Q3 revenue decline, profit and commercialization facing challenges, WeRide needs a decisive battle

![]() 12/08 2024

12/08 2024

![]() 567

567

Author|Xingxing

Source|Baiduo Finance

On December 2, the global business magazine Fortune unveiled its list of 'The Future 50' companies for 2024. WeRide (NASDAQ:WRD), the world's first publicly traded Robotaxi company, ranked 26th on the list, alongside Kuaishou Technology as the only two Chinese tech companies to make the cut.

However, beneath its glow, WeRide still faces numerous issues that need addressing. Recently, WeRide released its third-quarter financial report ending September 30, 2024. Data showed that WeRide's third-quarter 2024 operating revenue declined compared to previous periods, with gross margin experiencing a steep drop and the company remaining in a loss position.

Facing numerous uncertainties in the path to autonomous driving commercialization, anxiety in the secondary market is abundant. On the fourth day of its listing, WeRide's share price fell below its IPO price. As of the U.S. market close on December 5, 2024, the company closed at $15.95 per share, with a daily decline of 5.84% and a market capitalization of $4.378 billion.

Various signs indicate that going public is far from the end for WeRide; it marks the beginning of long-term scrutiny by the capital market.

According to public information, WeRide was founded in 2017. With the WeRide One autonomous driving platform at its core, the company provides users with autonomous driving products and services ranging from L2 to L4, covering applications such as smart mobility, smart logistics, and smart environmental sanitation.

Currently, WeRide has formed five product matrices: Robotaxi, Robobus, Robovan, Robosweeper, and Advanced Driving Solution, offering various intelligent driving solutions externally.

WeRide's core business can be divided into two categories: products and services. Sales products include L4 autonomous vehicles such as Robotaxis and Robobuses, along with related sensor kits. Services encompass L4 autonomous driving and Advanced Driver Assistance Systems (ADAS) R&D services.

Notably, in recent years, WeRide has been driving changes in its business model and operational structure, shifting its revenue focus from products to services. The company's sales revenue has dropped from RMB 102 million in 2021 to RMB 54.19 million in 2023; service revenue, however, has doubled to RMB 348 million in 2023, accounting for 86.5% of total revenue.

However, in Q3 2024, service revenue, which supported WeRide's revenue growth, decreased by 25.8% from RMB 74.1 million in Q3 2023 to RMB 55 million. This was mainly due to the completion of customized R&D services by certain customers, resulting in a decline in ADAS R&D service revenue. Renewed contracts are expected to take effect in 2025.

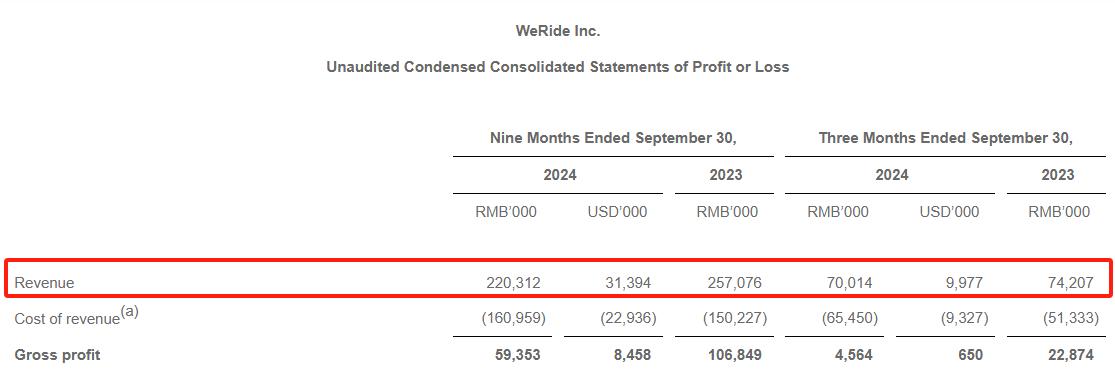

Data shows that WeRide's product revenue in Q3 2024 was RMB 15 million, a sharp increase from RMB 100,000 in the same period in 2023, but it failed to compensate for the shortfall caused by the decline in service revenue. Combined, WeRide's total revenue in Q3 2024 was RMB 70.014 million, a year-on-year decrease of 5.6%.

In the first three quarters of 2024, WeRide's revenue was RMB 220 million, down 14.3% from RMB 257 million in the same period in 2023. Meanwhile, WeRide expects its 2024 annual revenue to be approximately RMB 350 million to RMB 380 million, representing a change of -5.4% to -12.9% from the same period in 2023, which was RMB 402 million.

