearly 2% of the market from a near-zero baseline. This proves that success in Europe's mature market is achievable without a Silicon Valley pedigree.

Tesla, once the electric trendsetter, saw its market share decline to 2.2%, the weakest performance among mainstream automakers. This shift reflects that a first-mover advantage does not guarantee long-term leadership when consumers have more choices beyond the Model 3.

Volkswagen maintained its dominant position in Europe with a 26.7% market share, demonstrating the resilience and adaptability of traditional manufacturers during the transition.

Geographically, Germany led Europe's EV market with a 43.2% growth rate, followed by the Netherlands, Belgium, and France. These four countries accounted for 62% of total European EV sales, with their well-developed charging networks and dealership systems turning EVs from concepts into viable options.

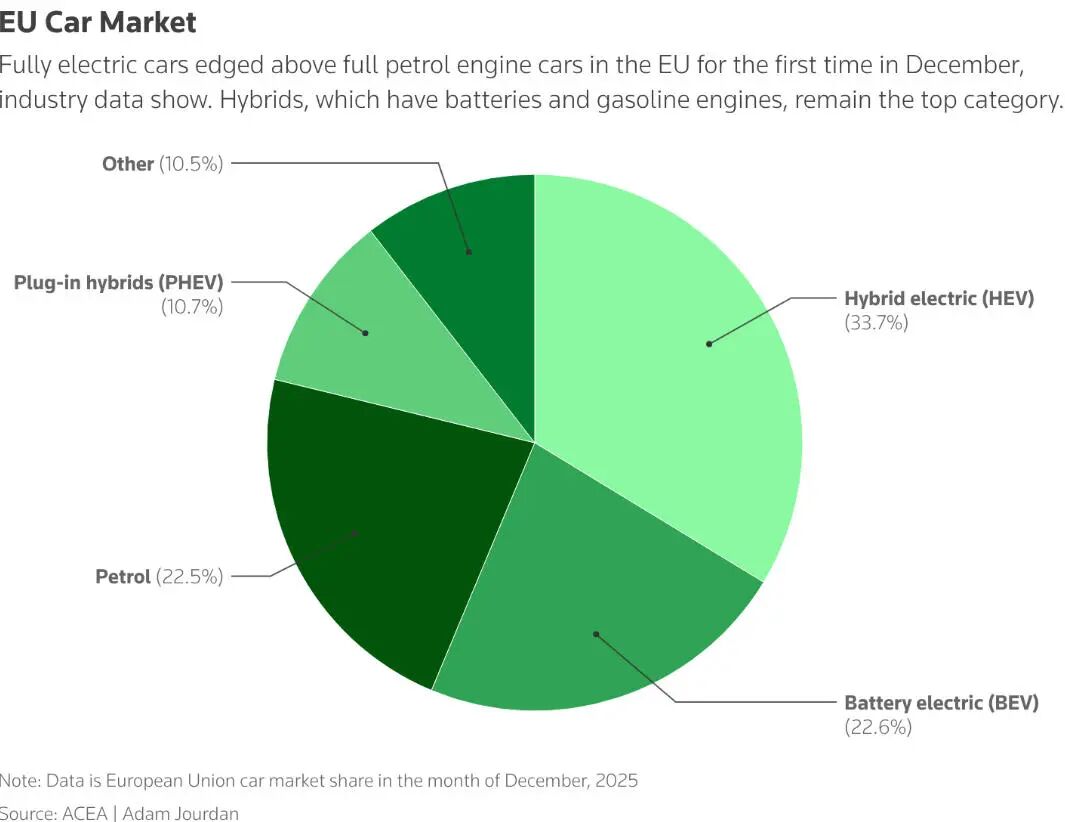

Despite the EU's minor adjustment to its 2035 zero-emission target—allowing 10% of fuel to come from e-fuels or biofuels—consumer choices appear unaffected by policy fluctuations. Hybrids dominate the market with a 34.5% share, while pure EV penetration steadily rose to 17.4% annually, indicating a market-driven shift toward electrification.

When European consumers consider their next vehicle purchase, they will face a market with richer choices, more competitive pricing, and better infrastructure. The turning point arrived not solely due to environmentalism but because superior products are now available.

Independent auto analyst Matthias Schmidt noted that some gasoline vehicles reclassified as "mild hybrids" in sales statistics still rely heavily on gasoline engines, offering limited emissions reductions. "It may take another five years for pure EVs to fully surpass gasoline vehicles across Europe, but this is undoubtedly a strong start," he said.

