General Motors Loses China Market, Signaling Official Decoupling of China-US Auto Industry

![]() 12/23 2024

12/23 2024

![]() 592

592

In China's automotive landscape, there's a peculiar rule: whether it's about new models, leadership changes, factory closures, layoffs, or other rumors, if an automaker vehemently denies them, the rumored events often come to pass. This time, General Motors' (GM) denial carries a different weight.

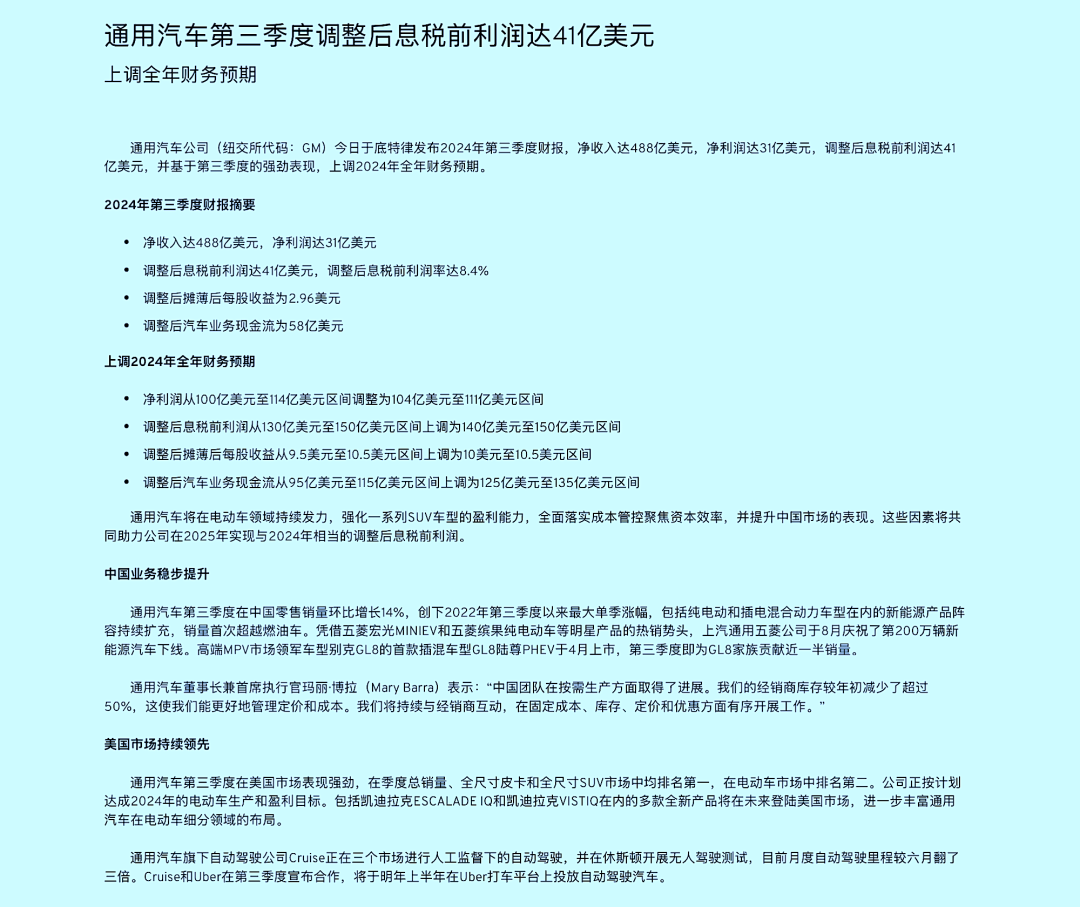

Recently, GM headquarters announced plans to invest over $5 billion in restructuring SAIC-GM, involving a write-down of shares worth $2.6 to $2.9 billion and provisions for factory closures and model production adjustments amounting to approximately $2.7 billion. However, GM China 'denied' that its China business is and will remain a high-quality asset.

SAIC-GM, once a cornerstone of SAIC Group's success in the Chinese market alongside SAIC Volkswagen, now finds itself in a developmental quandary. This signifies that, following Ford and JEEP, American car brands are contracting across the Chinese market.

SAIC-GM peaked in 2017 with sales of 2 million vehicles, becoming a benchmark for joint-venture brands. Despite continuous introduction of new technologies and models, and the localization of luxury brand Cadillac as a leader in the second-tier luxury segment, SAIC-GM's sales have been declining annually.

In November 2024, SAIC-GM reported terminal sales of 66,797 vehicles (including exports), marking five consecutive months of month-on-month growth. However, cumulative sales from January to November stood at only 600,000 vehicles (including exports), compared to 1.001 million in 2023, suggesting a potential sales drop of over 30% for the full year of 2024.

In the third quarter of 2024, GM's China business lost $137 million, with cumulative losses for the first three quarters amounting to $347 million (approximately RMB 2.5 billion). Weak sales growth and the one-price strategy have weakened SAIC-GM's profitability, significantly impacting GM's overall earnings performance.

Having fallen from a peak of 2 million vehicles sold, and with 'dealer inventory reduced by over 50% from the beginning of the year,' GM had to take drastic measures against SAIC-GM. Besides closing some factories and adjusting model production, significant layoffs are inevitable.

