Annual Report | China’s Online Laptop Sales Rise by 9% in 2025; AI PC Sales Skyrocket 115%, Capturing 40% Market Share; Lenovo, ASUS, and Mechrevo Lead E-commerce Sales

![]() 02/06 2026

02/06 2026

![]() 456

456

According to the latest data from Runto’s China Notebook Computer Online Retail Market Monthly Tracker report, China’s online laptop sales across all channels reached 13.44 million units in 2025, marking a 9.0% year-on-year increase. The total sales value surged to 89.3 billion yuan, up 21.1% year-on-year.

The sales value growth rate outpaced volume growth, primarily due to product structure upgrades, technological advancements boosting product value, policy-driven demand for high-end models, and supply chain cost increases—all of which collectively pushed up average market prices.

From a full-year perspective, the market displayed a distinct “strong start, weak finish” trend. In the first half of the year, sales volume surged over 20% year-on-year, driven by national subsidy policies stimulating direct demand and a wave of device replacements across government, enterprise, and consumer sectors following the discontinuation of Windows 10. Meanwhile, the widespread adoption of AI chips and on-device large language models fueled product innovation, while display technologies like OLED panels accelerated user upgrades.

The second-half sales decline resulted partly from a high base effect due to the 2024 national subsidy rollout. Additionally, market constraints emerged, including memory chip price volatility affecting terminal pricing, weakening consumer demand as policy impacts faded, and sluggish mid-to-low-end market performance—all dragging down overall market growth and leading to a gradual year-long deceleration.

1. Channel Structure: Traditional E-commerce Dominates; Emerging Platforms Grow Rapidly

Runto divides online channels into traditional mainstream e-commerce platforms (e.g., JD.com, Tmall) and emerging platforms (e.g., Douyin, Kuaishou).

Traditional e-commerce remains dominant in 3C product sales. In 2025, laptop sales on these platforms reached 11.76 million units (+6.4% YoY), accounting for 87% of total online sales. The sales value rose 14.8% YoY to 78.4 billion yuan.

Emerging platforms, however, saw faster growth, with sales volume surging 31% YoY, becoming a critical battleground for brand expansion.

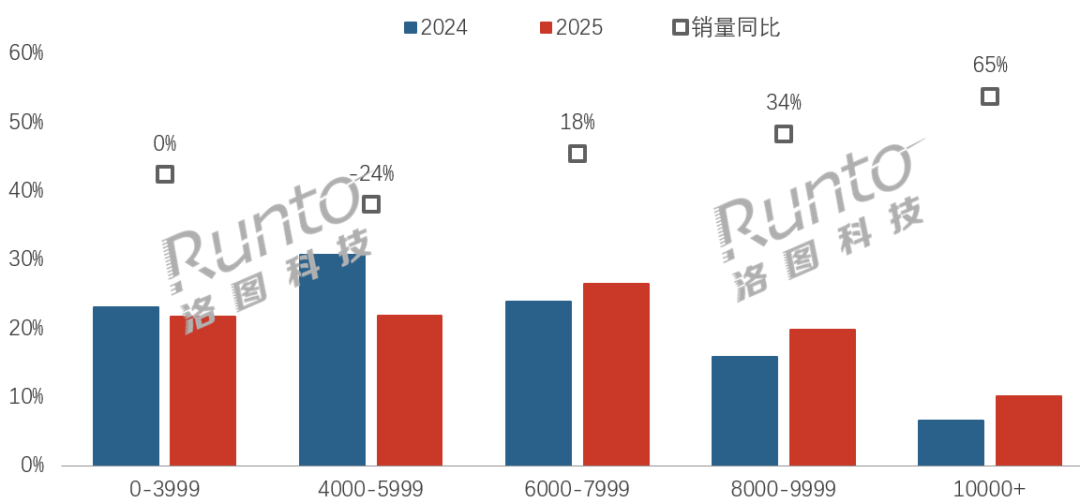

2. Price Distribution: Average Prices Climb; High-End Segment Expands

Runto’s online monitoring data reveals that China’s average online laptop price rose to 6,672 yuan in 2025 (+8% YoY).

Consumer acceptance of premium pricing has grown significantly in recent years, with core technologies like AI computing power and OLED displays providing strong price support. This is evident in the market’s price segment distribution, where high-end expansion is pronounced.

Sales of laptops priced above 8,000 yuan jumped 43% YoY, with market share rising from 22% to 30%. Ultra-premium models (≥10,000 yuan) surged 65% YoY.

In contrast, the 4,000–5,999 yuan segment—last year’s largest—plummeted 24% YoY, with its share dropping 9 percentage points to 22%.

The 6,000–7,999 yuan segment emerged as the leading price band in 2025, with sales volume up 18% YoY and market share climbing to 26%.

