2026 New Year Ranking Race: Which Emerging Automakers Take the Lead, and Which Fall Behind?

![]() 02/05 2026

02/05 2026

![]() 523

523

Let's talk about January sales today.

On the first day of every month, automakers release their sales reports.

This marks the first sales report for 2026.

Many people are alarmed by the 'dismal' January sales figures in the auto market.

There's no need for such pessimism; let's take a broader view.

It's normal for new energy vehicle (NEV) sales in January-February to be lower than those in November-December of the previous year.

Of course, this isn't an excuse for automakers. The decline is due to a combination of policy changes, year-end demand exhaustion, and seasonal factors like the Spring Festival holiday, representing a regular industry fluctuation.

First, let's discuss policy impacts. Starting in January this year, the purchase tax exemption for NEVs was halved, with a maximum reduction of 15,000 yuan per vehicle. This means an additional cost of about 8,850 yuan for 200,000-yuan models and up to 15,000 yuan for 300,000-yuan models, directly increasing purchase costs and causing hesitation among buyers.

Additionally, at the end of the previous year, manufacturers often launched promotions like 'guaranteed subsidies' and 'last-chance discounts,' leading to a significant release of demand. By January and February, automakers had fewer pending orders, resulting in a temporary lull.

Meanwhile, the Spring Festival and New Year holidays in January and February also influenced consumer purchasing decisions.

So, if you see a sharp decline in an automaker's January sales compared to December, there's no need for excessive pessimism.

However, achieving strong sales under these conditions is highly commendable.

After all, accelerating on a straight road is easy; true speed comes from navigating bends.

Now, let's look at the emerging automakers:

NIO: 27,182 units

XPeng: 20,011 units

Li Auto: 27,668 units

Leapmotor: 32,059 units

Xiaomi: 39,000+ units

Now, let's dive in.

01 NIO

NIO delivered 27,182 vehicles in January, including 20,894 NIO-branded cars, 3,481 from its sub-brand Onvo, and 2,807 from its Firefly brand.

Regarding January sales, NIO released two posts:

One stated that NIO delivered 27,182 vehicles in January, a 96.1% year-over-year increase.

The second post highlighted the all-new NIO ES8, which delivered 17,646 units in January.

The ES8 deserves its own mention.

It accounted for 65% of NIO's January sales, with a starting price of over 400,000 yuan and a high gross margin of around 20%+, making it a significant cash cow.

What does this indicate? Issues like the Spring Festival holiday or insufficient order reserves are negligible when a true blockbuster model is involved.

Moreover, NIO's sales ramp-up has been impressive:

10,000th unit: 41 days (achieved on October 31, 2025)

20,000th unit: 70 days cumulative (achieved on November 29, 2025; 29 days for units 10,001-20,000)

30,000th unit: 89 days cumulative (achieved on December 18, 2025; 19 days for units 20,001-30,000)

40,000th unit: 100 days cumulative (achieved on December 29, 2025; 11 days for units 30,001-40,000)

50,000th unit: 120 days cumulative (achieved on January 18, 2026; 20 days for units 40,001-50,000)

60,000th unit: 134 days cumulative (achieved on February 1, 2026; 14 days for units 50,001-60,000)

This shows that NIO's ES8 production ramp-up has been smooth, and its dealership delivery processes have been efficient, which is commendable.

Additionally, on February 2, a user commented in NIO's forum that their vehicle delivery was still 9-10 weeks away (about 2+ months).

Given NIO's intense production efforts, this delay suggests that ES8 still has a substantial backlog of orders.

After all this time, NIO has finally tasted success with a blockbuster model, maintaining both production and delivery efficiency—no easy feat.

Based on NIO's current product roadmap, the ES9, ES7, and even the L80 will only start gaining traction from the second quarter onwards.

The first quarter will rely heavily on existing models.

However, the pressure on the ES8 to carry NIO's sales alone is increasing. In January, out of 27,182 total deliveries, the ES8 accounted for over 17,646 units, more than 60%.

Meanwhile, NIO's brand lineup (7 models) + Onvo (2 models) + Firefly (1 model) = 10 models, yet they collectively sold less than 10,000 units.