Last month, pure EVs accounted for 22.6% of EU registrations, slightly exceeding gasoline vehicles' 22.5%. Plug-in hybrids and conventional hybrids together represented the largest segment at 44%. Including the UK and Norway, broader European car sales achieved year-on-year growth for six consecutive months.

Despite the EU's December adjustment to its 2035 gasoline vehicle ban under industry pressure—with automakers facing Chinese competition, U.S. tariffs, and EV profitability challenges—the industry remains confident in electrification's future.

Chris Herron, Secretary-General of the European Electric Vehicle Association, said European brands have responded by launching more affordable electric models, while countries have updated incentive policies. "We see consumers responding with their wallets," Herron said. "We are confident the European EV market will continue growing in 2026."

02 One in Ten Vehicles Sold in Europe Is Now Chinese-Made

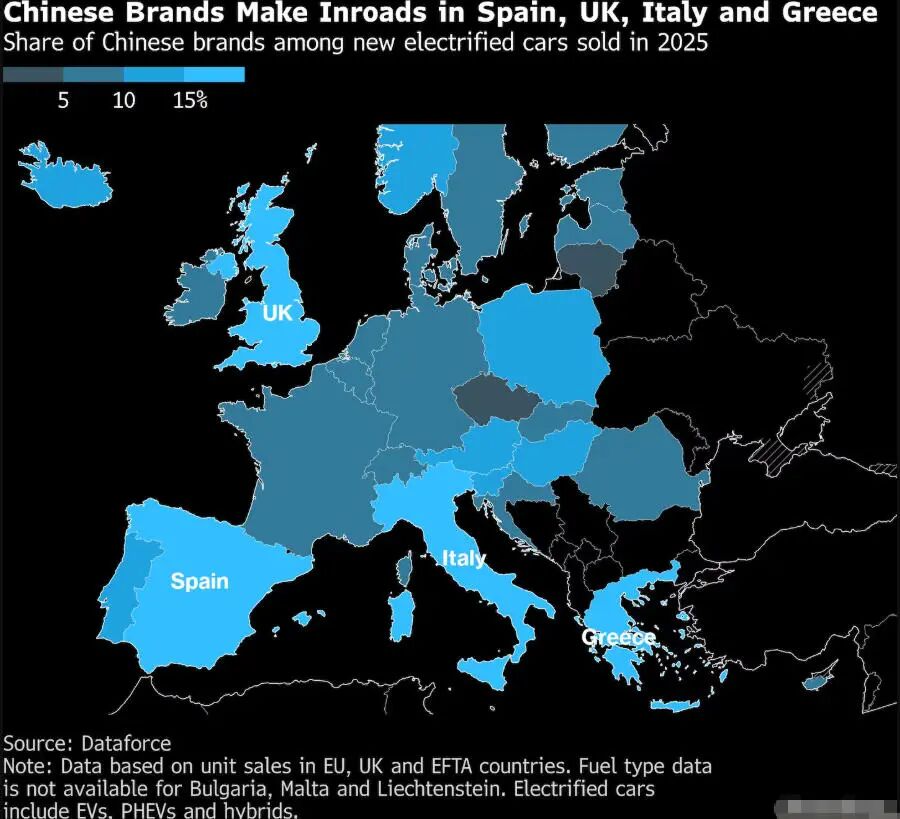

Last month (December), Chinese automakers achieved a new milestone in Europe: Their passenger vehicle sales accounted for nearly one-tenth of total European sales. This record share capped a year of rapid growth for Chinese cars in Europe, driven primarily by strong electric and hybrid vehicle sales.

