iPhone 17 Unveiled, 134 Apple Supply Chain Concept Stocks See Heightened Activity

![]() 09/12 2025

09/12 2025

![]() 735

735

The 'Most Genuine' Generation of iPhone Makes Its Debut.

At 1 a.m. Beijing time on September 10, Apple hosted its autumn new product launch event, introducing four models: iPhone 17, iPhone Air, iPhone 17 Pro, and iPhone 17 Pro Max.

Among these, the newly launched lightweight iPhone Air is approximately 5.6mm thick and weighs just 165 grams, making it the thinnest iPhone ever released.

Regarding pricing, the iPhone 17 series did not experience a price hike as anticipated by the industry. Instead, the base version offers 'more value for the same price,' with the lowest configuration upgraded to 256GB, priced 1,000 yuan less than the previous 256GB model.

Additionally, the iPhone Air starts at 7,999 yuan; the iPhone 17 Pro at 8,999 yuan; and the iPhone 17 Pro Max at 9,999 yuan. The new top-tier 2TB storage version can reach a maximum price of 17,999 yuan.

These models will be available for pre-order starting at 8 p.m. on September 12 and will officially go on sale on September 19.

In terms of sector performance, the Apple concept remains highly sought-after. Foxconn Industrial Internet (601138.SH), a key player in the Apple supply chain, witnessed its stock price gap up and hit the daily limit again near noon, reaching 53.67 yuan per share with a total market capitalization of 1.07 trillion yuan.

Eton Electronics (603328.SH) also hit the daily limit, while Jay Optoelectronics (688025.SH), Vacuum Tech (301392.SZ), Wanghua & Qingsong (603256.SH), and Bogie (002975.SZ) were among the top performers.

The Supply Chain 'Reacts'

From the perspective of industry observers, every new move by Apple sends ripples through the entire supply chain, and this occasion is no different. From chips to screens, from assembly to software, every link in the Apple supply chain may see new growth opportunities.

As a benchmark in global technology manufacturing, the Apple supply chain is underpinned by a precise collaboration network spanning over a dozen fields and involving hundreds of core suppliers.

Among them, the upstream sector controls 'key raw materials + core IP'; the midstream sector manufactures 'components + modules'; and the downstream sector is responsible for 'final assembly + global distribution'.

Prior to this autumn's launch event, Apple delivered a robust quarterly financial report, achieving its largest single-quarter revenue growth since December 2021. The primary driver was the surge in iPhone sales, with 'national subsidy' policies in certain regions of China significantly boosting the company's product sales and directly reversing the declining trend in its Greater China business over the previous two quarters.

The latest news indicates that Apple plans to produce approximately 100 million iPhone 17 series units in 2025, surpassing the initial estimate of 90 million units for the previous iPhone 16 series.

Goldman Sachs analysts anticipate that the iPhone 17 series will effectively motivate users with older devices to upgrade, estimating that it will drive Apple's iPhone business revenue to achieve year-on-year growth of 5% and 7% in fiscal years 2025 and 2026, respectively.

It is reported that currently, Foxconn's Zhengzhou Airport zone is ramping up production for the iPhone 17 series, with the factory entering its busiest period of the year and a surge in demand for temporary workers.

Core Concept Stocks See Heightened Activity in Advance

It can be said that the birth of every iPhone is a celebration of technological innovation and a game of interest for the global supply chain.

Public information reveals that since Apple announced the date of its autumn launch event, the overall A-share Apple supply chain has strengthened. Since the third quarter, over ten Apple supply chain companies, including Foxconn Industrial Internet, Crystal-Optech, Dongshan Precision, Avary Holding, and Unimicron, have received intensive visits from over 50 institutions.