This 'one model carrying the entire brand' dynamic increases NIO's risk exposure. If ES8 sales fluctuate, few other models can fill the gap.

NIO must address this issue urgently.

A few days ago, both NIO and Onvo introduced 7-year low-interest financing options to boost order reserves.

02 XPeng

XPeng delivered 20,011 vehicles in January, which may seem modest.

Some might ask: Didn't XPeng launch four new models in January? Why didn't sales surge?

Firstly, order conversion involves a 'lock-in → scheduling → production → logistics → delivery' process, which takes time.

Secondly, January marked a transitional period between clearing old inventory and ramping up new model production. Additionally, the new models only launched on January 8, leaving a limited window for sales.

Coupled with the factors mentioned earlier, these elements collectively contributed to the significant decline in January deliveries.

However, the four new models have effectively boosted order reserves. Combined with XPeng's 7-year low-interest financing policy, a large backlog of unconverted orders is expected to be delivered in February-March, likely driving a rapid sales recovery.

XPeng is also launching an aggressive product offensive this year. Upcoming models include the XPeng G01, G02, and two MONA SUVs (D02 and D03), all SUVs.

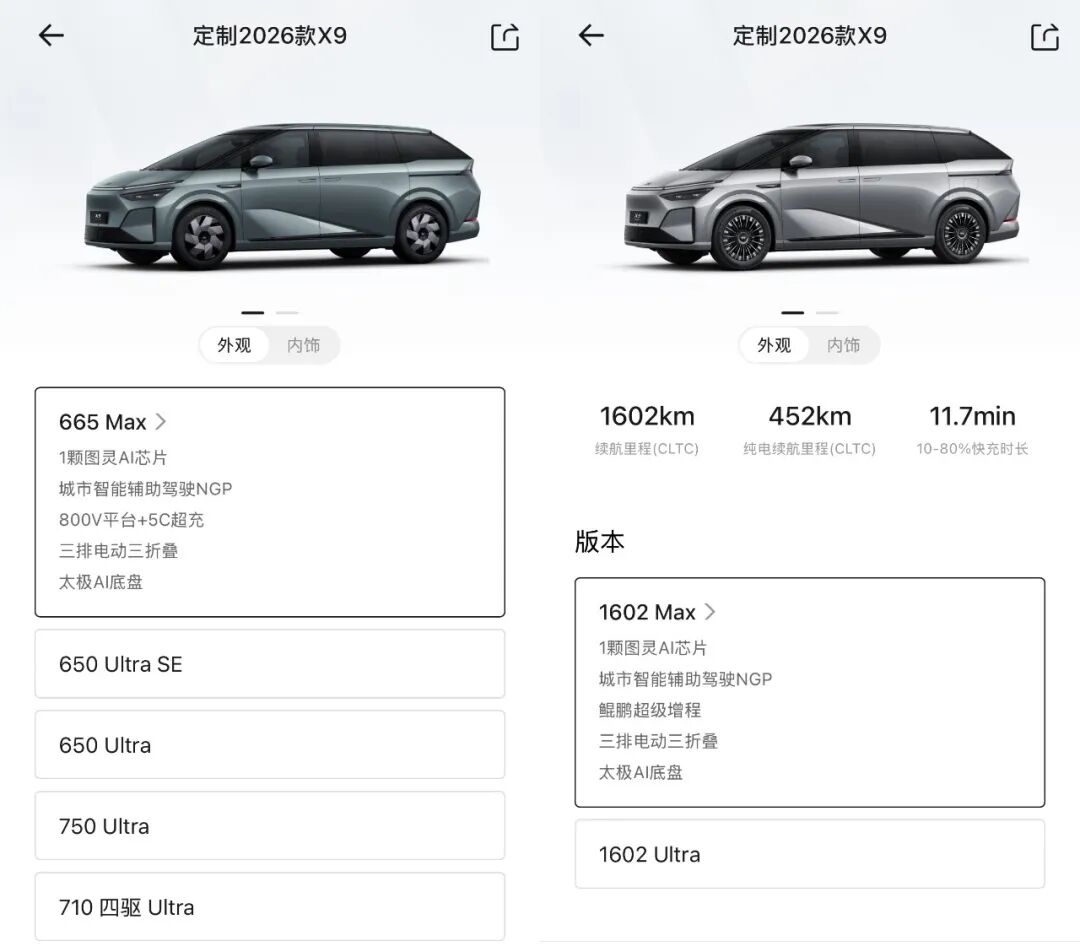

Let's discuss the X9 pure electric model separately.

