Another Case of Hype Without Substance: When Will AMD Truly Step Up Its Game?

![]() 02/05 2026

02/05 2026

![]() 406

406

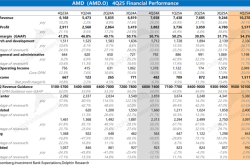

AMD (ticker: AMD.O) unveiled its financial results for the fourth quarter of 2025 (ending December 2025) after the U.S. market closed on the morning of February 4, 2026, Beijing time. Here are the key takeaways:

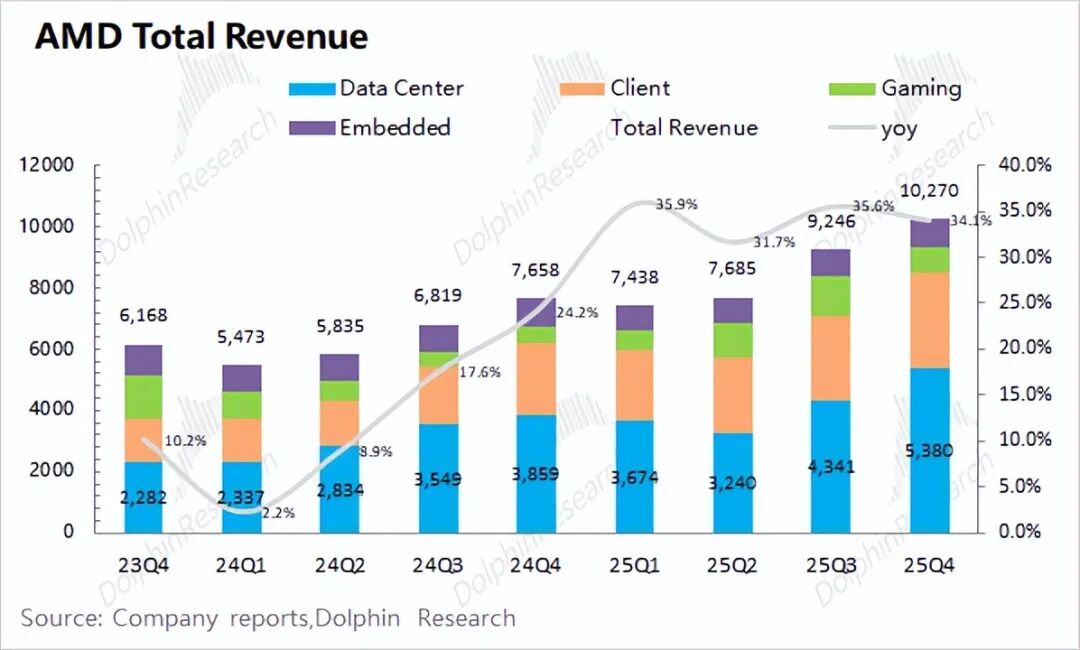

1. Overall Performance: AMD reported a revenue of $10.27 billion in Q4 2025, marking a 34.1% year-over-year (YoY) increase and surpassing the revised market expectations of $10 billion. The recent uptick in server CPU demand has prompted mainstream market analysts to upwardly adjust their forecasts for the company. This quarter's revenue surge was primarily driven by growth in the data center CPU and client businesses.

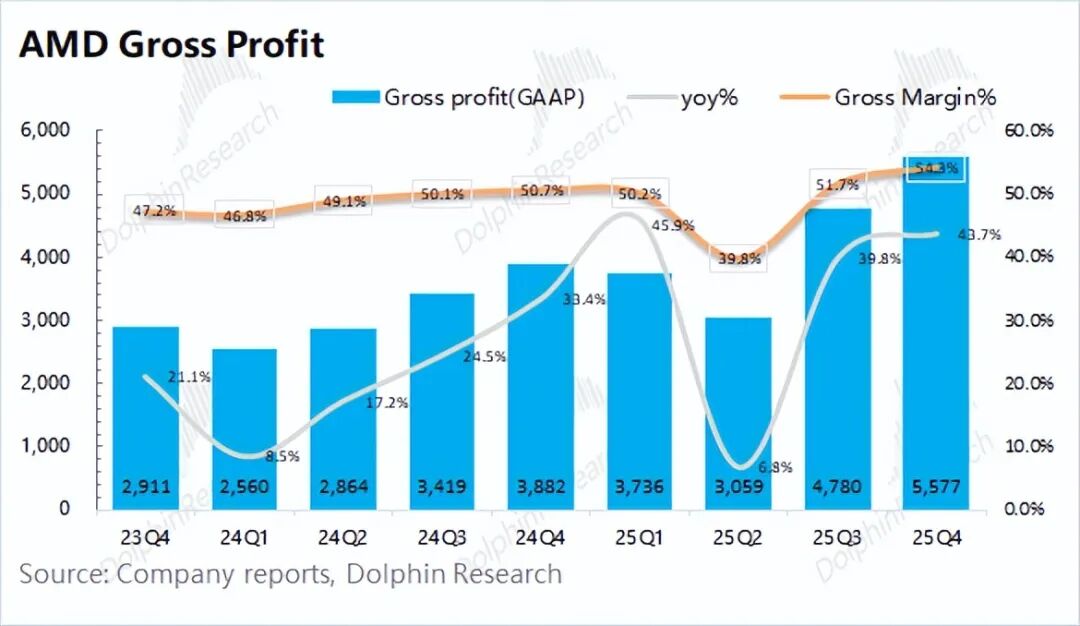

The company's gross margin (GAAP) for the quarter stood at 54.3%, up 3.6 percentage points YoY, thanks to the liquidation of MI308 inventory (valued at approximately $360 million). Excluding this impact, the actual gross margin was 50.8%, roughly in line with the previous year.

