Can Hongmeng Challenge Android and iOS for Market Supremacy?

![]() 09/09 2025

09/09 2025

![]() 521

521

Introduction: Yu Chengdong's Vision of a 'Three-Way Split' and Huawei's High-Stakes Bet

Hongmeng OS Surpasses 10 Million User Milestone

Recently, Yu Chengdong announced at the autumn new product launch event for Luxeed and Aito that the number of devices running HarmonyOS 5 has exceeded 12 million.

This figure soared from 10 million to 12 million in just 25 days.

Industry analysts note that Hongmeng OS has now cleared a critical survival threshold and is poised to compete directly with Android and iOS.

The latest Hongmeng 5.0 officially launched commercially in October 2024, with Huawei's foldable-screen Pura X—released in March of the same year—being the first device to adopt the system.

Since its debut, user feedback has been mixed.

Some praise its seamless performance as a symbol of Chinese innovation, while others criticize its frequent bugs, dismissing it as a "rebranded Android."

Internally, Huawei has pinned high hopes on this "pure Hongmeng." Yu Chengdong has repeatedly vowed to take Hongmeng global, claiming it will "capture one-third of the global market."

The question remains: How transformative is Hongmeng 5.0, and can it truly rival Android and iOS?

I. The Emergence of a Third OS

For many, Hongmeng OS may seem comparable to Xiaomi's HyperOS or Honor's Magic OS, all perceived as Android-based optimizations.

This perception stems from Hongmeng's earlier "dual-framework" approach, which maintained Android compatibility.

However, starting with Hongmeng 5.0, the system has fully decoupled from Android, adopting a "single-framework" model and becoming China's first fully independent mobile OS.

Achieving this milestone was challenging, but the greater hurdle lies in market adoption and gaining share.

The global mobile OS market is nearly monopolized by Android and iOS, with a combined share exceeding 90%.

This dynamic mirrors WeChat's dominance in China's social app market: even if competitors launch superior apps, displacing WeChat is nearly impossible.

Similarly, in the mobile OS arena, users and developers tend to cluster around the dominant platform, creating a "winner-takes-all" effect.

Once an ecosystem stabilizes, even a formidable challenger like Huawei faces an uphill battle.

Moreover, in an era of specialized global supply chains, participating in established systems offers low costs, high returns, and predictability, making it difficult for companies to disrupt mature markets without compelling incentives.

Objectively, U.S. sanctions have accelerated Huawei's push for self-reliance.

First, post-sanctions, Huawei struggles to secure advanced chips in the short term. With outdated hardware, optimizing software performance becomes critical.

Relying on Android, which prioritizes broad compatibility over precision, is no longer viable.

Huawei engineers note that up to 10 million lines of Android's open-source code may be redundant or ineffective for a single device.

This mismatch between Huawei's needs and Android's design accelerated its decision to break away.

Second, sanctions have heightened developers' willingness to explore alternatives, as all stakeholders worry: "What if Android becomes unavailable?"

Though unlikely, this risk has spurred both public and private sectors to consider contingency plans.

DingTalk CTO Babu revealed discussions with industry experts and government leaders, including Chinese Academy of Engineering academician Ni Guangnan, all advocating for domestic OS development.

Even without Hongmeng, a fully independent Chinese OS would likely emerge eventually.

When DingTalk adapted to Hongmeng OS, its team leader predicted it might prevent a "fourth OS" from entering the market.

Adapting to multiple systems is resource-intensive; since a "third OS" is inevitable, early adoption is strategic.

Furthermore, the rise of AI agents and the trend toward device interconnectivity demand deeper integration among hardware, chips, and operating systems.

Launching a self-developed OS could accelerate Huawei's growth in the IoT sector.

If Hongmeng OS succeeds in rivaling Android and iOS, Huawei's influence in the premium market will strengthen.

Conversely, Xiaomi, Honor, and OPPO/Vivo will face greater challenges in catching up.

According to Tianyancha APP, among these smartphone giants, only Xiaomi is publicly listed.

If Hongmeng matures, developers—including giants like Alibaba and Tencent—will have little incentive to adapt to a "fourth OS."

In this scenario, OPPO/Vivo must either remain within the Android ecosystem, acting as "Android's followers," or collaborate with Huawei to join the Hongmeng ecosystem.

Choosing the former limits differentiation, while the latter amplifies Huawei's advantages.

Of course, this hinges on Hongmeng OS being a viable alternative to Android.

Currently, this goal remains distant.

Multiple media outlets have reported widespread user complaints about Hongmeng 5.0, including missing features in apps like WeChat and Douyin, fingerprint recognition failures in niche apps, and frequent crashes.

Additionally, some users have switched devices due to the limited selection of Hongmeng-compatible software.

