Tech Giants' AI Showdown During Spring Festival: Just a Taste of What's to Come

![]() 02/05 2026

02/05 2026

![]() 400

400

By Liang Tian

Source: Node Finance

This Spring Festival, the familiar tradition of red packet wars made a comeback, but with a new twist—all the major tech players joined the fray.

Last year, DeepSeek burst onto the scene unexpectedly, amassing over 100 million users globally in just one week and catching the tech giants off guard. Back then, companies' investments in AI, especially Tencent's, seemed hesitant and unfocused.

A year later, with reinforcements in place, the first major battle for AI entry points erupted this Spring Festival.

From a strategic standpoint, the approaches were highly diverse.

Tencent's Yuanbao kicked off with a massive 1 billion yuan cash incentive to drive traffic to its AI social platform. However, internal competition reared its head as WeChat unceremoniously blocked Yuanbao's activity links. Baidu expanded its reach with Wenxin Assistant, offering 500 million yuan in cash red packets to tie its app to various Spring Festival AI activities. Alibaba's Qianwen app invested a staggering 3 billion yuan in its "Spring Festival Hospitality Plan," with Taobao Flash Sales, Fliggy, Damai, Hema, Tmall Supermarket, and the entire Alipay ecosystem joining the fray. ByteDance secured exclusive interactive rights for the CCTV Spring Festival Gala, aiming to leverage the massive viewership to propel "Doubao" to national prominence.

This Spring Festival, the major players stopped testing the waters and went all in.

It's Not AI Reconstructing the Giants, But Giants + AI

Looking back at the initial phase of AI entry point competition, chatbots like Kimi cast a wide net to acquire traffic but had yet to fully validate their commercial closed-loop models.

Internet giants may have been slightly late to the game, but they had clearer strategies, using established ecosystems to guide users into new AI territories.

ByteDance leveraged its content ecosystem, Tencent its social network, Baidu its search capabilities, and Alibaba its commercial services.

When Tencent launched its AI social platform Yuanbao on February 2, it resembled a fusion of "WeChat + Tencent Meeting + AI Assistant": users could chat casually, share screens to watch videos together, hold remote meetings or teach classes, while AI served as both a task assistant and emotional companion.

Of course, Tencent's Yuanbao also had defensive undertones. After all, on January 27, Baidu's Wenxin tested multi-role group chats, and on January 26, Alibaba's UC Browser launched multi-agent group chats—both had previously eyed the social space, making Tencent's caution against being outmaneuvered in the AI era understandable.

However, what we find regrettable is Tencent's continued sluggishness from the WeChat era, unwilling to make bold moves within the WeChat ecosystem. For instance, it could have leveraged its countless merchant mini-programs to introduce intelligent agents and create a closed-loop ecosystem, similar to Doubao Mobile. Instead, it cautiously introduced AI into social contexts. As a result, some bloggers interpreted this move as "rushed."

Unlike Tencent's AI + social approach, Alibaba and ByteDance focused on building closed loops.

Specifically, Qianwen acts as the front desk of Alibaba's commercial empire.

It covers numerous service scenarios, including e-commerce shopping, local life, financial services, cultural entertainment, and work-study. Thanks to its integrated ecosystem, users can complete transactions seamlessly within Qianwen.

ByteDance, on the other hand, announced on December 23 that its Volcano Engine would be the exclusive AI cloud partner for the 2026 CCTV Spring Festival Gala, with its intelligent assistant "Doubao" deeply embedded in the live broadcast, featuring various interactive activities. The core of this strategy is to leverage the gala's massive traffic to establish Doubao as an AI entertainment entry point.

Of course, this is just the beginning. Doubao is merely ByteDance's vanguard in the AI era, with Liang Rubo stating that future Doubao-like assistants will connect with other products.

It's easy to imagine Doubao serving as a fulcrum to mobilize various businesses within ByteDance's ecosystem. After all, in November of the previous year, Doubao had already initiated an e-commerce closed loop—on Doubao, users could now see clickable "product cards" that redirected to Douyin for direct group-buying ticket purchases.

Finally, looking at Baidu, unlike the other three giants, which supported new apps, Baidu demonstrated an internalized integration model for AI applications—by embedding AI capabilities into high-frequency scenarios within the Baidu app, users could satisfy their needs without downloading a new app or switching tasks to find AI tools.

