AI: The New Energy-Intensive Frontier

![]() 01/16 2025

01/16 2025

![]() 559

559

Reflecting on 2024, AI emerged as the dominant investment theme in global stock markets. Whether in U.S. stocks like NVIDIA, TSMC, and Broadcom, their counterparts in Japanese markets, or the NVIDIA supply chain in A-shares, over a dozen AI stocks witnessed at least doubling in gains, with some achieving even more spectacular returns.

By the second half of 2024, U.S. stock funds gradually transitioned from AI hardware to lower-level AI software, encompassing data management platforms, data security firms, and advertising intermediaries. This shift momentarily dampened NVIDIA's performance until last week, when news of Microsoft's $80 billion capital expenditure plan for 2025 reignited the rally in hardware stocks, with NVIDIA reaching a new high of $153.

Regarding the reasons behind the new highs in hardware stocks, market opinions diverge. Some argue that Microsoft's $80 billion capex exceeded expectations, while others contend it did not, as foreign banks had maintained forecasts between $80-85 billion.

Nevertheless, the investment narrative for AI in 2025 is likely to be clearer than in 2024. Firstly, the profitability of AI investments is being validated. Secondly, AI applications are progressing rapidly, with advancements in large models, advertiser investments, AI robots, AI glasses, and other software-hardware combinations forming a dual impetus that accelerates AI development.

Beyond the demand for AI hardware from tech stocks, the anticipated surge in power demand over the next three years may vastly exceed market projections.

I. The Magnitude of AI's Incremental Power Demand

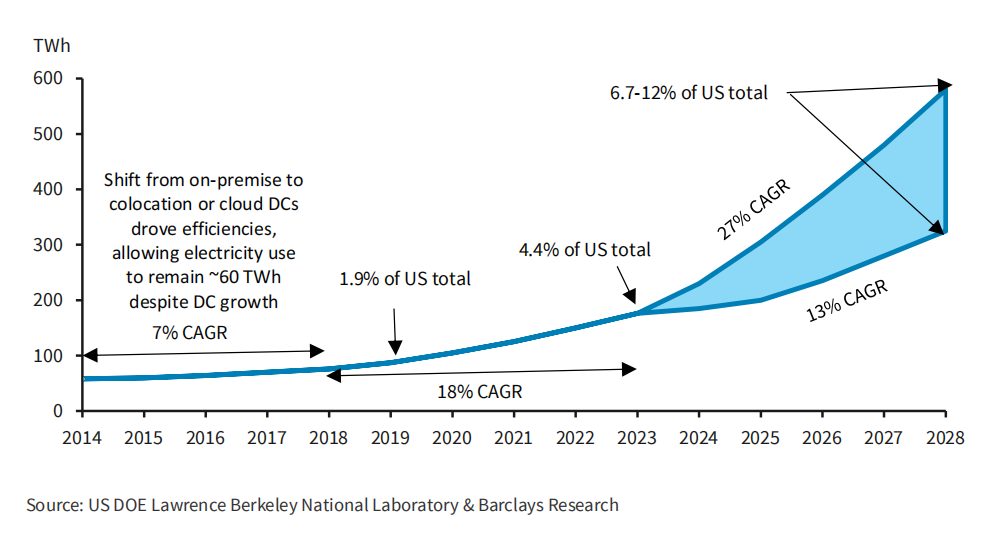

On Christmas Eve, the U.S. Department of Energy released a report on power demand for AI data centers. The following chart illustrates the forecasted total electricity consumption of U.S. data centers from 2014 to 2028.

As shown, from 2014 to 2016, annual energy consumption of U.S. data centers remained stable at approximately 60 TWh, continuing the lowest growth trend since 2010.

Starting in 2017, the overall number of server installations in the U.S. began to rise, with GPU-accelerated and AI servers becoming a significant portion of data center server inventory, leading to a resurgence in total electricity consumption.

By 2018, data centers consumed around 76 TWh, accounting for 1.9% of the U.S.'s annual total electricity consumption. From 2018 to 2023, electricity usage in U.S. data centers continued to grow, from 76 TWh in 2018 to 176 TWh in 2020, representing 4.4% of total U.S. electricity consumption.