While surpassing 12 million devices is notable, it is merely the first step in challenging Android and iOS.

II. How Close Is the 'Three-Way Split'?

As mentioned earlier, U.S. sanctions have spurred developers to adapt to Hongmeng, with over 5,000 mainstream apps now available in Hongmeng versions.

However, this pales in comparison to Android's ecosystem of millions of apps. Huawei's rotating chairman, Xu Zhijian, stated at the Hongmeng Conference that "100,000 apps are a milestone for the Hongmeng ecosystem to meet consumer needs."

Scaling up remains a challenge for Hongmeng OS.

The difficulty lies in the mobile OS's typical two-sided effect: a rich software ecosystem retains users, but a large user base attracts more developers.

The same applies to system iteration; only with a substantial user base providing feedback can software rapidly optimize and enhance the user experience. However, initial functional deficiencies make attracting users difficult.

This is essentially a "chicken or egg" dilemma.

Major firms like Alibaba, Tencent, and ByteDance have the resources to collaborate with Hongmeng even at a small scale.

However, small and medium-sized developers, particularly those in niche markets, are reluctant to take risks without clear prospects.

In response, Hongmeng has implemented two strategies. First is the "1+8+N Strategy," enabling multi-terminal operation and deployment across phones, tablets, computers, and other devices through a single codebase, breaking away from the traditional approach of developing separate OS alternatives for each platform.

This significantly reduces developers' overall adaptation costs and accelerates Hongmeng's deployment across diverse device types.

Second, Huawei has introduced a series of optimization policies through its ecosystem, such as providing traffic resources, cash support, and actively collaborating with third-party training institutions to offer free Hongmeng developer training.

While these measures may boost small and medium-sized developers' enthusiasm to some extent, expanding the user base remains a challenge.

Huawei might draw inspiration from Apple's past strategies in this regard.

In the late 1990s, Adobe grew by developing software for Windows.

In 1999, Steve Jobs requested Adobe to adapt to Mac OS, but Adobe declined, citing Mac's smaller ecosystem and lower return on investment compared to Windows.

However, to Adobe's surprise, Mac's ecosystem quickly attracted a cohort of loyal, high-value users with strong willingness to pay, leading to rapid ecosystem growth.

Eventually, Adobe chose to adapt to Mac.

Hongmeng's current situation resembles Mac OS's early days, with a smaller scale but high user value.

In August 2023, the Mate 60 series quietly launched without prior announcement or promotion. Within an hour, the news spread globally after being reported by China's first media outlet.

That same year, Huawei's global high-end smartphone market share increased by 2%.

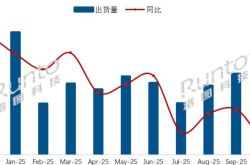

According to Canalys data, in the second quarter of 2025, Huawei regained the top market position with 12.2 million shipments, capturing an 18% market share.

These figures demonstrate Huawei's highly loyal user base.

Thus, Hongmeng can follow Mac's example, continuously iterating and refining the user experience based on its existing users and mainstream applications, thereby attracting more high-value users.

An increase in high-value users will naturally attract more developers, creating a positive feedback loop.

Unfortunately, Hongmeng 5.0 may not have perfectly executed the first step—ensuring a flawless experience for limited mainstream applications.

Issues like "WeChat's location feature not working," "Douyin's live streaming tools malfunctioning," and "JD.com's barcode scanning not working" should not frequently occur on Hongmeng OS.

Given Huawei's focus on high-end products, such functional deficiencies are even more inexcusable.

If not promptly addressed, Hongmeng OS risks not only failing to attract new users but also losing existing ones.

Had Mac OS frequently made basic errors when running Office, it would never have enticed Adobe to return.

Perhaps these issues are temporary. If Hongmeng can ultimately resolve these flaws and mature, its value and prospects will be immense.

Hongmeng's uniqueness lies in its interconnectivity across devices; it was not designed solely for phones but can integrate various scenarios like in-car systems, smartwatches, and PCs—a capability lacking in Android and iOS, which primarily focus on mobile devices.

Overall, chip constraints have strengthened Huawei's resolve to develop its own OS, while concerns over relying solely on smartphone sales to drive new system adoption have accelerated Hongmeng's interconnectivity progress.

Every cloud has a silver lining; the pain of sanctions may ultimately yield benefits.

However, whether Hongmeng OS can withstand market scrutiny and gradually grow remains to be seen over time.

Disclaimer: This article is based on legally disclosed company information and publicly available data, offering commentary. However, the author does not guarantee the completeness or timeliness of this information.

Additional Note: Stock market investments carry risks; enter with caution. This article does not constitute investment advice; investors must conduct their own due diligence.