The Foldable iPhone Is on Its Way: Apple Steps In with 'Hingeless Screen'—Can It Outshine Huawei and Samsung?

![]() 12/02 2025

12/02 2025

![]() 651

651

The engineering verification phase is drawing to a close, and Apple's supply chain for foldable-screen smartphones is already gearing up for stock preparation, biding its time for the final green light.

The 'Game-Changer' Arrives Five Years Behind Schedule: Can It Turn the Tables This Time?

'This time, Apple's foldable screen is truly on its way,' a long-standing analyst tracking Apple's supply chain wrote in a recent report. According to a flurry of supply chain updates from late November to early December 2025, Apple's inaugural foldable phone, the iPhone Fold, has entered the critical engineering verification and pre-mass production stage.

This signals that the product design is nearly locked in, with only minor refinements left, bringing it a significant step closer to its anticipated launch in the latter half of 2026.

Unlike previous years when rumors abounded without substance, multiple key component suppliers have confirmed they are 'already in stock-preparation mode' and primed to meet mass production demands at a moment's notice.

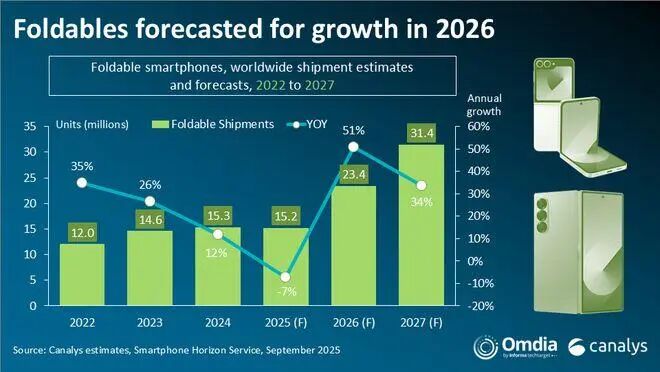

Apple harbors high expectations for this product, with an initial plan to ship 7 to 9 million units in its first year, aiming for a 30-40% slice of the global foldable phone market.

01

The Latecomer Titan

Apple's foldable screen project has been in the works for over five years, with the final comprehensive device design scheme only confirmed in the latter half of 2025. This timeline places it a full generation behind the market frontrunners.

Half a decade ago, the foldable screen market was still a chaotic, untapped frontier. Any well-crafted product had the potential to shape the future. Had Apple entered then, leveraging its formidable ecosystem and brand clout, it might have set the market standard, much like the original iPhone did.

However, the market didn't stand still. According to the latest industry figures, global foldable phone shipments peaked at 21.2 million units in 2023, dropped to an estimated 18.8 million in 2024 (an 11.3% year-on-year decline), and are projected to rise only marginally to 19.5 million in 2025 (a 3.7% increase).

The market has transitioned from explosive growth to a phase of steady consolidation. This means Apple is stepping into not a blue ocean but a fiercely competitive red ocean with an established pecking order.

Public data reveals that in the first half of 2025, Huawei dominated global foldable phone shipments with a 48% share, while Samsung trailed with just 20%—less than half of Huawei's.

Huawei has cemented an unassailable lead in China's foldable market through relentless technological advancement and product innovation. Its Mate X series has become synonymous with premium foldables. Globally, Samsung maintains its top market position with the Galaxy Z Fold and Z Flip series.

The late-arriving Apple has missed the chance to define the category and must now assume the role of challenger, fighting for market share from the established players.

02

Samsung's Screen, Apple's Hinge Innovation?

According to verified supply chain sources, the iPhone Fold's inner display panel will be exclusively supplied by Samsung. This raises a pivotal question: If even Samsung's own flagships haven't fully eradicated creases, how can Apple achieve a breakthrough using Samsung's screens?

Multiple sources report a crucial detail: Apple isn't just passively sourcing screens but has been deeply involved in customizing the panel's design, materials, and bonding process. Reports indicate that Apple redesigned the layer stack and collaborated with Samsung to develop a customized display process aimed at minimizing creases from a physical standpoint.

More daring reports claim Apple has successfully developed a 'crease-free screen' and will make it the iPhone Fold's primary selling point.

Hinge technology is another major area of focus. Apple is reportedly utilizing a special liquid metal for the hinge components, which offers a refined feel while maintaining low deformation and high toughness, potentially significantly enhancing folding smoothness and durability.

Screens and hinges are the technical heart—and cost driver—of foldable phones. Apple's deep involvement suggests it aims to control the core user experience upstream in the supply chain. However, all these innovations will be reflected in the price. Multiple forecasts suggest the iPhone Fold will cost around $2,400 (≈17,000 RMB), far surpassing current foldable flagships from Samsung and Google and becoming the priciest iPhone ever.

Apple is attempting to justify its highest-ever price by proving it has solved the most vexing problem. Whether consumers will pay a premium for this 'crease-free screen' and the costly custom technology behind it will be its first major test.

03

Foldable Screen or Unfulfilled Automotive Ambitions?

Compared to the high-profile foldable screen project, Apple's even grander 'Titan' electric vehicle initiative ended quietly earlier. After a decade and tens of billions of dollars in investment, it was ultimately shelved. This backdrop casts a complex shadow over the foldable iPhone's debut.

From a strategic vantage point, smart electric vehicles represent a trillion-dollar new market and a terminal for reshaping future mobility ecosystems. Foldable phones, in contrast, remain an internal upgrade and segmentation within the smartphone market, with a clear ceiling.

Apple's decision to fully commit to foldables now seems like a 'prudent' strategic pivot—competing for the high-end market in a familiar arena with higher technological integration to boost average product prices and profits.

What impact will this have on the vast 'Apple supply chain'? In the short term, the effect may be limited. Renowned analyst Ming-Chi Kuo has noted that foldable iPhone shipments are expected to account for only a small fraction of total iPhone shipments initially.

For core suppliers like TSMC, Foxconn, and Largan Precision, this merely represents a new high-value business addition rather than a disruptive demand shift.

In the long run, if foldables become a high-end standard, Apple's entry will cement its supply chain partners' leadership in cutting-edge components (e.g., ultra-thin glass, precision hinges, new thermal management).

Apple's automotive dreams have been dashed, but the smartphone battle is far from over. The foldable iPhone represents Apple's most significant 'technical showcase' and 'market test' since hardware innovation plateaued. It may not usher in a new era like cars, but its success will profoundly influence Apple's product daring and market confidence in the next decade.

The supply chain machinery is already in motion, preparing for the 2026 debut. This flagship, rumored to feature a 7.8-inch inner screen, under-display camera, and 5,400mAh+ battery, embodies Apple's ultimate ambition for smartphone form factors.

The industry watches to see if Apple can leverage a 'technical overhaul' five years late to validate itself and force rivals like Huawei and Samsung onto a new trajectory.

For now, foldable iPad development has reportedly been paused, with resources fully redirected to the iPhone Fold. Apple's hardware narrative is entering a high-stakes, suspenseful capital market gamble.

Qiyingmen

Insightful, Knowledgeable, Entertaining

With Readers | With Stories | With Reverence