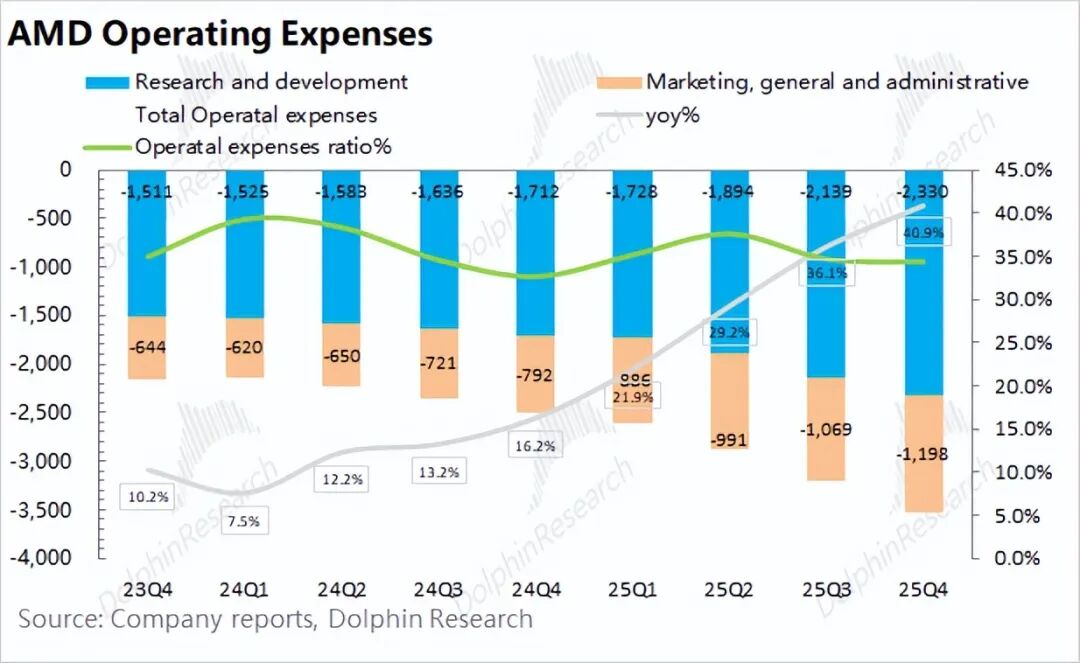

2. Operating Expenses: AMD's research and development (R&D) expenses for the quarter amounted to $2.33 billion, a 36.1% YoY increase, while selling and administrative expenses reached $1.2 billion, up 51% YoY. As revenue continued to grow robustly, the company's core operating expenses also rose. The core operating expense ratio climbed to 34.4% this quarter, up 1.7 percentage points YoY.

AMD reported a net profit of $1.5 billion for the quarter, significantly influenced by non-recurring items. From an operational standpoint, the company's core operating profit was $2.05 billion, continuing its growth trajectory, with a core operating profit margin of 20%.

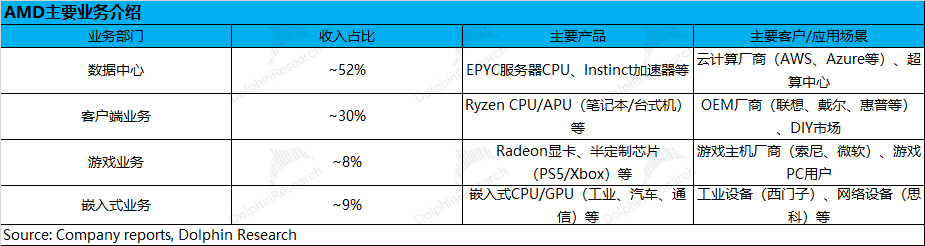

3. Business Segment Breakdown: Driven by growth in the data center and client businesses, these two segments contributed over 70% of the total revenue.