China’s Online Laptop Market Sales Volume Structure by Price Segment (2025)

Data Source: Runto Online Monitoring Data (Unit: Yuan, %)

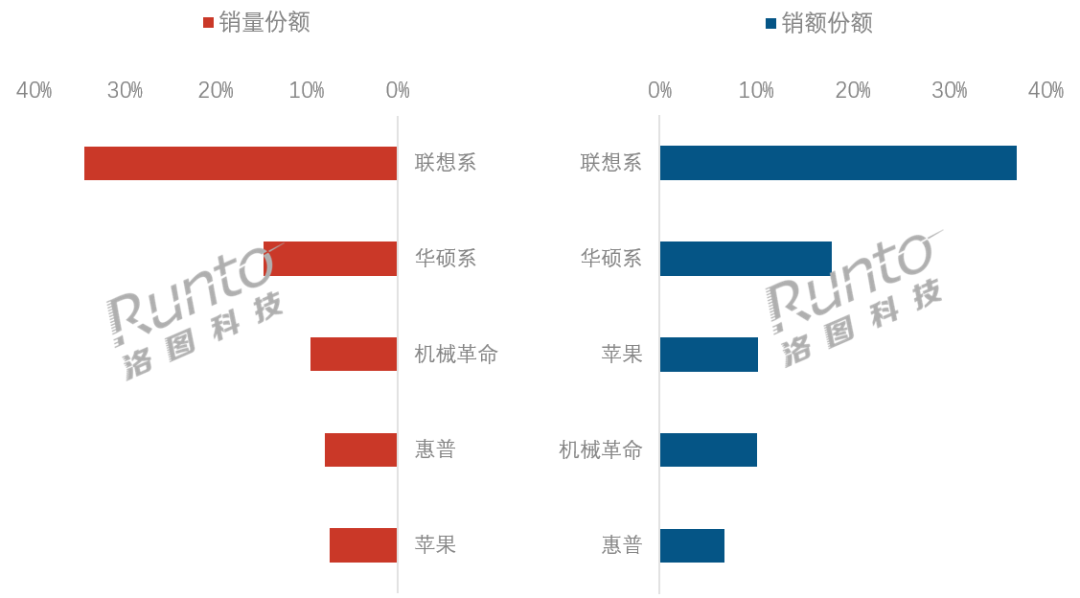

3. Brand Competition: Top 10 Brands Capture Over 90% Market Share; Lenovo Leads in Volume and Value

Leading brands are solidifying their dominance by leveraging technological and supply chain advantages during the “national subsidy year.” Runto’s data shows that in 2025, the top 10 brands accounted for 91% of China’s online laptop market (+2 percentage points YoY).

Lenovo Group ranked first in both sales volume (35% share) and value, excelling in key segments like AI PCs (40%+ market share) and OLED displays (53% share).

Brands like ASUS and Mechrevo focused on gaming laptops, each commanding over 20% market share in this niche, demonstrating stable performance.

China’s Online Laptop Market Sales Share by Top Brands (2025)

Data Source: Runto Online Monitoring Data (Unit: %)

Meanwhile, Apple capitalized on AI PC products to drive sales growth, while Huawei focused on OLED models, contributing to a diversified competitive landscape.

4. Product Trends: AI Integration, Display Upgrades, and Scenario-Based Innovation

AI PCs saw explosive growth in 2025, becoming China’s laptop market’s core growth driver. Online market data shows AI PCs accounted for 40% of total sales volume (+115% YoY), with AI computing power emerging as a key competitive differentiator.

In display technology, OLED panel adoption rose from 6% in 2024 to 10%, with sales volume up 81% YoY. High refresh rate specifications (180Hz, 240Hz) also gained traction, with market shares reaching 5% and 14%, respectively (+5 and +6 percentage points YoY). Similar to monitors, high refresh rates are gradually replacing traditional display specs.

Regarding product form and scenario innovation, 2-in-1 laptops—though accounting for less than 1% market share—saw sales volume rise 26% YoY due to their form factor flexibility and multimodal interaction advantages, outpacing the broader market. Among scenario-based products, gaming laptops benefited from esports demand (+14% YoY), while ultrabooks leveraged AI upgrades for mobile office suitability (+3% YoY).

5. Market Forecast: Downward Pressure Looms; Three Key Risks Identified

In 2026, China’s laptop market will face both continuities and challenges.

The industry will continue its high-endization and segmentation trends, with product competition centered on optimizing on-device AI computing power and OLED display adoption. AI flagship models and scenario-based blockbusters will become brand priorities.

Ultrabooks will evolve toward “ultra-thin, ultra-light + long battery life,” commercial laptops will emphasize modularity and repairability to extend lifecycles, gaming laptops will strengthen cooling and performance, and creative design laptops will emerge as a new growth area. While niche segments flourish, competition will intensify.

However, 2026 will bring new constraints. The revised national subsidy policy now offers only a 15% subsidy for first-tier energy-efficient products, raising thresholds and reducing overall subsidy intensity. Additionally, soaring memory chip prices are driving up laptop prices by ~20%, significantly curbing consumer upgrade意愿 (willingness). Runto notes that laptops may be the consumer electronics category most vulnerable to memory price fluctuations.

Furthermore, localization procurement in sectors like government, finance, and telecommunications will accelerate. Driven by the trustworthy IT ecosystem, domestic chips (Zhaoxin, Phytium, Kylin) and operating systems (Uniontech UOS, HarmonyOS) are improving compatibility, with their government/enterprise market penetration expected to exceed 40% by 2030.

Runto issues three market risk warnings:

- Weak consumer demand, prolonged replacement cycles, and price hikes suppressing the mid-to-low-end market.

- Import restrictions on high-end chips and precision components hindering AI PC computing power upgrades and high-end model supply.

- Insufficient ecosystem compatibility, with domestic chips and systems requiring time to align with professional software.

Runto forecasts that in 2026, influenced by national subsidy phase-outs, high base effects, rising memory costs, and weak consumer resilience, China’s online laptop market will face downward pressure, with retail volume expected to decline ~6% YoY to ~12.60 million units.

Thank you for reading. If you found this analysis valuable, please like, share, and follow for more insights.