Xiaomi Auto’s Revenue Outstrips That of Smartphones: Lei Jun Hits the Jackpot Once Again!

![]() 09/11 2025

09/11 2025

![]() 655

655

Authored by Wang Xin, Edited by Yang Lingxiao, Presented by Electric New Species

Recently, an automotive blogger disclosed that, for the first time, Xiaomi Auto's weekly revenue in China has surpassed that of its smartphones.

To be specific, during the 35th week of 2025 (from August 25 to August 31), Xiaomi Auto delivered 11,880 vehicles, with estimated revenue exceeding 3.5 billion yuan. In the same week, Xiaomi's smartphone revenue in China was eclipsed.

Since the official launch of its inaugural model, the SU7, in 2024, Xiaomi Auto has achieved remarkable milestones. By July 2025, monthly deliveries exceeded 30,000 units and maintained this level in August, accomplishing this feat in less than two years.

Lei Jun once remarked that venturing into car manufacturing was his “final entrepreneurial endeavor,” even pledging his reputation on it. Now, it seems this high-risk gamble is yielding substantial rewards. A company renowned for smartphones is swiftly transforming its “secondary venture” into its “primary business.”

01 How Did Xiaomi Auto Accomplish This “Overtaking”?

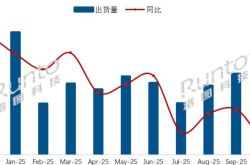

Xiaomi Auto's ascent has surpassed most expectations. In August 2025, its monthly deliveries exceeded 30,000 units for the second consecutive month, with cumulative deliveries from January to August surpassing 270,000 units. Analysts predict that Xiaomi's annual deliveries could reach between 400,000 and 420,000 units, significantly exceeding the original internal target of 350,000 units.

Behind these high delivery volumes lies robust demand. Currently, the estimated delivery time for the Xiaomi SU7 series ranges from 34 to 41 weeks, while the newly launched SUV model, the YU7, requires a wait time of 41 to 58 weeks.

Another pivotal factor contributing to the revenue surpassing that of smartphones is the “unit price.” The Xiaomi SU7 Ultra is priced at over 500,000 yuan, while the standard version starts at above 200,000 yuan. In the second quarter of 2025, the average selling price (ASP) of Xiaomi Auto reached 253,700 yuan, marking a 10.9% year-on-year increase. In contrast, the ASP of Xiaomi smartphones was merely 1,073 yuan.

In simpler terms, the profit generated from selling one car is equivalent to that from selling 5,600 smartphones. This disparity places them in entirely different categories.

02 Smartphones Remain Central, but Automobiles Are the New Growth Driver

Despite the rapid expansion of its automotive business, smartphones continue to serve as Xiaomi's cornerstone. From January to July 2025, Xiaomi held approximately 17% of the domestic smartphone market share, ranking among the top three. In the second quarter, new Xiaomi smartphone activations reached 11.5 million units, with a market share of 16.8%, securing the top spot in China.

However, the reality is that the smartphone industry faces clear growth constraints and intense competition. In the second quarter of 2025, affected by Huawei's strong resurgence and industry price wars, Xiaomi's smartphone revenue declined slightly by 2.1% year-on-year, while gross margins dropped from 12.4% to 11.5%.

The automotive sector presents a different scenario. In the second quarter of 2025, Xiaomi earned a gross profit of 69,000 yuan per car sold, equivalent to the profit from selling 5,600 smartphones.

Furthermore, while the automotive business has not yet achieved overall profitability, losses are diminishing rapidly: from a loss of 500 million yuan in the first quarter to just 300 million yuan in the second quarter. Xiaomi anticipates achieving monthly or quarterly profitability in the second half of this year.

03 The “Human-Vehicle-Home Ecosystem” Is Becoming a Tangible Reality

Xiaomi Auto's success extends beyond the automotive products themselves; it lies in the comprehensive ecological closed loop it has constructed.

From smartphones and home appliances to automobiles, Xiaomi is forging a seamless ecosystem. The car is no longer an isolated entity but a vital component of the “human-vehicle-home” ecosystem. The SU7 can seamlessly integrate with Xiaomi's home devices, offering an experience that traditional automakers or smartphone companies with single-business models cannot replicate.

Ecological synergy is also evident in channels and services. By the end of August, Xiaomi Auto had established 370 stores across 105 cities in China, with service networks covering 189 cities. Leveraging its existing brand influence and user base, Xiaomi swiftly established an automotive sales and service system.

Looking ahead, AI has emerged as the linchpin connecting all businesses. Xiaomi's self-developed large model, Xiaomi MiMo-VL-7B, has excelled in multiple evaluations, and its AI glasses continue to enjoy strong sales. AI not only enhances smartphones and home appliances but also serves as the cornerstone of intelligent driving and automotive interactions.

Lei Jun has emphasized that AI is the “most critical strategy,” and automobiles represent one of the best scenarios for AI implementation.

Summary

Overtaking Triumph: Xiaomi Steps into the “Automotive Era”

Xiaomi Auto surpassing smartphones in weekly revenue marks a historic milestone. It signifies not merely another profitable venture for Xiaomi but also reflects a strategic transformation for the tech giant: from mobile internet to smart electric vehicles, and from device manufacturing to ecosystem construction.

Smartphones remain Xiaomi's foundation. However, it is evident that Lei Jun has placed his future bets on automobiles and AI. In the second half of 2025, with new factories coming online and production capacity expanding further, Xiaomi Auto's deliveries could potentially double. Once it achieves scalable profitability, Xiaomi will truly enter the “automotive-driven” era.

Reflecting on the past, Lei Jun's bold declaration about “staking his lifetime reputation” now appears far from mere rhetoric. In his final entrepreneurial venture into car manufacturing, he has indeed made a shrewd move.