Apple's Record Earnings: A Signal of Mediocrity Amidst Success

![]() 08/14 2025

08/14 2025

![]() 486

486

Source | BohuFN

Apple's latest financial report reveals that in the second quarter of this year, the company achieved a record-breaking revenue of $94.036 billion, marking a 10% increase from the $85.777 billion recorded in the same period last year. Net profit also surged, reaching $23.434 billion, up 9% from the $21.448 billion reported in the previous year's corresponding quarter.

These results surpassed even the lofty expectations of Wall Street analysts, who had forecasted sales of $89.34 billion and profits of $21.43 billion for the quarter.

How did Apple manage to achieve such impressive figures? Tim Cook credited the strong performance to the Chinese and American markets.

This admission, however, marks a departure from Apple's typical demeanor.

01 Hidden Troubles Beneath the Glittering Financial Results

After seven consecutive quarters of year-on-year revenue declines in Greater China, Apple reported a 4% increase in revenue to $15.369 billion in the second quarter, up from $14.728 billion in the same period last year.

During the earnings call, Tim Cook explained that the second quarter marked the first full quarter where the impact of "national subsidies" for digital products, including smartphones, was felt, and Apple products benefited from these subsidies.

However, what Cook omitted was that since the beginning of this year, Apple has broken its tradition of not easily discounting prices, opting instead to boost sales volumes through price reductions. Ahead of the 618 shopping festival, Apple issued price adjustment notices to its channel partners, significantly lowering prices for multiple flagship models, including the iPhone 16 Pro. For instance, the price of the iPhone 16 Pro 128GB version was cut by $200 to $5999, aligning perfectly with the range of national subsidies. With an additional $500 national subsidy, the final price dropped to $5499, and other higher-configuration models also witnessed price adjustments exceeding $1000.

Apple's response to declining market share through price cuts is a direct result of the pressure exerted by Chinese smartphone brands, particularly the resurgence of Huawei. IDC data indicates that in the second quarter of 2025, Huawei reclaimed the top spot in the domestic market with shipments of 12.5 million units, accounting for 18.1% of the market share. Brands such as OPPO, vivo, Xiaomi, and Honor are also competing fiercely for Apple's market share through price advantages and comparable functional experiences.

But can the sales volume gained through price reductions be sustained? On July 29, Apple's official Chinese website announced that the Apple Store located in Dalian's Bailiancheng would cease operations on August 9. This marks the first time Apple has closed a retail store in China since entering the market 19 years ago. Opinions differ as to whether this is the beginning of a trend or merely an isolated incident.

The situation in the American market mirrors that of China.

The American market once provided a robust boost to Apple's performance, with consumers rushing to purchase iPhones and Macs ahead of tariff increases, driving a year-on-year increase of over 13% in iPhone sales for the quarter, which reached $44.58 billion. Mac sales also achieved double-digit growth.

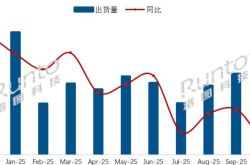

However, analyzing industry data reveals that the growth of the smartphone market has essentially peaked. The global smartphone market growth rate for this quarter hovered in the low single digits, and Apple's smartphone shipment growth rate was approximately 2%.

Even more concerning, Apple's software services, a significant profit driver for the company, are fraught with challenges. This quarter, sales of services including the App Store, Apple Pay, and Apple Music continued to rise, with revenue increasing by 13.3% to $27.42 billion, accounting for approximately 30% of total revenue.

However, the App Store's commission structure is facing scrutiny from developers, and the European Union has already issued related rulings. In a worst-case scenario, US banks estimate that Apple could lose up to 10% of its net profit as a result. Additionally, there is uncertainty surrounding a pending ruling in the Google antitrust case, where a judge is poised to make a decision regarding Google's contract as the default search engine for Apple's Safari browser, which could impact the future of this lucrative agreement.

Crucially, this contract generates only 6% of Apple's revenue but contributes nearly one-fifth of the company's operating profit.

In summary, Apple's current success is largely built on "eating old capital," with growth in China proving unsustainable, and the American market becoming increasingly competitive and constrained.

All these issues point to a broader concern: Apple appears to have lost its ability to truly drive future innovation in the technology sector.

