Long article breakdown! The list of the world's 50 most promising startups, understanding the next five years' trends

![]() 11/21 2024

11/21 2024

![]() 504

504

Author|Amelie, Editor|Manman Zhou

"

AI leads the way, Chinese companies rise!

"

In today's rapidly developing technology, innovation is no longer exclusive to a few giants. Startups are transforming industry landscapes at an unprecedented speed.

From AI music generation to intelligent robots, these young enterprises are bringing more imagination to the possibilities of future life and work with astonishing vitality and creativity.

Recently, The Information, one of Silicon Valley's most influential technology media known for its "exclusive" and "in-depth" content, released the 2024 list of "The World's 50 Most Promising Startups" (abbreviated as "TI 50"), a highly authoritative year-end list in the tech industry.

This globally influential startup trendsetter selects 50 startups with high growth potential worldwide, summarizing current entrepreneurial trends and outlining a technological blueprint full of endless possibilities.

Below, I will analyze this list from several aspects. The complete list of startups and their introductions are at the end. Enjoy!

#01 How to Be Selected

The Information's "TI 50" list began in 2020, highlighting 50 promising startups each year. Since then, the list has been released annually with the intention of identifying companies that have achieved substantial success or revolutionary impact within the tech ecosystem.

These companies are selected based on financial indicators, market disruption, scalability, and the unique value they add to their industry. Selected companies must also meet two core criteria: funding below $100 million and a valuation below $1 billion, or establishment within the past two years.

This restriction excludes companies that are already "unicorns" or have a book value exceeding $1 billion, keeping the list focused on relatively young companies that have demonstrated rapid growth potential.

The Information evaluates companies based on undisclosed business and financial information, growth prospects, and other dimensions, and also publishes revenue and valuation information for some companies. For the 2024 selection, startups covered included eight major areas: AI applications, SaaS security, innovative creators, fintech and cryptocurrency, commerce, computing, devices and robotics, energy, and a unique "Asia Region" category. Among these, AI, robotics, SaaS security, and energy were the primary finalists, and these directions are likely to become hotspots for innovation and investment in the future.

#02 Industry Trends

In this year's list, 21 companies are related to AI applications, accounting for over 40%. From AI chips and AI data orchestration to virtual AI assistants and AI-generated content, AI has permeated various industries.

Based on the list, I have summarized the following key trends:

1. AI Content Generation Tools:

Companies like Suno and Clay, valued at $500 million each, offer AI music generation and AI marketing support. Suno helps users generate music from text, while Clay uses large language models to help companies quickly identify potential customers and write personalized marketing content. These tools simplify the creative process, lower the threshold for creativity, and are significant developments in the content creator space.

2. Industry-Specific AI:

Companies like 11x and Leya use AI to automate specific domains. For example, 11x uses AI to replace simple, repetitive tasks within companies, while Leya integrates legal knowledge bases from law firms and enterprises to optimize legal question answering. This customized application of AI demonstrates that it is not just a general tool but can delve into industries to provide efficient solutions for specific problems.

3. Intelligent Robots and Devices:

Collaborative Robotics aims to create robots with autonomous learning capabilities, enabling them to perform complex operations in industrial fields. Similar innovations are emerging not only in manufacturing but also in the service industry, representing the future direction of integrating the physical world with digital intelligence. Galbot has launched its first product, the wheeled, dual-armed, general-purpose embodied robot Galbot G1. In data training, Galbot adopts an innovative "pure simulation" strategy without using any real physical data but can generalize to grasp objects of various materials with a 95% success rate.

4. AI Programming and Development Tools: Cursor has created an Integrated Development Environment (IDE) that allows developers to interact with AI in real-time while writing code. The AI provides code suggestions, error detection, and autocompletion. Braintrust is an end-to-end enterprise platform for building AI applications, helping companies that want to create AI products evaluate and predict models and technologies, and provide insights into AI product development.

Unlike many large internet companies, most AI startups on this year's list have achieved revenue in their early stages. From this perspective, funding is no longer the sole lifeline for AI startups; quickly identifying market demand and achieving profitability have become new trends.

Entrepreneurs in the AI industry are no longer just pursuing algorithmic advancements but also commercial viability.

#03 Most Promising Areas

Innovation is ubiquitous across industries, and companies that are both innovative and have future market potential are more likely to accelerate in various sectors.

Among the six Asian companies on this year's list, four are from China, with three focusing on AI applications.

These companies demonstrate the innovative capabilities of Chinese startups in AI and robotics, representing a rapid transformation from "imitation" to "creation" among Asian companies.

The distribution of this year's list suggests several possible entrepreneurial directions for future growth:

1. Low-Barrier Creation Tools

AI content generation, video editing, music production, and other tools allow ordinary users to quickly create high-quality content, meeting the content demands of the self-media era. These tools will become increasingly popular in the future and may even evolve into a creative industry "accessible to everyone."

2. Data Infrastructure and Circulation

In the data-driven era, efficient and intelligent data circulation is crucial. Companies like Recurve and Positron AI use AI data orchestration and data infrastructure construction to improve data integration and utilization efficiency. Such companies will become increasingly important in future data-intensive industries.

3. Energy and Sustainability

AI not only appears in content and creativity but also shows great potential in energy and environmental protection. For example, companies like Blumen use AI to identify regulatory issues in renewable energy projects. Such innovations will help enterprises address environmental regulations and promote the achievement of sustainable development goals.

4. Customized AI Applications in Industries

The integration of AI with traditional industries is becoming increasingly clear. Leya acts as an AI assistant in the legal industry, helping law firms improve efficiency, while Browserbase uses AI to support headless browsers. These applications demonstrate the fusion of AI with industry expertise and are expected to expand into more fields such as healthcare, finance, and education in the future.

