Suspicion of Interest Transfer in Low-Price Share Transfer, Megvii's IPO Hits a Roadblock

![]() 07/01 2024

07/01 2024

![]() 512

512

This article has a total of 7,830 characters and will take approximately 26 minutes to read.

Written by Rui Finance Li Shanshan

At the Hannover Messe IT Expo in Germany on March 16, 2015, after delivering the keynote speech, Jack Ma specifically demonstrated Ant Financial's Smile to Pay facial recognition technology to the guests on site and used it to purchase a stamp by scanning his own face.

That facial recognition technology, which went viral in the AI circle, was developed by Megvii Technology Limited (hereinafter referred to as "Megvii"), and Megvii has since gained significant fame.

As one of the "AI Four Dragons" in China, Megvii was one of the earliest to initiate a charge at the capital market, however, its IPO journey has been quite bumpy.

In August 2019, Megvii submitted its prospectus to the Hong Kong Stock Exchange. However, two months later, the US Department of Commerce included Megvii and other entities on the Entity List on the grounds that "the entities are reasonably believed to be involved in activities contrary to the foreign policy interests of the United States," and the company ultimately failed to list on the Hong Kong stock market.

Two years later, in March 2021, Megvii shifted its focus to the STAR Market, advancing its IPO process in full swing within half a year and passing the review in September 2021. However, just one step away from the capital market, its IPO application was stuck in the registration process, failing to obtain approval for over two and a half years now.

It is worth mentioning that since March 2022, Megvii has experienced four suspensions of the registration process due to the expiration of financial materials, with three resumptions. Currently, Megvii, which is still under suspension, remains uncertain whether it can resume the registration process and successfully obtain approval.

01

23-year-old graduates from Tsinghua's "Yao Class" start a business

9 rounds of financing push valuation to 26 billion yuan

In the Department of Computer Science at Tsinghua University and even across the entire campus, the legend of the "Yao Class" is widespread.

In 2004, Yao Qizhi, the only Chinese winner of the Turing Award (a computer award established by the Association for Computing Machinery in the United States), resigned from his tenured position at Princeton University in the United States and returned to China to teach at Tsinghua University. He wanted to establish one of the world's most outstanding undergraduate classes, and thus, the "Yao Class" was born. Its full name is "Tsinghua Xuetang Computer Science Experimental Class," aimed at cultivating leading international innovative computer science talents.

The three founders of Megvii hail from the Yao Qizhi Experimental Class, which is praised as "half of the country's talents gather at Tsinghua, and half of Tsinghua's talents are in the Yao Class." In October 2011, three young people, Yin Qi, Tang Wenbin, and Yang Mu, all 23 years old, jointly founded Megvii.

In the early stages of the business, Megvii's main business was a game called "The Crow Is Coming" based on face tracking. However, the founding team did not intend to delve deeply into the gaming industry but insisted on developing artificial intelligence.

In 2012, Megvii achieved a breakthrough, using 1 million yuan of funding from Lenovo Venture Capital to delve into visual recognition technology, also known as facial recognition technology. In October of the same year, the company team launched Face++, a visual technology open platform for ToB, primarily providing visual technology solutions for enterprise customers.

With the rapid development of mobile internet, Megvii's AI technology products entered a rapid growth phase, attracting the attention of many capitalists.

