Has China's Domestic TV Market Entered a Protracted Slump, Rendering Products Hard to Sell?

![]() 12/11 2025

12/11 2025

![]() 422

422

When was the last time you switched on your TV? Was it for the Spring Festival Gala? Or to catch up on the Scottish Premiership? Suddenly, it dawns on you that the era when the entire family congregated around the TV set is a distant memory. Even during the recent Double 11 shopping spree, leading TV brands uniformly reported lackluster sales figures, with a palpable chill in the air...

01. Eight Major Brands Face Collective Challenges~

This November, which boasted the 'earliest start and longest duration' Double 11 promotion in history, was anticipated by TV giants to drive substantial shipments. However, reality dealt a harsh blow: approximately 3.22 million units were shipped that month, marking a sharp 15.7% decline from the previous year!

Figure: Monthly shipment trends of Chinese TV market brands over 13 consecutive months. Data Source: RUNTO. Unit: 10,000 units. %

According to RUNTO (Luotu Technology) statistics, in November 2025, China's TV market brand shipments totaled approximately 3.22 million units, slightly down from October and significantly lower by 15.7 percentage points compared to November of the previous year, further underscoring the downward pressure on the industry.

During the Double 11 promotion period from 'October 6 to November 16,' the total retail volume in the TV market across all channels plummeted by 19.6% year-on-year, while the retail value crashed by 22.1%. This 'double whammy' of declining volume and value rendered the e-commerce shopping festival's promotions ineffective in an unprecedented manner.

Brands including Hisense, TCL, Xiaomi, Skyworth, Changhong, Haier, Konka, Huawei, along with their sub-brands, accounted for over 95% of the market share, totaling approximately 3.08 million units, a 13.9% year-on-year decline. This indicates that nearly all of China's top eight TV brands experienced a downturn.

Xiaomi (including Redmi) shipped 530,000 units that month, capturing a 16.5% market share, down slightly from 17.9% in October. Huawei, Samsung, Sony, Sharp, and Philips maintained shipments at several tens of thousands of units, facing significant pressure to break through.

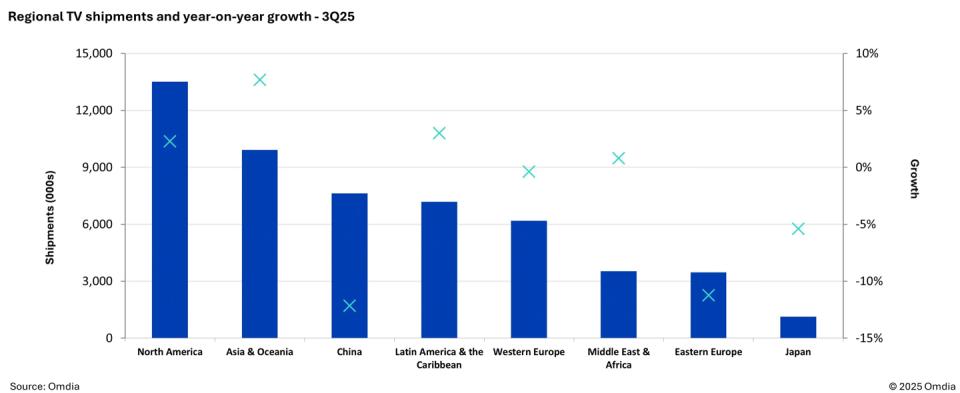

According to the latest data from Omdia, in the third quarter of 2025, global TV shipments slightly declined year-on-year to 52.5 million units, a 0.6% drop. Omdia's 'Quarterly TV Market Tracker' data reveals that China's TV shipments fell by 12.2% year-on-year, while the Asia and Oceania markets grew by 7.7%, and the North American market increased by 2.3%.

This implies that the slight decline in the global TV market in Q3 2025 was primarily influenced by the Chinese market. The growth in markets like Asia and Oceania is also somewhat linked to the performance of the Chinese market, but let's set that aside for now.

It's worth noting that objective factors such as the phase-out of government subsidies and premature consumption demand are widely regarded by the industry as major reasons for the sharp decline in November's performance, as mentioned in reports by Omdia and RUNTO. RUNTO believes that the terminal market in December will likely continue its downward trend, with full-year shipments in 2025 expected to hit a historic low of 33 million units, and the Chinese market size may further decline in 2026.

In fact, the shrinking of China's TV market has been evident for some time.

For instance, the '2024 China Smart TV Interaction New Trend Report' released by Forward Industry Research Institute shows that since 2016, China's TV viewership rate has plummeted from 70% to less than 30% in 2022.

The collapse of viewership rates is closely tied to the decline of the overall TV market!

