Tencent: The AI Investment Conundrum and Capital Allocation Strategy

![]() 04/14 2025

04/14 2025

![]() 505

505

Amidst the backdrop of AI's burgeoning influence, Tencent's Q4 performance carried significant weight, yet it fell short of expectations. The ADR remained relatively stable that night, suggesting a funding dilemma. However, the following day, Tencent's shares plummeted by nearly 4% on the Hong Kong stock market, where major funds are concentrated. This decline directly indicated funds' dissatisfaction and triggered a wave of adjustments in Hong Kong stocks.

Source: Longbridge, Dolphin Research

So, what precisely are mainstream funds dissatisfied with?

Dolphin believes the issue is not related to Tencent's business performance per se. Rather, it stems from the upcoming capital allocation decisions: Tencent's "initial plan" to repurchase shares worth 80 billion yuan and invest an average of 90 billion yuan in capital expenditures (Capex) has inadvertently "offended" two key investor groups:

1) Value investors prioritizing shareholder returns;

2) Investors in the domestic computing power industry chain.

Why is it termed an "initial" plan? Dolphin believes that this is not Tencent's final capital allocation strategy for 2025, whether for repurchases or Capex. Not only did management mention on the earnings call that they had reserved a 20 billion yuan buffer for Capex, but Dolphin also believes there is even more room for flexibility.

However, investors in the industry chain should not get too excited. If Tencent increases its Capex, it will not necessarily benefit the entire industry chain. Unlike Alibaba, which primarily outsources its computing power needs based on customer demand, Tencent's purchased computing power is mainly used for its own ToC business, and commercial monetization will take time. Thus, even if Tencent plans to invest up to 100 billion yuan in Capex, its spending must be carefully calculated to ensure wise utilization of funds.

Conversely, Dolphin believes that investors valuing endogenous growth should alleviate some concerns, actively seek low-risk, high-return positions, and increase their bets on Tencent, the top player with the greatest potential to create ToC AI Agents and occupy the super entrance of AI.

Below is a detailed analysis:

I. AI Enthusiasm: Who Did Tencent Offend?

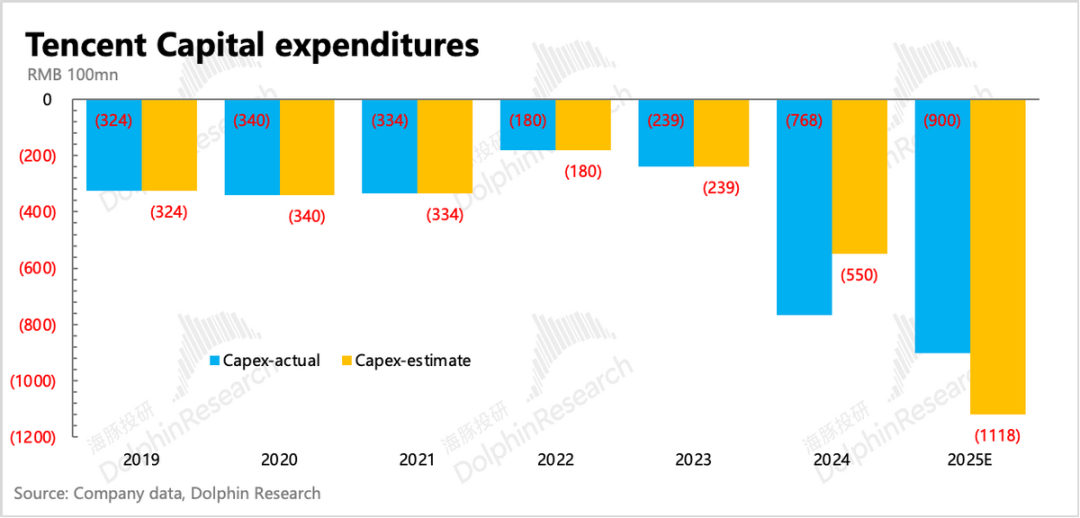

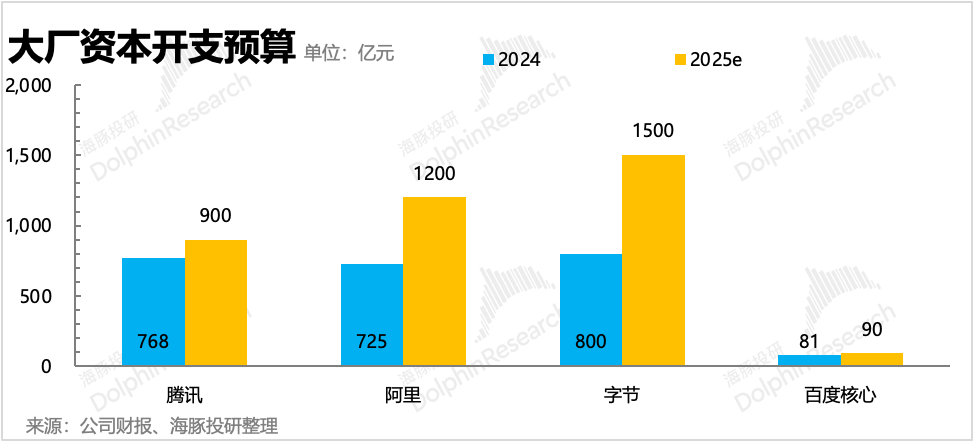

Tencent's 2025 Capex budget represents a low-teens percentage of its revenue. Based on the current revenue growth expectation of 9%, this translates to a minimum of 72 billion yuan and a maximum of 108 billion yuan in Capex, with a median of around 90 billion yuan.

Is this number substantial or insignificant? The market debates endlessly, with differing opinions on both sides. Ultimately, it depends on one's perspective.

In Dolphin's view, at least from Tencent's perspective, this budget growth is not negligible. Although it does not match Alibaba's passionate shout of 380 billion yuan over three years, it marks a time when Tencent is "most willing to spend money" in recent years.

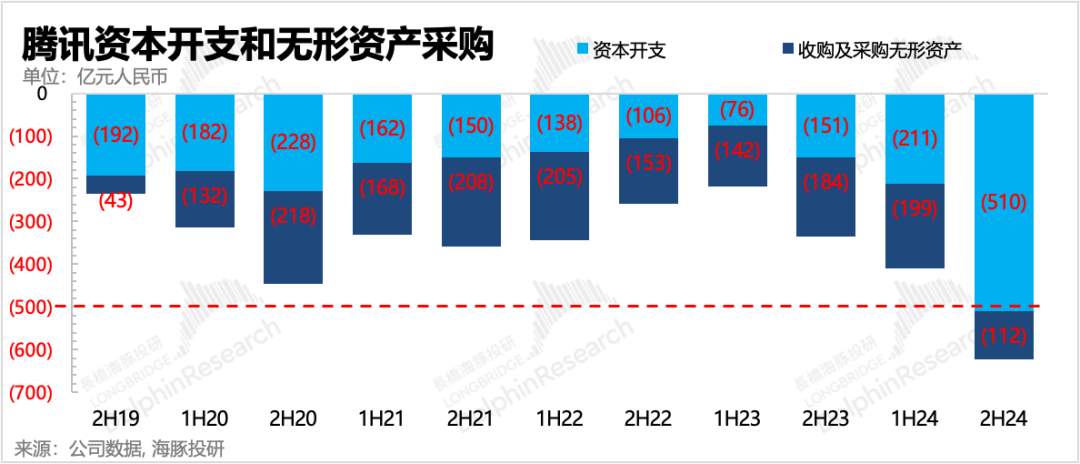

1. Capex That Has Effectively Doubled

At first glance, the median Capex of 90 billion yuan this year, compared to 76.8 billion yuan last year, represents only a 17% increase. However, it's crucial to note that Q4 Capex surged to 36.7 billion yuan due to a sudden surge in demand leading to emergency stockpiling. Additionally, it's possible that this was due to advance orders under upgraded restrictions on purchasing high-end chips (primarily used for training).