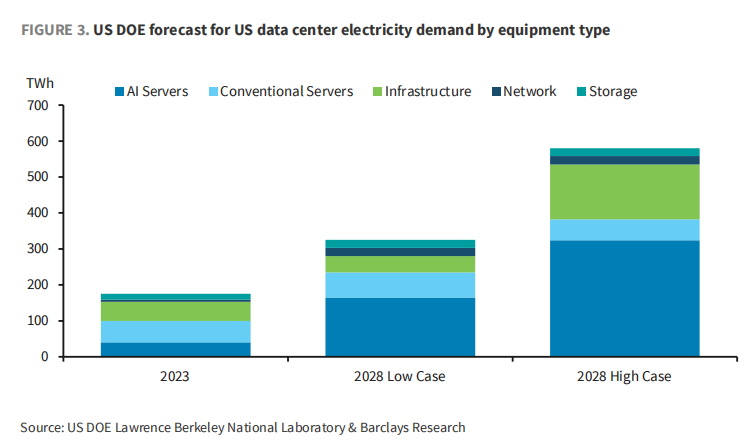

The U.S. Department of Energy predicts that, excluding power consumed by cryptocurrency miners, from 2023 onwards, electricity consumption for U.S. data centers will increase by 13-27% annually. By 2028, it is projected to reach 325-580 TWh, accounting for 6.7%-12% of total U.S. power demand. According to this forecast, power demand for U.S. data centers is expected to grow 2-3 times from 2023 to 2028.

Power demand for AI servers is anticipated to increase from approximately 40 TWh in 2023 to 165 TWh in 2028 (pessimistic scenario) to 325 TWh (optimistic scenario), marking a growth of about 4-8 times.

By 2028, AI training consumption will surpass AI inference demand, accounting for 50-53% of total AI server energy consumption, due to the increased use of high-power GPUs for AI training. In contrast, power demand for traditional servers remains relatively stable and is not expected to grow significantly.

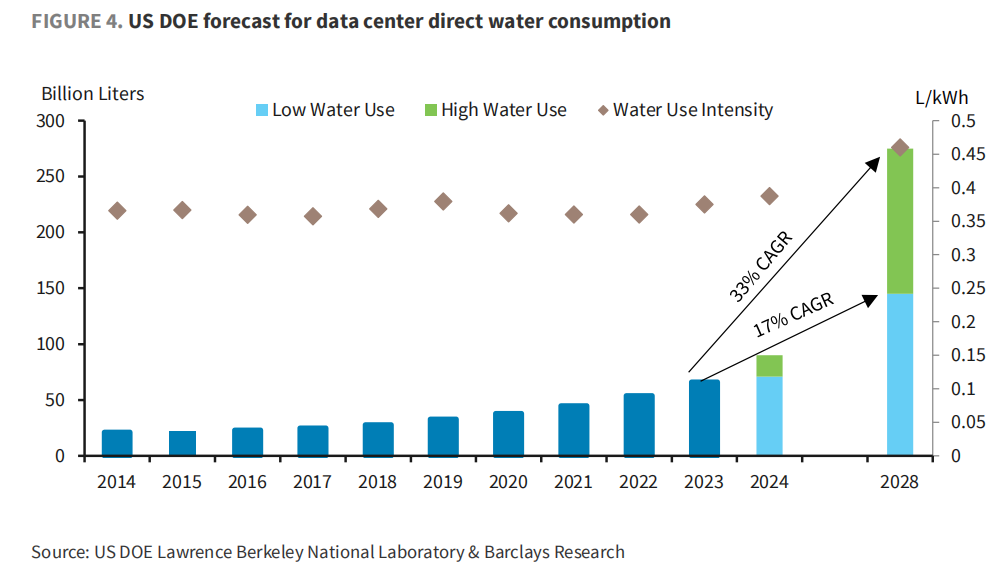

Furthermore, the U.S. Department of Energy also predicts that the growth in water consumption for U.S. data centers in the coming years will outpace the growth in power demand. Currently, direct water usage has soared from 21 billion liters in 2014 to 66 billion liters in 2023, and is projected to grow by about 2-4 times by 2028.