Statistics from AVC (Auyou Cloud Network) show that from 2016 to 2022, China's TV sales were 50.89 million, 47.52 million, 48.98 million, 47.72 million, 44.50 million, 38.35 million, and 36.34 million units, respectively. If we estimate full-year sales in 2025 at 33 million units based on RUNTO's projections, it means that over the past decade, our TV market has shrunk by nearly 18 million units.

Corresponding to the sharp decline in viewership rates is the increasing complexity of operational logic!

In the past, turning on the TV was sufficient to watch programs, with a single remote control adequate for channel changing. Nowadays, many households' smart TVs require set-top boxes, optical modems, and at least two remote controls (for the set-top box and TV). Forget about elderly family members; even young people face a learning curve to navigate the main menu, secondary menus, and seamless switching between video platforms and TV channels.

What's even more exasperating than the complex operational logic is the 'nested' charging for various advertisements and VIP services!

Some brands display half-minute advertisements upon startup, followed by a UI interface cluttered with options. You're unsure which to click, and when you do watch a video, you're prompted to subscribe to VIP. Sometimes, you've already subscribed to VIP on your phone, but using it on your TV requires an additional fee. Moreover, programs in the music and children's sections require separate payments... What's the psychological toll on a normal consumer at this point?

The most disheartening fact is that times have changed, and smartphones have become the core product for consumers' entertainment lives!

Counting the years since smartphones emerged, how many electronic products have they rendered obsolete or crippled? Radios, music players (CDs, MP3s), video players (MP4s), calculators, alarm clocks, PSPs, navigators, digital cameras... With their unparalleled portability and powerful entertainment and social attributes, smartphones have relegated large-screen TVs, which were once the icing on the cake, to a non-essential status.

At this juncture, it seems that smart TVs are on the verge of becoming obsolete?

02. Is Overseas Expansion the Only Solution?

The downward pressure on the domestic smart TV market is an undeniable fact, and some factors are entirely beyond the control of TV manufacturers. Consider two sets of data:

In 2024, China's single adult population exceeded 280 million, with 130 million living alone, meaning one in four households is a 'single-person household.' For single and solitary/renting young people, the practical demand for purchasing large-screen TVs is not as strong as that of family users.

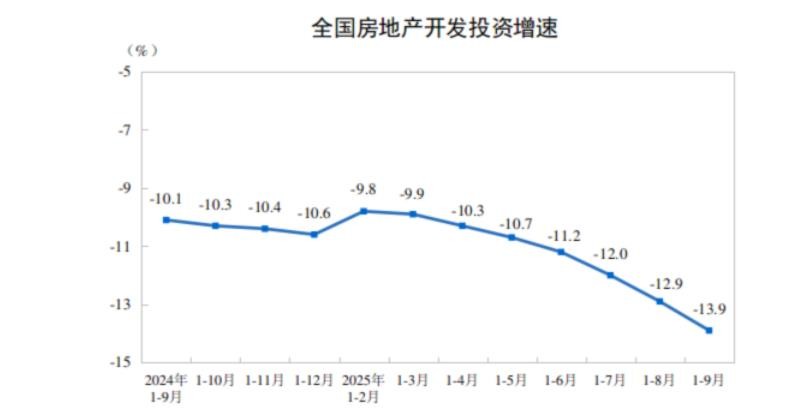

From January to September 2025, national real estate development investment was 6,770.6 billion yuan, a 13.9% year-on-year decline, with residential investment at 5,204.6 billion yuan, down 12.9%. The real estate market prosperity index is closely linked to the new home decoration market, which in turn affects large black appliances like TVs.

Figure: National Bureau of Statistics

However, for these eight major TV brands, the darkest hour is far from over. The solution lies right before their eyes: 'A tree that's moved dies, but a person who moves thrives.' With the domestic market experiencing unprecedented intense competition, approaching saturation, and fierce price wars, it's natural to intensify overseas market expansion and seize incremental dividends to compensate for the domestic market gap. China's top players have already begun taking action, and most have performed reasonably well.

