January’s Sales Data: Are There Only Five True Blockbusters Left?

![]() 02/05 2026

02/05 2026

![]() 482

482

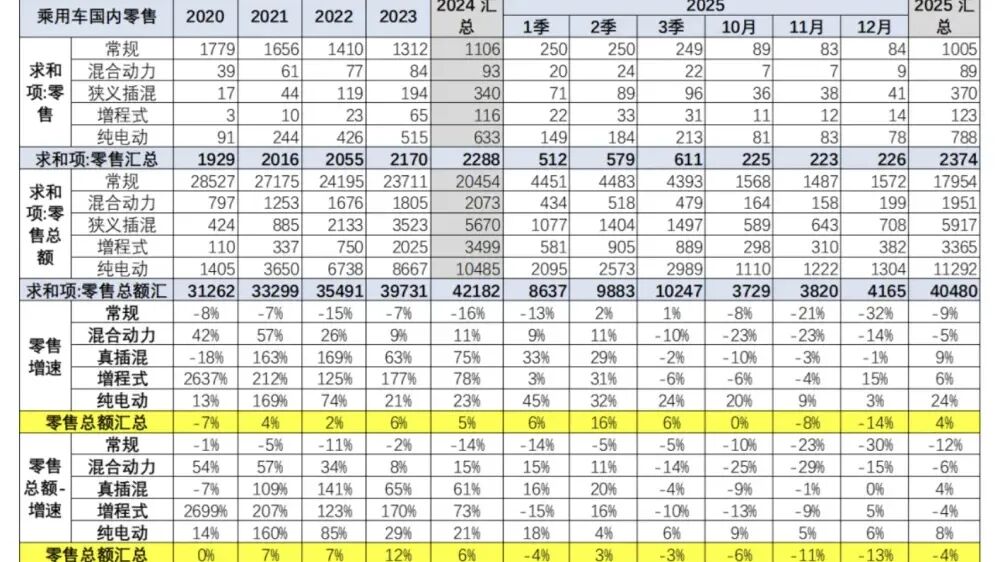

January’s auto sales figures have been released, revealing that many models once hailed as "blockbusters" have lost their shine.

For instance, numerous brands that claimed to launch blockbusters ended up with January sales figures that failed to reach 10,000 units.

Due to changes in purchase tax policies, nearly all automakers rushed to secure orders, leading to the pre-digestion of some early 2026 orders in the fourth quarter of 2025. Furthermore, with current models undergoing technological upgrades and product refreshes at a pace similar to smartphones, the traditional rhythm of mid-cycle facelifts every three years and major redesigns every five to six years has been disrupted. Consumers are now adopting a wait-and-see approach, fearing potential regrets after purchase.

Thus, the decline in auto sales for January 2026 was widely anticipated. As major automakers began releasing their specific January sales figures from January 1st, new trends in the 2026 auto market started to emerge.

Although BYD lost the sales crown to Geely in January, this was a strategic inventory adjustment by BYD, which plans a counterattack after the Spring Festival. Despite several automakers posting year-on-year increases, a month-on-month decline of less than 50% compared to December 2025 is actually a positive sign for sales performance. Additionally, joint venture brands may see a minor surge in 2026, as evidenced by GAC Toyota's mere 8% month-on-month sales decline in January, far lower than peers announcing their results.

Are last year’s blockbusters losing momentum in January’s sales?

Nearly 30 auto brands have released their sales figures, with the overall conclusion being that since late January 2025 fell during the Spring Festival while January 2026 was a complete sales month, the year-on-year data holds relatively little significance. However, a month-on-month decline of less than 50% deserves recognition.

Nevertheless, among those experiencing month-on-month declines, BYD saw a 30.11% drop, Li Auto a 7.55% decrease, and XPeng a 34.07% fall. The reasons vary; BYD is rapidly adjusting its 4S store inventories and plans a flurry of new releases after the Spring Festival, including new batteries, architectures, charging solutions, and models.

Additionally, while BYD's overall sales of 210,000 units in January 2026 were surpassed by Geely's 270,000, it still led in new energy vehicle sales, with Geely at 124,000.