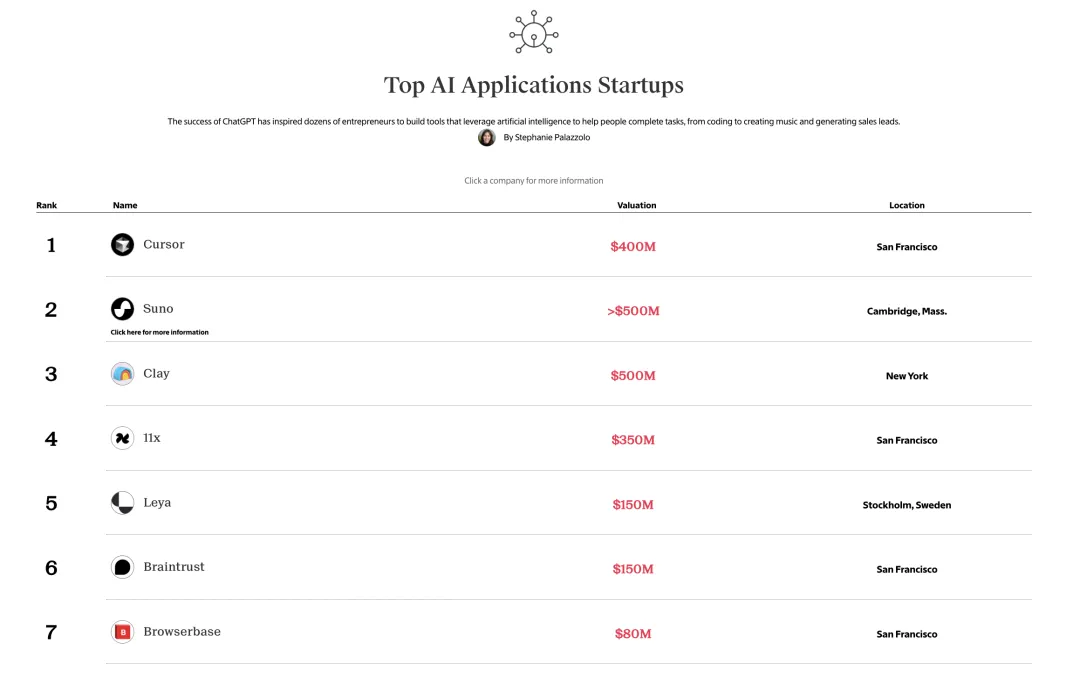

#04 Appendix: List and Company Introductions【Top AI Application Companies】Seven companies on the list are—

▌Cursor – AI Programming Tool

Features: Cursor creates an Integrated Development Environment (IDE) that allows developers to interact with AI in real-time while coding. The AI provides code suggestions, error detection, and autocompletion. It offers multiple AI models, allows personalized adjustments, and suggests code based on the developer's coding style.

Valuation: $400 million

Revenue: Over $20 million annually

Team: Founded by four MIT students.

Latest Funding: August 2024, Series A, $60 million.

Investors: A16z, Thrive Capital, OpenAI, among others, with participation from Google's Jeff Dean, Meta's Noam Brown, and founders of Stripe, GitHub, Ramp, Perplexity, and OpenAI.

▌Suno – AI Music Generation Tool

Features: Toc lowers the barrier to music creation. Suno generates audio corresponding to text prompts to create songs in various styles. Currently, Suno serves over 25 million users.

Valuation: Over $500 million

Revenue: Over $40 million annually

Team: The four founders of Suno AI, Mikey Shulman, Georg Kucsko, Martin Camacho, and Keenan Freyberg, previously worked at the financial data AI startup Kensho Technologies.

Latest Funding: May 2024, Series B, $125 million

Investors: Lightspeed Venture Partners, Nat Friedman, Daniel Gross, Matrix, and Founder Collective.

▌Clay – AI Marketing Platform

Features: Clay integrates over 75 data-rich providers, uses various large models to search and identify potential customer leads, and supports AI-automated personalized promotional content (such as emails). It currently has over 2,500 clients and over 100,000 users.

Valuation: $500 million

Revenue: $20-50 million annually

Team: Founded by Nicolae Rusan and Kareem Amin, two Canadian graduates of McGill University.

Latest Funding: June 2023, Series B, $46 million.

Investors: Led by Meritech Capital, with participation from Sequoia Capital, First Round, Box Group, Boldstart, and several sales and marketing leaders.

▌11x – AI Digital SDR Employee (Sales Development Representative)

Features: Uses AI Agents to replace employees in simple, repetitive business scenarios within the company, covering the entire SDR workflow. Additionally, 11x created a digital avatar, Alice, which appears more like a coworker than a tool.

Valuation: $350 million

Revenue: Over $8 million annually

Team: Founder and CEO Hasan Sukkar, born in 1997, holds an engineering degree from the University of Exeter in the UK and previously worked at McKinsey. The CTO and VP of sales at 11x are former employees of Brex.

Latest Funding: October 2024, Series B, $50 million.

Investors: A16z, Benchmark, with other investors including 20VC, Project A, Lux Capital, and SV Angel.

▌Leya – AI Legal Assistant

Features: Integrates knowledge bases from client law firms and external legal regulations and case databases, using AI to answer legal questions and optimize workflows. Leya primarily targets the European market, supporting authoritative information from over 15 jurisdictions and having over 70 clients, including law firms and in-house legal teams.

Valuation: $150 million

Revenue: Over $1 million annually

Team: Founded in Stockholm, Sweden, in 2023 by Max Junestrand, August Erséus, and Sigge Labor. CEO Max Junestrand previously held growth strategy positions at several Y Combinator-backed startups and holds a Master's degree in Computer Science from the University of Illinois at Urbana-Champaign. CPO August Erséus initially worked in psychology before transitioning to programming. CTO Sigge Labor has worked at several startups, including Scrintal, Flugelhorn, Sipy, and Causiq.

Latest funding: August 2024, Series A, $25 million.