Regardless of the underlying factors, the Q4 situation was exceptional. Dolphin estimates that if the previous investment intensity is maintained, the annual investment should be around the scale previously guided, i.e., a high single-digit revenue share, or approximately 50-55 billion yuan. This means that in 2024, Tencent actually "spent" over 20 billion yuan more than budgeted.

Therefore, considering Tencent's investment pace, the actual Capex for this year corresponds to 90+20=110 billion yuan, effectively doubling last year's 50-55 billion yuan. For Tencent, which has tightened its belt in recent years, this level of investment is rare in the past decade.

Unfortunately, linearly evolving market expectations were already ahead:

Regarding Q4/2024 full-year investment, combined with news of Tencent's card purchases in Q4, market expectations were raised by 10 billion yuan. Compared to updated expectations, the actual performance exceeded by 10 billion yuan (=20-10).

For 2025 Capex, Tencent's guidance falls within the range of 80-100 billion yuan. If the additional 10 billion yuan spent in Q4 is added back, this year's budget is only 90-110 billion yuan. This is still significantly lower than the 120 billion yuan expected by investors in the computing power industry chain, who benchmark against Alibaba and ByteDance's Capex. Notably, some more optimistic investors have blindly guessed it to be 150 billion yuan. Obviously, compared to Alibaba's "going with the flow," Tencent's "cautiousness" is disappointing.

2. Discounted Repurchases with Decreased Total Amount

Did Tencent's shareholders find solace in spending less money?

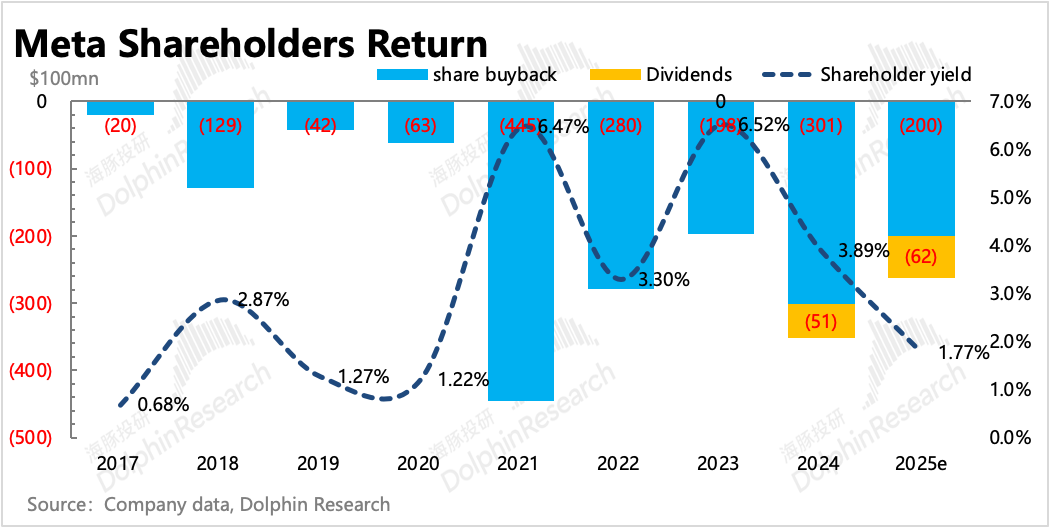

Not really. The savings on computing power did not correspondingly increase shareholder returns (repurchases + dividends). Instead, overall shareholder returns were 20 billion Hong Kong dollars lower than last year (121 billion vs. 144 billion).

In the commentary, Dolphin also emphasized that "shrinking shareholder returns, after the market value rises, mean that the rate of return will be greatly reduced. Tencent's 100 billion yuan repurchase last year attracted many value investors and insurance funds pursuing stable returns. If subsequent repurchases are not increased, with only a 2.5% shareholder return, the investment attractiveness is no longer what it used to be."

From the perspective of value investors, they are also dissatisfied - you can increase Capex, but you cannot cut my returns. For instance, when Meta and Google expanded their Capex budgets in the past two years, they also provided a "gift package" to value investors - large-scale repurchases + first dividends. Although compared to their trillion-dollar market values, the shareholder returns of these two companies are not high, at least the absolute value of the return scale has increased.

But interestingly, combining (1) and (2), if we consider total shareholder returns and Capex, Tencent's overall capital planning has actually shrunk:

Last year's total of 144 billion Hong Kong dollars + 76.8 billion yuan, amounting to 209.3 billion yuan in "total non-operating cash outflows," compared to this year's 201.3 billion yuan (121 billion Hong Kong dollars + 90 billion yuan), suggests that Tencent's capital allocation has become somewhat "cautious." This obviously does not conform to conventional judgment.

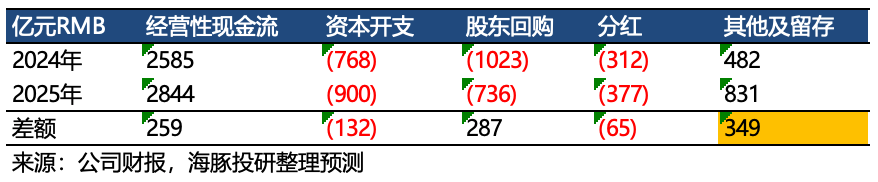

After all, if there is still a 9% revenue growth and a 12%-15% net profit growth next year, then operating cash flow should also expand at the same rate. So why be so harsh on expenditures outside of operations?

On the earnings call, management mentioned that there would be a 20 billion yuan buffer for Capex, which comes from the 20 billion yuan reduction in shareholder returns. However, the problem is that from the perspective of overall external cash outflows for shareholder returns + Capex, which is 221.3 billion yuan, it has increased by less than 6% compared to last year, still lower than this year's potential profit/operating cash flow growth rate.

So, where did Tencent spend the extra money?

