International Report: From Hype to Large-Scale Application, the Quadruple Challenges of Financial Large Models

![]() 07/16 2024

07/16 2024

![]() 462

462

Source | Lingyi Think Tank

With breakthroughs in underlying technologies and a surge in computing power, the iteration of large models by technology companies represented by OpenAI has presented a steep curve. The successive emergence of ChatGPT, Sora, and others has also pushed the tide of artificial intelligence to an unprecedented peak.

Sandeep Alur, Director at Microsoft, mentioned in an interview that anyone with consumer devices and an internet connection can experience AI technology on a large scale.

And Andrew Ng, a renowned computer scientist, stated in a speech that AI, like electricity and the internet, is a general-purpose technology; the greater opportunities lie in large-scale application implementations.

Since chatGPT3.5 ignited the era of large models at the end of 2022, the hurricane of artificial intelligence has grown increasingly fierce, sweeping through every corner with capital measured in tens of billions of dollars.

The financial industry is the most sensitive to cutting-edge technologies and was also the first to embrace artificial intelligence. If previously only top financial institutions were conducting theoretical research or small-scale pilots, with more institutions observing or hyping, now even the most sluggish micro-financial institutions cannot ignore the profound changes brought about by artificial intelligence. Because failing to adapt means you never know when you'll be left behind.

Among various vertical large models, the number of financial large models released also ranks among the top. So, what stage is the application of artificial intelligence in the financial industry at? Recently, international institutions such as UK Finance, the Bank for International Settlements (BIS), and Citibank have released research reports exploring the impact of artificial intelligence on the financial industry.

Through these reports, we can observe from a global perspective how artificial intelligence, especially large models, have changed the financial industry to varying degrees and what the roaring future will look like.

01 Present and Future

The emergence of different generations of artificial intelligence, including machine learning (ML), generative AI (GenAI), and AI agents, has enhanced the information processing capabilities of the financial industry to varying degrees, bringing both opportunities and challenges.

Financial institutions are very cautious about applying artificial intelligence. Traditional/predictive AI applications are common but shallow; while the commercialization of generative AI (GenAI) in the financial sector is still in its very early stages, mainly as pilot projects or proof of concepts, but with broad prospects.

GenAI primarily emerges in the form of large language models, which are particularly useful for the financial industry in two key aspects.

First, machine learning has been processing structured data and quantitative tasks in the financial sector for years, while most enterprise data (around 80-90%) is unstructured, locked away in emails, copies, documents, and reports. Now, GenAI will enhance the readability of unstructured data, which can be applied to risk analysis, credit scoring, forecasting, and asset management.

Second, GenAI endows machines with the ability to converse like humans, improving back-office processing, customer support, robotic consulting, and compliance.

How will the forefront of AI innovation, represented by GenAI, affect the financial industry currently and in the future?

Current - Already Making an Impact

The Bank for International Settlements (BIS) believes that artificial intelligence has enhanced the financial system's ability to process information, analyze data, identify patterns, and make predictions. Early AI systems have already been used for automated trading and fraud detection. With technological advancements, machine learning and deep learning models have been widely applied in asset pricing, credit scoring, and risk analysis. Although GenAI is still in its infancy, the financial system is already adopting it to enhance back-office processing, customer support, and compliance.

For example, Bloomberg launched a financial assistant based on a large language model specific to the financial sector in 2023, while Goldman Sachs' investment banking division uses large language models to provide coding support for internal software development.

UK Finance's research notes that as early as 2021, HSBC and Google Cloud launched anti-money laundering (AML) AI, which is more efficient and accurate than traditional monitoring systems, while also addressing privacy and data security issues during transmission with encryption keys.

Future - Choosing Robots Over Banks

"The next frontier of AI innovation is likely to be AI agents," both Citibank and the Bank for International Settlements predict in their reports.

AI agents - AI systems built on advanced language models like GPT-4 or Claude 3 and endowed with planning capabilities, long-term memory, and often access to external tools (such as executing computer code, using the internet, or making market transactions) - will see widespread application.