Li Auto's decline stems from multiple factors, including production constraints on the Li i6 and diminished product appeal of the Li L series. XPeng's simultaneous year-on-year and month-on-month declines surprised many, given its numerous 2025 launches, nearly all hailed as "order-bursting new blockbusters." In January, it unveiled new electric and extended-range models, including the G6, G7, G9, and P7+.

From a month-on-month perspective, automakers with declines between 0% and -50% include BYD Group (-30.11%), Chery Group (-18.2%), HarmonyOS Intelligent Mobility (-35.3%), Xiaomi Auto (-22%), Leapmotor (-46.9%), Li Auto (-7.55%), NIO Group (-38.5%), and XPeng (-34.07%).

However, delving deeper into these figures reveals bright spots. For instance, Zeekr delivered nearly 24,000 units, a near 100% year-on-year increase. Lynk & Co's January sales dipped by less than 5,000 units from December 2025, remaining near 30,000. NIO's ES8 delivered 17,600 units in a single month, a figure many new energy brands struggle to achieve in a month or even several months combined.

Xiaomi's performance is also noteworthy; despite a drop from over 50,000 units in December to over 39,000 in January, the delivery figures for the Xiaomi YU7 were substantial.

The underlying reason is evident: the brands that held steady in January possess ample orders, or in simpler terms, "true blockbusters."

Zeekr has the 9X, Lynk & Co the 900, AITO the M7, NIO the third-generation ES8, and Xiaomi the YU7.

Given the current consumer mindset, with the new energy vehicle purchase tax halved to a maximum of 15,000 yuan and the upcoming Spring Festival holiday, most consumers are adopting a wait-and-see attitude. Historically, automotive consumption tends to rebound 40-60 days after such policy shifts.

As the internet saying goes, "Only when the tide goes out do you discover who's been swimming naked." Of course, January’s sales figures do not represent the entire trend for 2026, as more changes lie ahead.

Will 2026 see more than just premium vehicles dominate?

Several noteworthy new trends offer insights into the 2026 automotive consumption landscape.

For instance, in an interview with FAW-Volkswagen executives, they estimated that while the fuel vehicle market is shrinking, it will still reach around 10 million units in 2026. Data shows fuel vehicle sales dropped from 18.17 million in 2020 to 10.7 million in 2025, with the top 5 brands' market share increasing from 29% in 2020 to 37% in 2025, an 8% rise over five years.

Leading automakers' fuel vehicle sales are expected to maintain monthly sales exceeding 10,000 units. For example, GAC Toyota, which performed well in January 2026, saw a slight increase in Camry discounts compared to December 2025, securing its market share.

Moreover, most of the released sales figures come from Chinese domestic and new energy brands, with Volkswagen, FAW Toyota, and others yet to announce their data. Based on previous knowledge, several fuel vehicle models have maintained stable blockbuster figures, which official agencies will likely release around February 10th.

Another key trend in January’s sales is that models priced above 200,000 yuan were relatively less affected in terms of orders and sales, while new energy vehicles under 150,000 yuan saw a greater impact.

In the short term, the market above 200,000 yuan will focus on technological innovation, while the market below 200,000 yuan will see explosive growth in configurations and parameters.

Numerous examples have emerged regarding these product and corporate strategies.

With Yu Chengdong announcing the imminent launch of the AITO M6, expected around February 4th, a new round of MIIT new vehicle filings will disclose information on models launching around March this year.

The AITO M6 is anticipated to inherit many features from the AITO M7 and M8, not just Huawei's full suite of cabin and intelligent driving assistance technologies and batteries. Given its target demographic of relatively affluent young consumers, it will likely feature a more sport-oriented tuning of the Touling chassis, differing from the comfort-focused AITO M7, M8, and M9.

Furthermore, a new round of competition among NIO, Xiaomi, Li Auto, and Luxeed is expected to break AITO M9's current dominance in the 450,000 yuan and above segment.

According to the latest disclosed information on the Li L9, its range extender will be upgraded to reduce fuel consumption and increase power generation efficiency. With deep involvement in pure electric vehicle business, its power consumption is also expected to decrease, while active chassis and rear-wheel steering are anticipated additions.

The Xiaomi YU9 is expected to feature an 80-degree battery range extender system, with Xiaomi's operational logic likely setting new mainstream standards in key areas. Luxeed remains mysterious, with its new model, the Luxeed R9, only revealing potential naming. Given AITO M9's success, Luxeed R9 can strategically target technological breakthroughs.