Investors: Led by Redpoint, followed by YC, Benchmark, Alt Capital, and Wayfinder Ventures.

▌Braintrust - AI Development Evaluation Tool

Features: An end-to-end enterprise platform for building AI applications, helping companies evaluate and predict models, technologies, and provide insights into AI product development. Customers include Notion, Airtable, Instacart, Zapier, Vercel, etc.

Valuation: $150 million

Revenue: Over $1 million annually

Team: Founder Ankur Goyal was previously VP of Engineering at Singlestore and founded AI company Impira (later acquired by Figma).

Latest funding: October 2024, Series A, $36 million.

Investors: Andreessen Horowitz, Elad Gil, Greylock, Basecase.

▌Browserbase - AI Browser

Features: Provides a reliable, high-performance infrastructure platform for running, managing, and monitoring headless browsers at scale. Headless browsers are browsers without a graphical user interface (GUI) that can load and parse web pages, execute JavaScript, and handle network requests and responses.

Valuation: $80 million

Revenue: Around $1 million annually

Team: Founder and CEO Paul Klein was the founder of a company called Stream Club.

Latest funding: October 2024, Series A, $21 million.

Investors: Kleiner Perkins, CRV, Okta Ventures.

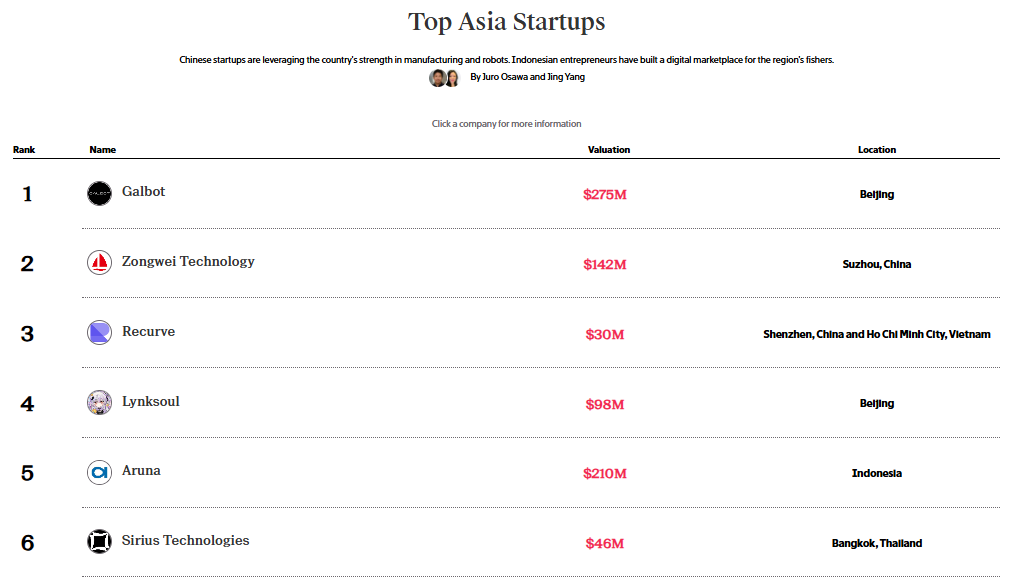

[Top Asian Startups] 7 companies listed:

▌Galbot - Robotics Company

Features: Focuses on autonomous learning and physical grasping through simulation technology. Has launched its first product, the wheeled dual-arm general-purpose embodied robot Galbot G1. Uses an innovative "pure simulation" strategy for data training, achieving a 95% success rate in grasping objects of various materials without using real physical data. Their robots can perform practical skills like opening cabinet doors, drawers, and hanging laundry.

Valuation: $275 million or $425 million (different sources)

Revenue: Not available

Team: Founder Wang He graduated from Tsinghua University in 2014 and received his Ph.D. from Stanford University in 2021 under the supervision of Professor Leonidas J. Guibas. In May 2024, Wang He led Galbot to collaborate with Peking University to establish the Peking University-Galbot Embodied Intelligence Joint Laboratory, serving as its director. He also concurrently serves as the director of the Embodied Intelligence Research Center at the Beijing Academy of Artificial Intelligence. Co-founder Yao Tengzhou graduated from Beihang University under the supervision of Professor Wang Tianmiao. Before partnering with Wang He, Yao Tengzhou held key positions at ABB's Shanghai Robotics R&D Center and ROOBO's Robotics R&D Department, responsible for the development of multiple series of robots such as Pudding and Jelly.

Latest funding: June 2024, Angel Round, over RMB 700 million.

Investors: Strategic and industrial investors such as Meituan Strategic Investments, BAIC Industry Investment, SenseTime Capital, iFLYTEK Venture Capital, as well as Qiming Venture Partners, BlueRun Ventures, Matrix Partners China, Source Code Capital, and IDG Capital.

▌Zongwei Technology - Production and R&D Company of Intelligent Magnetic Levitation Conveyor Systems

Features: A research and development company focused on intelligent magnetic levitation conveyor systems, with its sTrak series of flexible magnetic levitation conveyor line modules currently applied in various industries such as new energy and 3C electronics. Customers include BYD, CATL, and Foxconn.

Valuation: $142 million

Revenue: $14.2 million

Team: Core members come from renowned universities such as Shanghai Jiao Tong University, Tsinghua University, Peking University, and Harbin Institute of Technology.

Latest funding: May 2024, nearly RMB 200 million, Strategic Round.

Investors: BYD, Yongxin Fangzhou, Shengbao Capital, Lingjun Venture Capital, Huaye Tiancheng, etc.

▌Recurve - AI-Native Data Orchestration Platform

Features: Focuses on serving enterprises in the consumer goods, e-commerce, manufacturing, and pharmaceutical industries by providing ways to aggregate, circulate, and use data, building a data foundation to better adapt to the implementation of new-generation AI in enterprises. The company's flagship product is reportedly in its final stages of development and has entered iterative testing, with a planned release within 2024.

