Double 11 Mobile Phone Sales: Only Apple and OV Experience Significant Growth, Xiaomi, Huawei, and Honor See Declines

![]() 12/01 2025

12/01 2025

![]() 633

633

Were all brands not supposed to claim the top spot?

The longest Double 11 shopping festival in history concluded nearly half a month ago. During this period, numerous mobile phone manufacturers released their battle reports, highlighting explosive growth in transaction volumes on specific platforms and claiming the top spot. However, we all understand that with such reports, adding a few qualifying terms and carefully selecting time periods can always create a 'number one' scenario. Therefore, we still need to refer to third-party research reports to truly understand the competitive landscape during this year's Double 11.

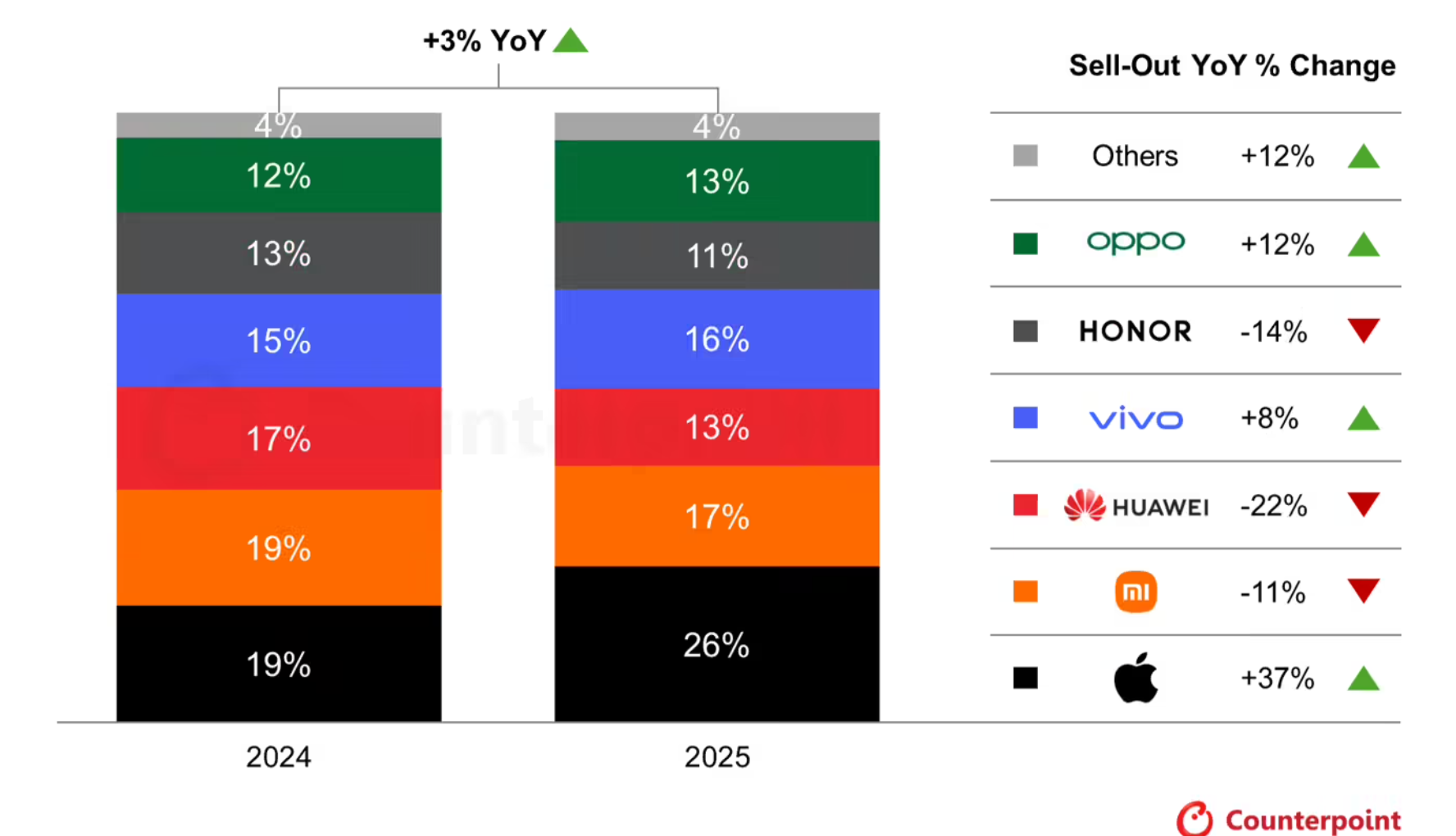

Recently, market research agency CounterPoint Research finally released the sales data for China's mobile phone market during the Double 11 shopping festival. The data compiled year-over-year sales volume changes for six major brands: Apple saw a 37% increase, Xiaomi a 11% decrease, Huawei a 22% decrease, Vivo an 8% increase, Honor a 14% decrease, and OPPO a 12% increase.