Another trend for relatively high-priced models is that, based on our previous confirmations, most models priced above 300,000 yuan will incorporate active chassis features. The best will augment single-vehicle pre-mapping with cloud-based data.

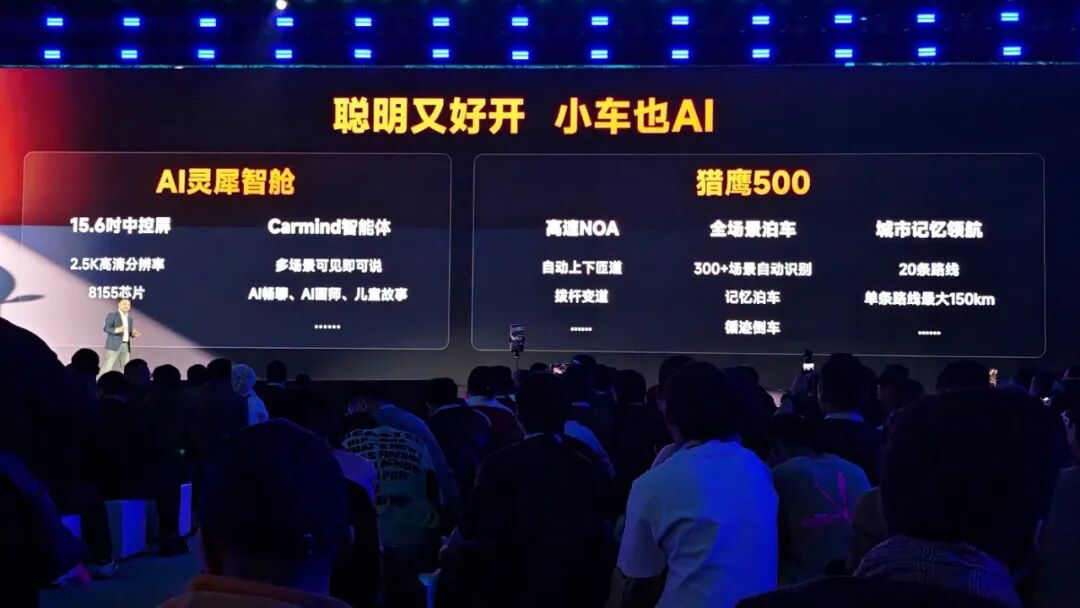

Turning to new vehicles priced below 200,000 yuan, the competition centers on who can offer larger batteries, better intelligent driving assistance, and lower vehicle pricing.

Geely has already taken the first shot with the Galaxy M7.

Expected to be priced between 110,000 and 160,000 yuan, it will use Golden Brick Batteries, offering 225 kilometers of pure electric range and a combined range of 1,730 kilometers on a full tank and charge, with further reductions in fuel consumption to 3.35L per 100 kilometers. Meanwhile, BYD has preemptively upgraded its 100,000-150,000 yuan plug-in hybrid SUVs to offer 220 kilometers of pure electric range.

From the previous round of declaration images, it can also be observed that with BYD Seagull adding the option for an optional LiDAR system, the upcoming Chery's new QQ3, which is about to start pre-sales, will also be equipped with the Falcon 500. Within 150,000 yuan, the popularization of NOA in urban areas will be progressively advanced starting from 2026. As large models become increasingly mature, reinforced training has shown a near-qualitative leap in performance after a year in 2025.

In Conclusion

Indeed, as the title suggests, based on extensive data analysis and considering the new car and technology plans that many automakers have largely made public, we anticipate that the number of true blockbusters in 2026 will be significantly fewer than in 2025.

The reason is that during numerous communication sessions, the founders or executives of various companies were asked the same question:

"Has intelligent technology currently entered a convergence phase?"

The answer was unanimously affirmative, with no other perspectives.

Therefore, after several years of explosive technological innovation, the main focus in 2026 will shift back to competition in efficiency, cost, reputation, and fulfillment capabilities.

Whoever can deliver on their promises accurately and do it well will receive positive results. For example, AITO, Zunjie, and NIO are typical cases.