Has Yingling A1 Stumbled, Setting a 'Poor Precedent' for Frivolous Competitive Tactics?

![]() 12/08 2025

12/08 2025

![]() 627

627

In 2025, the tech industry has been rocked by a series of controversies stemming from frivolous competitive tactics, with the automotive and smartphone sectors being particularly hard-hit.

For instance, in the automotive arena, some manufacturers have resorted to disparaging their rivals during product launches to boost their own standing. They compare their intelligence features to Tesla's, their aesthetics to traditional luxury car brands, and their handling to BMW's.

Similarly, in the smartphone industry, companies often stir up controversy by belittling competitors and exaggerating features such as imaging capabilities, battery life, charging speeds, AI, and Dynamic Island technology.

Given the inherent attention benchmark brands receive, frivolous competition can initially drive traffic and generate buzz for a company's products. However, such tactics have now sparked significant backlash.

From August to November, DJI found itself at the center of a series of public opinion controversies, including guided price reductions and disputed market share reports.

A report by Mercer China indicated that in the third quarter of 2025, Instone captured 49% of the panoramic camera market, while DJI held 43%. In contrast, a Frost & Sullivan report placed Instone at 75% and DJI at a mere 17.1%. However, according to media reports such as the 21st Century Business Herald, Frost & Sullivan withdrew the report due to "internal data verification" issues.

On December 5th, Instone Innovation officially launched its first panoramic drone, the Yingling Antigravity A1. Marketed as the "world's first 8K panoramic drone," the product manager highlighted its differences from traditional drones during the live launch, directly challenging DJI's dominance in the drone market.

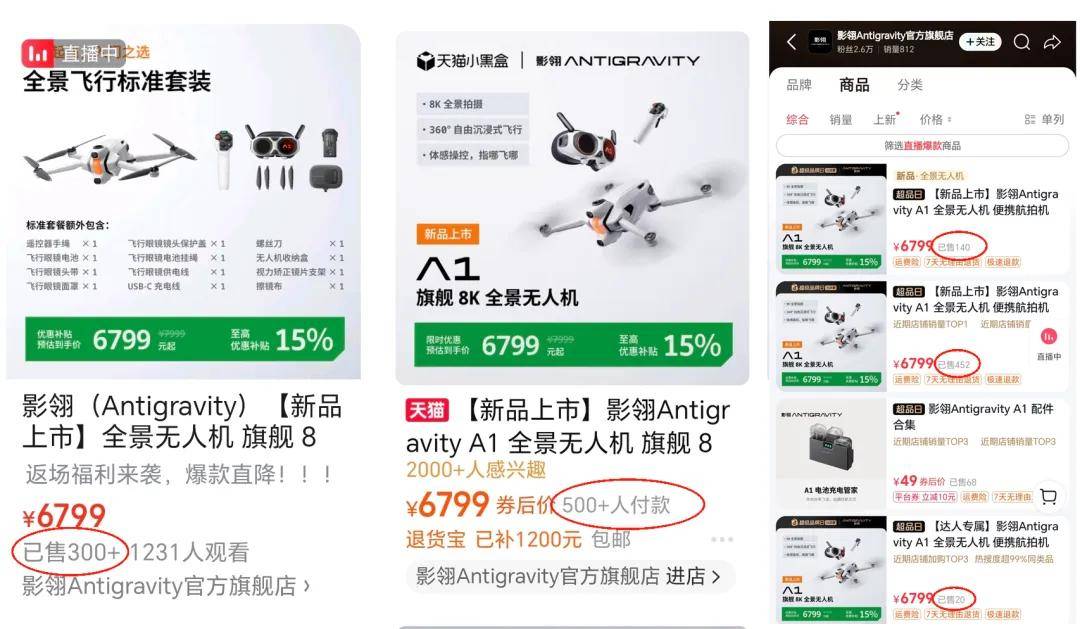

The Yingling Antigravity A1 drone comes in three price tiers, with standard, exploration, and long-endurance exploration packages available for users. Due to overlapping discounts and subsidies during the sales period, the final prices after subsidies are 6,799 yuan, 7,999 yuan, and 8,499 yuan, respectively.

The announcement of these prices was met with stunned silence, as they were significantly higher than anticipated.

At 11:00 PM on December 5th, Yingling's official Weibo account claimed that the Antigravity A1 panoramic drone had topped sales charts across multiple platforms on its first day of release.