II. "Saver" Tencent vs. "Spendthrift" Meta

At the end of 2023, when Tencent announced a 100 billion Hong Kong dollar repurchase plan, Dolphin discussed Tencent's capital allocation in "Tencent Raises the Gun Again: One, Two, Three, Who's the Wooden Man?" We mainly did a simple calculation and concluded that:

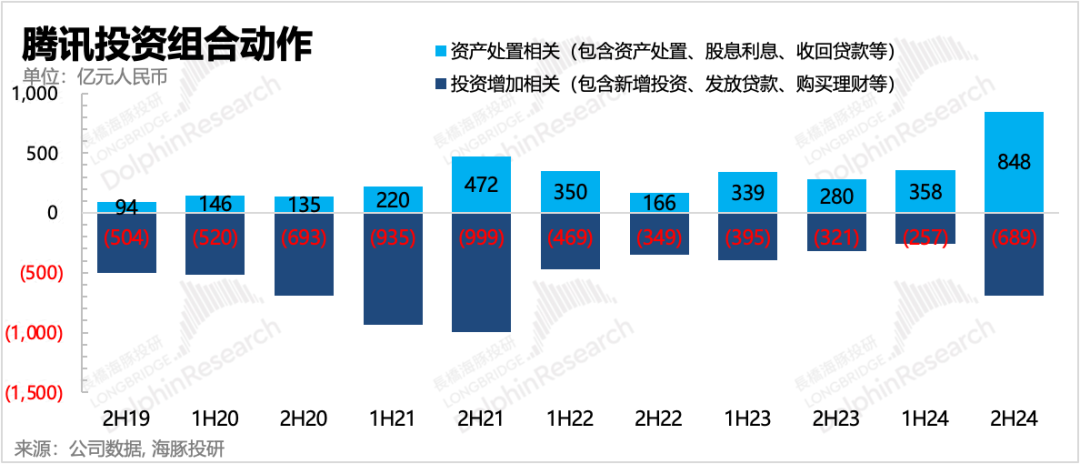

To comfortably meet normal operations and the 100 billion yuan repurchase, Tencent needs to efficiently manage its investment portfolio, including ROI-driven new foreign investments and timely disposal of assets in the existing asset pool to meet the cash flow required for foreign investments.

This is different from the physical dividends from the reduction of holdings in JD.com, Sea, and Meituan in 2022-2023. The 100 billion yuan repurchase requires real money, preferably in US dollars, to avoid the inconvenience of foreign exchange control. Later, we also saw Tencent's reduction actions over the past year. It's challenging to track non-listed companies, but for listed companies, known examples include Nubank, NIO, BOSS Zhipin, and Reddit, all listed on the US stock market. After selling, Tencent can immediately obtain US dollars for repurchases.

So, in 2025, when Tencent needs to increase Capex, how does management allocate funds among the five key demands: basic operations, foreign investment, Capex, shareholder returns, and debt repayment and interest payments? What strategic thinking does management imply behind the current allocation?

How does Meta, another social media giant that has also initiated massive investments due to AI, differ from Tencent in terms of capital allocation?

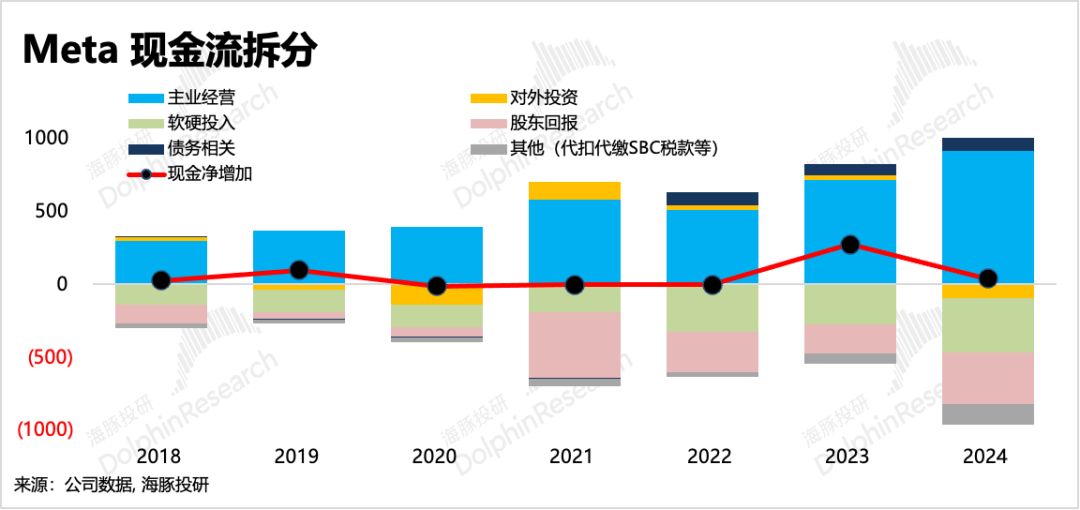

(1) Meta: A Balanced Allocation Strategy for Both Value and Growth

Meta's overall capital allocation strategy synchronizes revenue and expenditure. When business performance is strong, Capex also expands proportionally, ultimately controlling net cash changes within a very small range. Except for the abnormal increase in net cash in 2023, mainly due to occasional revenue and expenditure adjustments (the US economy was low in the front half and high in the back half + advertising increments from Chinese cross-border e-commerce/gaming companies, while reducing investment in VR at the request of shareholders).

In terms of specific net cash outflows, Meta primarily spends on investments in hard and soft assets and shareholder returns. Especially after significantly increasing shareholder returns in 2021, these two main expenditures are almost equal. This is actually the most reasonable allocation strategy - the money earned from operations is either invested in development or distributed to shareholders.

(2) Tencent: A Precise ROI Allocation Strategy

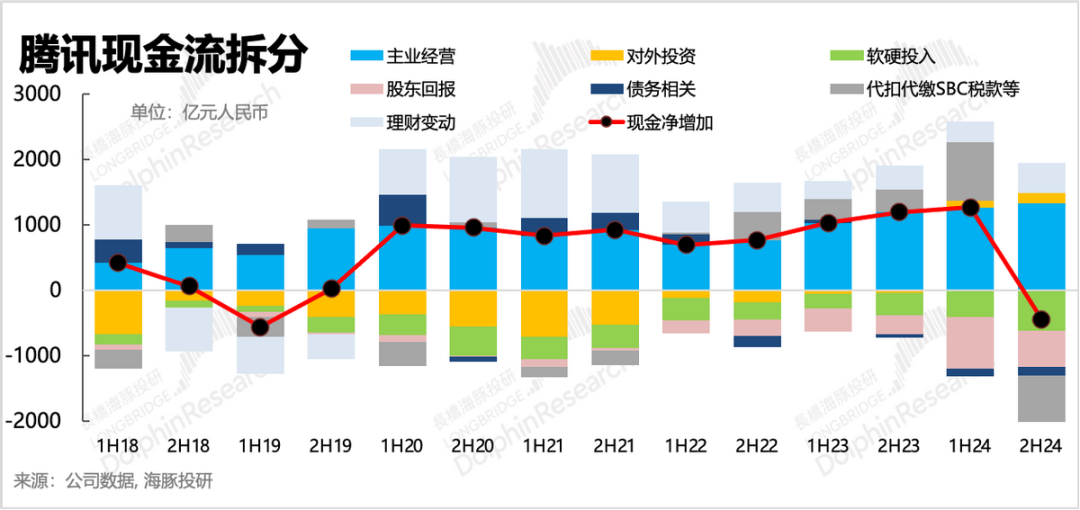

Tencent's capital allocation differs significantly from Meta's. From the perspective of net cash changes, Tencent prefers to maintain a net cash inflow greater than net expenditures. Especially after the collective "tightening of belts" in the internet industry in 2022, operational efficiency within the Tencent Group has improved markedly, and the proportion of net cash increase has also been continuously rising.

In terms of specific Capex, 2021 was a watershed.

