vivo's Vision: Innovating Beyond Apple's Flop

![]() 08/26 2025

08/26 2025

![]() 539

539

By Ma Teng

Marking its 30th anniversary, vivo unveiled its inaugural mixed reality headset, the vivo Vision Explorer Edition. This cutting-edge product instantly garnered significant buzz within the tech industry. With its featherweight design of 398 grams, unparalleled dual 8K resolution, and seamless eye-hand interaction, vivo Vision presents an astonishingly refined product.

However, this "Apple-inspired" product undeniably reflects the influence of Apple's Vision Pro, including the latter's unresolved challenges of limited content and application scenarios. During the prototype trials, despite basic functionalities like movie watching, gaming, and spatial photo albums, a groundbreaking "killer app" that revolutionizes productivity remains elusive.

The launch of vivo Vision appears as a meticulously planned "catch-up" strategy. It has thoroughly absorbed Apple's technological approach and interaction philosophy while addressing shortcomings in wearability and pricing.

When Apple Vision Pro, expensive and cumbersome, met with lukewarm global sales, becoming "Apple's biggest flop," can vivo, a pragmatic follower, circumvent the same pitfalls and even surpass its predecessor through this "pixel-level" imitation and enhancement? This not only tests vivo's acumen but also serves as a pivotal exploration for the future trajectory of the entire MR industry.

Feeling the Stones: A "Pixel-Level" Benchmark and Refinement

"Feeling the stones" is a common strategy employed by Chinese enterprises in technological advancement. In the sparsely populated MR headset landscape, Apple's Vision Pro stands as the largest and clearest "stone." vivo's Vision Explorer Edition, released this time, is an exemplary practice of "feeling Apple's stones," deeply mirroring Apple's product philosophy and technical approach.

In terms of technology, vivo has opted for the "VST (Video See-Through)" solution, akin to Apple's. Over the past two years, two paths have emerged for smart wearable devices: lightweight AI glasses, exemplified by Meta Ray-Ban, focusing on AI voice interaction and photography, and immersive headsets, represented by Vision Pro, utilizing VR with camera see-through technology to achieve MR experiences. vivo chose the more intricate and immersive MR headset route, acknowledging and continuing Apple's strategic direction.

In terms of core interaction, vivo has replicated Apple's "eye tracking + gesture" solution. Unlike mainstream VR devices like Quest and PICO, which rely on controllers, vivo Vision eschews physical controllers entirely. It is equipped with up to 11 cameras, both inside and outside, with internal lenses for precise eye tracking and external lenses for gesture capture. Users can simply "look and point" with their eyes and hands, select targets through eye movements, and confirm with a gentle thumb and index finger pinch. This intuitive interaction, which impressed during Vision Pro's launch, has been successfully transplanted by vivo, achieving exceptional fluidity and precision.

In terms of hardware specifications and initial applications, the two devices are highly convergent. vivo Vision boasts top-tier Micro-OLED screens, achieving dual 8K resolution on par with Vision Pro, powered by Qualcomm's cutting-edge Snapdragon XR2+ Gen 2 platform. Its initial demonstrated applications are nearly identical to Vision Pro's: a 120-inch equivalent giant screen for movie watching, immersive spatial photos and videos, a multi-window office interface, and seamless streaming and screen mirroring with mobile phones and PCs.

However, vivo is not merely copying; it's making precise, "surgical" improvements on user pain points. The core improvement lies in wearability.

Apple Vision Pro's weight of 600-650 grams and poor center of gravity design make it feel burdensome, turning prolonged wear into a torture, which significantly contributed to its poor sales and low usage rate. In contrast, vivo has kept the body weight at 398 grams, comparable to a pair of over-ear headphones. Through lighter materials, optimized structural design, and shades tailored for Chinese face shapes, vivo Vision offers superior wear comfort, providing a "dimensionality reduction attack" on Vision Pro.