On January 29, the 2026 X9 pure electric version opened for pre-orders.

However, the variant lineup is perplexing:

665Max, 650 Ultra SE, 650 Ultra, 750UItra, and 710 All-Wheel Drive Ultra.

Have you forgotten, XPeng?

You previously faced backlash for the excessive number of SKUs in the G9. Even Li Auto has now streamlined its model variants to just one. Why are you reverting to old habits?

What's your strategy, He Xiaopeng?

Before launch, I urge you to revisit this with your product team to avoid potential pitfalls.

03 Li Auto

In January, Li Auto delivered 27,668 new vehicles.

Li Auto faces two key challenges: declining competitiveness of its current extended-range series and production capacity issues with its pure electric i-series.

For the extended-range models, the minor updates in last year's refresh have left them outdated in today's market, making sales declines inevitable.

A particularly awkward point is that the 2025 L-series refresh is scheduled for May (Q2), with the 2026 models likely launching in April-May.

This means the current extended-range lineup must hold for at least three more months. Given the intense competition, sales pressure remains high.

Moreover, many consumers may delay purchases, waiting for the refreshed models, further reducing the potential customer base.

While I recommend waiting for the refreshed models (which offer significant upgrades), it's understandable why some might prefer the current versions.

For the pure electric i-series, production capacity remains the primary issue. Li Auto issued an apology to customers:

"We apologize for the anxiety and inconvenience caused by delays and uncertainties.

Due to slower-than-expected production ramp-up for core components, some orders' production schedules have been affected. We will now provide updated estimated delivery times in the app to enhance predictability and reduce blind waiting and speculation."

However, many users report that the updated delivery times have lengthened further, from 1-2 weeks to 4-6 weeks, 6-8 weeks, or even 8-10 weeks.

The daily compensation of 600 points (capped at 20,000 points per order) has also been poorly received.

For Li Auto, the first quarter will be challenging, and the ripple effects of declining sales may slow its momentum.

Hopefully, the refreshed extended-range L-series will turn things around in a few months.

Oh, and Li Auto also offers a 7-year ultra-low monthly payment plan covering all current models. Its impact remains to be seen.

04 Leapmotor

Leapmotor delivered 32,059 vehicles across all models in January.

However, this marks a significant decline from December's 60,432 units, effectively halving sales. The release of 200,000 units in the last three months of 2025 clearly depleted a substantial portion of order reserves.

I'm not overly concerned about Leapmotor's sales, as its strategy of low margins + ultra-high cost-effectiveness has proven effective in driving volume.

This approach is risky, leaving little room for error.

For Leapmotor, halting or slowing down is not an option. Every part of the supply chain is under strain, necessitating continuous acceleration.

After exceeding its 2025 annual sales target of 500,000 units (actual deliveries: 596,555), Leapmotor set a 2026 target of 1 million units (900,000 domestic, 100,000 overseas).

Leapmotor currently dominates the sub-200,000-yuan segment, particularly the 60,000-150,000-yuan range.

In 2026, Leapmotor aims to 'root downward, grow upward.'

Rooting downward: Solidifying its dominance in the ~100,000-yuan segment, exemplified by the A10—a 100,000-yuan entry-level pure electric SUV with laser radar. Competitors in this price range are in for a treat.

Growing upward: Leapmotor will launch two larger models this year—the D19 (flagship SUV) and D99 (luxury MPV), priced at 250,000-300,000 yuan.

Leapmotor's strategy is clear: aggressive feature stacking, reminiscent of how the Li Auto ONE disrupted the 500,000-600,000-yuan BBA segment.