Valuation: $30 million

Revenue: Estimated at $1.2 million for 2024

Team: Founder Ren Dongni is a serial entrepreneur. In 2014, he founded Yimiandata in Shenzhen as its founder and CEO, which was later acquired by Ascential, a multinational group focused on data services, and has become part of Flywheel.

Latest funding: May 2023, Angel Round. Investors: Sequoia Capital China, ZhenFund.

▌Lynksoul - AI Game Companion and Virtual Companion Assistant, breaking through traditional electronic game interaction methods to provide a more humanized experience.

Features: Created dozens of anime AI characters that can engage in dialogue with users while they play electronic games or watch movies. The AI companions can recognize and understand users' on-screen actions, cheer them on during gameplay, share tips, or discuss the movies they are watching.

Valuation: $98 million

Revenue: $140,000

Team: Founder Liu Binxin has previously served as Deputy Director at Baidu, Assistant President at 360 Group, and Vice President at bilibili.

Latest funding: January 2024, Angel+ Round. Investors: CDH Investments, Paradigm Ventures.

▌Aruna - Indonesian B2B E-commerce Platform for the Fisheries Industry

Valuation: $210 million. As Indonesia's largest fishery trading platform, it connects small-scale fishermen (accounting for about 90% of fishing licenses) to the global market by creating a digital platform for fair trade and transparent pricing. Founded in 2016, Aruna did not finalize its current business model until 2019 and won its first venture capital funding. The company has also built warehouses and other infrastructure across Indonesia.

Aruna aggregates global buyer demand and distributes orders to over 50,000 Indonesian fishermen registered with the startup. It generates revenue by taking a cut from the fees paid by buyers. Nearly 80% of Aruna's transactions are exports to international buyers, with the US accounting for nearly half of exports, followed by Asia and the Middle East. To meet traceability and sustainability requirements, Aruna screens fishermen joining its platform and provides them with training.

Fishermen using Aruna for fishery transactions have seen their average income increase by at least three times compared to traditional methods. Compared to local competitors, Aruna focuses on building communities and distribution channels (food distributors, hotels, restaurants, retail, etc.) and targets the international market, selling branded products overseas and launching financial services to quickly achieve a second growth curve.

▌Sirius Technologies - Provides tools for enterprises to rapidly scale and launch digital products, driving innovation and growth for customers and partners.

Valuation: $46 million. Some co-founders of this startup previously worked at WeBank (an online bank supported by Tencent) to develop digital banking systems. Established three years ago, Sirius is drawing on the co-founders' experience at WeBank to help traditional banks and other financial institutions in emerging markets establish digital services such as account opening, payment processing, online lending, and digital wallets. The startup currently has customers in Thailand, Hong Kong, and Taiwan in Asia, as well as Colombia and Chile in Latin America.

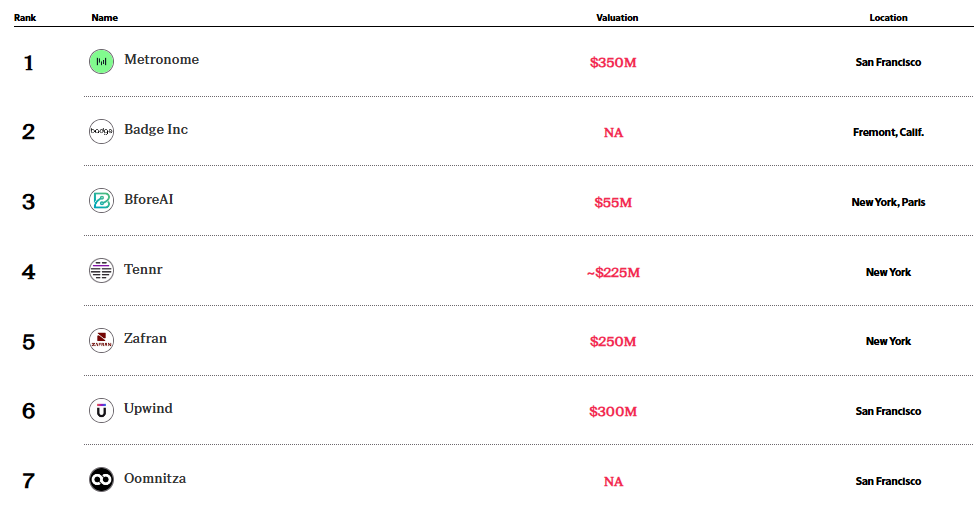

In addition to the [Top AI Applications] and [Top Asian Startups] lists, there are seven other sub-sector lists. [Top SaaS and Security Startups] 7 companies listed:

▌Metronome, a software that allows enterprises to charge customers based on the number of times certain features are used. The pay-as-you-go pricing model for enterprise software is gradually replacing seat-based billing. Metronome is a major beneficiary of this trend, with an ARR exceeding $15 million earlier this year. OpenAI is one of its major customers, relying on Metronome to charge for the use of models like GPT-4o. Current valuation: $350 million.

▌Badge Inc, a software that uses facial recognition to verify user identity without storing any facial data that could theoretically be stolen. Badge has developed a new form of cryptography that addresses a core issue in identity security: how to verify people's identities without storing biometric information in a manner that could be stolen. Instead of storing data about users' faces, Badge uses algorithms that reliably convert facial scans into private keys (strings of code) that can then be used to verify individual identities.

▌BforeAI, software that uses AI to search the web for scammers impersonating customers or using their brands to scam others, such as phishing websites with URLs like "faceboook.com" that attempt to trick people into entering their passwords. BforeAI flags these websites to partners including Google, which can lower their search rankings and alert law enforcement agencies responsible for eradicating online scams. Current valuation: $55 million.