Image source: CounterPoint

Seeing this data, many people might be puzzled. Apple, OPPO, and Vivo experiencing explosive growth, while Xiaomi, Huawei, and Honor seeing declines? Is this really the case?

Apple flourishes during Double 11, while Xiaomi and Huawei falter?

To be honest, the data released by CounterPoint significantly differs from my initial guesses. For instance, the report indicates that Apple's sales volume increased by over 37%. Although I anticipated strong sales for Apple, I did not expect such a substantial increase, especially since Apple implemented stringent price control measures this year, resulting in less aggressive price reductions.

However, this year's iPhone 17 standard edition is indeed highly competitive, prompting many loyal users to upgrade their phones. Many placed orders during the initial sales phase, but numerous others hoped for Double 11 discounts. After all, in previous years, the standard edition often saw price reductions of 1,000 yuan or more on platforms like Pinduoduo.

Of course, they were destined to be disappointed this year. As the saying goes, 'Why lower prices when sales are strong? Only products that don't sell well need price reductions.' The strong sales of the iPhone 17 prompted Apple to tighten its promotional flexibility, with most platforms only able to offer discounts of around 500 yuan through subsidies. Considering that this was the last major promotion of the year, most people decided not to wait any longer. After all, a 500 yuan discount is better than buying at the original price, right?

Image source: Apple

Although Double 11 has traditionally been a period of explosive sales growth for Apple, it has often been accompanied by declines in sales during regular periods. For example, both last year and this year, Apple's sales volume decreased year-over-year in several quarters. Therefore, achieving explosive sales growth during this year's Double 11 without relying on significant price reductions is undoubtedly a source of pride for Apple.

If Apple is celebrating, then naturally, others are feeling the pinch. The most noticeably affected are Xiaomi and Huawei, both of which experienced rare year-over-year declines in sales volume during Double 11. However, in my opinion, the reasons are not due to a lack of product competitiveness from Xiaomi and Huawei but rather a combination of various factors.

Let's first discuss Xiaomi. This year, the release of Xiaomi's flagship digital series was a month earlier than usual, causing the initial sales period, which coincidentally aligned with Double 11, to shift to October. Do not underestimate the sales volume during the initial sales period. On October 2nd, Lu Weibing announced that the sales volume of the Xiaomi 17 series had surpassed 1 million units, similar to the pace of the Xiaomi 15 series.

Image source: Weibo

Considering that there was a gap of over half a month between October 2nd and October 20th (the starting date for CounterPoint's data statistics), it can be said that a significant number of Xiaomi 17 units were sold during this period. These sales, which occurred before the statistical time frame, were naturally overlooked.

Of course, another reason is that the Xiaomi 17 series did not see significant price reductions during Double 11, with only platform subsidies of two to three hundred yuan. This indicates that Xiaomi's pricing strategy has become more conservative this year, apparently aiming to shape a more premium image. However, this also led some cost-conscious Xiaomi users to choose to wait.

Now, let's discuss Huawei. As the brand with the most significant decline in the statistics, what are the reasons? Let's look at the data from the first three quarters: a 19.4% increase in the first quarter, a 12% increase in the second quarter, and a 2.6% decrease in the third quarter.

Therefore, Huawei's smartphone shipments actually started to decline in the third quarter, and the reason is simple: no new models. Last year, Huawei's strong return directly fueled purchasing demand. The Pura series in April and the Nova series in October were both best-selling models, significantly boosting sales.

However, this year is different. You'll notice that the release times for the new models of the best-selling Pura series and Nova series were moved to the second quarter. The Mate XTs, released at the end of the third quarter, although attractive with its triple-fold design, was too expensive, inevitably limiting its sales volume.

In simple terms, Huawei did not release any significant new models during the third quarter and Double 11 period. Additionally, Huawei's own discounts were relatively lower, leading to a significant year-over-year decline in overall sales compared to the same period last year.

Of course, if Huawei had released the Mate 80 series at the end of October, the situation might have been different. However, the production capacity of the Mate 80 series clearly could not meet this demand. After all, before its release on November 25th, even the pre-order shipping time for the standard edition was already scheduled until December 21st, with the shipping times for the subsequent three models extending until January 31st of the following year.

