Doubao's 'AI Smartphone': Is It Real or Just a Laugh?

![]() 12/11 2025

12/11 2025

![]() 700

700

Is Doubao's 'AI Smartphone' Concept a Reality or Simply a Comedic Farce?

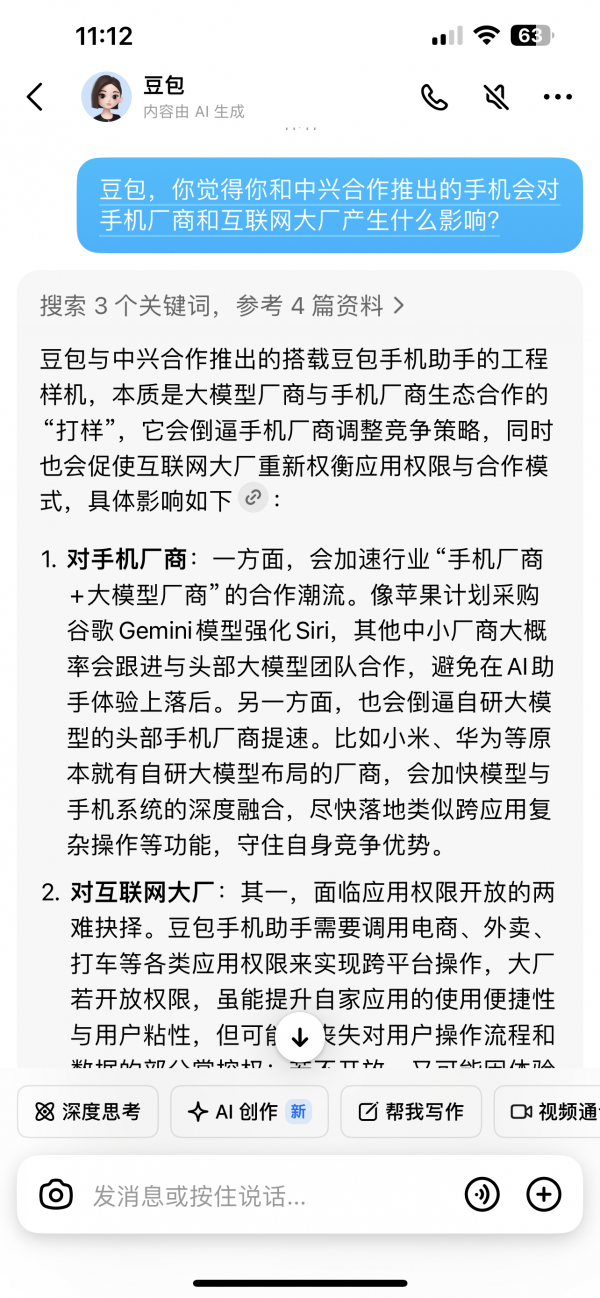

Recently, Doubao's mobile assistant has made waves in the tech market, reminiscent of DeepSeek's debut earlier in the year, sparking widespread excitement. Some claim it can operate seamlessly without relying on traditional apps, posing a challenge to the ecosystems of major internet companies. Observers also note its profound impact on transforming the traditional hardware and software configurations of smartphones.

Initially, it was anticipated that ByteDance's partnership with ZTE would swiftly garner industry-wide acclaim. However, Doubao soon found itself under siege.

On December 2, Doubao's mobile assistant announced the discontinuation of its WeChat integration feature. Three days later, on December 5, it further restricted the use of AI-powered phone functionalities in incentive, financial, and gaming sectors.

On December 9, Nubia's President, Ni Fei, acknowledged on Weibo that the team had received feedback on previous issues and was actively engaging with partners to address them. Subsequently, Li Liang, the Vice President of Douyin Group, shared the post, emphasizing that AI-driven transformations are genuine, as are user demands, and asserting that "regardless of success or failure, AI is undoubtedly the future."