Before 2021, Tencent's largest capital outflow was foreign investment, followed by investment in itself. Shareholder returns only began to improve from 2022 and barely approached half of the cash outflows in 2024, when market valuations were extremely suppressed.

In terms of hard and soft expenditures, excluding the abnormal values in 2H24, 1H23, and 2H20, historically, it does not seem to completely follow the fluctuations in business performance. Compared to the sharp fluctuations in other expenditures, it is more like Tencent has steadily anchored an absolute scale range, for example, the semi-annual variation range has been 20-30 billion yuan since 2020.

The above allocation strategy, whether before 2021 or from 2022-2024, actually reflects Tencent management's "prudent" approach to capital management:

a. Before 2021, Tencent had an investor mindset. Although the company's internal business was developing rapidly during this period, it did not focus on cash outflows. The allocation attitude was relatively positive, but management liked to weigh the preferences for internal and external investments from the perspective of "return on investment" (ROI), comparing the investment results of internal teams with external enterprises to calculate ROI, which is also another interpretation of the horse racing mechanism. Therefore, sometimes compared to directly investing in business expansion, Tencent preferred to leverage the data advantages of ecological traffic for selective external investments.

b. In the two years after 2022, Tencent adopted an accountant mindset, with the overall idea of "cutting expenses." Thus, a more cautious and precise accountant mindset was adopted, pruning different branches of the business to make it more focused and reduce waste of resources.

The question is, will Tencent maintain its original "prudent" attitude towards capital use in 2025, when domestic AI Agents are destined to make a big splash?

Dolphin believes that Tencent is still gradually playing its cards but has left itself a backdoor of up to 35 billion yuan. Of these 35 billion yuan, 20 billion yuan is the buffer that the company has identified for Capex, but the remaining 15 billion yuan is unlikely to be fully utilized for repurchases. Instead, it will still prioritize investment, whether internal or external.

The reasons are twofold:

(1) Limited US dollar deposit reserves and direct exchange for repurchases entail substantial friction costs for fund inflows and outflows.

(2) AI represents a "WeChat-level" opportunity with the potential for higher investment ROI.

Below, Dolphin delves into these points individually.

III. Tencent's "US Dollar Account"

In the past two years, amidst extreme market pressure, Chinese internet companies embarked on a wave of "dividend repurchases" to affirm their value with tangible capital. This is undoubtedly the most effective strategy for a mature enterprise to convey optimism about its future prospects.

However, during implementation, a conundrum emerged. Most Chinese internet companies operate primarily within China, earning and spending in renminbi. This poses no issue under normal circumstances.

Nevertheless, due to their overseas listings, these companies require US dollars or Hong Kong dollars for repurchases. Without sufficient foreign currency reserves:

a. Currency exchanges must adhere to State Administration of Foreign Exchange regulations on fund inflows and outflows.

b. Additionally, due to the VIE structure, funds earned by domestic operating entities (subsidiaries) must be remitted to the listed entity (parent company) controlled overseas, entailing a 5%-10% withholding dividend tax (viewed as a dividend distribution from subsidiary to parent).

c. Furthermore, when market values fluctuate significantly and temporary repurchases are necessary, companies must bear exchange gains and losses.

These challenges are mitigated for companies with overseas operations that generate US dollars directly. Hence, we observed that Chinese companies listed in the US, such as Alibaba, issued US dollar bonds temporarily following significant repurchase announcements last year.

1. Where Does Tencent's US Dollars Come From?

Compared to other Chinese assets, Tencent has more diverse means of acquiring US dollars:

(1) No Loss: Direct Overseas Revenue Generation

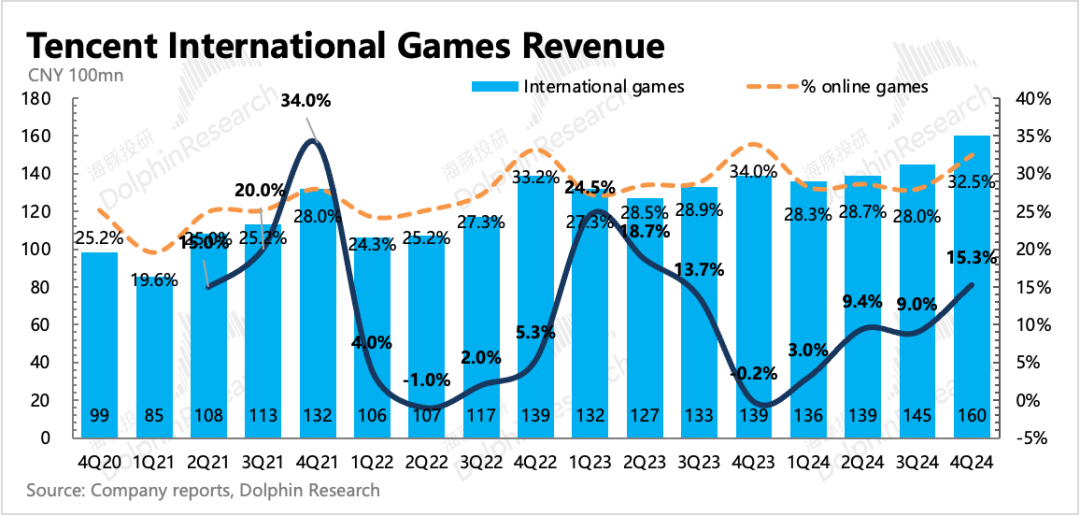

Tencent's international business, primarily fueled by overseas game revenue, generated 58 billion yuan in 2024, equivalent to over 8 billion US dollars. However, before "forcing" accelerated overseas expansion in 2021, Tencent's annual overseas game revenue peaked at 4 billion US dollars. Excluding 30-50% for developers, net income was less than 3 billion US dollars.

(2) Low-Interest Cost: Borrowing US Dollars

Without direct US dollar revenue, external borrowing is necessary. Tencent primarily borrows US dollars through two channels:

1) Issuing US Dollar Bonds

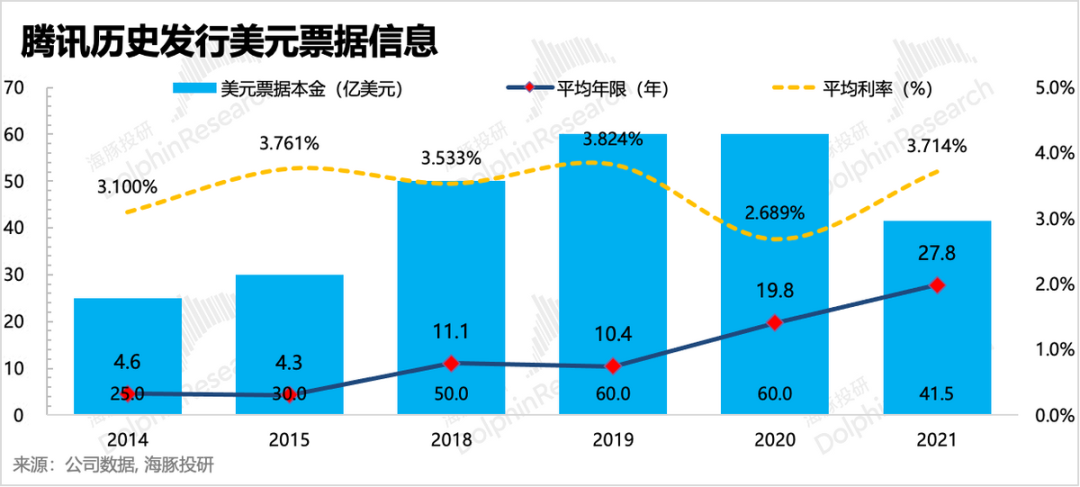

Alibaba and JD.com also rely on this method for temporary US dollar exchange for repurchases, albeit with different implementations. Tencent's "investor" strategy requires foreign exchange for global investments, prompting it to preemptively plan for foreign exchange funding. In 2014, Tencent launched the "Global Medium-Term Note Program," authorizing it to issue multi-currency bonds to a consortium of international investment banks like Goldman Sachs and HSBC at favorable interest rates to obtain necessary foreign exchange.