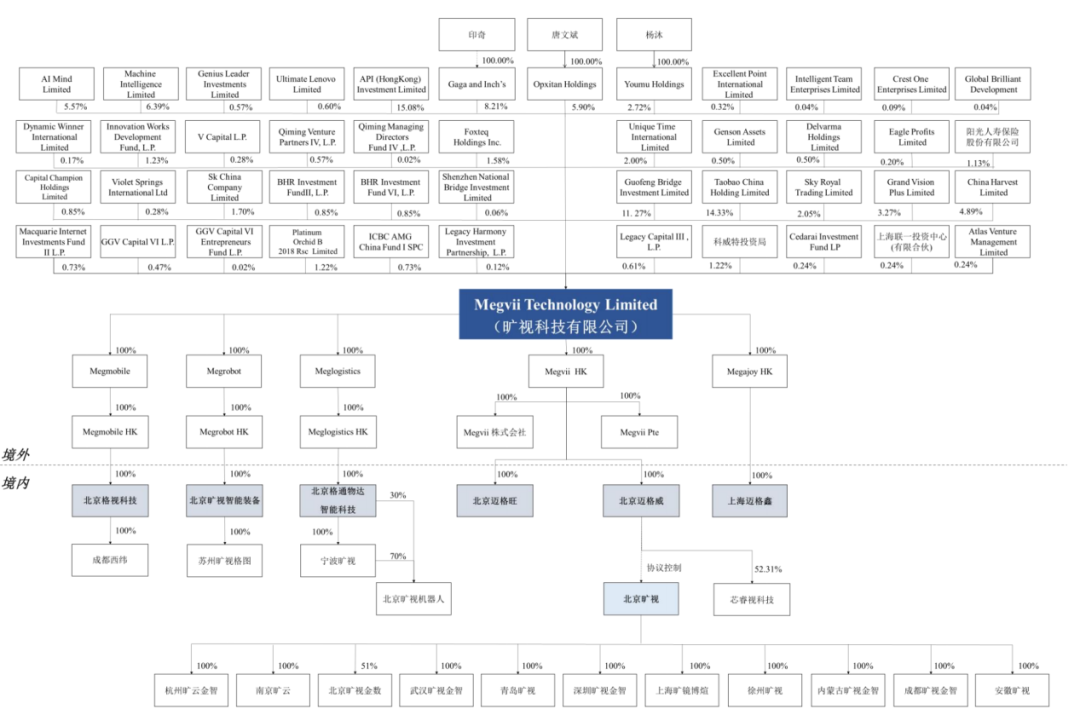

Since its inception, Megvii has undergone 9 rounds of financing, raising a total of approximately US$1.351 billion, equivalent to RMB 8.473 billion yuan. Its shareholder system is vast, with Ant Group, Alibaba, companies under State-owned Assets Supervision and Administration Commission of the State Council, Hon Hai Precision, Sunshine Insurance, SK, Bank of China Group, and Kuwait Investment Authority among its investors.

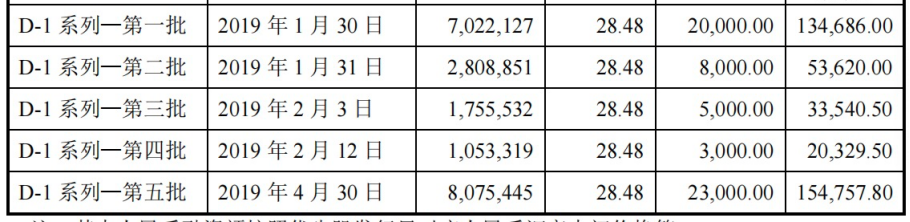

The prospectus shows that after completing the D round of financing in April 2019, Megvii's valuation had reached US$4.09 billion, equivalent to RMB 26.046 billion yuan.

Before submitting the prospectus, Megvii's actual controllers, Yin Qi, Tang Wenbin, and Yang Mu, collectively controlled 16.83% of the company's shares, exercising a total of 70.28% of voting rights.

02

Actual controllers breach contract and transfer shares at a low price to compensate Ant Group

Regulators question interest transfer

During Megvii's financing process, there were instances of low-price share transfers.

In May 2017, the shareholding platforms of the company's founders, Yin Qi, Tang Wenbin, and Yang Mu, transferred a total of 1.5009 million shares they held in the company to API (Hong Kong) Investment Limited (hereinafter referred to as "API") at a price of US$1.33 per share, while the C1 round of financing price was US$10.42 per share. API is wholly owned by Ant Group through its wholly-owned subsidiary Shanghai Yunju Venture Capital Co., Ltd.

Coincidentally, in April 2019, the aforementioned shareholding platforms again transferred 1.4934 million shares to API at a price of US$1.33 per share, while the D1 round of financing price was US$28.48 per share.

In response, the Shanghai Stock Exchange required Megvii to explain in the first round of inquiries the background reasons and rationality for the low-price transfers, whether other investors were aware and agreed, whether it violated relevant provisions of the financing agreement, and whether there were any disputes or potential disputes.

The response letter showed that API had previously subscribed for 8.0321 million shares of the company at a price of US$2.73 per share in March 2015, with an investment of US$21.9276 million. This price represented a 64.46% premium over the previous B-1 round financing price of US$1.66 per share. Megvii stated that the higher premium was primarily due to considering the potential value of the company's joint venture and business and technological cooperation with Ant Group, an affiliate of API.

However, during the actual promotion of subsequent business cooperation, Yin Qi, Tang Wenbin, and Yang Mu regretted their decision and believed that retaining the business involved in the cooperation within the company would be more conducive to the company's future development, thus deciding to actively terminate the cooperation.

As compensation for terminating the cooperation with API, Yin Qi, Tang Wenbin, and Yang Mu transferred their shares to API at a low price.