Can They Launch Another Pearl Harbor Surprise?

Tencent, which has been highly cautious in the AI era, placed great hopes on this Spring Festival. Pony Ma stated that he hoped Yuanbao could replicate the success of WeChat's red packet phenomenon 11 years ago.

Looking back at the 2015 Spring Festival, Tencent distributed 500 million yuan in red packets through WeChat's "Shake" feature, achieving the rapid binding of 200 million bank cards in three months—a feat dubbed by Alibaba as a "Pearl Harbor surprise."

Of course, as Pony Ma critiqued the Qianwen ecosystem, he acknowledged its systemic advantages but noted that the "family bucket" (all-in-one package) might not align with all user preferences, as not all services within the ecosystem were industry-leading.

Pony Ma's critique of Alibaba's Qianwen holds merit, but whether Yuanbao can truly retain users remains questionable.

In December 2025, QuestMobile data showed that ByteDance's Doubao ranked first in weekly active users among domestic AI-native apps, with DeepSeek second. Tencent's Yuanbao, while third, lagged significantly behind the top two. Moreover, Alibaba's Qianwen, though newly launched, was gaining momentum rapidly, approaching Yuanbao, which had been out for over a year.

However, under the red packet offensive, Yuanbao's rankings surged across major app stores by January 31, claiming first place on Huawei's AppGallery trending list, second on Apple's China App Store free list, and second on VIVO's App Store download list.