Initially, the program had a quota of 5 billion US dollars, which was annually adjusted to the current 30 billion US dollars. Over ten years, Tencent issued 25.7 billion US dollar notes and an additional 3 billion Hong Kong dollar notes.

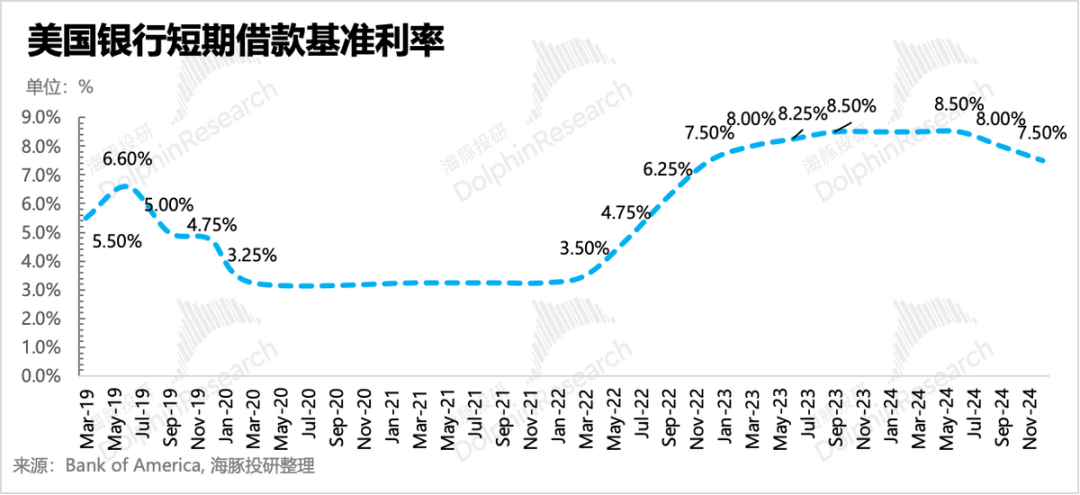

As these notes are typically long-term bonds (5-40 years), interest costs are locked in for years, testing Tencent's long-term business planning vision. Tencent excels at "timing," issuing during periods of low global interest rates (e.g., 2014-2015, 2018-2019, 2020-2021) with increasingly longer lock-in periods. Issuance ceased after the global interest rate hike cycle began in 2022.

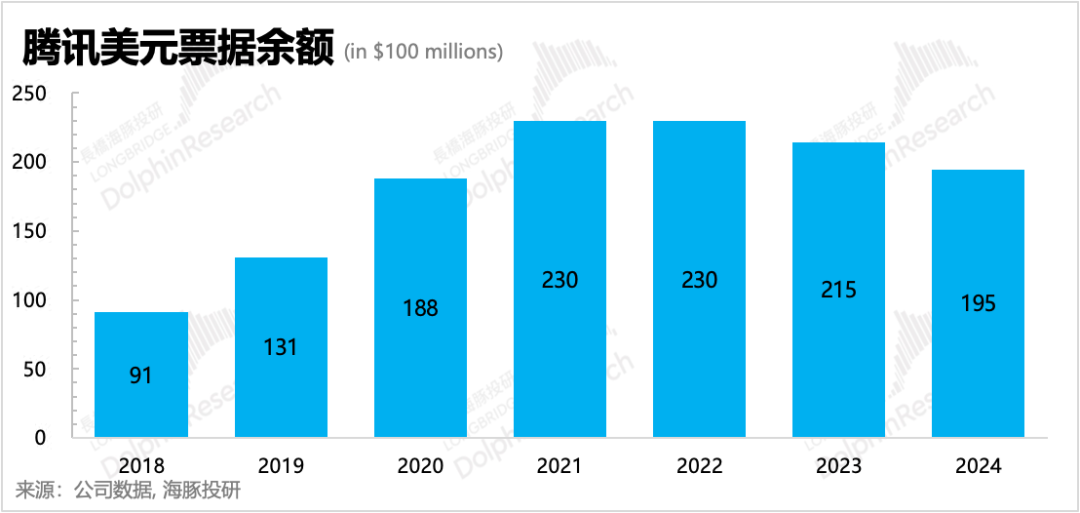

As of 2024's end, Tencent's outstanding US dollar notes' principal balance was 19.5 billion US dollars.

2) Borrowing Directly from International Investment Banks

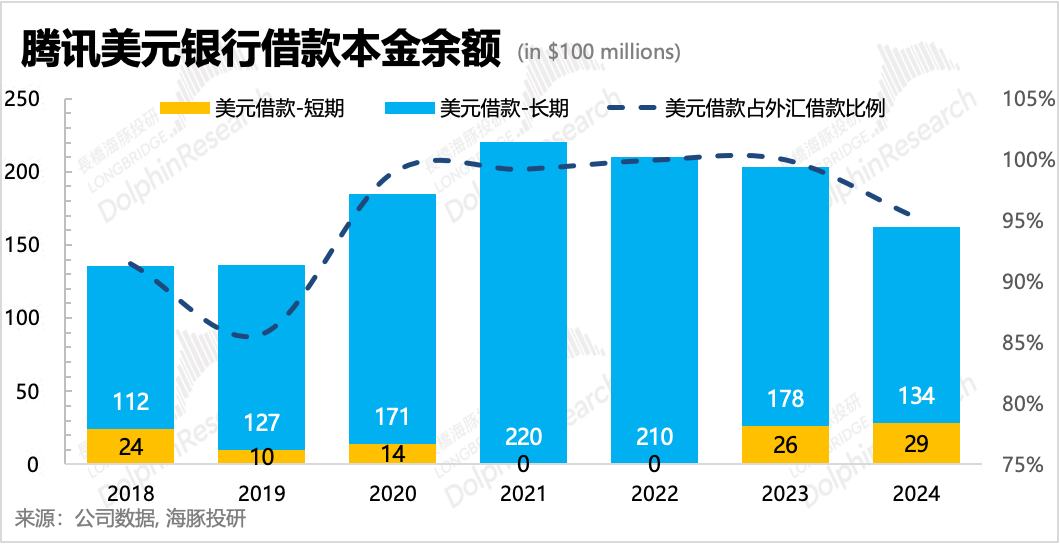

In addition to long-term notes, Tencent borrows foreign exchange directly from international banks. Long-term US dollars dominate (over 90% of total foreign currency borrowing), while short-term borrowings are in multiple currencies, mostly for temporary needs. Tencent typically signs floating interest rates and uses interest rate swap contracts to hedge against interest rate changes.

