Xiaomi Breaks Through: Southeast Asia's Largest Smartphone Manufacturer, Thanks to Localization Efforts

![]() 08/21 2025

08/21 2025

![]() 577

577

First, fortify your position; then, leap forward.

Xiaomi has finally ascended to the pinnacle of the Southeast Asian market.

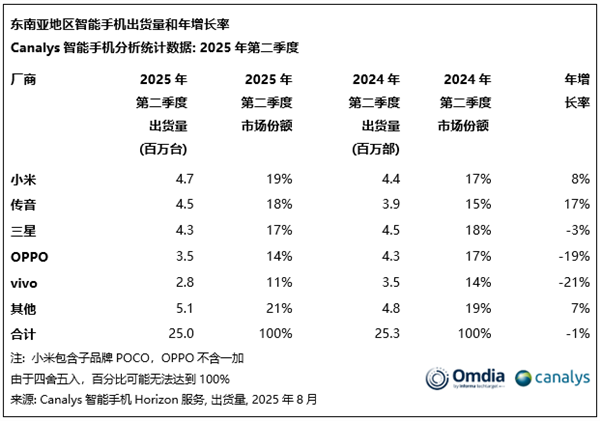

Recently, the South China Morning Post cited data from Canalys, revealing that Xiaomi has become Southeast Asia's largest smartphone manufacturer for the first time in four years. The report noted that Xiaomi shipped 4.7 million units in Southeast Asia in Q2, marking an 8% year-on-year increase and capturing a 19% market share, surpassing Transsion's 18% and Samsung's 17%. In the midst of an overall decline in smartphone sales, Xiaomi's breakthrough stands out as particularly remarkable.

Image source: Canalys

This "contrarian" success begs the question: how did Xiaomi achieve such results in the fiercely competitive Southeast Asian mobile phone market, second only to China in terms of intensity?

Xiaomi's "overseas territory" is expanding comprehensively

To understand Xiaomi's victory in this fiercely competitive market, one must first comprehend its global strategy. Like Transsion, a brand deeply rooted overseas for many years, Xiaomi's overseas expansion did not happen overnight. It is a multi-year, multi-regional sales network built upon local consumption habits.

In 2014, Xiaomi entered the Indian market, firing the first shot in its "go global" strategy. With its unmatched cost-effectiveness and passionate fan community, Xiaomi achieved "one million shipments" within just six months. In 2015, Lei Jun personally attended the Indian launch event for the Xiaomi Mi 4i, and the phrase "Are you OK?" and associated fan-created videos became an endearing label that has accompanied Lei Jun for over a decade.

Image source: Xiaomi

Even during the "SU7 era," Xiaomi collaborated with fan creators to launch derivative products centered around "Are You OK?"—an OK gesture wheel valve decoration.

Relying on the Redmi series' (later renamed Redmi, POCO) advantages in price and configuration, Xiaomi successfully "captured" a vast number of Indian mobile phone users, turning India into its largest single overseas market, ranking first in sales for many years.

After securing the Indian market, Xiaomi used it as a springboard to introduce its cost-effectiveness to Southeast Asian countries like Indonesia, Vietnam, Thailand, and the Philippines. In Q2 2025, Xiaomi shipped 4.7 million units in Southeast Asia, becoming the regional leader with a 19% market share.

Image source: Xiaomi

In the European market, Xiaomi did not replicate the "extreme cost-effectiveness" strategy it employed in India. After all, unlike India, where 4G population coverage is less than 50%, European consumers have higher standards and demands for mobile phones. However, in terms of execution, Xiaomi retained its "fortify and leap" approach; Spain served as Xiaomi's entry point and bridgehead in the European market.

In 2017, Xiaomi entered the Spanish market and began establishing its own sales channels, promoting Xiaomi mobile phones in Europe in a more down-to-earth manner. Meanwhile, overseas giants like Samsung, Apple, and Google did not offer much "localization" adaptation and promotion for the European market, and their product positioning (like Samsung's A series) and promotional strategies closely followed a "global market" approach. It should be clarified that the "global market" mentioned here is not a "one-size-fits-all" solution but rather a neutral and stable solution that "avoids sensitive points worldwide and offends no one."

Image source: Lei Technology

Obviously, such a brand promotion strategy is from a different era compared to Xiaomi's "fan economy." In 2018, Xiaomi opened its first Mi Home in Barcelona, and Lei Technology visited the store and reported in detail on its local store operations. Lei found that these Xiaomi stores not only served as sales terminals but also became display windows for brand image.

Moreover, during the Mobile World Congress (MWC) each year, Xiaomi strengthens its exposure at major locations in Barcelona, leveraging the regional attributes of MWC to enhance its influence in Europe. During the years when the Lei Technology MWC reporting team was in Spain, Xiaomi's presence was easily found in airports, train stations, and even roadside advertising spaces.

Image source: Lei Technology

Relying on Spain's geographical advantages and the performance gap between domestic mid-range phones and overseas mid-range phones, Xiaomi quickly entered the top three in markets like Spain and Italy, and even surpassed Samsung in 2021, successfully topping the Spanish mobile phone market.

Why is Xiaomi selling so well overseas? Is it solely due to its localization efforts?