Before submitting the prospectus, Ant Group held 15.08% of Megvii's shares through API, making it the company's largest shareholder. In addition, Taobao China Holding Limited, wholly owned by Alibaba, held 14.33% of the company's shares, making it the second-largest shareholder. As affiliated companies, Ant Group and Alibaba collectively held 29.41% of Megvii's shares.

In addition to holding shares in the company, Ant Group and Alibaba also have related transactions with Megvii, prompting the Shanghai Stock Exchange to raise questions about whether there was interest transfer in the low-price share transfers to API and whether there were other interest arrangements between the two parties.

It is reported that Megvii's cooperation with Ant Group and its subsidiaries began in 2014, providing facial recognition technology support and identity verification solutions for Sesame Credit, Alipay, and Zhejiang Internet Bank.

Among them, the company should charge a fee of not less than 0.85 yuan per transaction for providing identity verification technology services to Sesame Credit; from 2016 to 2018, the prices charged for providing services to Alipay and Zhejiang Internet Bank were 5 million yuan, 6.5 million yuan, and 8 million yuan, respectively.

From 2018 to 2020, Megvii's sales revenue from Ant Group and its subsidiaries was 25.6662 million yuan, 9.4115 million yuan, and 22,200 yuan, respectively, with a year-on-year decrease in related sales revenue.

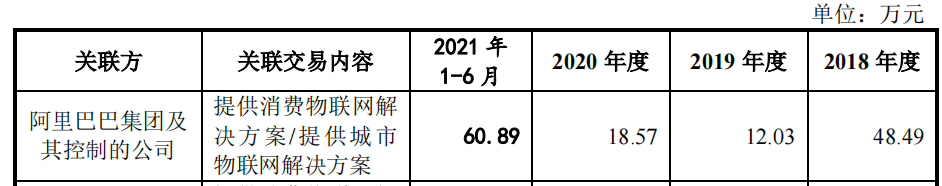

In addition, Megvii provided identity verification access control and related maintenance services, as well as identity verification SDK services, to Alibaba and its subsidiaries. From 2018 to the end of June 2021 (hereinafter referred to as the "reporting period"), the related sales generated revenues of 484,900 yuan, 120,300 yuan, 185,700 yuan, and 608,900 yuan, respectively.

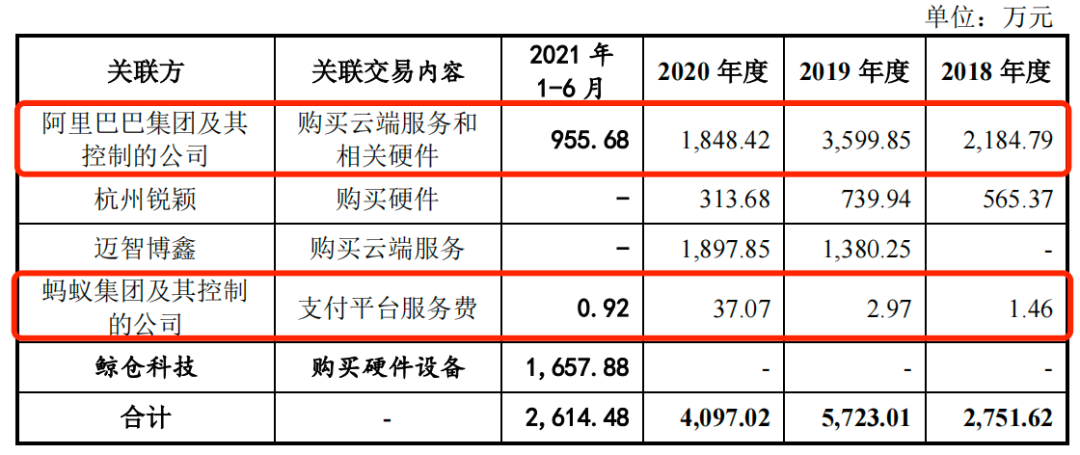

In addition to related sales, Megvii also has related procurement relationships with Alibaba.

During the reporting period, the company purchased cloud services and related hardware from Alibaba and its controlled companies for amounts of 21.8479 million yuan, 35.9985 million yuan, 18.4842 million yuan, and 9.5568 million yuan, respectively; it paid platform service fees to Ant Group and its controlled companies of 14,600 yuan, 29,700 yuan, 370,700 yuan, and 9,200 yuan, respectively.

According to the response letter, when purchasing cloud services from Alibaba Cloud, the company clearly indicated the price discount in the annex of the framework service agreement, and both parties executed the transaction at the discounted price, with discount rates typically ranging from 50% to 90%. If the discount was not specified in the annex of the framework service agreement, both parties executed the transaction based on the official price and discount of Alibaba Cloud at the time of ordering. Megvii stated that the discount rates involved in the cloud service procurement transactions between the two parties are normal commercial discounts, and the billing prices are fair.

