The Hidden Risks Lurking Behind Mingming Manlang's Hong Kong Stock Market Push

![]() 11/14 2025

11/14 2025

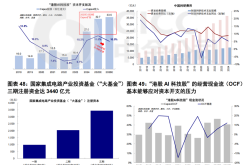

![]() 340

340

Hunan Mingming Manlang Business Chain Co., Ltd., which has filed its IPO application with the Hong Kong Stock Exchange for the second time, is striving to enter the capital market as “China's largest casual food and beverage chain retailer”. Based on the post - hearing materials submitted to the Hong Kong Stock Exchange, by the end of 2024, the company's total number of stores had surpassed 14,394, covering most county - level administrative regions across 28 provinces in China. In 2024, it achieved a Gross Merchandise Volume (GMV) of approximately RMB 55.5 billion, with further growth to about RMB 41.1 billion in the first half of 2025.

However, it's of utmost importance to note that GMV represents the total consumer spending at stores, while the revenue confirmed in the company's financial statements is merely the shipment volume of wholesale goods to franchisees and directly - operated stores. According to the prospectus, the actual revenue in 2024 is estimated to fall within the range of RMB 11 - 12 billion. The significant difference between the two figures should not be overlooked.

Despite its rapid expansion, Mingming Manlang still grapples with multiple challenges in compliance operations, profit sustainability, governance structure, and market competition. This IPO battle for the title of “first snack retailer” is, in essence, a test of the resilience of its business model.

The Fragile Balance Behind the Scale Myth: The Vulnerability of the Low - Profit Model

Mingming Manlang's growth narrative has always centered around “scale”. Between 2022 and 2024, its number of stores soared from fewer than 5,000 to 14,394, with an average of roughly 21 new stores opening daily, setting an industry benchmark. In September 2025, it became the first company in the industry to exceed 20,000 stores.

Nevertheless, this scale expansion has not translated into enhanced profit quality. The prospectus reveals that in 2024, the company's overall gross profit margin remained in the range of 7.5% - 7.6%, with a net profit margin of approximately 2.1%. This implies that for every RMB 100 in operating revenue, only about RMB 2 in net profit was retained.

This level is markedly lower than that of traditional retail companies. A horizontal comparison is as follows:

Wanchen Group (01783.HK): In 2024, its overall gross profit margin was 10.8%, and the net profit margin was about 1.5% (Source: Wanchen Annual Report);

Catering chains such as ChaBaiDao and Hushang Ayi: Gross profit margins generally range from 25% - 35%;

International benchmark Dollar General (Dollar Tree): Relying on a high proportion of private - label products, it has a gross profit margin exceeding 30%.

The core of Mingming Manlang's low - profit model lies in extreme operational efficiency. Inventory turnover days have been compressed to about 11.6 days, far outperforming industry competitors like Bestore (about 30 days). However, if the “accounts receivable turnover rate exceeding 200 times” is accurate, it indicates a collection period of less than 2 days, which is extremely challenging to achieve in a system with thousands of franchisees. There may be an issue with the statistical caliber (measurement standards), which needs to be verified after the disclosure of the complete financial report.

More concerning is the highly concentrated revenue structure. 99.5% of revenue comes from wholesale sales of goods to franchisees and directly - operated stores, while other income such as franchise fees and system service fees accounts for less than 0.5%. Profit sources are highly dependent on commodity price differentials. In 2024, sales and marketing expenses reached RMB 177 million (up from RMB 42 million in 2022), primarily used for brand promotion and franchise recruitment.

On the other hand, franchisees must bear all store operating costs and there is no profit - sharing mechanism. An anonymous franchisee in a county in Jiangxi Province admitted, “The headquarters requires a minimum monthly purchase of RMB 120,000 in goods to qualify for rebates, but the local population is less than 50,000. We often have excess inventory. I closed one store last year and opened another this year—it's all a gamble.”

If supply chain costs or consumer price sensitivity fluctuate by 1% - 2%, the company may approach the breakeven point.

Compliance Red Lines: Regulatory Concerns Surrounding Dual - Brand Operations and Franchise Expansion

In November 2023, “Snack Very Busy” and “Zhao Yiming Snacks” completed a strategic merger to form the “Mingming Manlang” Group, adopting a dual - brand parallel strategy. Although the two brands nominally retain independent names and visual identities, their procurement, warehousing, and logistics systems are highly integrated in practice. With approximately 58% of stores located in county and township markets, consumers may experience cognitive confusion due to the similarity in product mix, pricing strategies, and promotional messaging.

The China Chain Store & Franchise Association (CCFA) warned in its 2025 “Franchise Compliance White Paper” that “if the substantive merger of dual brands is not fully disclosed, it may mislead consumers and potentially violate Article 8 of the Anti - Unfair Competition Law.”

The Hong Kong Stock Exchange has focused its review of the second IPO application on the consistency of financial data consolidation and brand independence after the merger. Additionally, by 2024, the company's number of franchisees had reached 7,241, more than sixfold growth from 2022. Some franchise contracts require franchisees to pay a security deposit of RMB 50,000 - 80,000 and commit to a minimum first - year purchase volume of RMB 800,000. Such terms, if deemed “disguised compulsory transactions,” may violate Article 17 of the “Regulations on the Administration of Commercial Franchises.”