For consumers, grand launch presentations and emotional development/user stories pale in comparison to 'unbeatable pricing.'

Alongside new models, the C-series is also expected to receive refreshes. Overall, Leapmotor's product offensive will continue unabated this year.

On February 2, Leapmotor announced February purchase incentives.

I'll dedicate a separate article to reviewing Leapmotor's 2025 performance and 2026 outlook.

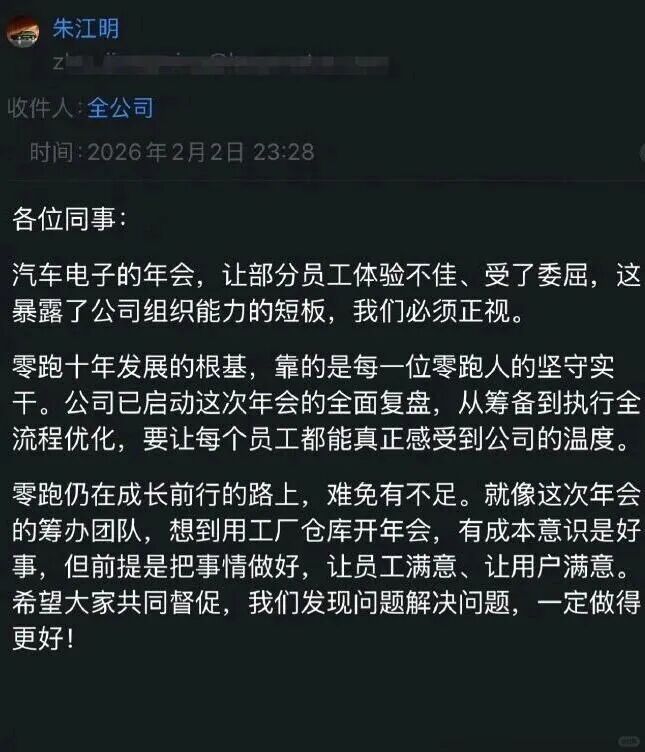

Oh, and here's a quick rant:

Leapmotor's year-end gala in Huzhou at the end of January sparked widespread employee dissatisfaction, dubbed the 'Beggars' Banquet.' Key grievances included:

1. No provided meals; employees were advised to bring their own food. Many resorted to snacks, bread, or even instant noodles with hot water mid-event.

2. Poor venue conditions: Cold weather with sleet/freezing rain, yet the venue lacked heating/air conditioning, and restrooms/hot water were inadequate.

3. Poor signal and audio equipment.

Let me voice Leapmotor employees' frustrations.

Leapmotor had an outstanding 2025, exceeding targets and becoming the top-selling emerging automaker. However, hosting such a shabby gala amid this success has created a stark contrast, deeply affecting employee morale. Employees feel 'undervalued despite their hard work,' and that the company 'overlooks their sacrifices.'

This is likely another case of mutual misunderstandings. The company may believe it's treating employees to a gala, while employees perceive it as half-hearted.

I sincerely advise against hosting such awkward events. They discomfort employees, invite online ridicule, and damage reputation. It would be more practical to distribute cash bonuses instead.

If you insist on hosting, ensure it's dignified and enjoyable for all.

On February 2, Zhu Jiangming issued an internal letter reflecting on the incident. Here's a summary:

Zhu expressed his vision: 'To build Leapmotor into a world-class enterprise.'

I admire Zhu's ambition, as Leapmotor enables consumers to access better vehicles at lower costs. The vision of a 'world-class enterprise' is indeed inspiring.

However, we must not overlook individual well-being amid grand narratives—especially for your own employees.

World-class enterprises win not just markets, but also hearts.

Zhu Jiangming once said, 'I have already achieved financial freedom. The purpose of starting a business to build cars is definitely not solely to make money, but more about interest and a sense of accomplishment.'

The highest level of this sense of accomplishment should include creating an outstanding organization that makes every member feel proud, warm, and respected. It's essential to learn to balance 'efficiency control' with 'humanistic care.'

In this regard, we can learn a lot from Tesla's Elon Musk and NIO's William Li, as they have done an excellent job in this area.

