AI Learning Machines are 'Sinking' in Popularity

![]() 07/18 2025

07/18 2025

![]() 585

585

Image generated by Doubao AI

Despite fierce competition, students still refrain from using them?

Written by Li Xuanqi

Edited by Chen Dengxin

Typeset by Annalee

As the momentum of AI technology continues to surge, the first wave of AI-equipped learning machines is experiencing a decline in popularity.

The summer vacation, coupled with a surge in 'national subsidies,' has intensified competition among major learning machine brands. Residential elevators and parents' social media groups are flooded with AI learning machine advertisements. Additionally, various social platforms and e-commerce live streaming rooms are buzzing with sales pitches and parental inquiries.

However, a notable shift is the decreasing prices of new models from leading brands. Once upon a time, AI learning machines commanded prices exceeding 10,000 yuan. Nowadays, they are exploring the market below 3,000 yuan.

This shift is closely tied to market share. The high-end market in first- and second-tier cities has become saturated, while the lower-tier market still offers profit potential. Yet, tapping into new growth in this market for AI learning machines is no easy feat. The aura that AI initially brought to learning machines is gradually fading.

Shedding the Label of High-End 'Miracle Device'

Recently, Xueersi held a new product launch event, introducing three series of learning machines: P, S, and T. Notably, the P4 is priced at 2699 yuan, equipped with 50 AI learning tools, covering all school stages from enlightenment to senior high school. It provides a comprehensive set of learning resources, from synchronization to improvement, and integrates Xueersi's classic practice modules.

On May 10, Zuoyebang followed suit, launching new versions of the X50 learning machine and various series of learning tablets, including P, T, X, and S. Zuoyebang's P30 and other models from December 2024 fall into the 2000-3000 yuan price range, while the T30 and T35 learning machines cater to the mid-range market above 3000 yuan. AI capabilities have become standard, featuring functions like 'AI Smart Shooting and Practicing' and 'AI Inspired Learning'.

Xueersi's New Products

Leading brands are continuously sending new signals in the industry: as learning machines have become one of the most sought-after segments in educational and 3C products in recent years, amidst intensifying competition, these brands are adjusting their pricing strategies. They aim to shed the label of high-end 'miracle device' and focus on 'cost-effectiveness'.

Brand prices in the learning machine market are primarily divided into three ranges: low price (below 2000 yuan), mid-price (2000-6000 yuan), and high price (above 6000 yuan).

According to RUNTO's 'Monthly Tracking of China's Learning Tablet Retail Market,' the average price of China's online learning machine tablet market in the first quarter of 2025 was 3164.3 yuan, recording year-on-year and month-on-month declines. Among them, the sales volume of the mid-price segment (2000-2999 yuan) accounted for 30.9%, with a year-on-year increase of 13.8%. In contrast, the high-end market (above 6000 yuan) and low-end market (1000-1999 yuan) accounted for 7.6% and 11.8%, respectively, with year-on-year declines of 10.1% and 14.5%.

AVCRevo data reveals that as of the first quarter of 2025, sales of learning machines are converging towards the mid-price segment. Products priced between 2000 and 3999 yuan accounted for 57.2% of the market share in this quarter, gradually becoming the mainstream price segment. Zuoyebang's P30, with an average price of 2399 yuan, accounted for 17.5% of overall sales volume in the first quarter, making it the best-selling learning machine product on the market.

Just two years ago, the price of learning machines was on the rise, particularly those associated with 'AI.' According to RUNTO's online platform data, by June 2023, the retail average price of China's online learning tablet market peaked at 3625 yuan, a 76.2% increase compared to January 2022. For most subsequent months, it remained above 3000 yuan.

Learning machines priced above 5000 yuan typically cover all AI functions, with many priced at nearly 10,000 yuan or more. For instance, NetEase Youdao's Xiaodu Qinghe Learning All-in-One has a retail price of up to 9999 yuan. The initial price of the AI learning machine X20 starts at 5999 yuan, while the Xueersi xPad2 Pro series starts at 6599 yuan. Consequently, many parents have questioned on social platforms, 'Is it an intelligence tax?' This has sparked widespread discussions in the media.

Image source: Xiaohongshu

From this perspective, the current 'drop' in AI learning machine prices is more of a response to market trends. As the potential of this segment is fully explored, competition intensifies, extending from hardware capabilities and educational content to pricing. Despite consistently optimistic sales figures, the anxiety of major learning machine brands is hard to conceal.

In the end, will they still 'gather dust'?

It's undeniable that the momentum of learning machines is unstoppable. As the saying goes, 'No matter how hard life is, we mustn't let our children suffer; no matter how poor we are, we mustn't let education suffer.' Parents are always willing to spend more on educational products. However, when parents bite the bullet and make purchases, they can't help but wonder: Are AI learning machines truly beneficial?

To assure parents that their investment is 'worth it,' leading learning machine brands are 'rolling up their sleeves and competing fiercely.'

According to a review by the New Consumer Daily, there are currently three main types of manufacturers in the AI learning machine segment: traditional learning machine manufacturers led by BBK and Xiaobawang; internet giants with strong AI R&D capabilities, including Baidu, iFLYTEK, Huawei, NetEase, etc.; and educational technology companies represented by Zuoyebang and Xueersi, which possess abundant educational resources.

From the emergence of basic AI functions in early 2019 to the popularity of large model concepts in 2022, the integration of learning machines and AI has deepened, ranging from AI homework correction to academic performance diagnosis, from real-time explanation to 1V1 personalized tutoring. All these demonstrate 'AI capabilities' to consumers.