The financial crisis once plunged GM into a long-term development dilemma, ultimately forcing it to sell Opel and strategically abandon the increasingly stringent European market for fuel efficiency and emissions of gasoline vehicles. Little did it anticipate having to significantly scale back its operations in the world's largest market.

With a peak annual sales volume of 2 million vehicles, SAIC-GM has been active: it was the first to export Chinese cars to the North American market, localized the Cadillac brand, offered multiple models using the Ultium platform at the lowest prices globally, and applied SAIC Group's plug-in hybrid technology to its star product, the Buick GL8.

However, despite launching multiple models at the global lowest 'one-price,' which partially recovered some sales, the overall downward trend could not be reversed, with annual sales falling below 1 million. Compared to an annual production capacity of 2 million vehicles, SAIC-GM is now severely overcapacitated.

As a quasi-state-owned American automaker, GM has prioritized financial indicators such as operating revenue and profitability in recent years. SAIC-GM's global low-price promotions and idle capacity are effectively subsidizing Chinese car users with American money.

The Chinese market was once GM's largest, and while GM China is reluctant to admit it is no longer a leader in this market, SAIC Group cannot afford the huge shock caused by the stagnation of SAIC-GM's development.

However, with the Pan Asia Technical Automotive Center (PATAC), the strongest R&D company among multinational automakers in the Chinese market, it's not so much that GM cannot keep up with the Chinese auto market's pace as it is that the rise of Chinese autonomous automakers has dealt a devastating blow.

Autonomous automakers, once considered incapable of making good cars, have made leapfrog advancements in automotive technology, design, and quality control. Leading automakers like BYD, Geely, and Chery are gradually on par with century-old multinational automakers in market share and brand influence.

It's not just GM; almost all multinational automakers cannot fathom how autonomous automakers have achieved this. The ultimate conclusion can only be extreme internal competition and predatory low-price dumping caused by alleged overcapacity.

Benefiting from China's rapid economic growth, multinational automakers once enjoyed robust sales in the Chinese market with almost any model, earning profits far exceeding the average level in the Chinese auto market.

Whether it's R&D and cost control across the entire automotive chain or the use of local Chinese technologies, standards, and raw materials, multinational automakers have not truly integrated into the development of the Chinese auto industry. They have mainly introduced global technologies to the Chinese market and focused on localized production.

SAIC Group is well aware of how much multinational automakers have benefited from the Chinese market, as it became China's top automaker relying on its two leading joint ventures, which accounted for only half of its vehicle sales profits.

It's not difficult to understand why autonomous automakers offer such high configurations at low prices. However, multinational and state-owned automakers are unwilling to admit their years of profit exploitation in the Chinese market or give up their past glories.

Unlike Chang'an Suzuki and GAC Mitsubishi, which directly went bankrupt and dissolved, brands like Peugeot-Citroen and JEEP have attempted to maintain their presence in the Chinese market through asset-light models. Changan Ford has long since withdrawn from the million-unit sales race, maintaining its niche market presence.

SAIC-GM has more options and is far from bankruptcy or delisting. However, following Ford's new development model in the Chinese market, SAIC-GM may gradually withdraw from the top ten in sales competition, leading to significant adjustments for the Chevrolet and Cadillac brands.

Brands like GM, Ford, and Chrysler are already struggling to compete with Toyota and Honda in their native North American market, and opportunities in overseas markets are dwindling as Europe and China enter the new energy era, a global automotive industry trend.

With GM contracting its business in the Chinese market, the decoupling of the China and US auto industries has officially begun. Eventually, only Toyota and Volkswagen may remain as multinational brands in China's mainstream market.

So, does GM still have a chance in China?

The Chinese auto market is the largest in the world, offering endless business opportunities, but SAIC-GM has wasted too much time and opportunities.

Volkswagen and Toyota's cooperation with autonomous automakers has escalated from production to deeper R&D and technological collaboration. For example, Volkswagen has invested in XPeng to create electric smart cars exclusive to the Chinese market, while Toyota has joint ventures with BYD and cooperates with GAC Group to create new energy vehicles using local electric technology.

GM has long ranked among the top three in sales volume in the Chinese market, and SAIC Group possesses China's strongest R&D and financial strength in the auto industry. However, their cooperation has remained limited to joint-venture production. Is it because they have won too easily for too long and are unwilling to strive, or are they too focused on immediate gains to upgrade their cooperation?

When we see GM announce the abandonment of its Cruise autonomous taxi project, which it had supported with $10 billion over eight years, we can already foresee the future of SAIC-GM.

Of course, we need not worry about SAIC-GM's layoffs and closures as it has sufficient funds and resources for aftermath handling. Even laying off employees in lines and snatching up discounted cars can be amusing.

From Ford, JEEP, to GM, whether it's factory closures or layoffs, once this process begins, the outcome may be far worse than we imagine.

Whether it's the rise of autonomous automakers or the rapid development of new energy vehicles, the decoupling of the China and US auto industries is inevitable. GM's adjustments reveal a harsh reality: while Chinese automakers cannot easily enter the North American market, American automakers have lost the Chinese market themselves.