This excludes the power-intensive mining operations; if mining consumption is included, the figure may be even larger.

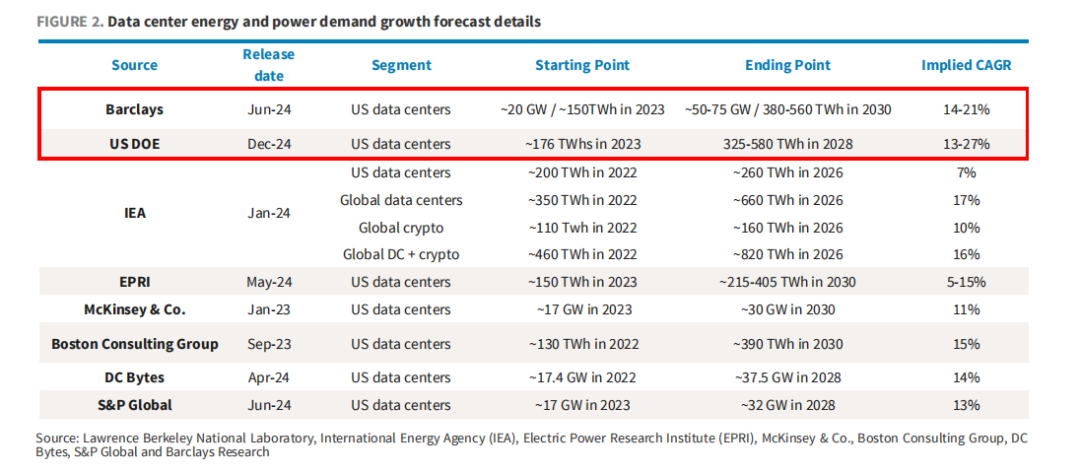

Last week, Barclays, a foreign bank, commented on the Department of Energy's report, stating that the Department's forecast of an annual growth rate of 13-27% is significantly higher than the 15% annual growth rate predicted by many foreign banks and also higher than Barclays' previous estimate of 14-21% annual growth.

This suggests that the actual power demand in the coming years may vastly exceed market expectations, as the Department of Energy's report is more trusted by the market compared to those of foreign banks, given its direct affiliation with the U.S. government and not being a sell-side report.

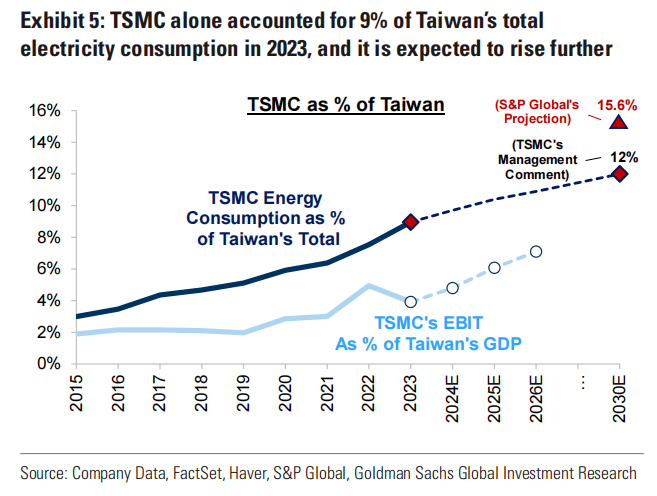

Moreover, as mentioned in a previous article, "Tech Stocks, Each with a Mini Nuclear Reactor?", in 2023, TSMC alone accounted for 9% of Taiwan's power consumption and 16% of Taiwan's industrial sector demand, up from 5.1% in 2019. In contrast, the semiconductor industry consumed 13.4% of Taiwan's power, up from 8.4% in 2019.

According to S&P, by 2030, TSMC's power consumption will account for 15.6% of Taiwan's total power consumption. Assuming a more optimistic scenario for AI development, TSMC's power consumption could reach up to 23.7% of Taiwan's total power consumption.

With the increase in capital expenditure and the production of more advanced technologies, AI-related power demand is projected to increase eightfold by 2028. Taiwan plans to construct over 10 data centers this year, and power demand growth is anticipated to accelerate to over 2.8% annually, compared to an average annual growth rate of only 1.4% over the past decade.