Image source: Dingjiao One public account

The surge in popularity of DeepSeek has further intensified competition in AI learning machines. Facing this new trend, no one dares to lag behind. As soon as 2025 began, many education and related enterprises, such as Gaotu, iFLYTEK, Yuanfudao, and Xueersi, announced the integration of the DeepSeek large model.

The Youdao XiaoP App has now integrated DeepSeek. Image source: NetEase Youdao

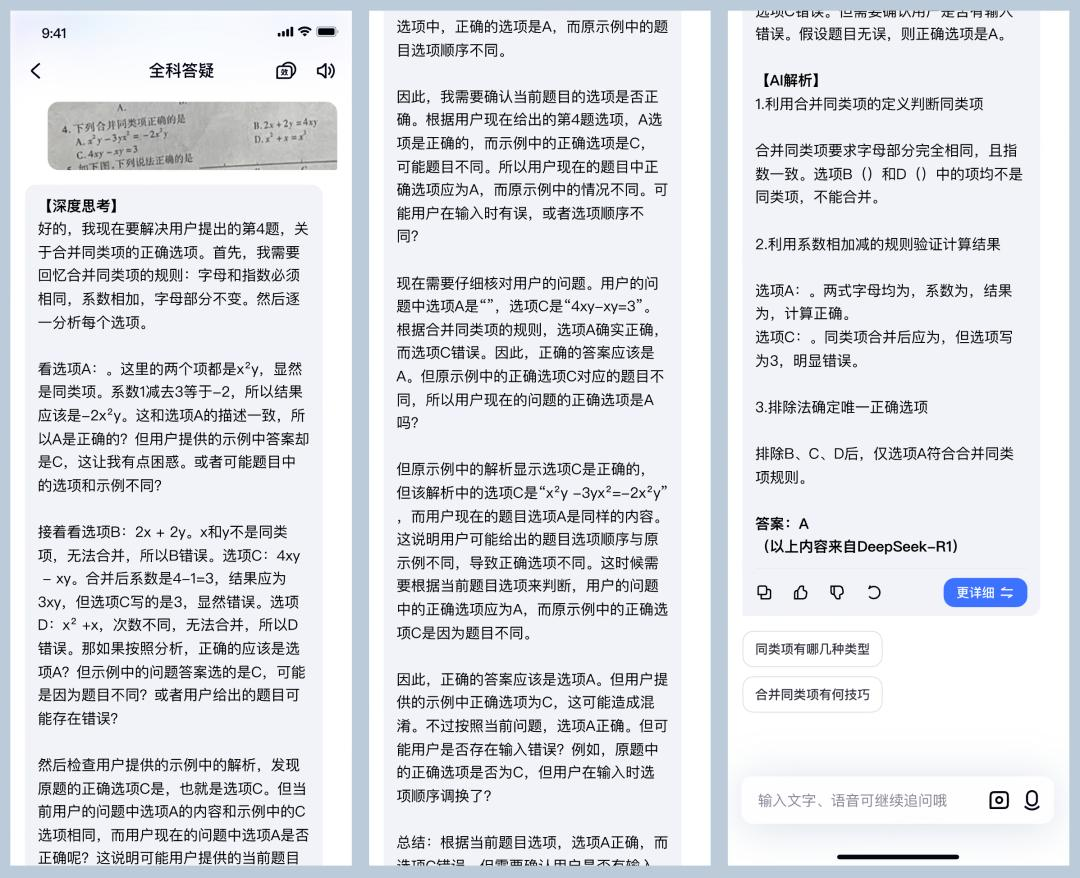

Despite these advancements, parents remain skeptical about AI learning machines.

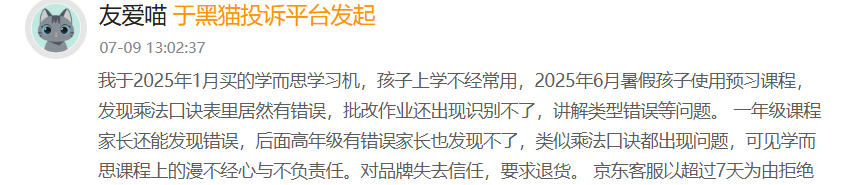

On the Heimao Complaint Platform, there are numerous complaints about 'AI learning machines not being intelligent at all.' Most issues center around 'false advertising,' such as the lack of AI one-on-one functions, poor AI homework diagnosis, incorrect math problem explanations, etc. One consumer mentioned frequent lags, errors in knowledge content, and inconsistencies between questions and explanations after purchasing and trying out the Xueersi learning machine s3. Another complained: 'I bought the Xueersi learning machine in January 2025, and my child rarely uses it during school. In June 2025, during the summer vacation, my child used it for preview courses and found errors in the multiplication table. It also failed to recognize corrected homework and explained the wrong type of problem.'

Many consumers have also pointed out hardware issues with Zuoyebang learning machines. One consumer complained: 'I just received the Zuoyebang learning machine and tried it out on the third day. Today, my child doodled following the drawing in the learning machine, and there were obvious scratches, clearly a quality issue with the screen.' Another mentioned that the screen of their learning machine spontaneously cracked after three months of use.

Therefore, when many parents, overwhelmed by anxiety, pin their hopes on AI learning machines, they often end up with an 'idle' device. According to Kungfu Finance, internal industry data shows that about 70% of learning machine users activate them less than three times a month, and over 40% of devices are completely idle six months after purchase. Many friends who have bought learning machines complain, 'When we bought them, they promised accurate score improvement, but now they're just gathering dust in the corner.'

From this perspective, while the AI functions of leading learning machine brands are becoming increasingly rich and homogeneous, the question remains: how many of these functional pages are actually frequently used by students? If students 'don't use them,' no matter how fiercely the major learning machine brands compete, it ultimately loses its meaning.