▌Tennr, software that helps healthcare facilities automate paperwork, such as digitizing patient records from faxes. Many medical practices still rely on manual paperwork or cumbersome record-keeping processes, making them beneficiaries of AI automation. Tennr has made progress in this market, attracting hundreds of customers who have signed contracts worth over $5 million this year, a figure that has grown nearly 20-fold in the past six months, according to CEO Trey Holterman. Current valuation: nearly $225 million.

▌Zafran, software that helps customers patch vulnerabilities detected in applications and servers faster. Co-founded by Sanaz Yashar, who fled Iran for Israel as a teenager and later founded Zafran in New York, the company has gained popularity among security executives at large companies who say it delivers on its promise to accelerate vulnerability mitigation. Customers include Kraft Heinz, Chipotle, and another cybersecurity company, Netskope. Current valuation: $250 million.

▌Upwind, focused on vulnerability and code monitoring. Upwind specializes in monitoring the code actively running in customers' applications to automatically flag potential vulnerabilities or abnormally behaving code. It focuses on real-time monitoring of the code itself. Since launching its stealth mode last year, the company has been steadily winning customers and now has an ARR of over $5 million. Current valuation: $300 million.

▌Oomnitza, which automatically scans a company's software applications, creates inventories of data and devices, and automates common tasks. Oomnitza's software is popular among security managers for its ease of use and helpfulness. According to insiders, the company has a strong client list that includes Apple, which has increased its spending on Oomnitza software every year for the past four years. Oomnitza's biggest backer, SYN Ventures, has had a strong track record in small and medium-sized cybersecurity companies in recent years, including Talon Security, which was sold to Palo Alto Networks for over $600 million last year, and RevelStoke, which was acquired by Arctic Wolf last year. Annual revenue figures for Oomnitza have not been disclosed.

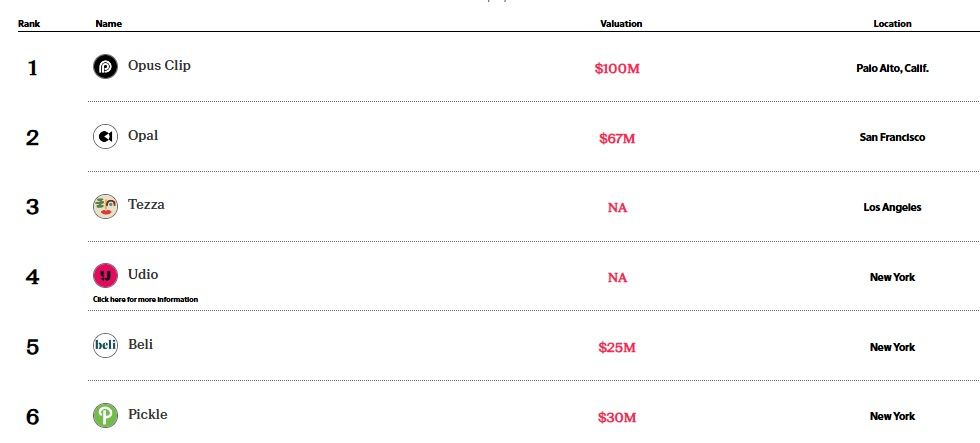

[Top Creator and Consumer Startups] 6 companies listed:

▌Opus Clip, AI editing software that converts long videos from creators and businesses into short clips and publishes them on social platforms. Opus Clip's software makes it easier to quickly publish videos without editing skills. It currently has 100,000 paying customers, more than five times the number from the previous year. Its 6 million total users include mainstream media companies such as iHeartMedia and Univision, as well as well-known creators like podcaster Scott Galloway. Over the past year, users have created 170 million video clips, with 68 million clips exported to other platforms.

▌Opal, a webcam developer. Webcams are popular among remote workers and creators who use them to produce content. Opal is dedicated to creating professional-grade webcams priced at $300 for creators and remote workers.

According to previous reports by The Information, Opal plans to develop other types of devices supported by OpenAI models and is working closely with OpenAI researchers to prototype various device ideas. The company has also attracted investments from well-known creators including Casey Neistat, Marques Brownlee, and Charli and Dixie D'Amelio. Neistat and Brownlee have also shared ideas with the company and tested early prototypes.

Since its launch in 2020, Opal has shipped over 25,000 devices as of January this year. The Open AI Startup Fund is leading a $60 million Series B funding round for Opal, which is still ongoing.

▌Tezza, a photo and video editing app for creators and social media users. Tezza effectively promotes app downloads and awareness through paid ads on TikTok, and founder Tessa Barton regularly shares new effects of the app.

The app has 2.5 million monthly active users, with KOLs such as Kim Kardashian, Gigi Hadid, and Chiara Ferragni using it. The company's offline events also help cultivate a loyal fan community.

▌Udio, an AI tool for musicians. Music beginners can create a short song by writing prompts and using controls on the Udio website. Experienced artists can upload their own sounds, such as piano improvisations or vocals, remix them, and then export their creations for refinement in other software.

Udio's investors include renowned musicians will.i.am and Common. A song created by King Willonius on Udio, "BBL Drizzy", reached 3.3 million plays on SoundCloud within a week but was later removed for copyright infringement. Despite many challenges, investors remain optimistic about its potential, especially since four of the company's five founders are researchers at Google DeepMind.

▌Beli, a social app for foodies. Users can view friends' opinions on nearby restaurants and rank their dining experiences. The app aims to help people discover new restaurants and uses a comparative ranking system to score user reviews.

▌Pickle, a peer-to-peer clothing rental marketplace. Pickle provides pricing suggestions, with rental periods ranging from 1 day to 4 weeks. Users can access high-end designer clothing at discounts of 80% to 90% of retail prices. Pickle also operates a physical store in New York, where influential North Americans like Danielle Bernstein and Lauren Wolfe rent clothes.