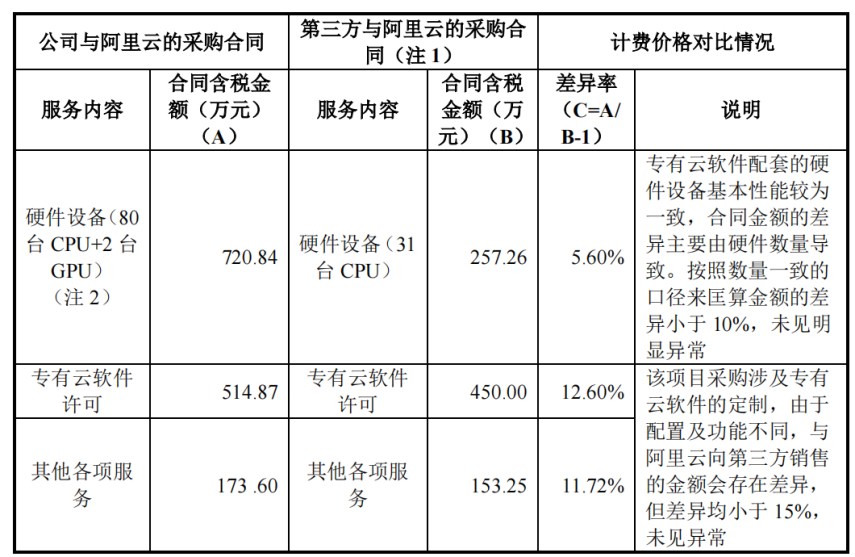

However, the prices that the company purchases hardware from Alibaba Cloud differ from those of other third parties. For example, the difference rates between the company's purchase prices for hardware equipment, proprietary cloud software licenses, and other services from Alibaba Cloud and the purchase prices of third parties from Alibaba Cloud are 5.6%, 12.6%, and 11.72%, respectively.

03

Executives' annual salaries are twice that of the founders, and a driver attempted to extort the actual controllers

In Megvii's executive team, in addition to the three founders from Tsinghua University, the other executives also have their own unique backgrounds.

For example, the company's Chief Financial Officer Wang Haitong graduated from Peking University with a double bachelor's degree in finance and statistics and has worked at several well-known companies such as Morgan Stanley Asia Limited and Goldman Sachs (Asia) LLC; President Fu Yingbo graduated from Shandong University and served as a senior strategic business consultant at Microsoft China; Chief Scientist Sun Jian graduated from Xi'an Jiaotong University and served as the Chief Researcher at Microsoft Research Asia, among other positions. He currently serves as an adjunct professor at Xi'an Jiaotong University and the Dean of the School of Artificial Intelligence at Xi'an Jiaotong University.

