November Sees Double-Digit Growth in Passenger Car Sales Year-on-Year and Month-on-Month Against a High Base, with a Slight Dip in MPV Sales

![]() 12/11 2025

12/11 2025

![]() 410

410

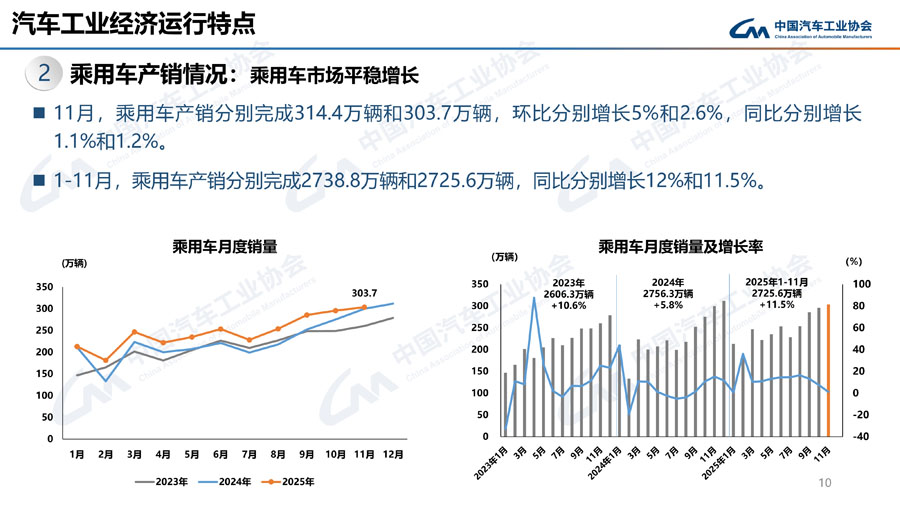

In November, enterprise-level production and supply maintained a relatively brisk pace, enabling passenger car sales to achieve both month-on-month and year-on-year growth despite a high comparative base. During this month, a total of 3.037 million passenger cars were sold, marking a 2.6% increase from the previous month and a 1.2% rise year-on-year. Among the primary passenger car categories, MPV sales experienced a slight month-on-month decline, whereas the other three major categories saw varying degrees of growth. When compared to the same period last year, basic passenger cars (sedans) and sport utility vehicles (SUVs) posted slight increases in sales, while MPVs and cross-type passenger cars witnessed double-digit declines.

From January to November, a cumulative total of 27.256 million passenger cars were sold, representing an 11.5% year-on-year increase. Across the main passenger car types, all four categories registered double-digit growth compared to the same period last year, with cross-type passenger cars experiencing the most notable surge.

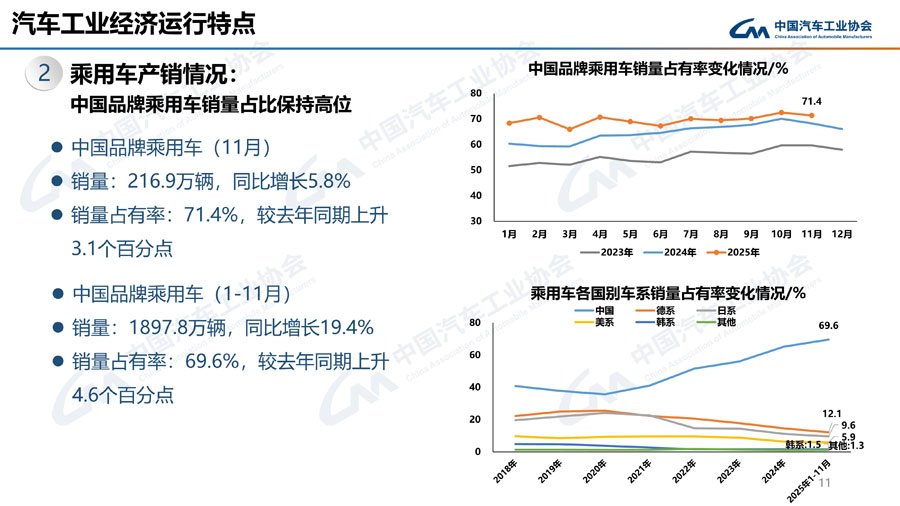

In November, Chinese brand passenger cars achieved total sales of 2.169 million units, up 1% month-on-month and 5.8% year-on-year, capturing 71.4% of the total passenger car sales market. This translated to a 3.1 percentage point increase in market share compared to the same period last year. Among the major foreign brands, Korean brands saw a slight month-on-month sales decline, while the other four major brands experienced varying degrees of growth. Year-on-year, however, all five major foreign brands reported sales decreases to varying extents.

In November, the sales market share for Chinese brand sedans, SUVs, and MPVs stood at 65.7%, 75.3%, and 71.6%, respectively. Month-on-month, the market share for Chinese brand sedans and SUVs decreased to varying degrees, while that for MPVs saw a slight uptick. Year-on-year, all three categories witnessed increases in their market shares.

From January to November, Chinese brand passenger cars accumulated sales of 18.978 million units, up 19.4% year-on-year, accounting for 69.6% of the total passenger car sales. This represented a 4.6 percentage point increase in market share compared to the same period last year. Among the major foreign brands, American and Korean brands saw sales increases to varying degrees, while the other three major brands reported declines.

From January to November, the sales market share for Chinese brand sedans, SUVs, and MPVs reached 64%, 73.4%, and 68.6%, respectively. Year-on-year, all three categories experienced increases in their market shares.

From January to November, the top ten sedan manufacturers by sales volume collectively sold 7.826 million units, accounting for 69.3% of total sedan sales. Among these, SAIC Volkswagen's sales declined compared to the same period last year, while the other manufacturers reported varying degrees of growth.

During the same period, the top ten SUV manufacturers by sales volume sold a total of 9.583 million units, making up 65.9% of total SUV sales. Among them, FAW-Volkswagen and Tesla experienced slight sales declines, while the other manufacturers saw varying degrees of growth.

Also from January to November, the top ten MPV manufacturers by sales volume sold a combined total of 862,000 units, representing 78.3% of total MPV sales. Among these, GAC Trumpchi and Dongfeng Motor Corporation reported sales declines, while the other manufacturers achieved varying degrees of growth.