So, why can Xiaomi excel in Southeast Asia and the European market? In Lei Technology's view, this is primarily due to Xiaomi's efforts in four directions: first-mover advantage, product strength, brand recognition, and sales channels.

We have just discussed the first-mover advantage, so let's set it aside for now. From a product perspective, Xiaomi established a "two-pronged" strategy overseas very early on. On one hand, there are cost-effective models represented by POCO (launched in 2018) and Redmi (independent in 2019), which use the combination of extreme configurations and prices to boost shipments; on the other hand, there are high-end digital flagship and MIX series models that emphasize imaging, performance, and technological innovation.

This combination allows Xiaomi to not only capture a larger share with cost-effectiveness in emerging markets like Indonesia, Vietnam, and Thailand but also establish premium pricing and reputation with Leica imaging in the European market. Furthermore, leveraging Xiaomi's ecological chain, the company has successfully brought the concept of domestic Xiaomi variety stores and "Lei Jun's Magic House" to overseas markets, using headphones, bracelets, and sweeping robots to drive mobile phone sales, which in turn contributes to Xiaomi's "people, cars, and homes" strategy.

Image source: Lei Technology

According to Lei Technology's MWC reporting team's observations in Spain, many overseas users' first Xiaomi product is not a mobile phone but rather an ecological chain product like a bracelet, headphones, or a sweeping robot, before gradually transitioning to mobile phones. This comprehensive brand ecological layout broadens Xiaomi's "entry" into the market, making consumers "once in, deeply immersed in Mi Home."

In terms of channels, Xiaomi has also actively adapted to the regional approaches of the Southeast Asian and European markets: in Southeast Asia, Xiaomi cooperates with e-commerce platforms to maximize the cost-effectiveness advantage through promotions; in the European market, it shifts from the domestic "e-commerce is king" strategy and achieves market penetration through offline retail.

Lastly, there's branding. Instead of following the domestic template, Xiaomi makes "Glocal" (Global+Local) adjustments for the local market: in price-sensitive markets like Southeast Asia, Xiaomi conducts "live clearance sales" on TikTok to maximize the price advantage.

Image source: rocknrollmadridrun

As for the "European battlefield," in 2023, Xiaomi collaborated with the local club Kings League InfoJobs in Spain to strengthen Redmi's brand identity through youth football; in January 2025, Xiaomi became the official sponsor of the Madrid stop of the Zurich Rock 'n' Roll Marathon Series, directly targeting European sports enthusiasts with "precision placement."

Additionally, in Europe, the heartland of global racing culture, Xiaomi has leveraged the SU7 to further enhance its brand image: after proving its strength with undoubted lap times, in May 2025, Xiaomi reached a deep cooperation with the Nürburgring racetrack, known as the "Green Hell," and the "Xiaomi SU7 Ultra Bridge" will appear in every lap of on-board footage at the Nordschleife, showcasing Xiaomi's capabilities to racing fans worldwide.

What insights does Xiaomi bring as domestic mobile phone brands go overseas?

From Southeast Asia to Europe, Xiaomi has gradually thickened its market presence and strengthened its brand. Looking back, its overseas growth path can almost be summarized as a complete "methodology for going overseas," which is also the most valuable "textbook" for domestic mobile phone brands to refer to:

First, marketing methods must keep pace with the times. From initially relying on extreme cost-effectiveness to boost sales volume to now skillfully using short video e-commerce platforms like TikTok Shop to clear inventory, Xiaomi has proven with actions that going overseas is not about "copying domestic experience abroad" but rather keeping up with overseas user habits and communicating with them through channels and content methods they are familiar with.

Secondly, localization, the "Glocal" (Global+Local) emphasized multiple times earlier, cannot just be a slogan nor like the previous "global models" that delusionally believed "one approach fits all global markets."

Image source: Lei Technology

Consumers in different regions have varying perceptions and views on brands and products. Even in China, a single market, several "mobile phone fan circles" can be differentiated, not to mention the nearly 6.9 billion people in overseas markets. Only by delving deep into the region and understanding users can brands find product strategies and marketing techniques that truly suit the local area. Only by being close to consumers can brands establish a true affinity.

Finally, there's the upgrading of brand positioning: Xiaomi emerged early with "cost-effectiveness" but did not stay within the red ocean of price competition. Instead, it gradually transformed towards a direction driven by technological innovation. The improvement in imaging capabilities brought by the collaboration with Leica and the continuous breakthroughs in performance brought by the collaboration with Qualcomm have allowed Xiaomi to shed the single label of "only competing on price" and gradually establish its own technological image in overseas markets.

Image source: Lei Technology

This layered approach has allowed Xiaomi to complete its transformation from a "Samsung substitute" to a "pioneer in the mobile phone industry." In Lei Technology's view, Xiaomi's overseas story is not just a victory in terms of sales volume but also an upgrade of China's mobile phone industry's business card.

Amidst a global economic slowdown and unpredictable tariffs, competition in the smartphone market will inevitably intensify. Xiaomi has already proven itself with market performance, so who will be the next "Xiaomi"?

Source: Lei Technology

Images in this article are from: 123RF Licensed Library