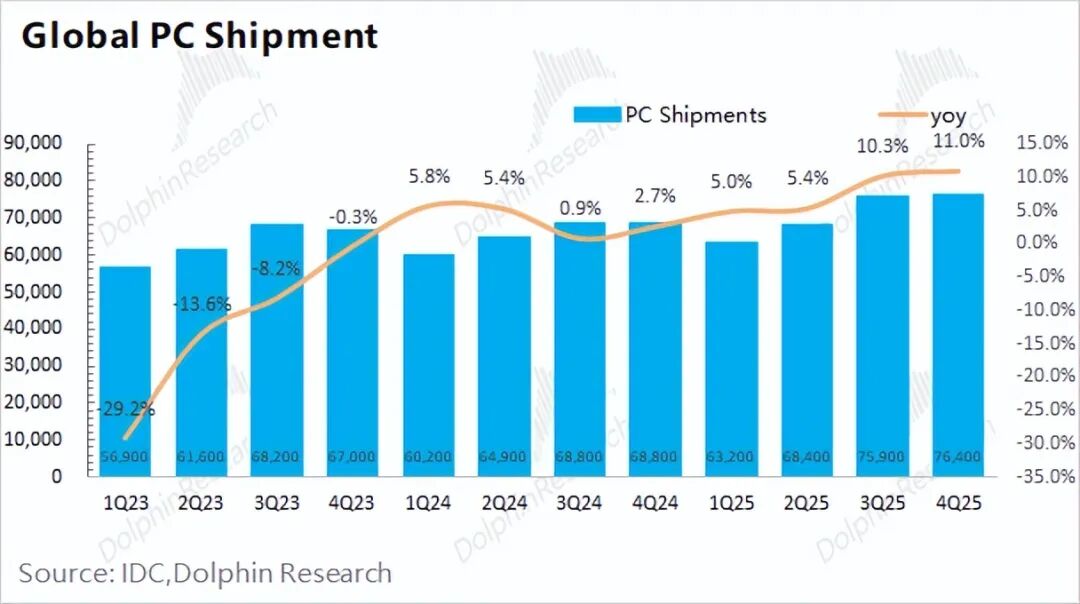

1) Client Business Gains Market Share: Revenue in this segment grew to $3.1 billion this quarter, a 34% YoY increase. Global PC market shipments rose by 11% YoY, while AMD's client business experienced significant growth, primarily due to its expanding market share in the PC segment.

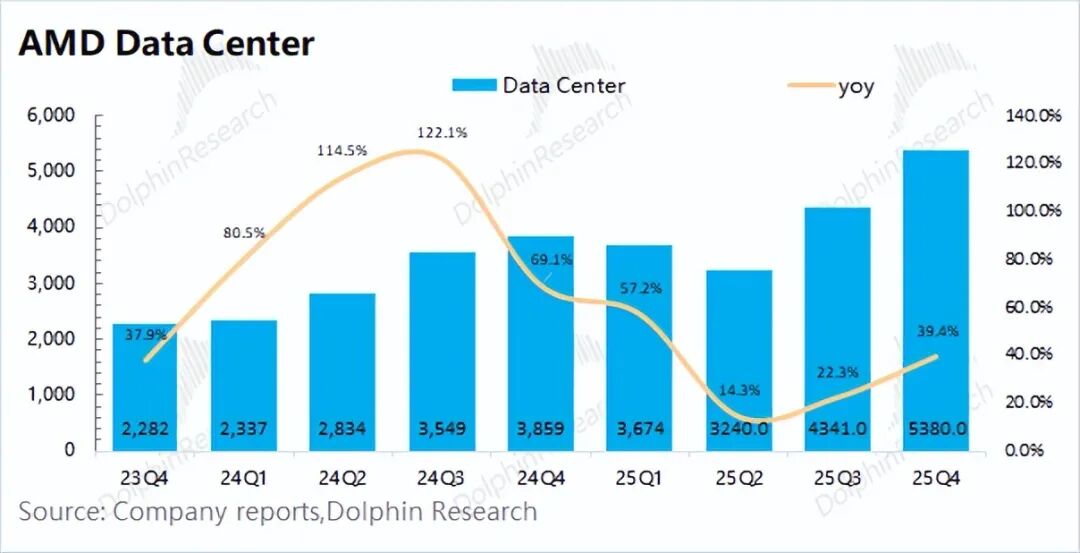

2) Data Center Awaits New Product Boost: Revenue in this segment was $5.38 billion this quarter, a 39% YoY increase. The growth was mainly attributed to increased production of server CPUs and the MI355 series.

① Server GPU: Performance Weakened Again. This quarter's revenue included $390 million from MI308 sales to China, which is included in the server GPU revenue.

Since last quarter's revenue did not include MI308 sales, excluding this item, the estimated revenue for the company's remaining server GPUs this quarter was approximately $2 billion, with a sequential increase of only $150 million, which is unsatisfactory.

While the market is eagerly anticipating the MI450 series, set for mass production in the second half of 2026 and marking the company's transition from "single-chip" to "rack-level cluster" delivery, the current slowdown in MI355 series growth is dampening market confidence.

② Server CPU: Remains Robust. The primary driver of growth in the server CPU business this quarter was the company's increased market share in this segment. According to third-party data, AMD's shipment share in the server CPU market has risen to over 20%.

4. AMD's Guidance: Revenue for Q1 2026 is expected to be between $9.5 billion and $10.1 billion (revised market expectations hover around $9.7 billion), with the midpoint ($9.8 billion) indicating a 4.5% sequential decline. The outlook includes approximately $100 million in MI308 sales to China. The company anticipates a non-GAAP gross margin of around 55% (market expectation: 54.5%).

Dolphin Research's Overall View: MI355 Mass Production Falls Short, Hopes Pinned on MI450's "Rack-Level" Solution

AMD's financial results for this quarter were respectable, with revenue and gross margin meeting market expectations, primarily driven by the recovery in CPU demand.

However, a closer examination reveals that the sequential growth of the market-focused MI355 series was disappointing. Since the company's data center growth this quarter was mainly driven by the recovery in server CPU demand, Dolphin Research estimates that AI GPU revenue this quarter was approximately $2.4 billion.