However, publicly available data from mainstream e-commerce channels like JD.com and Tmall seem to contradict this claim:

The Yingling Antigravity A1 drone went on sale on December 4th. Over the three days leading up to the press release, JD.com reported sales of over 300 units, while Tmall's official flagship store reported sales of over 500 units during the same period. Douyin E-commerce, offering platform coupons and thus the cheapest initial sales platform, had the highest sales volume but still only sold over 600 units.

With total initial sales of approximately 1,400 units, the estimated sales revenue is around 10 million yuan.

From the drone rankings on Tmall and JD.com, the top three spots on both e-commerce platforms were dominated by DJI, with Yingling A1 failing to make it into the top ten on either platform.

Yingling A1 ranked 11th on JD.com's best-sellers list and outside the top 20 on Tmall.

It is reported that a lens supplier for Yingling revealed during an investment exchange meeting that Yingling's sales target was 300,000 units, a goal that seems almost unattainable based on current sales performance. Affected by the underperformance of Yingling A1's sales, Instone Innovation's stock price plummeted by over 8% shortly after the market opened.

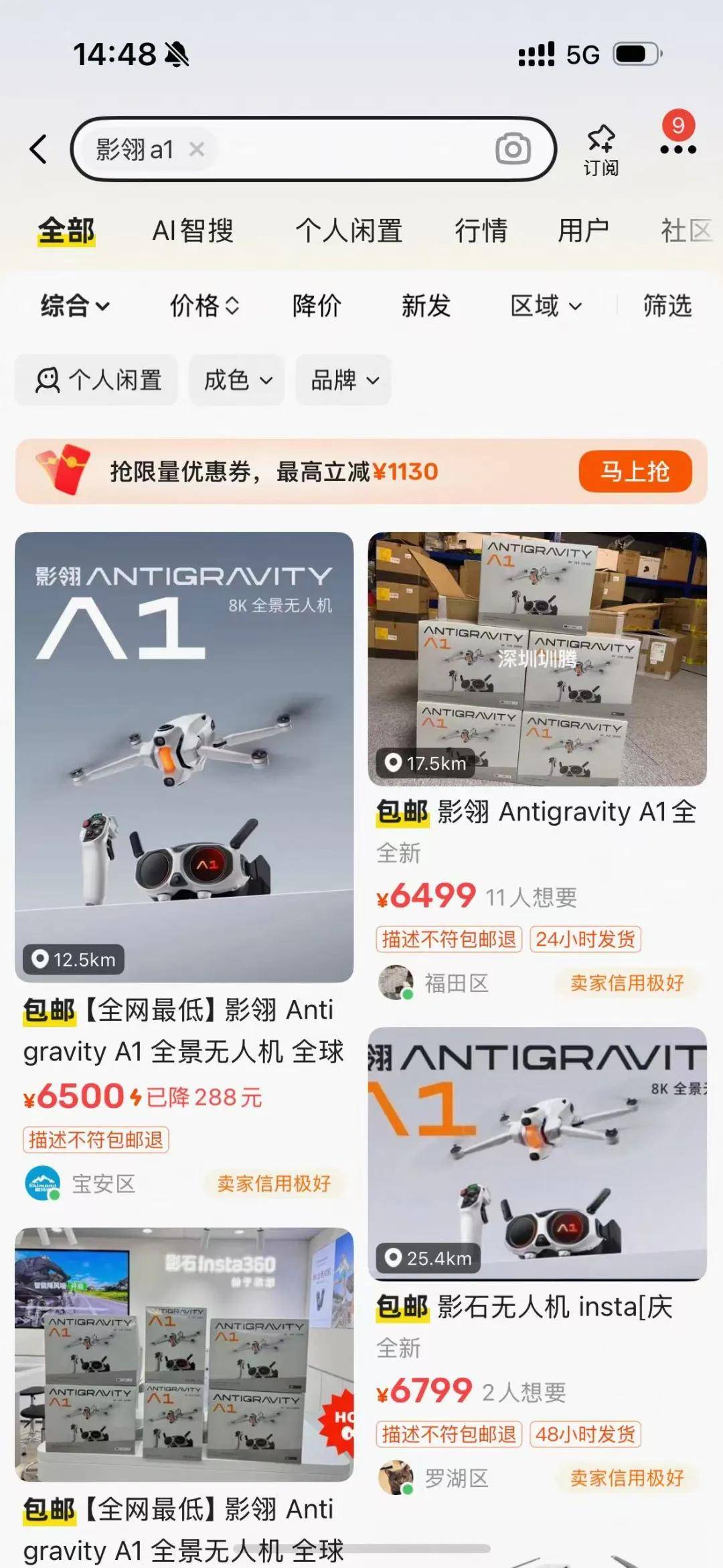

The day after the product release, listings for the A1 appeared on Xianyu (a second-hand trading platform), with brand-new, packaged units selling at discounts ranging from 400 to 1,000 yuan.

