Domestic Phones in a Quandary: Apple’s Sales Soar by 47%, Seizing the Crown in the Indian Market?

![]() 11/12 2025

11/12 2025

![]() 343

343

For quite some time, the Indian market has been colloquially dubbed the “backyard” for domestic smartphones.

The rationale behind this moniker is that domestic smartphone brands made an early foray into the Indian market, essentially establishing a stronghold and dominating the landscape.

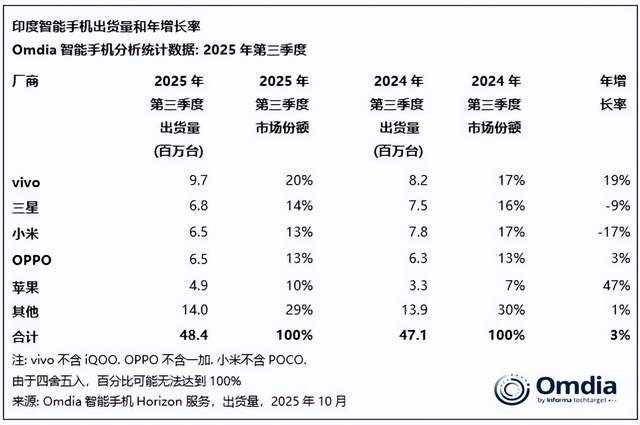

Previous data indicates that domestic smartphones have secured over 70% of the market share in India, with brands like Xiaomi, OPPO, VIVO, and Tecno reigning supreme.

Even industry giants like Samsung have found themselves struggling to keep pace in the Indian market, unable to outcompete domestic smartphones. Apple, in particular, has faced significant challenges in India, given the market's relative economic constraints, which make its premium products less accessible to the majority of consumers.

Against this backdrop, domestic smartphone manufacturers have increasingly turned their attention to India, aiming to capitalize on its vast potential and the world's largest population to solidify their presence and truly claim it as their “backyard.”

However, to their dismay, India's subsequent “predatory” tactics targeted domestic smartphones for exploitation. Initially, India launched a series of investigations into Xiaomi, OPPO, and VIVO, freezing bonuses and imposing hefty fines. Later, it introduced policies aimed at seizing assets and technology, effectively preventing domestic smartphone manufacturers from repatriating their Indian earnings.

Meanwhile, India sought manufacturers capable of challenging domestic brands and turned its attention to Apple, initiating cooperation to encourage Apple to establish factories in India. Apple, eager to tap into a promising market, readily agreed and made the move to India.

On one hand, Apple built factories in India, ramping up local iPhone production, which now accounts for approximately 15-20% of global output. Even all iPhones destined for the US market are now supplied from India.

On the other hand, establishing factories in India also endeared Apple to Indian consumers, leading to a growing appreciation for the brand.

Recently, an agency released the smartphone market share rankings for the third quarter of 2025, based on sales figures. The data reveals that Apple, with 28% of sales, has claimed the top spot in the Indian market.

In terms of revenue alone, India has become Apple's third-largest single smartphone market, trailing only the US and China.

Of course, when it comes to sales volume, Apple ranks fifth with a 10% share. However, due to the high unit price of Apple phones, selling one iPhone can be equivalent to selling two or even several domestic phones, resulting in substantial sales revenue despite a lower sales volume.

As illustrated below, this is the sales volume ranking. Apple holds only a 10% share, but its high average price propels its sales revenue far beyond that of VIVO, which ranks first, and also surpasses Samsung, which ranks third.

One wonders if domestic smartphone manufacturers are feeling the heat and the embarrassment?

After years of toil in India, Apple has managed to break into the top five in sales with a single push and directly claimed the top spot in sales revenue, effectively overshadowing all domestic smartphones.

Looking ahead, will domestic smartphone manufacturers continue to compete in India? Failing to do so may allow Apple to catch up or even surpass them, while continuing may lead to further exploitation by India, leaving them in a precarious position.