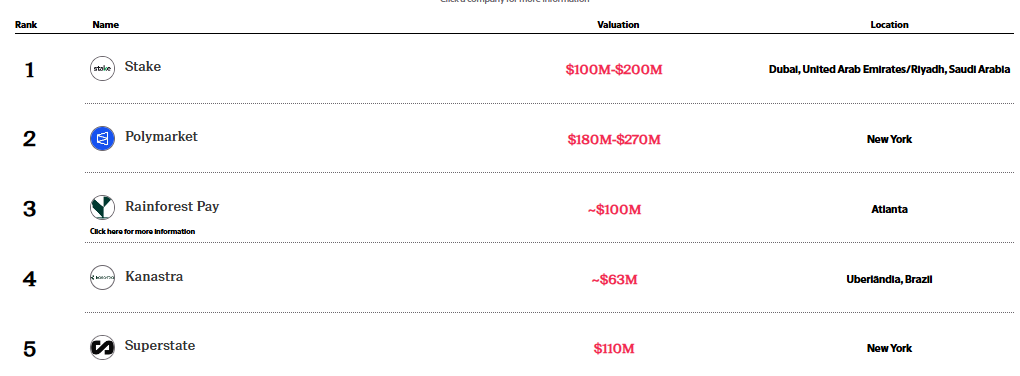

[Top Fintech and Crypto Startups] The top 5 companies are –

▌Stake, a digital platform for real estate investments. Stake has hired heavyweight venture capitalists crucial for expansion in the booming Middle Eastern real estate market, especially Wa'ed Ventures, a Saudi-centric venture fund backed by Aramco. So far, the company has stood out in a crowded market, helping sell 300 properties and attracting 750,000 users.

▌Polymarket, a prediction market that allows users to bet on future events using cryptocurrencies. By trading volume, Polymarket is the world's largest cryptocurrency-based prediction market. Ahead of the 2024 US election, its user base surged, with trading volume exceeding $2 billion. Due to regulatory restrictions, US users cannot access it. Currently, Polymarket does not charge trading commissions and has no meaningful revenue. In November this year, Polymarket successfully predicted the winner of the US presidential election, which was highly controversial.

▌Rainforest Pay, a payment provider for software companies. Rainforest Pay targets software companies with annual payments between $100 million and $2 billion. It also offers services such as fraud protection and checkout support. The company earns through service fees per payment but does not charge a software-as-a-service fee.

▌Kanastra, a service that helps fintech companies like private credit funds and lenders obtain debt financing, regulatory licenses, and data analysis. Within a few years, Kanastra, a fintech company, has hired over 100 employees and gained stable clients like Brazilian investment management firm XP and one of Brazil's largest banking institutions, Itau. During a more risk-averse period for fintech investors, it has also attracted capital, with its latest $21 million Series A funding round in June 2024. The company still has to prove it can win clients outside Latin America.

▌Superstate, an asset management firm that introduces traditional assets to the blockchain for use by cryptocurrency and other investors. Founded by cryptocurrency pioneer Robert Leshner, who created the popular decentralized lending protocol Compound, Superstate currently offers two funds: one for short-term US government securities, managing $155 million in assets, and another called the Crypto Spread Fund, managing $43 million in assets. Its primary clients are cryptocurrency investors, venture funds, and hedge funds that transfer funds between crypto assets and cash. Stablecoin issuers also use Superstate's funds as reserve assets.

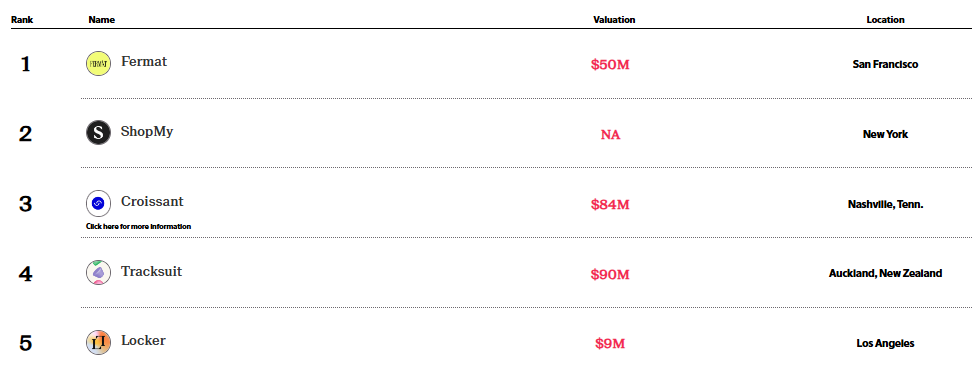

[Top Business Startups] The top 5 companies are –

▌Fermat, allowing brands and retailers to personalize web pages for specific customers to help sellers improve ad performance and increase shoppers' chances of making a purchase.

After Apple's 2020 privacy policy changes made it more difficult and expensive for brands to track customer data and ad performance, Rishabh Jain and Shreyas Kumar founded this company. Fermat creates personalized landing pages where brands can direct shoppers through digital ads. CEO Jain says the company's revenue has grown more than fivefold from a year ago, with millions of consumers using Fermat each month.

▌ShopMy, an affiliate marketing platform that allows influencers to create pages with shopping links and product recommendations. Creators can earn commissions from retailers through links, and brands can negotiate partnerships directly with creators using ShopMy's software. CEO Harry Rein says this feature is now the main driver of business growth.

▌Croissant, offering guaranteed resale prices to shoppers before they make purchases through browser extensions and mobile apps. Numerous startups try to make it easier for shoppers to buy and sell second-hand goods, from publicly traded companies like The RealReal and ThredUp to private companies like Trove and Treet. Croissant shows consumers the resale price they can expect after purchase. Its co-founder and CEO, John Howard, a former fintech investor at KKR, says consumers spend 50% more when they opt into Croissant's 'Guaranteed Buyback.' Croissant earns money by charging a small percentage of sales when the buyback option is enabled.