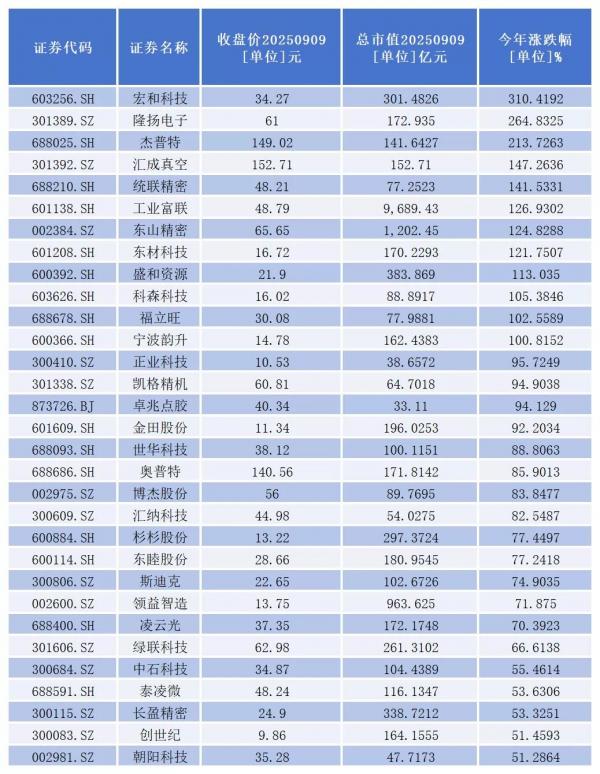

According to Flush data, there are currently a total of 134 Apple concept stocks in the A-share market. From an industry distribution perspective, based on the Shenwan Level 1 industry classification, they cover 13 major fields: electronics, machinery and equipment, non-ferrous metals, electrical equipment, basic chemicals, communications, trade and retail, media, computers, building materials, transportation, household appliances, and social services.

Among them, electronics, machinery and equipment, and non-ferrous metals rank in the top three, accounting for 44.0%, 26.1%, and 7.5%, respectively.

From a secondary market performance perspective, as of the close on September 9, 31 listed companies have seen their share prices rise by more than 50% this year. Among them, 12 listed companies, including Wanghua & Qingsong, Longyang Electronics, Jay Optoelectronics, Vacuum Tech, Tonly Electronics, Foxconn Industrial Internet, Dongshan Precision, Dongcai Technology, Shenghe Resources, Kersen Technology, Fuliwang, and Ningbo Yunsheng, have successfully doubled their share prices.

From today's trend, Dongshan Precision hit the daily limit, with the stock hitting the daily limit six times in the past year. It is reported that the company is Apple's second-largest supplier of flexible printed circuits (FPC) and provides FPCs for the iPhone 17 series. FPCs are crucial components in electronic products, and as Apple products upgrade, the demand and requirements for FPCs increase. The company is expected to benefit from its technological and supply capabilities. In the first half of the year, the company's revenue reached 16.955 billion yuan, and its net profit attributable to shareholders was 758 million yuan, representing year-on-year growth of 1.96% and 35.21%, respectively, with a significant improvement in profitability.

According to previous disclosures, Dongshan Precision plans to invest no more than $1 billion in the construction of a high-end printed circuit board project, focusing on emerging scenarios such as AI servers and high-speed computing, with capacity expected to be released in batches over the next 2-3 years. Additionally, the company plans to acquire 100% of Solus Advanced Technologies through its wholly-owned subsidiary Hong Kong Chaoyi, entering the field of optical communication modules and components, with the project progressing smoothly.

Foxconn Industrial Internet hit the daily limit today, with the stock hitting the daily limit 11 times in the past year. According to public information, the company undertakes the final assembly of traditional iPhone models and foldable screen models, provides precision structural components for the iPhone 17, and also manufactures high-end AI servers for Apple's AI infrastructure, with significant scale advantages. In the first half of the year, the company achieved revenue of 360.76 billion yuan and net profit attributable to shareholders of 12.113 billion yuan, representing year-on-year growth of 35.58% and 38.61%, respectively.

Notably, Luxshare Precision stands out. As the core contract manufacturer for Apple's full range of products, it participates in the production of the entire iPhone 16 series, Apple Watch Series 10, etc., with significant advantages in final assembly and multiple business segments. According to multiple media reports, Luxshare Precision has surpassed Foxconn, securing 45% of the final assembly share for the iPhone 17 series and becoming the largest contract manufacturer.