Excluding the $390 million contribution from MI308 sales to China, the remaining AI GPU revenue (including the MI355 series) was only around $2 billion, with a sequential increase of just $150 million. Given that the MI355 series only began mass production in the second half of 2025, the significant slowdown in sequential growth in Q4 is concerning.

Combined with AMD's guidance for next quarter, the company expects revenue to decline by around 5% sequentially. Considering seasonal declines in the client and gaming business segments, as well as the embedded business segment, Dolphin Research estimates that AI GPU revenue will also decline to around $2.2 billion next quarter.

Excluding the expected $100 million in MI308 revenue, the remaining AI GPU revenue will increase by around $100 million sequentially.

While the company attributes this to insufficient customer preparation, with approximately $1.5 billion in orders from the first fiscal quarter to be delivered in the second fiscal quarter, the MI355 series has shown sequential growth slowdowns for two consecutive quarters shortly after mass production began, raising questions about the product's competitiveness in the market.

Beyond this quarter's financial results, the market is primarily focused on the following aspects of AMD:

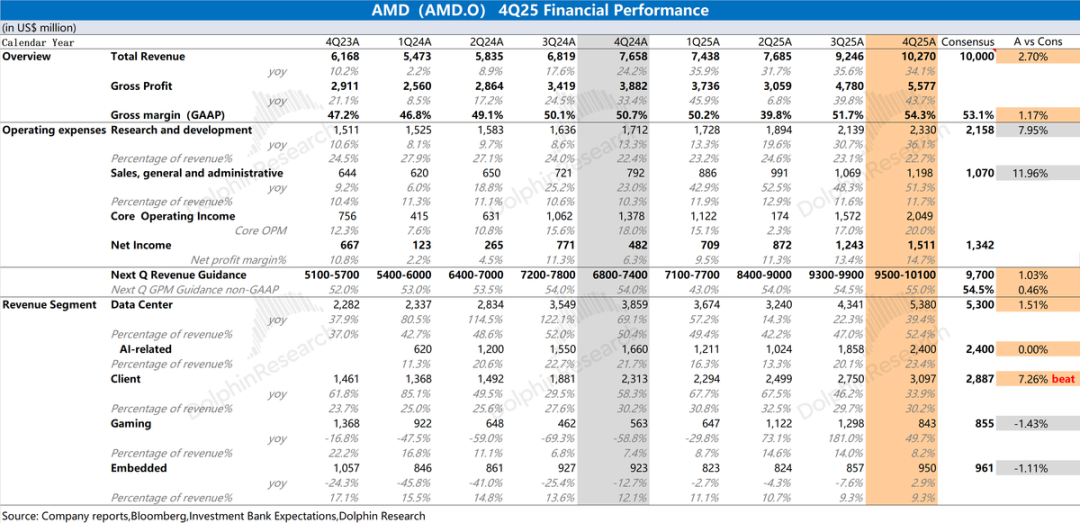

a) Major Players' Capital Expenditures: In this "hot" AI cycle, cloud service giants have been the primary chip buyers.

Recently, Meta and Microsoft were the first to release their latest financial results, with Meta further increasing its 2026 capital expenditures to $115-135 billion, a 60-87% YoY increase, significantly exceeding previous market expectations (around $110 billion).

For 2026, Dolphin Research expects the combined capital expenditures of the four core cloud providers (Meta, Google, Microsoft, and Amazon) to exceed $600 billion, with YoY growth of around 50%.

In terms of investment pace, 2026 will still feature a "low in the first half, high in the second half" pattern, mainly due to the mass production of NVIDIA's Rubin and AMD's MI400 in the second half of the year. Sustained high capital expenditures provide crucial industry support for servers and AI chips.