Citibank points out that as many technology companies venture into financial services, consumers may entrust certain financial decisions to these AI assistants. Equipped with complex algorithms and the ability to access vast amounts of data, these AI agents will negotiate with financial institutions to secure the best possible deals for their users. This shift will not only simplify financial services but also ensure decisions have a precision and foresight that human clients may not be able to achieve independently.

In this new paradigm, the critical decision consumers face will be choosing the right robot rather than the right bank. Selecting a robot-driven advisor, much like choosing a human financial advisor, will become a crucial task. By then, advisory firms, financial institutions, technology companies, and new service companies may all participate in this new market competition.

02

From "Amazing" to "How to Implement"

From a segmented perspective, banking, insurance, asset management, and payments all have operations that have applied artificial intelligence, such as credit underwriting, algorithmic trading, portfolio construction, and trade monitoring, but in this round of the AI arms race, banks and insurance companies are catching up.

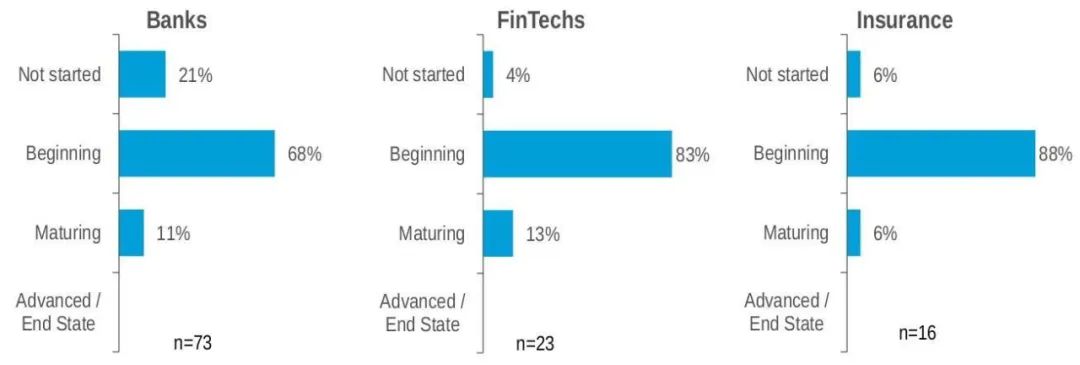

In Citibank's survey, nearly a quarter of banks have not yet started adopting AI, 68% of banks and 88% of insurance companies are still in the "start-up" stage of AI, and both are less mature than fintech companies, which stand at 13%.

Figure 1: Banks, Insurance, Fintech Companies

Percentage of Stages in the AI Arms Race

Source: AI IN finance, Citibank

"The general-purpose AI currently in use in production is negligible and less than predictive AI," said Shameek Kundu, Chief Data Officer at TruEra, an AI testing and monitoring startup. "We are still in the very early stages of commercializing general-purpose AI in the financial sector, with almost entirely pilot projects or proof of concepts."

Indeed, the business model of GenAI is still in the early stages of exploration. OpenAI has generated less than $2 billion in revenue since its inception but has consumed $11.3 billion in funding. Microsoft's GitHub Copilot loses more than $20 per user per month on average, reaching $80 for heavy users.

Regarding AI's implementation in the financial industry, Citibank believes that talent shortages, risks and compliance, and legacy technologies are the primary barriers for financial institutions adopting AI.

For example, to execute trades using robots, institutions need cloud-native technologies with embedded controls and regulations, crucial for demonstrating to regulators that decisions/results are fair and responsible. Achieving this level of complexity requires continuous reflection and retraining, combining product design, data engineering, risk and compliance, and technical proficiency. While the design itself may not be inherently complex, it necessitates a significant shift in capabilities.

UK Finance believes that data privacy risks, technology maturity, regulatory risks, hallucinations (where GenAI models generate information not based on real data or events but present it as fact), internal decision-making, and talent are the implementation challenges for GenAI.

Citibank predicts that AI could potentially add $170 billion or 9% to the global banking profit pool by 2028. Currently, GenAI has become part of the new productivity in the financial industry, but it does not yet possess the economies of scale of traditional software and needs to cultivate the market by offering substantial subsidies to users.