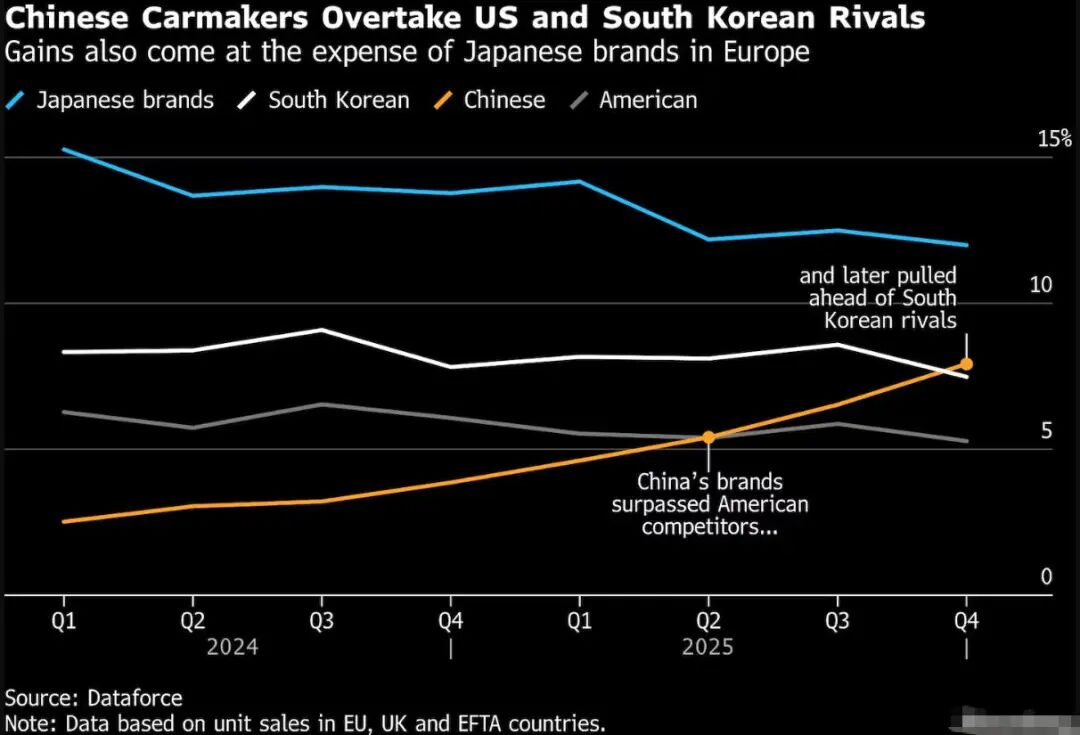

Market research firm Dataforce reported that Chinese brands captured a 9.5% market share in Europe in December, surpassing South Korean rivals (including Kia) in quarterly sales for the first time. With trade barriers lowering and Chinese exports accelerating, brands like BYD are poised to expand their market presence further.

Growth is primarily driven by the EV sector, currently the main engine of European automotive expansion. Leveraging significant advantages in battery technology, Chinese automakers have attracted consumers across Spain, Greece, Italy, and the UK, establishing footholds in the electric and hybrid vehicle segments.

"The rapid adoption of Chinese cars in Southern Europe has been remarkable," said Julian Lissinger, Dataforce analyst. "While we knew these markets were more flexible in brand choice, the speed of this shift in the EV sector exceeded expectations."

Beyond established brands like BYD and SAIC's MG, emerging players such as Leapmotor and Chery have also achieved significant sales growth, collectively dominating the Chinese automotive presence in Europe.

When including vehicles produced by non-Chinese brands like Tesla, Volkswagen, BMW, and Renault in China and exported to Europe, China's influence on the European EV market becomes even more profound. By 2025, an estimated one-seventh of EVs sold in Europe are expected to be Chinese-made.

Currently, Chinese automakers are intensifying their European market expansion. BYD announced on January 24 that it plans to increase overseas deliveries by nearly 25%. Facing strong growth from Chinese brands, European automakers—after three years of market expansion—have gained some breathing room.

They are responding with competitive electric models, including Stellantis' Citroën e-C3 and Renault's upcoming Twingo. Excluding the UK, European automakers still maintain share advantages in key markets like Germany and France.

Non-European brands with decades of European operations and mature dealership networks are now feeling competitive pressure from Chinese automakers. Dataforce shows Chinese brands surpassed U.S. automakers in European sales during Q2 2025 and overtook South Korean companies in Q4.

"We believe the rise of Chinese brands in Europe will force some other brands to exit the market," Lissinger analyzed. "Current overall sales remain below pre-2021 levels, and with Chinese brands capturing significant market share, survival will become harder for others."

From early acquisitions of brands like Volvo, MG, and Lotus to recent joint ventures and localized operations, Chinese automakers' European strategies have deepened. Companies like BYD are investing directly in local factories and design centers while committing to European supply chains, further integrating into the regional ecosystem.

Currently, Stellantis plans to produce Leapmotor EVs in Zaragoza, Spain, this year, while Chery is preparing to manufacture electric cars in Barcelona with local partners. Alongside localized production, Chinese automakers continue ramping up vehicle exports, pursuing a dual-track approach to accelerate their European market presence.

Editor-in-Charge: Cui Liwen Editor: He Zengrong

THE END