Image source: Huawei

With such a long production backlog for a late November release, one can only imagine how long it would have taken if it had been released in October. Therefore, it's not that Huawei didn't want to release the Mate 80 series earlier; it simply couldn't. Moreover, judging by the initial sales data of the Mate 80 series, Huawei's potential purchasing power remains quite impressive, and its market share in the flagship segment is also substantial.

Additionally, from Huawei's marketing efforts during Double 11, it seems they are not as focused on the event as before. This is not unique to Huawei; many mobile phone manufacturers have reduced their support for Double 11 compared to previous years.

Compared to previous years, although this year's Double 11 was the longest, there were few highlights in the sales data. On one hand, e-commerce promotions have become too frequent, with small promotions every three days and large promotions every seven days. On the other hand, the generous subsidies for trade-ins in the first half of the year have depleted consumer spending power in the second half. Many friends around me have said, 'There's nothing I really want to buy.'

Not all domestic mobile phones saw declines. OPPO and Vivo, which released new models in October, are quite happy. The Find X9 and Vivo X300 saw significant growth compared to previous years. It can be said that last year's Find X8 and Vivo X200 helped OV rediscover their flagship positioning, and this year they are expanding their gains and competing with Xiaomi in two rounds.

Therefore, the declines of Xiaomi and Huawei are mainly due to their choice of different sales strategies, while OPPO and Vivo have benefited from the vacated market share. It is particularly noteworthy that OPPO and Vivo are not following the 'cost-effectiveness route.' They relied more on offline channels in the past and often could only 'tag along' with Xiaomi during online promotions like Double 11. This year, the situation has reversed, with OPPO and Vivo seeing significant growth during Double 11. This not only reflects the product competitiveness of OPPO and Vivo's new models but also indicates that the market environment is truly changing.

However, what worries domestic brands the most is still Apple's 'comeback.' If the iPhone continues to maintain this level of iteration, the high-end market is bound to witness another 'fierce battle.'

Consumers No Longer Chase Price Drops; Usability is Key

From the sales volume data changes of various mobile phone brands during Double 11, it can be observed that domestic consumers' psychology for purchasing phones is quietly changing. That is, the obsession with buying phones during Double 11 is not as strong as before. Many people now place more importance on initial sales benefits. As long as it's a phone they like, they will basically place an order within the first month of its release, and overall, it's actually more cost-effective.

Take Xiaomi as an example. Initial sales benefits include two years of screen breakage insurance and 365 days of replacement-only service. The Pro and Pro Max models also come with additional back screen insurance, along with higher trade-in subsidies, etc., with an overall value exceeding 1,000 yuan. These initial sales benefits are much more generous than the discounts offered during Double 11. Moreover, many flagship new models do not see significant price reductions during Double 11 nowadays, so there's no real need to wait.

Image source: Weibo

Conversely, if people know that a major new product is set to be released shortly after the promotion, some will choose to wait even if the Double 11 discounts are substantial. The data changes for Xiaomi and Huawei this time are prime examples. Additionally, consumers are now willing to pay for tangible, long-term value they can see and touch, rather than just focusing on a few hundred yuan in savings during a major promotion.

For example, new models may feature AI imaging, AI assistants, and other functions that many older models lack, significantly influencing consumers' purchasing decisions. The prolongation of the replacement cycle also means that consumers are more concerned about whether the money they spend can provide a more stable experience and satisfaction in terms of imaging, AI, battery life, etc., over the next two to three years.

Moreover, the regularization of major promotions this year has also made many consumers 'desensitized' to a few hundred yuan in savings. They either buy during the initial sales or wait for significant price reductions next year. Impulse buying has noticeably decreased.

In fact, from this year's data, Double 11 has transformed from a 'must-win battleground' into one of the key nodes for year-round promotions. Brands that want to achieve impressive sales figures can release their new products in October, while those that don't want to compete fiercely can proceed at their own pace. Consumers will naturally make their choices.

From Leitech's perspective, the competition in the entire mobile phone market is no longer focused on specific nodes. The battle lines and timeframes are clearly longer than before. It can be said that from September to November, brands like Xiaomi, OPPO, and Vivo have been constantly active. Writing this, I recall previous reports that next year's flagship releases may be further advanced. If true, the major flagship battles may start as early as early October or even late September, and the Double 11 sales data may see further changes.

Apple, Xiaomi, Huawei, OPPO, Vivo

Source: Leitech

Images in this article are from the 123RF Authentic Library.