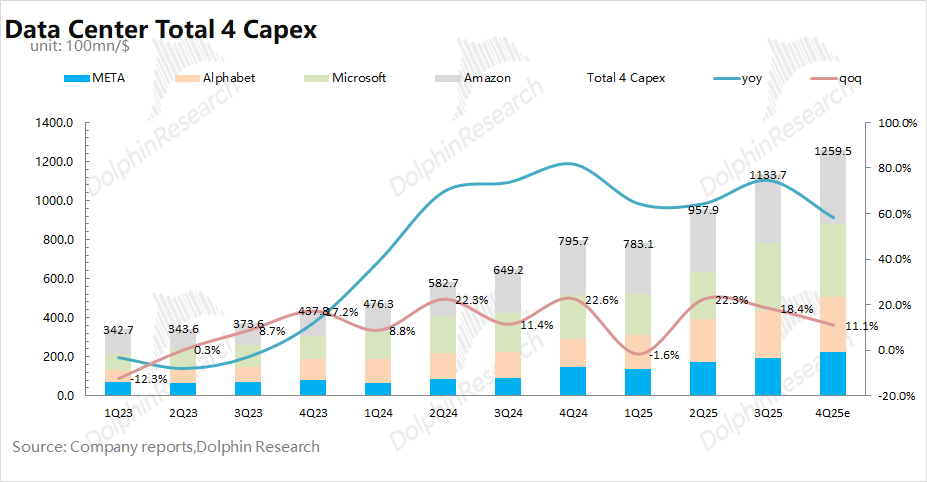

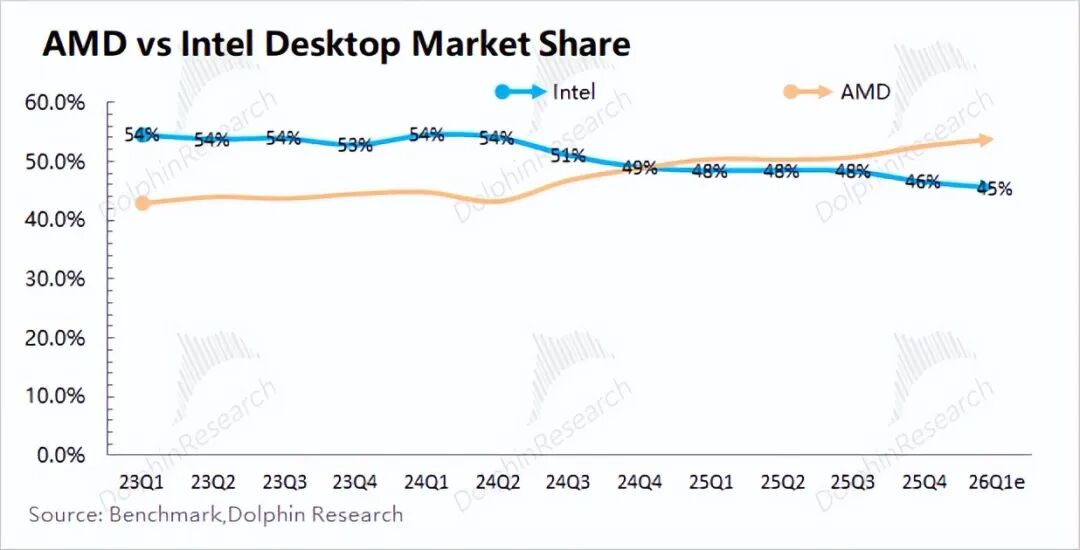

b) Enhanced CPU Competitiveness: AMD continues to erode Intel's market share in the CPU segment.

With the PC industry maintaining 11% YoY growth this quarter, Intel's client business actually declined by 6.6%, while AMD achieved 34% growth.

This "shift in competitiveness" reflects AMD's growing strength in the CPU market. From an overall CPU market perspective (including PC and server CPUs), AMD's market share has been steadily increasing, particularly in the desktop market, where it has surpassed Intel.

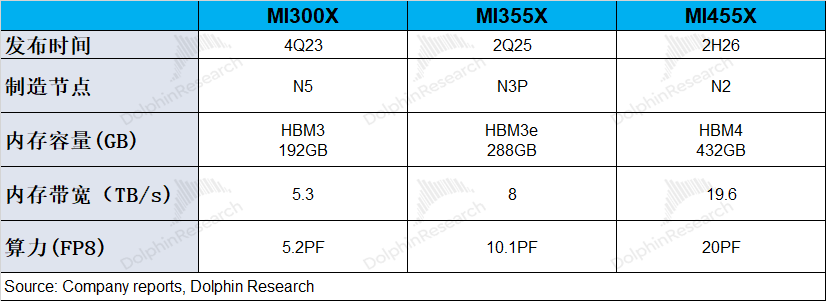

c) AI GPU Progress: AMD's current primary shipment is the MI355, with the next-generation MI455 set to launch in the second half of the year.

The improvements from the MI355 to the MI455 series mainly lie in compute power, memory, and clustering. Compute power is expected to double (adopting 2nm process technology), while memory upgrades (from HBM3E to HBM4) enhance bandwidth and capacity.

Compared to compute and memory improvements, the market is more focused on the company's breakthrough in rack-level solutions. As the focus of large language models shifts from training to inference, the importance of compute power diminishes. For example, AMD's MI355 series compute power is in the same tier as NVIDIA's B200, but AMD's market competitiveness hinges on its inability to deliver rack-level clusters.

