After Eight Consecutive Years of Losses, Has China's Pioneering AI Stock Finally Turned the Corner? No Wonder It Soared 400% in 2024

![]() 01/17 2025

01/17 2025

![]() 497

497

In 2024, murmurs of "China's NVIDIA" gaining substantial ground abounded, as the country's first AI chip stock skyrocketed by nearly 400%, even outpacing NVIDIA's gains.

Who holds this coveted title? I'm referring to Cambrian, which saw a remarkable surge in 2024, with its market capitalization briefly approaching 300 billion yuan, positioning it as the third-largest chip company in China, trailing only SMIC and Hygon.

However, Cambrian's ascent puzzled many, given that the company has consistently reported losses since its inception, never once turning a profit.

Cambrian initially gained recognition when Huawei incorporated its NPU into the Kirin 970, significantly boosting its profile. Nevertheless, Huawei subsequently abandoned Cambrian's chips in favor of self-developed NPU solutions, significantly impacting Cambrian as Huawei once accounted for nearly 80% of its revenue.

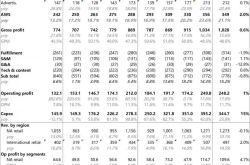

Media statistics reveal that since its founding in 2016, Cambrian has incurred cumulative annual losses amounting to nearly 6 billion yuan, presenting a formidable challenge in transitioning to profitability.

Moreover, Cambrian's revenue remains modest, with total earnings of just 185 million yuan in the first three quarters of 2024, accompanied by a loss of 724 million yuan. Such financial performance supporting a market value nearing 280 billion yuan seems somewhat inflated.

However, based on the fourth-quarter outlook, Cambrian may have finally turned the corner, achieving profitability—a potential driver behind its 400% surge in 2024.

According to Cambrian's forecasts, the company anticipates a net loss of between 396 million yuan and 484 million yuan for 2024, compared to a net loss of 724 million yuan in the first three quarters. This implies an expected net profit of 240 million yuan to 328 million yuan in Q4, marking Cambrian's first quarterly profit.

Some argue that as China's first AI chip stock, Cambrian focuses on the R&D of AI chip products and technological innovation, positioning itself as a competitor to NVIDIA.

While it may still fall short now, even a 1% chance of Cambrian becoming the next NVIDIA, given NVIDIA's current market capitalization exceeding 3 trillion dollars, suggests significant room for growth from Cambrian's current market value of less than 300 billion yuan.