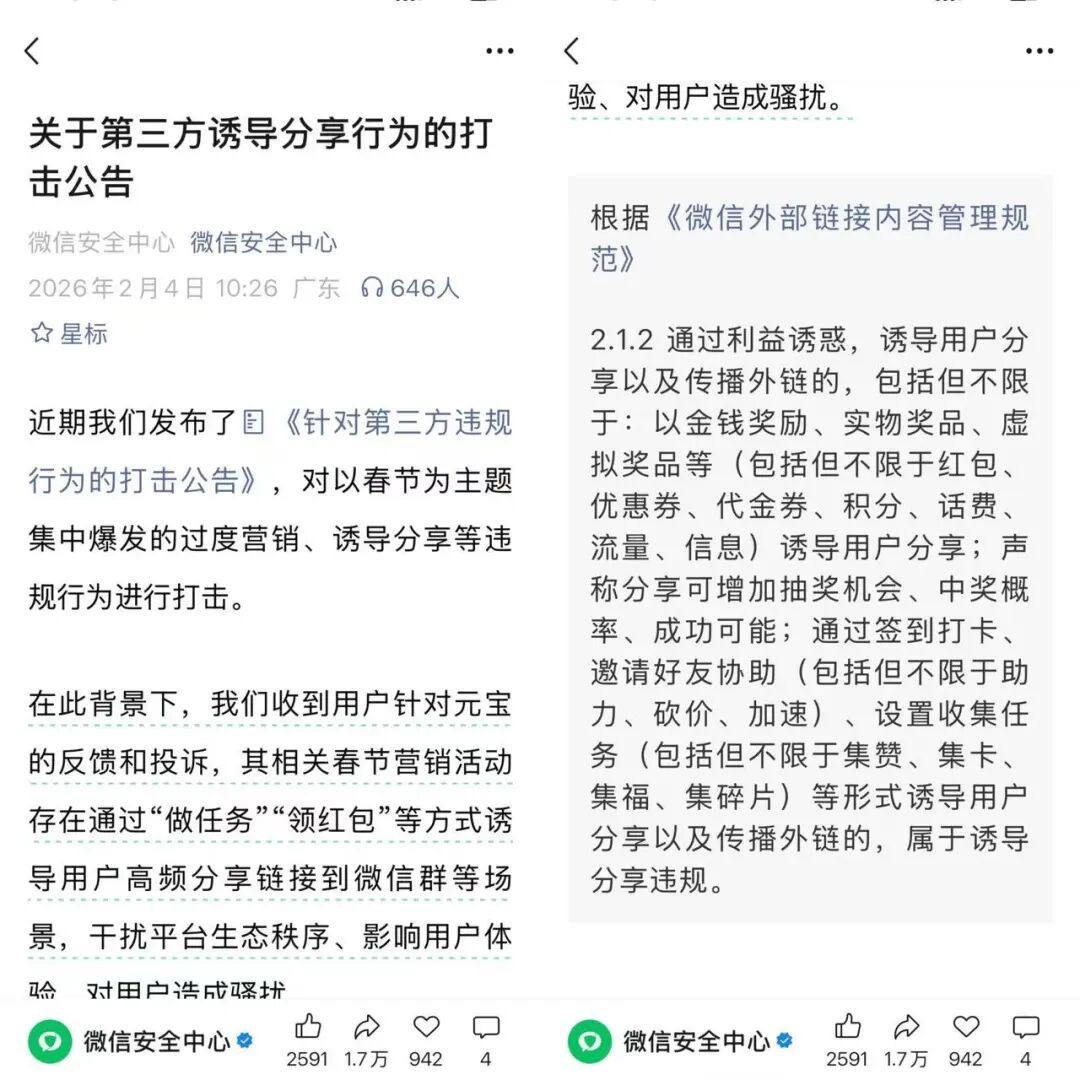

Yet, the good times didn't last. Yuanbao's red packet links spread rapidly in WeChat groups, achieving high-density viral transmission. However, this also pushed WeChat's limits. According to WeChat's long-standing "External Link Content Management Norms," any behavior that incentivizes users to share or propagate content through rewards is typically classified as induced sharing and becomes a target for strict governance.

Thus, on February 4, news spread that WeChat had personally blocked Yuanbao's forwarding links.

Many might be surprised by Tencent's self-sabotage, but we offer another perspective—perhaps Yuanbao had already saturated its traffic, and this block affected not only Tencent but also its competitors who were planning to distribute red packets. Meanwhile, Yuanbao's official account responded, stating, "We are urgently optimizing and adjusting the sharing mechanism and will launch it soon to ensure a smooth red packet experience for users."

So, let's view this block as a minor interlude in the red packet battle—the red packet frenzy will continue.

If so, it leads to the next question: with downloads secured, how many users will stay?

Many analysts argue that while red packets can boost user data in the short term, retaining users depends on shifting from simple user acquisition to deep habit cultivation and ecosystem building—a principle that applies not just to Tencent but to all the major players in this battle.

Because, in our view, red packets are merely an introduction. User retention depends on the ecosystem's depth.

The mobile internet era offers clear precedents.

In 2020, Kuaishou secured exclusive interactive cooperation for the Year of the Rat Spring Festival Gala and distributed 1.1 billion yuan in red packets. This high investment paid off, with Kuaishou's DAU peaking at 320 million during the gala. However, Kuaishou failed to retain many users. According to QuestMobile's "2020 China Mobile Internet Spring Report," Kuaishou's average DAU in March was 215 million, far below its peak and still about 100 million behind Douyin.

Of course, in the AI era, traffic holds different significance, representing a competition of full-stack AI capabilities among major players.

Unlike the internet era, where user growth reduced operational marginal costs, each interaction with a chatbot occupies the tech giants' computational resources, driving up inference costs. Especially amid the booming B-side AI transformation, this Spring Festival's billion-dollar red packet exercise serves as a show of strength.

That is, demonstrating to enterprises the major players' AI infrastructure's carrying capacity and stable service capabilities. Real user engagement has also become a powerful case study and trust symbol for Alibaba Cloud, Baidu Cloud, and Volcano Engine when selling large model services to enterprise clients.

Clients naturally assume that a product supporting hundreds of millions of users indicates stable and reliable underlying models and engineering capabilities.

It's Just the Beginning

While the astronomical red packets kept onlookers entertained, in our view, this is merely an appetizer in the AI era's competition among major players.

After all, the shape of terminal entry points in the AI era remains unclear.

This is evident from overseas AI industry developments. Clawdbot, Moltbot—2026 has just begun, and the AI sphere's hot topics are overwhelming, leaving many practitioners exclaiming, "There's too much to learn!"

Today's giants are navigating the "New World" with "old maps." While they possess financial and ecological moats, no one can guarantee that a new disruptor like DeepSeek won't emerge in the intelligent agent or other new sectors, sweeping the C-side market with a brand-new experience.

This means the giants' battle for entry points is just beginning—far from the final act.

*The featured image was generated by AI.