The interplay between these developments is intriguing. Within a few days, Doubao's mobile assistant began to "retreat" under questioning, debate, and restrictions from various stakeholders. Yidu Pro believes that the app's true significance lies in its impact on the smartphone market landscape and the defensive strategies of other tech giants.

| A New Era: The Second Wave of AI Smartphones |

The collaboration between Doubao and ZTE largely opens up a second avenue for phones to truly embrace the artificial intelligence era.

The integration of AI and smartphones is not a new concept. However, the industry's previous understanding has been limited to a superficial level, exemplified by "voice assistants (e.g., Apple's Siri, launched in 2011) + algorithm optimization."

A seasoned mobile phone industry expert told Yidu Pro that the industry has entered a period of AI smartphone development in recent years, but the path remains unclear. The initial commercialization route has largely focused on embedding large models. Simple intelligent agent scheduling and its instructional role in smartphone imaging and information processing do not qualify as true AI smartphones.

He further pointed out that the concept of AI smartphones lacks a comprehensive definition. While Huawei, Honor, Apple, and others are exploring based on their early technological foundations or system and ecological advantages, Honor even hinted at launching a RobotPhone next year, integrating AI smartphones, embodied intelligence, and high-definition imaging.

Coincidentally, Doubao's seamless, intelligent interaction experience with AI smartphones resembles breaking through the functional boundaries of traditional AI smartphones, paving the way for a new definition of AI smartphones. It can be seen as a beneficial exploration in advancing AI smartphones from the 1.0 stage to the 2.0 stage.

In the eyes of observers, the difference between the two is not merely a technological upgrade but a shift from tool assistance to "active service." At least, the engineering evaluation process on the internet has demonstrated this point.

This phenomenon bears some resemblance to Manus, which gained global attention earlier this year with its "full-process execution" selling point. Its intermediary-free decision-making and execution mode, where "input demand leads to output result," was even rumored to directly replace human stock trading.

Similarly, the core pain point of traditional AI smartphones lies in their passive responsiveness. Users must initiate functions through specific instructions, and recognition accuracy is significantly influenced by the environment, tone, and each app provider's technical procedures. Yidu Pro found that, besides announcing some AI features and parameters of their phones at product launches, manufacturers have not heavily promoted AI smartphones as a standalone marketing focus in the retail market. Many stores even lack an understanding of what AI smartphones are.

Although Doubao's mobile assistant is itself an app, it has generated significant market heat, leading to the sell-out of ZTE's model. Thus, the integration of AI smartphone assistants or AI agents on phones has the technical readiness, but true realization requires overcoming challenges in privacy, security, business models, and more.

| Will Smartphone Manufacturers Compromise Their Core?

In fact, most smartphone manufacturers have long been exploring AI assistants but have not launched products similar to Doubao's. Thus, a new question arises: Will smartphone manufacturers choose to compromise their core principles to win the competition?

Based on industry development patterns, this possibility seems low.

A professional with in-depth knowledge of the mobile phone business advised Yidu Pro to refer to Huawei's past identity, role, and positioning in the intelligent automotive industry. Although some automakers previously proposed the "soul theory," subsequent practice showed that Huawei and automakers achieved mutual success. Even if one party's influence might be greater, the resulting product leadership and definition were quite impressive.

Another reason is related to the current competitive landscape of smartphone manufacturers. Established mobile phone giants, having weathered years of industry competition and internal struggles, generally possess strong product refinement capabilities in AI, whether in imaging or systems, significantly superior to traditional OEMs. Some manufacturers only lack large model capabilities, leading some to rely on open-source solutions. However, others, like Apple, have strengthened their autonomous AI and ecological collaboration. Thus, cooperation is possible at various levels. However, due to the competition for "who controls user smartphone dominance," it is unlikely that model providers and mainstream smartphone manufacturers will reach a level of complete integration.

Smaller manufacturers, on the other hand, have more potential for growth.

Doubao's choice of ZTE, a manufacturer with a relatively low market share, resembles Huawei's initial strategy in the intelligent vehicle sector of partnering with less well-known automakers to explode the market and validate business opportunity feasibility.