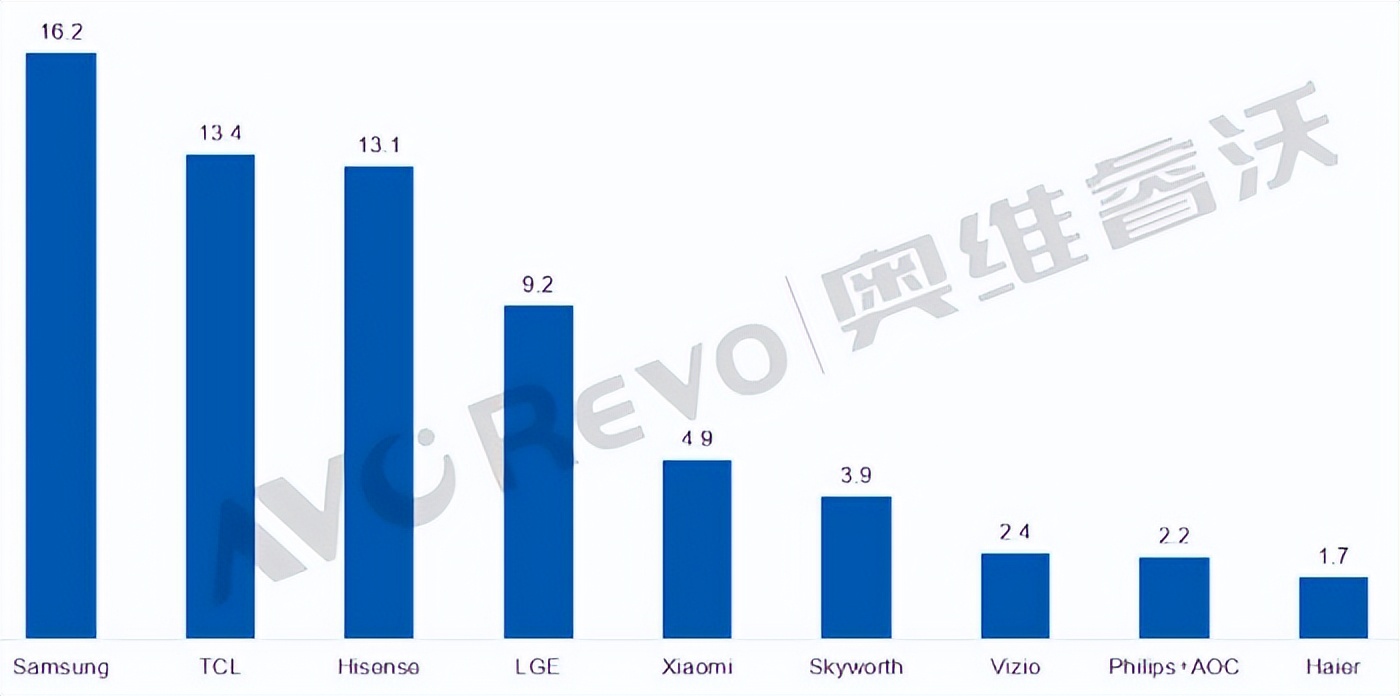

Statistics from AVC Revo show that as of the first half of 2025, the global TV TOP 10 are Samsung, TCL, Hisense, LGE, Xiaomi, Skyworth, Vizio, Philips+AOC, and Haier. Among them, TCL shipped 13.4 million units globally, Hisense 13.1 million, and Xiaomi 4.9 million.

In particular, TCL saw a 6.3% year-on-year growth, performing well in Europe and emerging markets. Hisense also grew by 2.6%, maintaining its lead in the Japanese market. Even Xiaomi, a cross-industry player, sustained strong growth in Western Europe and the Middle East and Africa, partially offsetting declines in other markets.

...

So, as hinted earlier, overseas expansion is the most crucial strategy for these TV brands to cope with the downward cycle. Domestic leaders like TCL, Hisense, Xiaomi, Skyworth, and Haier have already made relatively successful layouts, although brands like Huawei, Changhong, and Konka are slightly lagging.

While the vast domestic market makes it extremely difficult to achieve counter-trend growth in the short to medium term, there is still hope to slow down the downward trajectory. For instance, boldly simplifying smart TV operation processes, reducing ad push, increasing VIP compatibility (sharing across phones, tablets, and TVs), and adding exclusive content for large-screen TVs (such as popular football matches, boxing events, variety shows, etc.).

Moreover, with the AI boom, all TV giants still have one last trump card: smart home + whole-house intelligence!

As for how AI agents can diversely empower cross-device collaboration, enabling smart TVs and other large-screen devices to transition from passive response to proactive service, transforming from 'decorative items' to essential products, it's up to each brand to showcase its unique strengths!

Can the eight major TV brands reclaim their golden era?

Let's wait and see!

References:

Agency: Global TV Shipments Decline 0.6% Year-on-Year in Q3 - The Interface

National Real Estate Market Basics from January to September 2025 - National Bureau of Statistics

Omdia Report: China's TV Shipments Decline 12.2% Year-on-Year in Q3 2025 - IT Home

RUNTO November Briefing: Monthly Shipments of Chinese TV Market Brands - Runto Luotu Technology Observation

2025 TV Shipments May Drop to 33 Million Units, but Major Brands Welcome 'Harvest' Opportunities? - Dingke Technology

2024 Marriage Rate Hits 47-Year Low! 300 Million Singles Spur a 10 Trillion Yuan New Market - Shanghai Transformation Release

First Half of 2025: Global TV Shipments Reach 90.8 Million Units, with Samsung, TCL, Hisense, LGE, and Xiaomi Vying for TOP 5 - Projection Times