Baiduo Finance notes that WeRide's gross margin has significantly decreased. The company's gross margin for the first three quarters of 2024 was RMB 59.353 million, nearly half of the RMB 107 million in the same period in 2023; the gross margin for Q3 alone dropped sharply from RMB 22.874 million in the same period in 2023 to RMB 4.564 million.

WeRide's Chief Financial Officer, Jennifer Li, also admitted in the financial report that the company's gross margin fluctuations were driven by changes in revenue mix each quarter and expressed confidence in building a larger customer base through further commercialization of products and services to stabilize revenue and cost structure.

Moreover, the most pressing issue WeRide faces at this stage is its inability to achieve stable profitability. In 2021, 2022, and 2023, the company recorded net losses of RMB 1.007 billion, RMB 1.298 billion, and RMB 1.949 billion, respectively, with losses increasing annually.

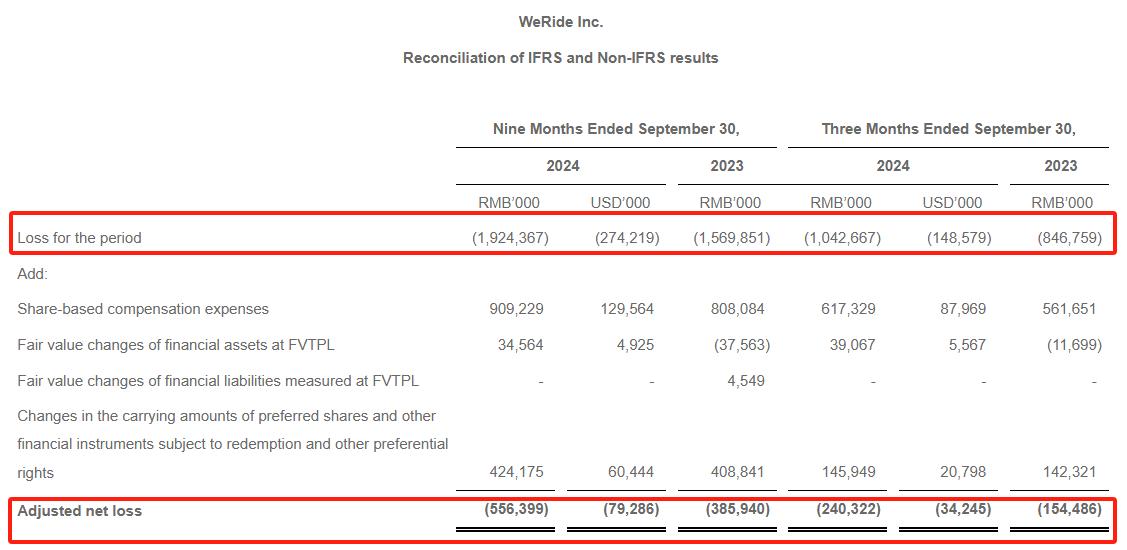

In the first three quarters of 2024, WeRide's net loss was RMB 1.924 billion, further expanding from RMB 1.603 billion in the same period in 2023; adjusted net loss was RMB 556 million, a year-on-year increase of 44.2%. Based on these calculations, the company has accumulated losses exceeding RMB 6 billion in less than four years, indicating significant operational pressure.