All technologies go through cycles: hype, disillusionment, and then large-scale adoption. Since the second quarter of 2023, expectations for artificial intelligence in the financial industry have been high. Financial institutions are transitioning from "amazing" to "how to implement," and the gap between hype and large-scale adoption remains substantial.

03

Quadruple Challenges and Issues

In applying artificial intelligence in the financial industry, financial institutions face the challenge of falling behind in competition, financial practitioners face the risk of structural unemployment, the financial industry faces increased risks from technological innovation, and regulators may encounter financial stability and systemic risks.

Moreover, the expansion of crime due to malicious misuse of AI and technological ethical risks also exist in financial markets.

Financial Institutions - Growth of Non-Human Clients

Banks were early adopters and investors in the first wave of technological advancements, investing in the first large computers as early as the 1950s, but they lagged behind in the recent internet and mobile eras.

Citibank's report predicts that the biggest novelty brought about by AI will be the growth of non-human clients. By 2030 or earlier, AI agents will be present in the financial sector, and clients may own AI agents and robots before banks do, inverting the hierarchy between large enterprises and consumers.

AI agents may be adopted first by technology companies, with agile banks quickly following suit, while many financial institutions will lose market share due to the drag of legacy technologies and cultural constraints.

Financial Practitioners - Lucrative Rewards and the Risk of Replacement

Citibank believes that the number of employees in financial companies will not substantially decrease due to AI in the future. Any gains from reducing content and coding-related staff may be partially or fully offset by an increase in AI-related compliance managers and ethical governance staff.

However, as AI technology advances, developers may become cheaper and more easily replaceable, with foundational roles being supplanted by technology. Those with the best ideas will reap lucrative rewards, while others face the risk of replacement.

Financial Industry - Increased Industry-Wide Risks

The Bank for International Settlements' report notes that as technology complexity increases, so do the risks and challenges faced by the financial system, including the opacity of complex machine learning models, reliance on vast amounts of data, threats to consumer privacy, cybersecurity, and algorithmic bias. GenAI exacerbates some of these challenges and increases dependence on data and computing power.

Additionally, concerns about market concentration and competition are rising, as GenAI models are primarily produced by a few dominant companies.

Regulators - Focus on Financial Spillover Risks Arising from Real Economic Disruptions

The Bank for International Settlements' report points out that other potentially more severe risks associated with the use of AI in the financial system include stability issues.

For example, even early rule-based computer trading systems were linked to cascading effects and herd behavior in the 1987 US stock market crash. Financial stability issues stem from dataset homogeneity, model herd behavior, and network interconnectivity, further exacerbated by GenAI's specific characteristics: increased automation, speed, and prevalence.

Moreover, from a regulatory perspective, using advanced AI technologies will face further challenges: the proliferation of complex interactions and inherent unexplainability make it difficult to detect market manipulation or financial stability risks in a timely manner. With GenAI, autonomous driving, and robotic advisors, decisions may become more homogenized, potentially increasing systemic risks.

It is worth mentioning that BIS highlights the financial spillover risks arising from real economic disruptions, where AI leads to significant labor market displacements, which could lead to financial stability risks depending on the extent of the disruption. Its transmission mechanism is similar to the 1920s, when agricultural mechanization shifted over 10% of the US labor force out of the agricultural sector, leading to widespread mortgage defaults that played a crucial role in the 1929 financial crisis and the resulting Great Depression.

In extreme negative scenarios, rapid automation by highly developed AI systems could lead to severe economic displacements. For instance, sudden income and wealth redistributions, corporate and consumer defaults, soaring interest rates, reduced government revenues, and political instability could all significantly undermine financial stability.

References: 1. UK Finance, "The Impact of AI Financial Services: Opportunities, Risks and Considerations" 2. Bank for International Settlements (BIS), "Intelligent financial system: how AI is transforming finance" 3. Citibank, "AI IN finance"

This article also references translations from Didi Financial News.