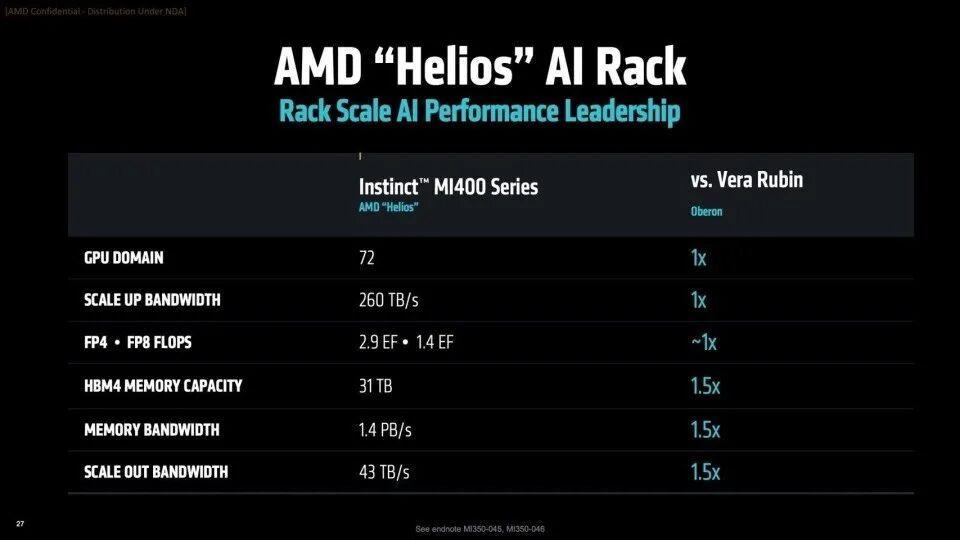

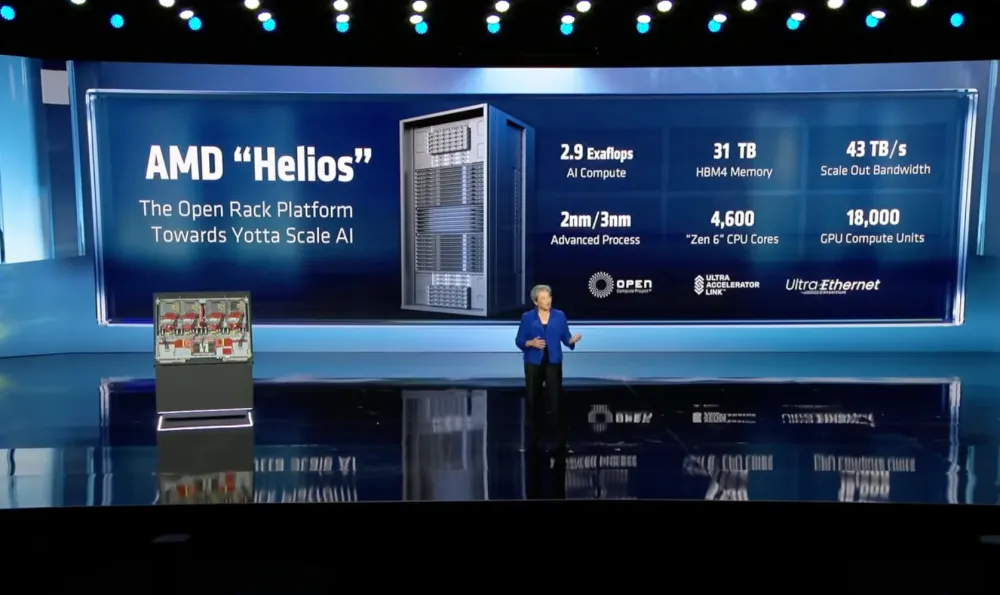

In its outlook for the MI450 series, the company plans to deeply integrate it with the Helios rack platform, enabling delivery from "single-chip" to "rack-level cluster," directly competing with NVIDIA's Rubin architecture.

The Helios rack will support up to 72 MI455X GPUs, achieving efficient cross-GPU and cross-rack collaboration through "43TB/s horizontal scaling bandwidth" (ultra-Ethernet technology) and "full liquid cooling design," delivering a single-rack AI compute power of 2.9 ExaFLOPS (FP4).

For large cloud service providers, large-scale "cluster" deployments are more critical than simply purchasing cards. The MI450 series' "rack-level cluster" delivery method is precisely what major cloud service providers (CSPs) need.

Since the MI450 series will only begin mass production in the second half of the year, AMD's AI revenue in 2026 will also follow a "low in the first half, high in the second half" pattern. With the mass production and shipment of the MI450, the company's data center business is expected to accelerate.

Given AMD's current market capitalization ($394.2 billion), it roughly corresponds to a 38x price-to-earnings (PE) ratio on 2026's after-tax core profit (assuming revenue +44% YoY, gross margin of 53.9%, tax rate of 13%). Due to significant fluctuations in the company's profits in the past, historical PE ratios are less referenceable.

Compared to peers in the AI sector, AMD's current PE is significantly higher than NVIDIA's (23x) and TSMC's (22x), reflecting market expectations for AMD to capture market share and achieve high growth in the AI sector.

Overall, AMD's short-term performance is primarily influenced by its CPU business and MI355 shipments. The MI355's slower-than-expected sequential growth will put downward pressure on the stock price. In the medium to long term, the market is more focused on the progress of the company's next-generation MI450 series, including new customers, new orders, and rack-level cluster deliveries.

As the focus of large language models shifts to inference, the importance of compute power diminishes, while CPU demand increases, benefiting AMD. Driven by the recovery in CPU demand, AMD's fundamental performance is expected to steadily improve.

While AMD still lags behind NVIDIA in compute power, this does not prevent the company from securing orders in the inference segment. Even with the current underperformance of the MI355, the company still has the MI450 series' "rack-level cluster" solution to look forward to after the stock price correction.

Here's a detailed analysis:

I. Overall Performance: MI308 Inventory Release Drives Continued Growth

1.1 Revenue

AMD achieved revenue of $10.27 billion in Q4 2025, a 34% YoY increase, surpassing the revised market expectations (around $10 billion). The company's sequential revenue growth this quarter was primarily driven by the data center CPU and client businesses.

Although the data center business saw a sequential increase of around $1 billion this quarter, approximately $390 million of that came from MI308 sales in China. Excluding this impact, the remaining AI GPU revenue only increased by $150 million sequentially, with the primary increment coming from server CPUs.

1.2 Gross Margin

AMD achieved a gross profit of $5.58 billion in Q4 2025, a 44% YoY increase. The gross margin for the quarter was 54.3%, showing a significant recovery.

Previously affected by MI308 inventory write-downs, the gross margin had once fallen to 39.8% (around 50.2% excluding write-down impacts). This quarter, the company benefited from the release of MI308 inventory (approximately $360 million). Excluding this impact, the actual gross margin was 50.8%, roughly flat YoY.