(3) The Last Resort: Net Sale of Assets

Generally, borrowing US dollars meets Tencent's foreign exchange needs, given its primary market in mainland China. However, in extraordinary times with high borrowing costs, Tencent can sell assets (especially US-listed companies) to obtain US dollars, incurring additional tax and fee losses from currency exchange.

Tencent Investments is renowned for its impressive investment returns, adhering to strict valuation algorithms and avoiding forced sales for US dollar liquidity unless absolutely necessary.

Yet, this remains an option. Under the pressure of the 100 billion yuan repurchase commitment last year, Tencent increased the "self-sufficiency" of its investment portfolio, ensuring operational cash flow was not diverted to new investments. In 2024, Tencent's investment department exceeded targets, with asset disposals exceeding increased investments.

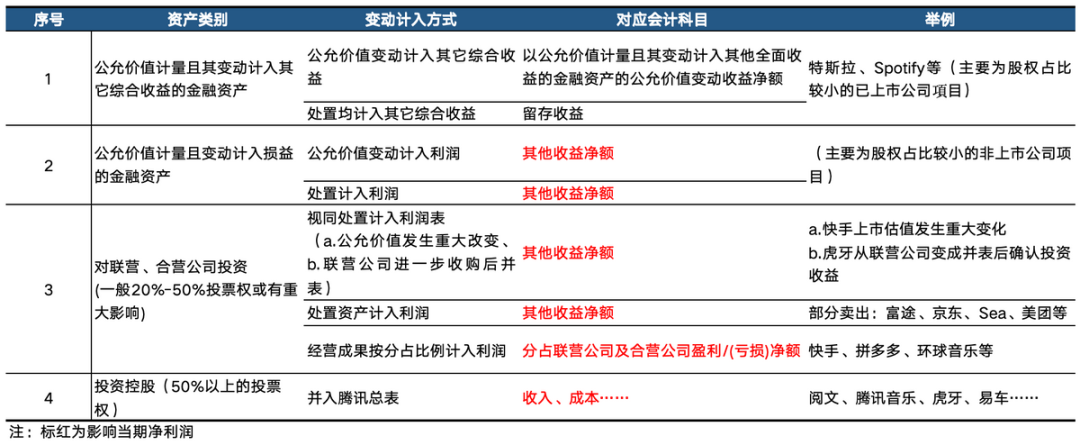

From some listed companies' disclosures, Tencent reduced holdings in Reddit, NuBank, and NIO last year. However, most 2024 disposals were unlisted companies - financial assets measured at fair value through profit or loss.

2. Is the Reserved Foreign Exchange Sufficient for Repurchases?

Borrowed or exchanged dollars through asset sales will eventually be spent.

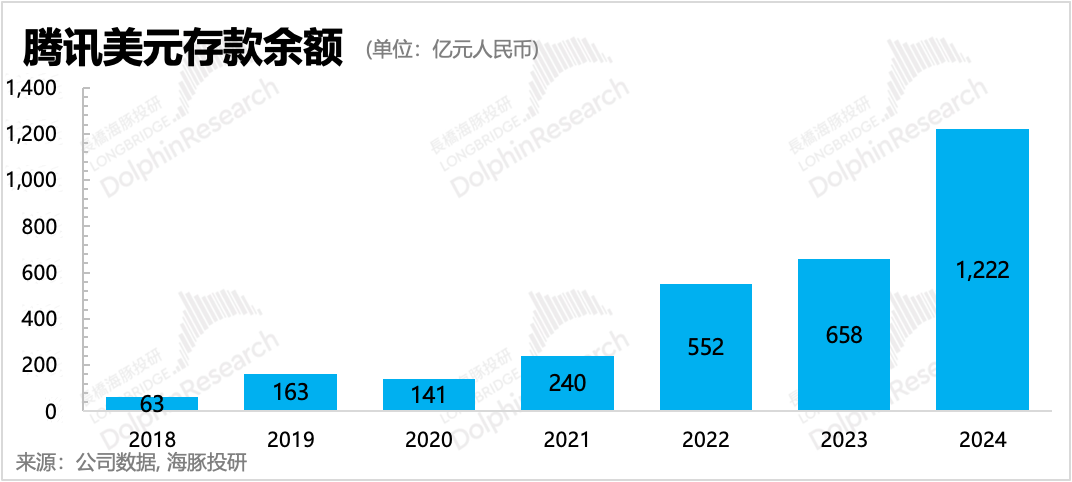

Tencent's US dollar deposits have increased annually but stood at nearly 17 billion US dollars (122.2 billion yuan, all short-term) at the end of 2024, less than its accumulated US dollar debt (borrowings + notes) of 35.7 billion US dollars over these years.

Of the 35.7 billion US dollars, only 4 billion are due within one year, making the 17 billion short-term deposits sufficient compared to this 4 billion debt.

However, after deducting 4 billion in short-term debt, the remaining 13 billion US dollar deposit, plus an estimated 3.5 billion US dollars from overseas game revenue this year (=9 billion gross revenue * (assuming 40% developer share + 20% overseas channel fee)), totals 16.5 billion US dollars in available funds.

Without assuming net sales from the investment portfolio, these 16.5 billion US dollars (approximately 120 billion yuan at a 7.2 exchange rate) are theoretically the maximum for direct repurchases (avoiding currency exchange and additional dividend taxes).

However, Tencent would not operate this way in practice, retaining US dollar reserves for debt repayment (as early as 2026) or other temporary needs. Following 2022-2023 trends, if 8 billion US dollars (60 billion yuan) are reserved, there will be a 2.5 billion US dollar repurchase gap (promising 80 billion yuan in repurchases, which is 11 billion US dollars, with 8.5 billion in deposit consumption, leaving a 2.5 billion shortfall).

Given high global financing interest rates and Tencent's history of pursuing ROI and cost-effectiveness, Dolphin believes the current motivation for large-scale external borrowing is low. Borrowing costs nearing 5%, coupled with fees to investment banks, are less cost-effective than direct currency exchange (incurring a 5% withholding dividend tax).

This gap can be bridged through direct currency exchange or reducing the investment portfolio receiving US dollars, such as holding higher proportions of Pinduoduo, Futu, and overvalued or duplicate holdings like Spotify and Sea.

Tencent will prioritize screening out targets with less future potential. Given Trump's tariffs disrupting the market, most Tencent investments are undervalued. Dolphin will not list a "death list" like in previous articles.

We believe Tencent, adept at timing and stock selection, will wait for a market recovery and carefully select targets before selling assets. This involves market value fluctuations and in-depth communication with management for timely responses.

If the Federal Reserve initiates another interest rate cut cycle, waiting to borrow US dollars later will be more beneficial.

In summary, Tencent's current net cash of 13 billion US dollars (after deducting short-term debt) and expected stable overseas game revenue of 3.5 billion US dollars (after deducting developer and channel shares) give it confidence to avoid high-interest borrowing. Alibaba's recent US dollar notes (4.875%~5.625% interest) highlight the higher costs compared to Tencent's historical financing.

However, US dollar reserves are insufficient, and historically, during high-growth periods, Tencent's willingness to return capital to shareholders has been lower than Meta. Last year's 100 billion yuan repurchase was more of a "bottom-supporting move" amid business stagnation and major shareholder selling, not a shift towards regular increased repurchases.