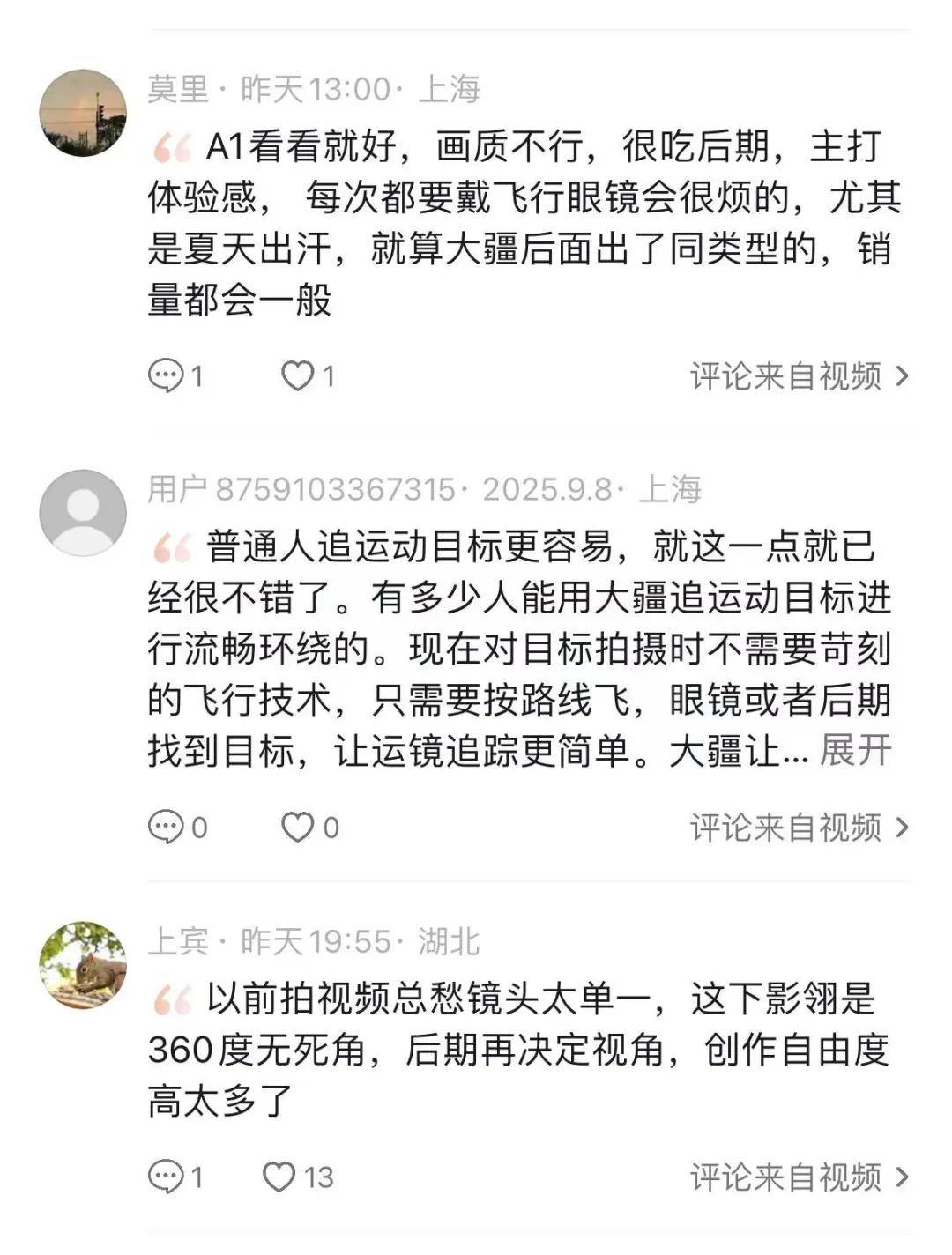

The initial sales failure of the Yingling Antigravity A1 drone may not solely be attributed to its high price but also to a mismatch between its product capabilities and perceived value. Since its release, social media discussions have been intense, with industry bloggers pointing out several issues.

On platforms like Douyin, some early adopters have shared works captured by the Yingling Antigravity A1 drone, criticizing its average nighttime image quality and subpar stabilization, which they believe need improvement.