1.3 Operating Expenses

AMD's operating expenses for Q4 2025 were $3.53 billion, a 41% YoY increase. Both R&D expenses and selling and administrative expenses increased by varying degrees.

Breaking down the specific expenses: ① The company's R&D expenses for the quarter were $2.33 billion, a 36% YoY increase. The company continues to increase R&D investment, primarily directed toward AI-related areas. ② The company's selling and administrative expenses for the quarter were $1.2 billion, a 51% YoY increase. Selling expenses are highly correlated with revenue growth, and the company has also increased employee incentive spending.

1.4 Profitability

Due to significant deferred expenses from AMD's acquisition of Xilinx, profits will be eroded for some time. Regarding this quarter's actual operating performance, Dolphin Research believes that "core operating

In the fourth quarter of 2025, AMD's data center business raked in $5.38 billion in revenue, marking a 39% year-on-year surge. This performance met market expectations, which had been revised upwards to around $5.3 billion. The key drivers behind this quarter's year-on-year growth were the increased shipments of server CPUs and the resale of MI308.

Based on both company and market expectations, a detailed analysis reveals the following: Dolphin Research projects that AI GPU revenue for this quarter will reach approximately $2.4 billion, while data center CPU and related revenue will amount to about $2.98 billion.

Given that MI308 resales hit $390 million this quarter, it can be deduced that revenue from other AI GPUs (including the MI355 series) was roughly $2 billion. This represents a sequential increase of only $150 million, falling short of market expectations.

Detailed Analysis:

a) Data Center CPUs: Maintaining Robust Performance

With Intel's CPU products showing signs of weakness, AMD has capitalized on the situation. Through its "CPU + GPU" combination strategy, AMD has steadily increased its market share in the data center CPU segment, now surpassing 20%. Although Intel recently forged a partnership with NVIDIA for its x86 CPUs, AMD is still poised to drive growth in its data center CPU shipments through iterative upgrades of its MI series.

b) AI GPUs: Once Again Underperforming

A closer look at the breakdown reveals that the primary growth in the company's data center business this quarter stemmed from the resale of MI308. In contrast, other AI GPUs (including MI355) only saw a sequential increase of around $150 million. Considering that MI355 is set to commence mass production only in the second half of 2025, this performance is unlikely to impress the market.

Taking into account both market and company conditions, Dolphin Research anticipates that the company's AI GPU revenue will reach around $2.2 billion next quarter, with $100 million coming from MI308 resales. This suggests that the quarterly incremental revenue from MI355 may only be around $100 million.

Given the upward revision of capital expenditures by the four major cloud providers—Meta, Google, Microsoft, and Amazon—Dolphin Research expects their combined capital expenditures in 2026 to exceed $600 billion, with a year-on-year growth rate surpassing 50%. This sets the stage for robust growth in the AI chip market in 2026.

In such a rapidly expanding market, AMD's ability to secure more orders hinges on the capabilities of its products. In the server CPU segment, AMD continues to aggressively capture market share. However, in the AI GPU segment, the current performance of the MI355 series has been "disappointing," prompting the market to shift its focus to the next-generation MI450 series.

Regarding the MI450 series, AMD plans to deeply integrate it with the Helios rack-mounted platform. This integration will enable the delivery of solutions ranging from "single-chip" to "rack-level cluster," directly challenging NVIDIA's Rubin architecture. This move aligns perfectly with the current needs of large cloud service providers (CSPs).

2.2 Client Business

AMD's client business generated $3.1 billion in revenue in the fourth quarter of 2025, marking a 34% year-on-year increase and outperforming market expectations of $2.9 billion. The growth in the client business was primarily fueled by the recovery in the PC market and the erosion of Intel's market share.

According to industry data, global PC shipments reached 76.4 million units in the fourth quarter of 2025, representing an 11% year-on-year increase. Meanwhile, AMD's client business achieved a 34% year-on-year growth. In contrast, Intel's client business still experienced a 6.6% year-on-year decline.

Comparing the growth rates of the three, Dolphin Research believes that the overall PC market is continuing its recovery, with AMD gaining a significant market share. In the desktop market, AMD has even surpassed Intel in terms of market share.