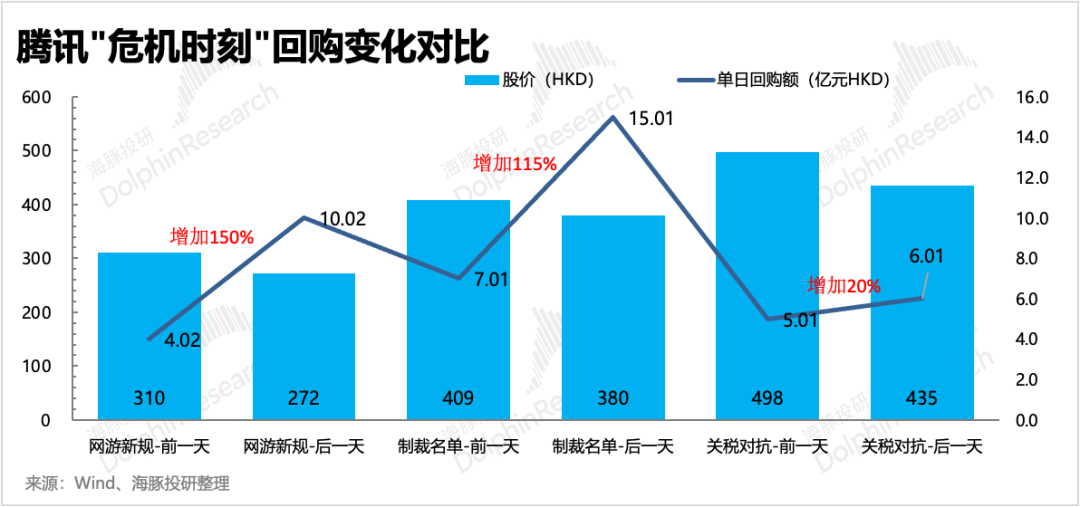

Tencent's repurchase willingness this year (subjective or forced) can be glimpsed from the tariff-triggered global stock market crash:

- On April 7, post-tariff announcement, Tencent's market value plummeted 12% in a day, but repurchases did not significantly increase, unlike events like new online game regulations (end of 2023) or the US Department of Defense sanctions list (early 2025).

IV. AI: An Industrial Opportunity on Par with "Rebuilding WeChat"

Returning to the original question, Dolphin concludes that the most likely allocation of the 15 billion yuan "reserve" funds is to continue increasing business investments (including capital expenditures) rather than repurchases.

Since late 2023, Tencent has shifted from a "wait-and-see" attitude towards AI transformation, possibly recognizing Yuanbao's rising traffic or Deepseek V1's "computing power deflation" trend.

Following DeepSeek's Spring Festival success, Tencent made a high-profile announcement, allocating top-tier traffic resources from the entire group ecosystem to "Yuanbao." If initial "Yuanmeng Zhixing" received billions in resources, "Yuanbao" must be receiving tens of billions. Recalling the last product to receive such group-wide support from Pony Ma, CEO of Tencent, it was WeChat.

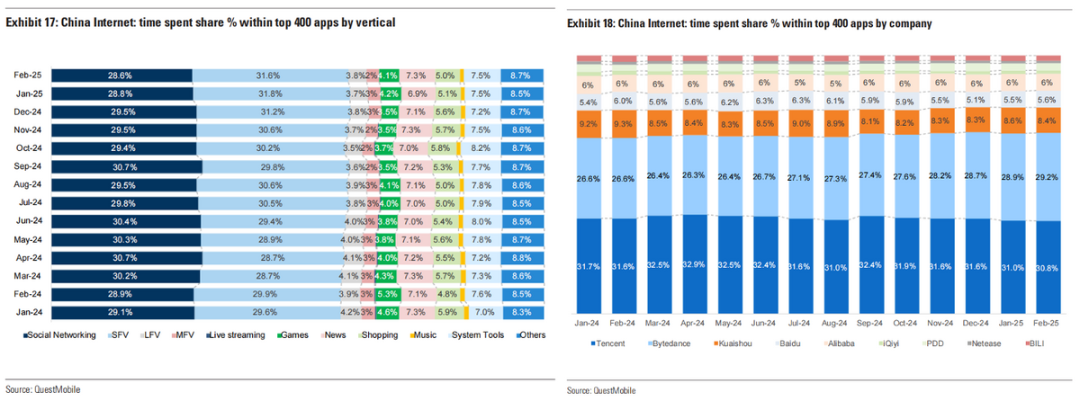

Dolphin believes creating the next super app is imperative for Tencent, not just due to AI optimism but critically to defend its position as the top traffic entry point.

AI will undoubtedly spawn a super entry point akin to WeChat, boasting over a billion users. However, the identity of this super entry point remains uncertain, with no one daring to make a definitive prediction. Over the past decade, no one foresaw that Douyin, with its innovative content format (video information stream) and addictive algorithm (privacy-intrusive precise recommendation), could breach the social defense chain of "two WeChats and one end" (WeChat, Weibo, and TouTiao) and emerge as another "social + content" platform with over a billion users. Similarly, TikTok has penetrated Meta's social network, rivaling even WeChat in influence.

In other words, new disruptors can arise at any moment. Who stands the highest chance of triumphing? Dolphin will share some subjective insights, not afraid to be proven wrong, merely for discussion's sake. After all, certainty is a rare commodity in the AI era.

Judgment 1: No New Players Will Emerge as AI Super Entry Points

Dolphin defines an AI super entry point not as an omnipotent entity but rather one that avoids becoming a "chicken rib" in users' eyes by trying to do too much. For vertical Agents, opportunities for SMEs or even independent studios remain abundant. However, for general-level super Agents, a more viable product form would be one that serves as a unified front-end for millions of vertical Agents in the background, in addition to handling general search functionalities. In simpler terms, it would be an "app store" for the AI Agent era.

Therefore, the final circle of super entry points will likely comprise established giants. Here are two reasons:

(1) Scenario demand trumps model benchmarking. The advent of the epochal milestone DeepSeek has, to some extent, leveled the AI playing field for domestic giants, rendering the significance of large model benchmarking rapidly diminishing.

This poses challenges for platforms that have heavily invested in their own large models. Resource wastage is a minor concern; the primary challenge lies in balancing DeepSeek with their existing models. Integrating DeepSeek into the front-end is straightforward, but managing the backend team's deployment becomes complex. Giants cannot abandon their large model development entirely, yet with limited or exclusive computing power, infrastructure, and promotional resources, internal and external allocation becomes a significant hurdle.