However, from another perspective, Doubao's rise provides the industry with new development ideas. Honor's shift from hardware competition to ecological construction through the "Alpha Strategy" demonstrates that in a market with intensifying homogeneous competition, technological route differentiation may be the key to breaking through.

Whether Doubao's model can become mainstream in the market remains to be seen. On the one hand, major smartphone manufacturers like Apple and Huawei have their considerations when cooperating with large model manufacturers and are unlikely to open core permissions to third-party large models under their proprietary OS product architectures. This further supports the notion that the "soul theory" in the mobile phone industry seems untenable.

The history of mobile phone industry development repeatedly proves that brands capable of leading technological changes are often not traditional giants clinging to their advantages but innovators daring to break free from path dependency.

Doubao, positioned to empower various industries, whether it can become the Huawei of the AI smartphone world requires time verification and depends on the development trend of the AI smartphone industry.

| Entry Points: A New Source of Anxiety |

Some influential figures view Doubao's mobile assistant's emergence as a continuation of the "entry battle." Zhou Hongyi directly stated that Doubao's mobile assistant would directly crash the defensive barriers of major internet companies, prompting executives from Meituan and Taobao to hold emergency meetings, and potentially leading to a joint defense agreement among giants.

From another perspective, its impact extends beyond smartphone manufacturers to more tech giants, as they are all built on the mobile internet's APP form.

From the operating system battle in the PC era to the APP ecosystem war in the mobile internet era, and now to the AI terminal competition, the essence is the fight for user attention and usage scenarios. In this silent war, various terminals like AI smartphones, AI glasses, and smart cars are all vying to become the core entry point of the next era.

Reviewing the tech industry's development history, entry point iterations often mean industry landscape reconstructions. In the 1990s, PCs as the core entry point led to the rise of Microsoft and Intel's "Wintel Alliance."

After 2010, smartphones became the first entry point, giving birth to industry giants like Apple and Huawei. According to Gartner's 2025 global smart terminal report, the AI terminal market size will exceed $1.2 trillion in the next five years, with AI smartphones accounting for 45%, becoming the largest market segment. This implies that whoever dominates AI smartphone development may hold the discourse power of the next-generation smart terminals.

Of course, various terminal manufacturers are accelerating their AI entry point layouts.

For instance, Xiaomi is building a "human-vehicle-home full ecosystem" through ecological collaboration between smart cars, phones, and home appliances. Other giants are expanding AI application scenarios through new categories like smart glasses and robots.

However, the core of the entry battle lies in the ecological system behind the terminals. Apple's dominance with the iPhone back then was not solely due to hardware leadership but because it built a closed-loop ecosystem of "hardware + system + applications."

Today, the biggest challenge for Doubao's mobile assistant is how to quickly establish a complete AI ecosystem. At the hardware level, ByteDance itself is not a phone manufacturer, and its cooperation with large phone manufacturers remains to be seen. The shipment volume of small phone manufacturers also cannot form scale in a short time. Given this situation, hardware tech companies still have ample time to respond.

Non-hardware internet companies, on the other hand, have built sufficiently strong commercial entry barriers in social, gaming, shopping, food delivery, and short video domains. Today, they need to consider how to consolidate their defensive barriers from the traditional application era.

No one can currently answer how APP applications and large models will coexist in the future. Alibaba CEO Wu Yongming boldly predicted in a speech that large models will be the next-generation operating systems, and AI Cloud will be the next-generation computer.

This also explains why major internet companies are entering AI hardware markets like XR glasses and robots, whether through self-research or cooperation.

Behind these moves lies entry anxiety. Whether traditional mobile phone product manufacturers or internet giants, each has a different positioning for their commercial entry points. Doubao's mobile assistant merely makes everyone more "crisis-conscious."

Returning to the initial question, is Doubao's version of an 'AI Smartphone' a myth or a joke? The answer may not lie in current public opinion but in future market practices. Regardless of the outcome, its emergence provides the industry with an important revelation: In today's era of accelerated technological iteration, daring to break through and innovate can almost subvert an industry and recreate a new one.

Image sourced from the internet. Rights reserved for the original author.