05 Xiaomi

In January 2026, Xiaomi Auto delivered over 39,000 units.

Many might think that this volume has 'dropped' significantly, but when compared horizontally among new forces, this achievement is still impressive, especially considering that there are currently only two models available (YU7 and SU7) and the SU7 facelift was announced in advance (on January 7th).

Lei Jun also personally promoted it, saying, 'The SU7 is about to get a facelift, and currently, the main deliveries are of the YU7. Over 39,000 units were delivered in January. There are still a few YU7s in stock and on display, available for pickup before the Spring Festival.'

The pre-sale prices for the new SU7 are 229,900 yuan for the Standard Edition, 259,900 yuan for the Pro Edition, and 309,900 yuan for the Max Edition. Compared to the old SU7, the prices for the new SU7 Standard and Pro Editions have increased by 14,000 yuan, while the Max Edition has increased by 10,000 yuan.

However, when it officially launches, the prices will definitely drop, at least by 10,000 yuan. Xiaomi likes to play this strategy of 'raising expectations in advance and ultimately offering At Par [regular price] or slightly discounted prices,' making consumers feel that they are getting a great deal even if they buy at the original price.

One has to admire Xiaomi and Lei Jun's marketing tactics; they are excellent, with great use of psychology.

Xiaomi is currently on a good trajectory. With the SU7 discontinued, the YU7 can be delivered at full throttle.

This year, Xiaomi will unveil several new models. Currently, we know of the following:

New SU7: Launching in April, it will come standard with 9 airbags, including 2 additional rear side airbags; full standard configuration [standard] laser radar and full-featured autonomous driving; long-range battery with a maximum range of 902km; new colors, new wheels, and upgraded chassis.

Compared to the current SU7, there are significant improvements, making it highly competitive overall.

Lei Jun, the livestreaming influencer, conducts high-frequency livestreams to bring more attention and orders to the new SU7.

SU7 L?

That is, the SU7 Executive Edition, which is an elongated version of the SU7 with more comfort features.

Thus, the SU7 family will include the SU7 Standard, SU7 Pro, SU7 Max, SU7 Ultra, and SU7 Executive Edition.

However, I don't quite understand the SU7 Executive Edition. The current appearance and vibe of the SU7 are clearly geared towards a young and sporty style, which is far from the businesslike and steady [stable] feel required for an executive model. If it truly aims for a business feel, the front fascia would need to be redesigned. But if that's the case, it might be better to introduce an even larger model.

YU7 High-Performance Edition?

Just as the SU7 has the SU7 Ultra, the YU7 will also have its high-performance version, featuring 21-inch wheels, ceramic brake discs, and six-piston calipers, aiming to be the fastest mass production [mass-produced] SUV.

However, considering the SU7 air duct incident, the YU7 High-Performance Edition will likely face significant challenges. I'm curious to see how Xiaomi will handle this crisis.

Xiaomi YU9: A full-size six/seven-seat flagship with range-extending powertrain, competing against the Li Auto L9/Seres M9.

This model has already entered the pre-launch promotion phase. Shunwei Capital Partner Hu Zhengnan and Xiaomi Group Vice President Zhang Jianhui have started posting about the YU9's winter testing on Weibo.

It is likely to be launched in the first half of this year.

Five-seat range-extender?

It is said that Xiaomi Auto will also release a five-seat range-extending model in the second half of the year, possibly the YU8?

Overall, Xiaomi's new energy offensive is quite strong this year.

Before the launch of the new SU7, the YU7 is currently the main sales driver for Xiaomi Auto.

The car already has a decent number of orders, and with the introduction of a 7-year low-interest policy this month, it can secure even more orders.

The YU7 now offers two purchase models: 'buying in-stock vehicles' and 'customizing new vehicles.'

A quick glance shows that there are quite a few in-stock vehicles available, which is indeed a good promotional strategy.

As for purchasing in-stock vehicles, the fastest delivery after locking in the order will still take 14-17 weeks, roughly 3.5 to 4 months.

Not to mention the new models launching this year, Xiaomi still faces significant delivery pressure and needs to further ramp up production.

The end.