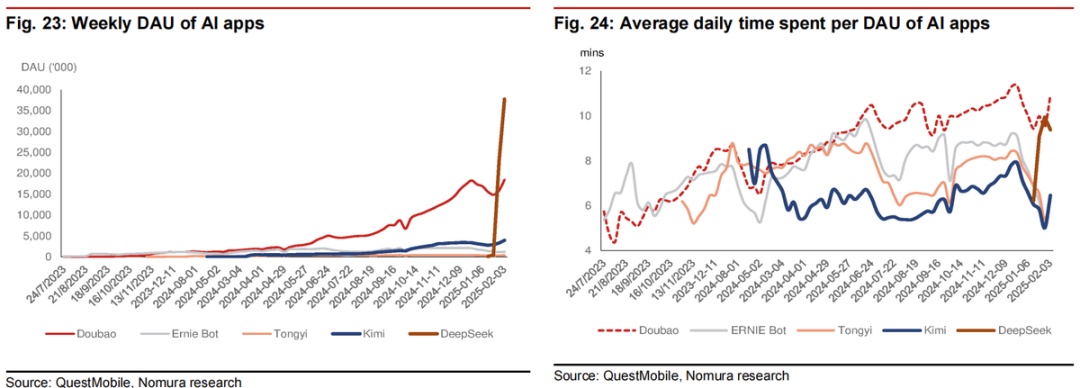

However, as DS, promoted by the state, aids in user education (as of February 2025, AI chatbots have amassed 258 million monthly active users, with a penetration rate exceeding 20%, outpacing early short video adoption), the competition's core shifts from technology to seizing user scenarios, returning to the giants' forte. This strengthens the large factories' existing traffic entry advantages—basic traffic facilitates an easier starting line, as exemplified by Doubao.

Leveraging Douyin's billion-level traffic, Doubao, despite not having the optimal model benchmarking score, has significantly outpaced its peers in just a year.

(2) The capital threshold may not have lowered. Existing entry point giants also have defensive needs and will proactively accelerate user penetration or, more accurately, user acquisition. As a super Agent, increased user stickiness suggests an exponential rise in invocation volume.

The computational and promotional costs behind this demand are evident from Alibaba, Tencent, and ByteDance's expenditures in this area. This remains a substantial financial commitment. In other words, DeepSeek's promoted "computational deflation" may expedite large factories' personal entry into the field but hasn't actually lowered the capital threshold in the competitive landscape, making it challenging for SMEs and even unicorns needing early-stage capital infusion.

Judgment 2: The Final Confrontation Will Be Between Tencent and ByteDance

As mentioned, a super entry point necessitates traffic, appeal, and infrastructure to invoke vertical Agents. The platform must have sufficient capital to nurture initial user habits.

Both in terms of traffic and invocation capabilities, platforms adopting a direct "appropriationist" approach currently enhance their odds of winning this competition.

Among China's AI giants, potential super entry point players in ToC with these capabilities are few: Tencent, ByteDance, Alibaba, and Baidu:

(1) Tencent and ByteDance possess billion-level, highly engaged traffic.

(2) Those with invocation capabilities (platforms enabling vertical Agents to hand over their API interfaces) include WeChat (Tencent) with its mini-programs, Alipay (Alibaba), Douyin (ByteDance), and similar Baidu intermediate pages.

However, Alipay lacks a chatting + information search user scenario, hindering further habit cultivation. Thus, Alibaba AI ToC has bet on "Quark Super Box."

Implementation strategies differ among giants:

(1) Allocation of internal and external large model resources: Tencent, emphasizing ROI and adept at balancing resource allocation in internal-external project competitions, currently values DeepSeek highly.

Baidu follows, unable to abandon self-research as the last pillar after traditional search's decline. However, its original entry point is weak, necessitating DeepSeek to attract users.

Alibaba and ByteDance rely on their models. Despite Quark's weaker C-end traffic, Alibaba hasn't introduced DeepSeek. Similarly, DeepSeek isn't embedded in ByteDance's Doubao.

Dolphin believes that simultaneously developing internal and external large models tests management's resource allocation and team balancing skills short-term. During adjustment, personnel turbulence might disrupt product progression. Alibaba and ByteDance avoid this, but it's based on their good models and parent company traffic diversion. Tencent may encounter issues but, given its extensive horse-racing experience, these may not cause significant problems.

(2) Front-end product form and strategy: These companies can be divided into two camps.

Tencent and ByteDance rely on social traffic, advancing both AI+ empowerment and independent apps.

Alibaba and Baidu rely more on search engine traffic. Although Baidu has an independent app, its traditional search traffic erosion has marginalized Wenxin Yiyan.

AI+ empowerment considers the ultimate product form in scenario integration. Dolphin believes that independent apps are currently a transitional choice.

To realize a practical Agent, integrating underlying content, third-party apps, and defining task nodes for super and vertical Agents requires continuous multi-party testing and discussion. Immediate integration might harm initial user impressions and affect the original product's user experience.

Thus, the final super entry point will likely attach to existing products. Comparing flagship products, WeChat > Douyin > Baidu > Quark in terms of traffic distribution for function invocation. However, traffic stickiness and product strength suggest that ByteDance can catch up and win in this final competition.

A formed super Agent signifies not only traditional search's demise but also app stores' obsolescence. This Agent can exist on any device, replacing millions of apps to become the most frequent user interaction entry point.

It shortens the user-function jump chain (end merchants) and has the most concentrated traffic allocation rights—deciding which vertical Agent to invoke for tasks it can't complete. When users become accustomed to an AI assistant knowing their preferences, migration costs will be huge. With a shorter industry chain, value concentrates near the user end.

In summary, the 2025 AI Agent presents Tencent with the greatest potential industrial opportunity but also the biggest threat if it fails. Therefore, Tencent will pour top resources into it. Compared to direct repurchases and dividends, investing now offers a higher ROI, per Tencent's usual strategy.

In 2025, don't expect Tencent to play it safe but rather to play more AI cards. Keeping a backup hand also shows Tencent management's crisis awareness.

Unless extreme trade war situations arise, like Treasury Secretary Bessent's recent delisting threats or investment restrictions causing liquidity-driven stock price pressures, prompting temporary repurchases, Tencent will focus on AI.

As a preview and out of prudence, Dolphin will soon conduct a special review of Chinese assets, using extraordinary thinking to deduce investment opportunities in the worst-case scenario. An updated value judgment on Tencent will also be provided. Stay tuned.

- END -

// Reprint Authorization This article is an original by Dolphin Investment Research. For reprints, please obtain white-label authorization. // Disclaimer and General Disclosure Prompt This report is for general data use, intended for browsing and reference by Dolphin Investment Research users. It doesn't consider specific investment objectives, product preferences, risk tolerance, financial situations, or special needs. Investors must consult independent advisors before making decisions based on this report. Users bear the risks of investment decisions made using or referring to this report. Dolphin Investment Research isn't liable for any direct or indirect losses arising from using this report's data. The report's information and data are based on public sources and are for reference only. Dolphin Investment Research ensures but doesn't guarantee the reliability, accuracy, or completeness of this information. The report's information or opinions aren't construed as securities offers, invitations to buy/sell, or advice, inquiries, or recommendations on securities or related financial instruments. The report's contents aren't intended for or to be distributed to citizens or residents of jurisdictions where such distribution, publication, provision, or use would violate laws or regulations or require Dolphin Investment Research and/or its subsidiaries/affiliates to comply with registration or licensing requirements. This report reflects the personal views, insights, and analysis methods of the relevant creative personnel and doesn't represent Dolphin Investment Research and/or its affiliated institutions' positions. Produced by Dolphin Investment Research, this report's copyright solely belongs to Dolphin Investment Research. Without prior written consent, no institution or individual may produce, copy, replicate, reprint, forward, create copies or reproductions, directly or indirectly redistribute or transfer to unauthorized persons. Dolphin Investment Research reserves all relevant rights.