Governance Concerns: Control Structure Under the Tripartite Alliance

In 2024, original shareholder Yanjinpuzi announced its full exit from the investment. According to the prospectus and disclosures by Tencent News, founder Yan Zhou directly holds 25.75% of the shares and controls 14.16% of the voting rights through six shareholding platforms. Zhao Yiming, founder of “Zhao Yiming Snacks,” holds 22.69% of the shares through Yichun Bird's Nest and has signed a unanimous action agreement with Yan Zhou. Together, the three parties control 62.60% of the voting rights, forming a de facto control alliance.

Huatai Securities' Consumer Group pointed out in a recent research report that “while the joint control of Yan Zhou and Zhao Yiming stabilizes the governance structure in the early stages of the merger, it also sows the seeds of future interest allocation risks. If regional market performances diverge, strategic coordination between the two parties may weaken.”

Although this structure enhances decision - making efficiency, it also weakens the board's checks and balances. Notably, Mingming Manlang has not established a family trust or complex shareholding platform, resulting in a relatively straightforward control structure. In the Hong Kong stock market, international investors generally adopt a cautious attitude toward such “simple and concentrated” equity structures.

Market Stranglehold: Homogenization Dilemma and Regional Competitors' Differentiated Breakthroughs

Mingming Manlang positions itself around “quality and price ratio,” claiming average prices approximately 25% lower than traditional supermarkets. However, as industry competition intensifies, the low - price strategy is evolving into an irrational price war.

At the product level, the company offers a total of 3,380 SKUs, but self - developed or customized products account for less than 25%, with over 70% being standard products directly supplied by manufacturers, lacking technological barriers. According to the “China Private Label Development Research Report (2024 - 2025),” while the annual renewal rate of new snack products is as high as 80%, less than 4% of SKUs contribute 80% of sales.

In contrast, Wanchen Group focuses on regional deep cultivation, building a “small but dense” network in Hunan, Fujian, and other regions. It optimizes its overall gross profit margin to around 10.8% through localized supply chains and forms regional differentiation advantages. Its store density in core counties can reach 3 - 4 stores per 100,000 people, far higher than Mingming Manlang's national average density.

Li Weihua, a consumer analyst at CICC, pointed out that “the true moat of bulk snack retailers lies not in the number of stores but in the replicability of the single - store model and the responsiveness of regional supply chains. Mingming Manlang's nationwide pie - spreading expansion is diluting its operational advantages.”

Supply Chain Vulnerabilities: Hidden Costs Under the Efficiency Aura

The massive SKU system poses inventory management challenges. Although overall inventory turnover is controlled at around 11.7 days, regional sales imbalances are prominent. A regional supervisor in a central province revealed, “New products promoted by the headquarters simply don't sell in county towns, but if we don't stock them, we can't qualify for quarterly rebates. We have to force the inventory.”

In terms of quality control, about 50% of the company's partner manufacturers are listed in the “2024 Hurun China Food Industry Top 100,” but there is a lack of unified quality inspection standards and third - party sampling inspection mechanisms. Loose - weight packaged goods account for over 40%, increasing the risks of contamination and spoilage during transportation and storage. Complaints on the Heimao Complaints Platform persist regarding inconsistent taste, leaking packaging, and the mixing of near - expiry goods.

Logistics capabilities also pose bottlenecks. Due to the lack of regional distribution centers, some remote stores face replenishment cycles exceeding 72 hours. Insufficient cold chain coverage makes it difficult to stably supply high - margin fresh food products.

IPO Pressure: Dual Tests of Stricter Regulations and Declining Valuations

Mingming Manlang's first IPO application to the Hong Kong Stock Exchange in April 2025 was unsuccessful, and its second application on October 28 of the same year, just six months later, reflects the urgency of its listing process. This timing coincides with the Hong Kong Stock Exchange's strengthening of its review of consumer IPOs. The “New Economy Company Listing Guidelines” issued in 2024 explicitly require companies to demonstrate a “sustainable profit path” rather than relying solely on scale expansion.

The Hong Kong Stock Exchange has focused on three key issues: the consistency of consolidated financial data, verification of the authenticity of 14,394 stores, and the revenue recognition logic under the franchise model. Meanwhile, the China Securities Regulatory Commission and the State Administration for Market Regulation are jointly conducting a “Special Rectification Action for Franchising,” targeting false advertising and compulsory procurement.

The valuation of the Hong Kong stock market's consumer sector remains under pressure. According to Dealogic, in 2024, the average price - to - earnings ratio of the retail and food and beverage sectors dropped to about 11.5 times, while the price - to - sales ratio fell to 2.8 times, with an IPO breakeven rate exceeding 65%. In this environment, Mingming Manlang's “high GMV, low profit” model is unlikely to receive a valuation premium.

According to the company's plans, it intends to invest over RMB 1 billion to expand into the northern market. If the final fundraising falls short of expectations, this expansion plan may be affected. Its highly external financing - dependent expansion model faces the risk of a tightened capital chain. In 2024, the net increase in stores was nearly 7,800, requiring funds far exceeding the coverage capacity of internal cash flow. (Produced by Zitai)