2.3 Other Businesses

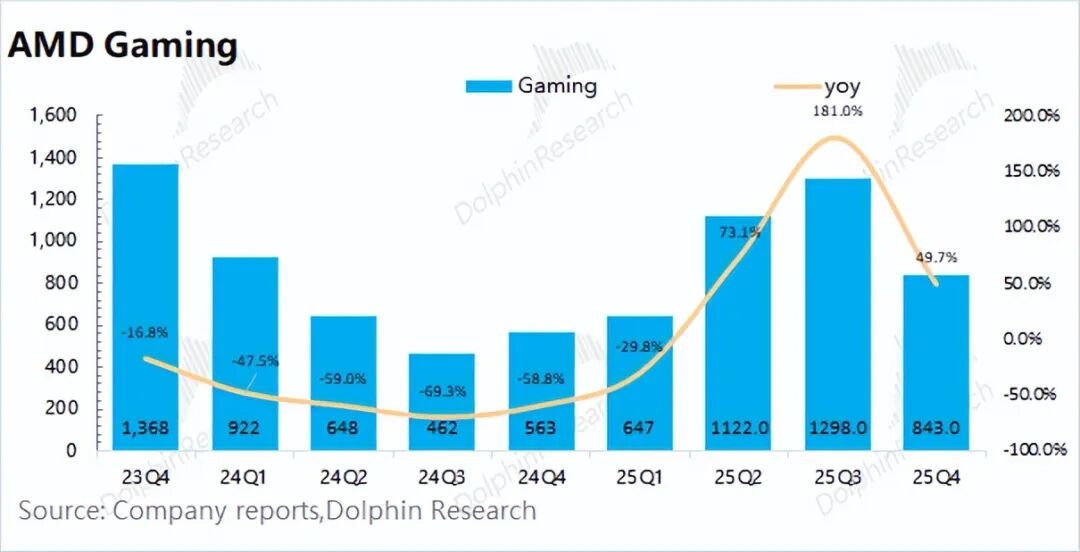

1) Gaming Business: The company's gaming business generated $840 million in revenue in the fourth quarter of 2025, marking a 49% year-on-year increase.

Specifically, ① Semi-Custom Business: This segment saw year-on-year growth but experienced a sequential decline. It is anticipated that in 2026, as the console cycle enters its seventh year, Microsoft will launch its next-generation Xbox (equipped with AMD's semi-custom SoC) in 2027. ② Gaming GPUs: The Radeon RX9000 series witnessed strong demand during the holiday season, with channel sales on the rise.

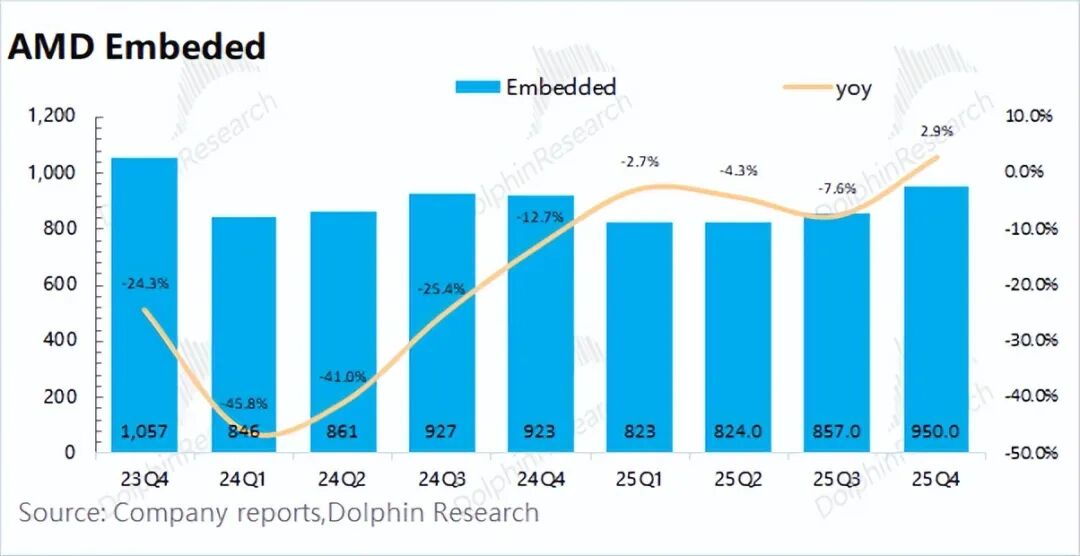

2) Embedded Business: The company's embedded business achieved $950 million in revenue in the fourth quarter of 2025, marking a 3% year-on-year increase. This growth was supported by the recovery in demand across multiple end markets.

- END -

// Reprint Authorization

This article is an original piece by Dolphin Research. Authorization is required for reprinting.

// Disclaimer and General Disclosure

This report is intended solely for general comprehensive data purposes, catering to the general viewing and data reference needs of users of Dolphin Research and its affiliated institutions. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or unique needs of any individual receiving this report. Investors are strongly advised to consult with independent professional advisors before making any investment decisions based on this report. Any person who makes investment decisions using or referring to the content or information mentioned in this report assumes full responsibility for their own risks. Dolphin Research shall not be held liable for any direct or indirect damages or losses that may arise from the use of the data contained in this report. The information and data in this report are sourced from publicly available materials and are provided for reference purposes only. Dolphin Research makes every effort to ensure, but does not guarantee, the reliability, accuracy, and completeness of the information and data.

The information or views mentioned in this report shall not, under any circumstances or in any jurisdiction, be construed as or deemed to be an offer to sell securities, an invitation to buy or sell securities, or constitute recommendations, inquiries, or endorsements of relevant securities or related financial instruments. The information, tools, and data contained in this report are not intended for or prepared for distribution to, or use by, any person in any jurisdiction where such distribution, publication, provision, or use would violate applicable laws or regulations or result in Dolphin Research and/or its subsidiaries or affiliates being subject to any registration or licensing requirements in that jurisdiction.

This report solely reflects the personal views, insights, and analytical methods of the relevant authors and does not represent the official stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and its copyright is exclusively owned by Dolphin Research. Without the prior written consent of Dolphin Research, no institution or individual shall (i) make, copy, reproduce, duplicate, forward, or distribute in any form any copies or reproductions, and/or (ii) directly or indirectly redistribute or transfer to any other unauthorized person. Dolphin Research reserves all related rights.