Another pivotal improvement is pricing. With a starting price of nearly 30,000 yuan in China, Vision Pro has become a "luxury toy" for a niche audience of geeks and developers. Hu Baishan, vivo's Executive Vice President, has clearly stated that vivo Vision's future target pricing is "around 10,000 yuan or even lower." By leveraging mature mobile phone supply chains, vivo aims to keep MR headset costs within a reasonable range, thereby tapping into a broader consumer market.

Apple's Dilemma and vivo's "Ace in the Hole"

Benchmarking and refining at the product level is just the first step in vivo's "feeling Apple's stones" strategy. Deeper down, it reflects vivo's profound understanding of the reasons behind Apple Vision Pro's struggles and the differentiated strategic "ace in the hole" it has prepared.

Apple Vision Pro's failure stems from a disconnect between "expectations and reality."

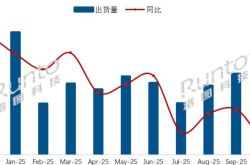

Since its launch, Vision Pro's sales have significantly lagged behind expectations, with shipments in the US market "far below 1 million units." Its core dilemma is that Apple positioned it as the "next revolutionary computing platform" after the iPhone but failed to deliver a groundbreaking "killer app." Currently, the visionOS ecosystem hosts fewer than 2,000 apps, most of which are simple ports of existing iPad apps. The anticipated "immersive video" content library is also sparse, and Apple has deliberately slowed down its own immersive content due to sales concerns.

This has trapped Apple in a vicious cycle: insufficient content fails to attract users, and a small user base discourages developers and content creators from investing in ecosystem development. Ultimately, this 30,000-yuan device has become a "high-end movie viewer" for most users.

Can vivo succeed where even Apple has faltered in this "content dilemma"?

vivo's advantage lies in its pragmatic approach, long-term strategic patience, and differentiated target positioning. As an "Explorer Edition," vivo Vision is not publicly available but is extensively tested in flagship stores across over ten cities to gather user feedback. vivo executives have stated that the company will take 2-3 years to refine a truly mature consumer-grade product. This "experience first, market later" approach avoids the pitfalls of prematurely launching immature products and ecosystems, as seen with Apple.

Furthermore, vivo has envisioned a broader strategic goal for MR headsets beyond being a "personal entertainment device" – to serve as the "eyes" and "brain" of home robots. This is perhaps the most noteworthy "deep narrative" of vivo's entire conference. In an interview, Hu Baishan, vivo's Executive Vice President, clearly stated that while the short-term value of MR devices lies in meeting users' demand for immersive large-screen experiences, their long-term strategic value is in providing core visual perception and spatial interaction capabilities for vivo's under-development home robots.

This strategic positioning radically transforms the value assessment of vivo Vision. It no longer bears the weighty mission of "overthrowing smartphones" like Vision Pro. Its core task is to accumulate core technologies and data for vivo in areas such as spatial computing, environmental perception, and human-computer interaction through extensive user experience and data collection, ultimately empowering the more imaginative embodied intelligence sector. One of the biggest challenges currently facing the robotics industry is the lack of real-world training data, and MR headsets offer an excellent solution.

From this perspective, the launch of vivo Vision is not merely about securing a share in the MR market but a strategic move that "kills two birds with one stone": it positions itself in the next-generation computing platform in consumer electronics while paving the way for a longer-term robotics strategy.

vivo Vision's debut has injected new life into the dormant MR market. It has ingeniously learned from Apple's pioneering advantages while adeptly avoiding its mistakes.

However, the towering "content ecosystem" hurdle remains formidable for all players. vivo's answer is to "leap over the mountain" and anchor MR's value in the long-term future of robots. This strategic concept is undoubtedly ingenious, offering sufficient patience and fault tolerance for the product's initial development. Yet, whether vivo Vision truly succeeds may hinge not on itself but on whether the grander "dream of robots" it carries can materialize in the next 5 to 15 years.