Simultaneously, as power demand escalates, electricity prices are also continuously rising. Taiwan's industrial users witnessed a 12.5% increase in mid-October, and Taiwan's strategy is to boost natural gas power generation while abandoning nuclear energy.

Is the actual power demand really that substantial? An example will elucidate this further.

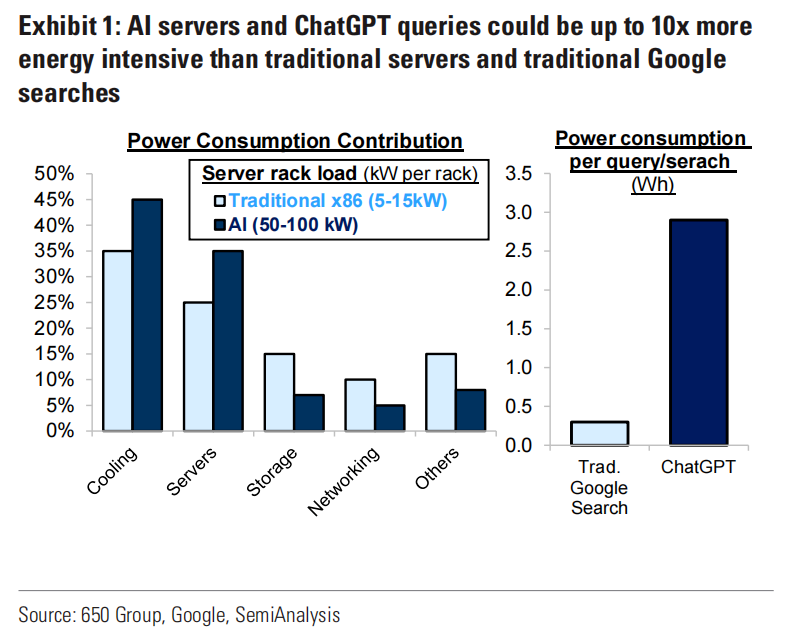

Last year, Google's Claude and ChatGPT launched their internet search functions. According to Goldman Sachs, as other internet products incorporate AI search, this could lead to significant energy consumption. For instance, a single search query and answer on ChatGPT are estimated to consume 6-10 times more energy than traditional Google searches.

If AI search consumes such vast amounts of power, and this does not even include the upcoming major AI agent theme?

II. With Tight Power Demand, What Are U.S. Stocks Hype?

Given these predictions of substantial growth in future power demand, several directions for U.S. stock speculation emerge.

1. Since last year, Microsoft, Amazon, and Google have all purchased small nuclear reactors, sparking a surge in U.S. stock speculation on OKLO small nuclear reactors, which have risen more than fourfold since September 2024.

As mentioned in previous articles, following tech giants in buying stocks related to small nuclear reactors might be more of an emotional speculation, and it is unlikely to see performance returns from these companies in the short term. For example, the seven small nuclear reactors invested in by Google in October 2024 will not be officially operational for at least 3-5 years, according to foreign media reports. In the coming years, performance may still be unimpressive, with only technology companies purchasing power purchase agreements from them.

It cannot be denied that the future development of AI is severely power-constrained, and more technology companies may purchase small nuclear reactors in the future. However, to meet power demand in the next three years, natural gas, wind, and solar power will remain the primary sources, with small nuclear power not yet capable of taking a leading role in power supply. What is certain is that U.S. stock speculation on small nuclear power plants will persist.

2. Apart from resource companies that directly produce power, hardware facilities supporting server power consumption are also of interest. For instance, power supply equipment, liquid cooling equipment, diesel engine equipment, and other related companies used in AI servers, and the corresponding U.S. stock prices are also on a trajectory of continuous new highs.

Conclusion

Overall, this year's AI development will make it more tangible for everyone to "feel," as technology companies' significant investments over the past two years have been in purchasing cards and constructing server rooms. This year, there will be more practical applications and hardware that enable a broader audience to access and utilize AI, making the logic behind investing in AI easier to grasp.