The iPhone is gradually losing its innovative edge, most notably evidenced by the absence of "revolutionary technology." When examining the most significant innovations in smartphones in recent years, foldable screen technology was introduced by Samsung, Huawei spearheaded the 5G era, and Huawei also pioneered the recent trend of satellite calls.

02 Apple No Longer Sets the Pace for the Future

Once upon a time, we eagerly anticipated the release of Apple's next-generation products. Now, however, we find ourselves questioning: Does Apple even know where it's headed?

A notable example is Apple's decade-long plan to enter the automotive industry.

Over the past decade, rumors about Apple developing electric vehicles have persisted. The "Apple Car" was once highly anticipated as the pinnacle of Apple's ecological strategy, envisioning a deep integration of hardware, software, and services that would revolutionize transportation.

However, in early 2025, Apple officially announced the abandonment of its car manufacturing plan. The reasons cited include a lack of focus, severe internal disagreements on the direction, and the fundamental fact that car manufacturing is an exceedingly challenging and low-margin business, ill-suited to Apple's business model.

Intriguingly, Xiaomi picked up where Apple left off. Lei Jun made a high-profile announcement for Xiaomi's SU7 and YU7 series, high-end electric vehicles that blend beauty, intelligence, and ecology, fulfilling the initial expectations many had for the Apple Car and validating the feasibility of consumer electronics companies venturing into automotive manufacturing.

Apple's decision to abandon its car manufacturing plans is not merely a product failure but also a failure of imagination, highlighting the company's hesitation in strategic execution.

Another controversial strategic investment was the Apple Vision Pro.

Upon its release, the Vision Pro was hailed as the "next iPhone-level" platform. Apple described it as a "spatial computing" device poised to revolutionize the way we entertain, work, and communicate.

Yet, a year later, hardly anyone mentions the Vision Pro anymore. This high-priced headset has become one of Apple's most notable flops since the Newton. Despite its sophisticated hardware technology, it failed to address any real pain points for mainstream users and has since been relegated to obscurity.

Apple's lag is even more pronounced in the crucial race of artificial intelligence.

After the emergence of ChatGPT, Apple's response was slower than that of giants like Google.

In 2025, Apple finally unveiled its generative AI strategy, Apple Intelligence, which is integrated into iOS and macOS, emphasizing the concept of "edge computing + privacy protection."

However, the highly anticipated new version of the Siri voice assistant was ultimately delayed. Despite Apple's polished presentation at the conference, the actual user experience lags far behind competitors. Siri remains "worryingly unintelligent," struggling to understand complex semantics or engage in multi-turn dialogues.

The turmoil within Apple's AI team underscores this issue.

In 2018, Apple recruited John Giannandrea, the former head of Google AI (known in the industry as "JG"), who reported directly to CEO Tim Cook. Upon joining, Giannandrea replaced the team's leader, cut unpopular features, and focused the team on core functionalities.

However, there is indecision within Apple regarding whether to invest heavily in AI. According to reports, software chief Craig Federighi believes that AI is not a core function of mobile devices and is reluctant to disrupt the development schedule of annual system updates for the iPhone, Mac, etc. This reluctance has left Apple unprepared for the advancements made by ChatGPT.

This "device-first" mindset also contributed to the departure of Peng Ruoming, the head of Apple's AI foundational model team. Earlier this year, Peng Ruoming drew up a preliminary open-source roadmap for the team. However, Federighi was concerned that open sourcing would compromise Apple's edge optimization advantage. Not long ago, Peng Ruoming joined Meta's "Super Intelligence Lab," making headlines in Silicon Valley.

It should be noted that this mindset starkly contrasts with that of other giants in Silicon Valley. The most symbolic example is Zuckerberg's public declaration of "war." At the Meta Connect conference, he bluntly dismissed Apple Intelligence as a "half-baked product" and declared that Meta would "dominate future human-computer interaction."

Apple was once the world's most valuable company, and at the end of last year, it was tantalizingly close to a market capitalization of $4 trillion. However, as NVIDIA and Microsoft have successively surpassed the $4 trillion mark, Apple has gradually fallen behind.

Market capitalization, of course, does not tell the whole story. Apple remains one of the most profitable companies on the planet, but profitability has never been the sole measure of a technology company's core competitiveness.