Croissant currently collaborates with brands and retailers like Shopbop, Reformation, J.Crew, Lululemon, Nike, and Neiman Marcus.

▌Tracksuit, market research and brand tracking software for small consumer goods companies and startups. Tracksuit aims to help marketers better understand how their brands compare to competitors, providing market research that is usually only available by hiring large companies like Nielsen or Qualtrics.

Tracksuit's software gives growing brands easy access to data from surveys conducted by Tracksuit to better understand how their brand compares to competitors in areas like brand awareness and customer perception. The company says it works with over 600 brands globally, including Supergoop and Bondi Sands, and plans further expansion in the US.

▌Locker, a mobile app and browser extension that allows users to save products to shopping wishlists and organize collections to share with friends.

Locker's app and website allow shoppers to save items from websites to their profiles and easily shop with just a few clicks when ready to buy. Users can group items into Pinterest-like collections on their profiles. Locker earns commissions from purchases made through its links, currently has over 150,000 users on its app and website, and plans to launch a cashback feature this fall.

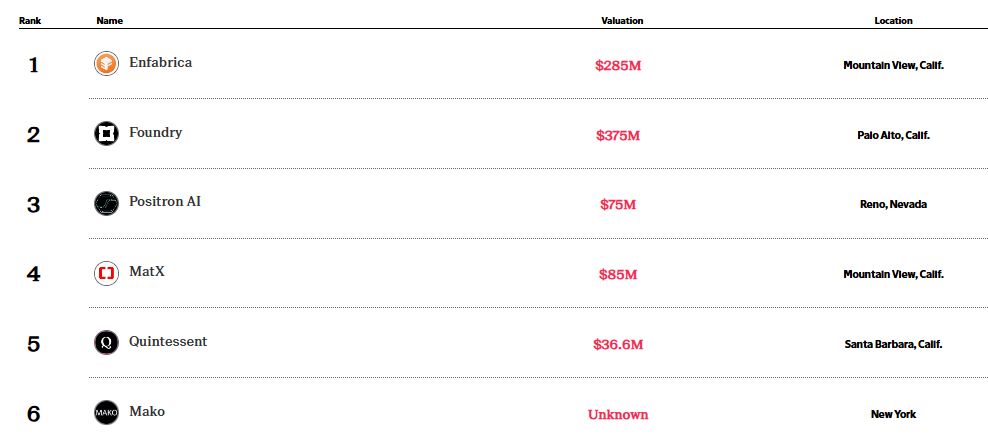

[Top Computing Startups] The top 6 companies are –

▌Enfrabrica, a chip developer for AI data centers. Enfrabrica aims to solve critical network and memory bottlenecks in large GPU clusters, connecting GPUs to CPUs and memory so all chips can process large amounts of data quickly. This becomes increasingly important as companies train and run large AI models.

Enfrabrica says its technology can improve GPU utilization and help developers reduce costs for using large language models by up to 50%. The company's chips (called Accelerated Computing Fabric devices) are available for pre-order, meaning they are not yet on the market.

▌Foundry, a cloud computing provider focused on AI, renting hard-to-get Nvidia GPUs to developers. The company hopes its cloud software and real-time pricing model will offer customers a cheaper and more flexible way to develop AI.

Foundry allows developers to rent GPUs by the hour, aiming to be cheaper than large cloud providers, partly by partnering with cloud computing providers and other companies with idle GPUs. Last summer, Foundry's valuation grew sevenfold, from a seed round to a Series A round led by Sequoia Capital and Lightspeed Venture Partners. Founder Davis says Foundry's revenue has grown by over 90% month-on-month in the past few months. Current clients include KKR, Pika, Poolside, and Arc Institute.

▌Positron AI, a chip developer. Positron has developed an AI chip aimed at reducing the cost of running large language models based on transformers and plans to eventually develop a custom chip for AI training.

One and a half years after its founding, Positron launched the first version of its chip and began testing with customers this year. Founder Thomas Sohmers (a former Thiel Fellow and seasoned semiconductor and cloud executive) says the chip's architecture will work better than older designs for transformer-based AI systems. The company is raising a new round of venture capital, according to insiders.

▌MatX, a chip developer. It specializes in designing chips for large language models, focusing on the large matrix multiplications required to run transformer-based models (like OpenAI's ChatGPT).

MatX's AI chip is scheduled to go on sale in 2026, potentially offering 12 times the performance per dollar compared to Nvidia's Rubin chip, also set to release that year. MatX is seeking to raise $75 million to $100 million in new funding to bring its first product to market. Its co-founders previously worked at Google, competing with Nvidia's GPUs.

▌Quintessent, a laser developer. It aims to develop better lasers for optical connectivity in data centers or optical-based technologies that can transfer data between chips and servers.

Quintessent's approach differs slightly from most companies: it focuses on developing better lasers. Building on a decade of research at the University of California, Santa Barbara, the company is leveraging new laser materials it believes are more efficient and reliable than those commonly used today.

▌Mako, a chip software service provider.

Mako's technology enables customers to efficiently run AI software on different types of chips, making it easier for customers to switch between hardware providers.

Mako has only been launched for seven months, but a few early customers are already using its software and reporting savings of over 50% on computing costs. Formerly known as A2 Labs, the company is discussing testing its technology with cloud providers and companies renting large numbers of GPUs. According to insiders, Mako raised over $8 million in seed funding.