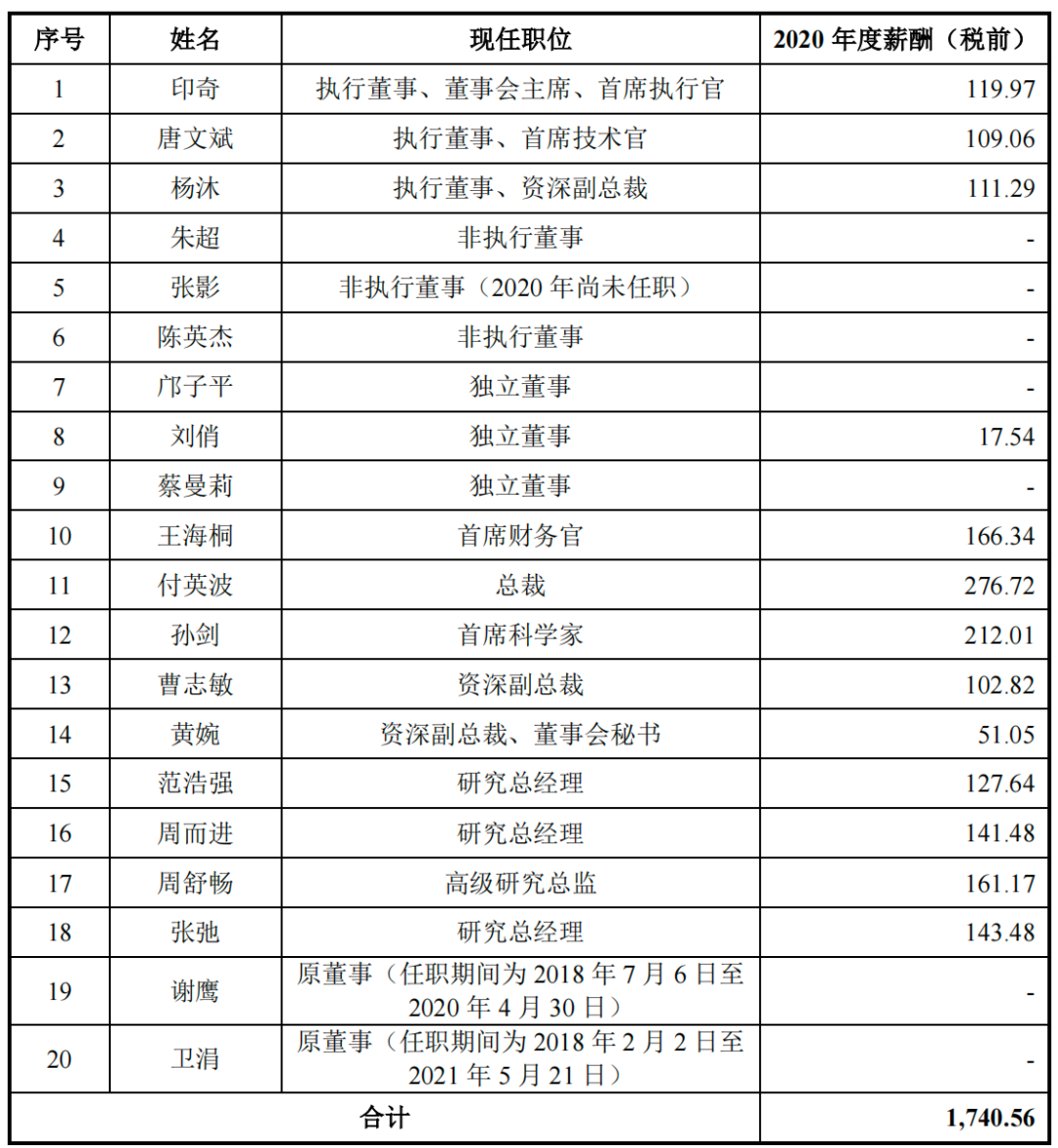

These executives receive higher annual salaries than the company's founders. In 2020, Yin Qi, Tang Wenbin, and Yang Mu's annual salaries were 1.1997 million yuan, 1.0906 million yuan, and 1.1129 million yuan, respectively, while Fu Yingbo and Sun Jian's annual salaries were 2.7672 million yuan and 2.1201 million yuan, respectively, more than twice that of the founders.

In addition, the company's core technical personnel, including Fan Haoqiang, Zhou Erjin, Zhou Shuchang, and Zhang Chi, also receive high salaries, with annual salaries of 1.2764 million yuan, 1.4148 million yuan, 1.6117 million yuan, and 1.4348 million yuan, respectively, in 2020.

In addition to receiving lower compensation than company executives, the founders narrowly escaped being extorted by the company's driver.

It is reported that from February 8 to 9, 2021, Hu Zijian, who once worked as a driver for Megvii, threatened to sell recordings of sensitive information about Megvii to competitors in places such as Rongke Building in Haidian District, Beijing, and demanded 3 million yuan from Yin Qi.

According to the information, Hu Zijian was born in 1997, dropped out of college, and has a household registration in Chaoyang District, Beijing.

After the extortion incident, Yin Qi reported it to the police, and Hu Zijian was arrested. After reviewing the case, the court found that the defendant Hu Zijian, with the purpose of illegal possession, extorted money from others in an especially large amount, and his actions constituted the crime of extortion, which should be punished. Ultimately, the Haidian Court sentenced him for the crime of extortion, giving him a fixed-term imprisonment of four years and a fine of 10,000 yuan.

The case handling situation disclosed by the Haidian Court showed that Hu Zijian had a recording pen, which was "confiscated as a criminal tool"; in addition, he also had two black Apple phones and a computer hard drive. The court ruled that after "clearing the case-related information," they would be returned to Hu Zijian.

It can be seen that Hu Zijian did indeed possess some recordings of Megvii, but the specific content is unknown. The driver's extortion case happened just before Megvii's IPO, and one month later, Megvii submitted its IPO application.

04

Retrospective adjustment of accounting policy changes

Revenue reduction of up to 570 million yuan Megvii is an artificial intelligence company focused on the Internet of Things (IoT) scenario, with three major business directions: consumer IoT, urban IoT, and supply chain IoT.

In 2012, Megvii entered the consumer IoT field and cooperated with multiple leading smartphone manufacturers and other consumer electronics customers, providing device security and computational photography solutions for hundreds of millions of smartphones.