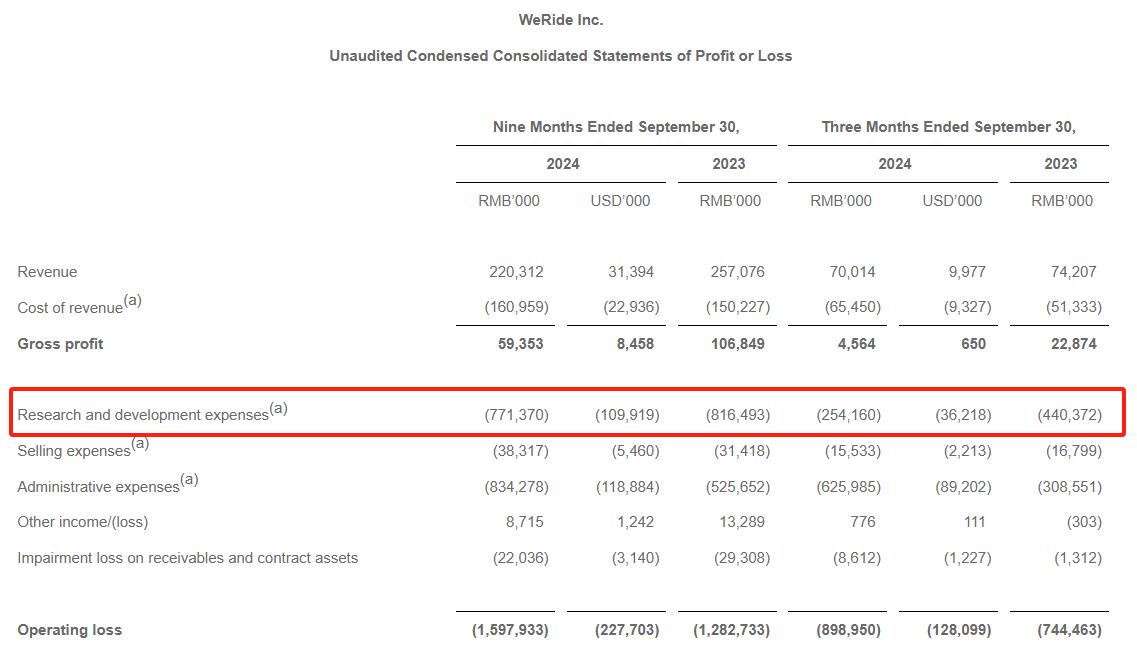

The primary reason for WeRide's persistent operating deficits is its substantial R&D investment. From 2021 to 2023, its R&D expenses were RMB 443 million, RMB 759 million, and RMB 1.058 billion, respectively, accounting for 320.7%, 143.8%, and 285.5% of revenue during the same periods, far exceeding operating income.

Entering 2024, WeRide has invested heavily in attracting R&D talent and in testing, trialing, and commercializing autonomous driving technology. The company's R&D expenses for the first three quarters were RMB 771 million, slightly lower than the RMB 816 million in the same period in 2023 but still a significant expenditure.

In Q3 2024, WeRide's R&D expenses were RMB 254 million, down 42.3% from RMB 440 million in the same period in 2023. Excluding share-based compensation, the company's Q3 R&D expenses were RMB 206 million, actually up 28.6% from RMB 160 million in the same period in 2023.

Admittedly, continuous R&D and technological accumulation have built a solid competitive barrier for WeRide. Leveraging over 1,800 days of Robotaxi public operation experience and the Farizon SuperVan's wire-controlled steering architecture, WeRide launched the industry-first next-generation Robotaxi platform, GXR, in October this year.

According to introductions, GXR integrates WeRide's proprietary L4 autonomous driving system, the new-generation sensor suite Sensor Suite 5.6, and the HPC 2.0 computing platform. It can effectively avoid single-point failures, ensuring passenger safety while efficiently meeting the computing demands of the entire vehicle.

EXEED, a premium brand under Chery Automobile, also launched the Falcon intelligent driving system, jointly empowered by WeRide and Bosch. WeRide provides a comprehensive end-to-end solution, enabling vehicles to navigate complex urban environments and ensuring a seamless driving experience without relying on high-definition maps.

WeRide's founder, chairman, and CEO, Han Xu, expressed confidence in the company's development, revealing that its business model has expanded to seven countries and regions. The company will continue to promote the global application of its autonomous driving products and remain at the forefront of technological progress.

The future plans are promising, but WeRide faces numerous practical challenges. Looking at the domestic intelligent driving landscape, compared to collaboration, new carmakers prefer the synergies of full-stack in-house R&D. Xpeng recently unveiled its AI Eagle Eye intelligent driving solution, and Huawei plans to mass-produce a 'one-stop end-to-end' intelligent driving system next year.

Once the increment of 'allies' peaks, WeRide will undoubtedly face more difficulties promoting its autonomous driving products and services in the vast automotive market. Moreover, the company's business monetization model remains unverified, and the uncertainty of operational implementation will become the biggest constraint on its development.

Zheshang Securities also analyzed in a research report that although the Robotaxi industry has made significant breakthroughs in policy and commercial operation this year, there is still a risk of falling short of expectations for the actual pace of large-scale implementation. As more regions open up trial operations, global competition may intensify, affecting the evolution of the competitive landscape.

The autonomous driving sector has entered the second half of the competition for large-scale commercialization. Slightly lagging behind, WeRide must find ways to stay in the game to have a chance to 'deal the cards'.