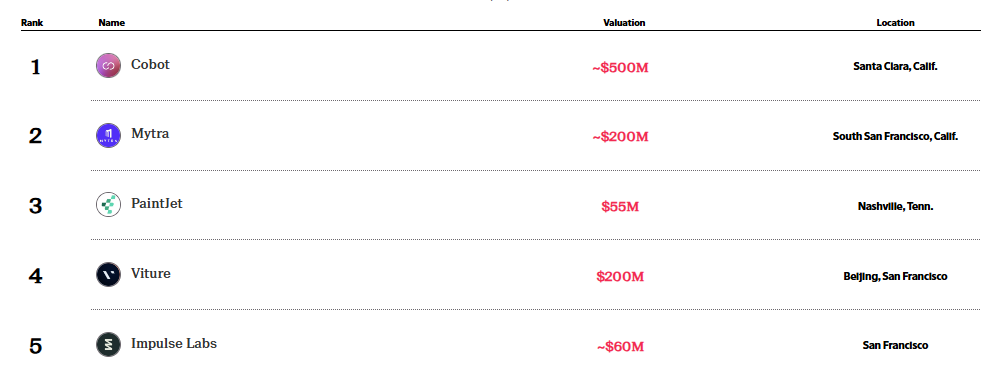

[Top Device and Robotics Startups] The top 5 companies are –

▌Cobot, a robotics manufacturer.

Collaborative Robotics produces robots designed to work alongside humans in industries like logistics, manufacturing, and hospitals. Founded by Brad Porter, a veteran of Amazon's robotics and delivery technology team and former CTO of Scale AI, Collaborative Robotics aims to build 'collaborative robots' that can work alongside humans. The company is building its own hardware and proprietary AI models to power them.

Earlier this year, the company deployed robots for its first client, shipping giant Maersk, outside Seattle. Porter, who deployed over 500,000 robots during his time at Amazon, says Collaborative Robotics hopes to deploy its robots 'anywhere people move boxes, tote bags, and carts.'

▌Mytra, which manufactures robots that automatically move and store warehouse items. Mytra uses robotics to streamline car manufacturing for Tesla and Rivian. Now, they hope to leverage robotics to streamline the movement of goods within warehouses. Co-founder and CEO Chris Walti previously helped manage the manufacturing of Tesla's Model 3 cars and helped develop the Optimus humanoid robot. The company has been piloting its system with grocery giant Albertsons.

▌PaintJet, a manufacturer of painting robots for large industrial projects such as production warehouses and ships. PaintJet CEO Nick Hegeman said he was inspired to co-found the company in 2020 after struggling to recruit quality labor while running an industrial painting company.

The robots installed on industrial lifts by PaintJet can paint faster and cleaner than humans. Hegeman said their operating costs are also low enough that the company has consistently won bids against traditional paint companies. Projects to date include Amazon warehouses, oil storage tanks, and large ships.

▌Viture, a manufacturer of augmented reality glasses that allows consumers to play PlayStation and Xbox games at home without a console. Viture's first product, Viture One, allows users to play games on a 120-inch virtual screen and has been well-received by gamers. The Viture Pro, launched earlier this year, has also received positive reviews. Co-founder and CEO David Jiang previously worked on Google Glass.

The Viture glasses and accompanying neckband are lightweight, allowing users to wear them for hours continuously. According to research firm Counterpoint, thanks to Viture One, the company became the third-largest participant in the AR smart glasses market in the first quarter of 2024. Viture is also trying to attract non-gamers by enhancing search and other productivity features.

▌Impulse Labs, a manufacturer of high-end electric stoves. Its performance is expected to surpass gas stoves. The stove includes a large internal battery for storing energy and providing additional power; users can boil a liter of water in 40 seconds. The stove allows users to set the pan to a precise temperature controlled by built-in sensors.

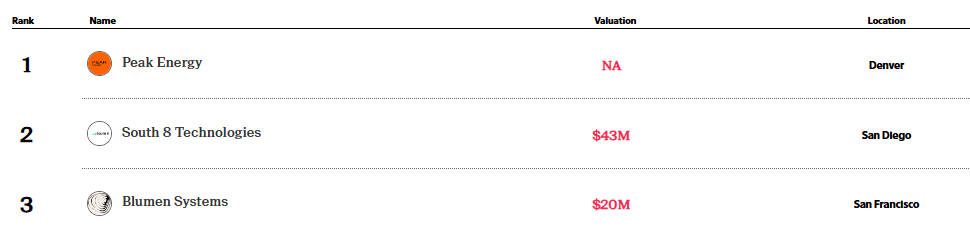

[Top Energy Startups] The top 3 companies on the list are:

▌Peak Energy, which manufactures sodium-ion batteries for grid storage. Peak is currently purchasing sodium-ion batteries made in China and plans to start producing its own batteries in the US by 2027, relying mainly on Wyoming's large reserves of soda ash.

▌South 8 Technologies, which manufactures lithium-gas electrolytes. South 8 has developed a liquefied gas electrolyte that allows battery voltages of up to 5 volts, higher than the current maximum of 4.5 volts for the best electrolytes.

▌Blumen Systems, which manufactures boxed industrial permits. Renewable energy projects, such as solar or wind projects with batteries, can be delayed for years as sponsors must comply with local and federal permitting regulations.

Blumen is trying to eliminate this bottleneck by using large language models to identify and index required permits. Subsequently, Blumen plans to enable the system to apply for permits as well.

▼

Industry giants always attract most of the attention, and startups face more challenges amidst the global economic slowdown.

However, under these circumstances, the potential enterprises showcased in the 'TI50' list remain vibrant, especially thriving in the fields of AI and robotics.

For entrepreneurs, opportunities still abound despite the giants' presence. Focusing on deep AI applications in specific industries and creative tools for the general public remains a worthwhile direction to explore.

Through in-depth analysis of companies on the list, we can also foresee that these innovative directions will spark a broader wave in the coming years. Whether it's AI-centric data orchestration tools, low-barrier creative platforms, or industry applications with AI customization services, these areas will be full of opportunities and possibilities.

Reference Links: The Information's 50 Most Promising Startups 2024. (The Information) Behind the scenes of the 50 Most Promising Startups 2024. (The Information) Introducing The Information's 50 Most Promising Startups for 2024. (The Information)