On Xiaohongshu, an overseas blogger mentioned three drawbacks of the product: lens flare, propeller shadows, and directional drift errors.

While these flaws may seem minor, they are critical shortcomings in the drone experience, affecting the essential needs for image quality and lens performance in aerial photography.

"The image quality is poor, heavily reliant on post-processing, and the lens flare is annoying when wearing flight goggles," a netizen commented. These experience issues often fail to meet the demands of both professional and casual users.

On Xiaohongshu, a blogger named Chaochao Digital believes the product has positioning issues: If it aims to be a professional aerial photography tool, its current image transmission and quality details are insufficient to meet the needs of professional creators. If it targets the recreational flight market, the device's dizziness issues may deter many players.

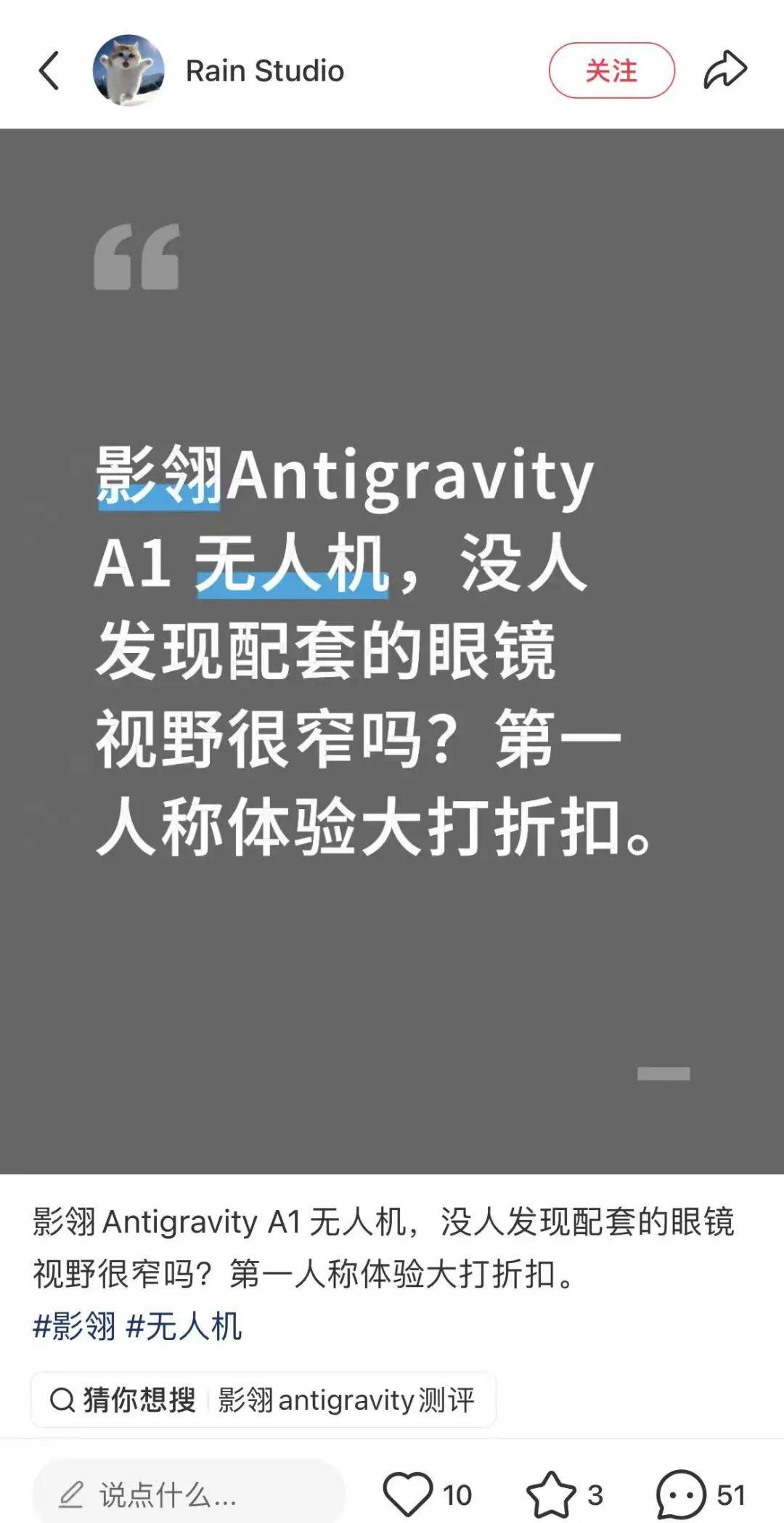

Additionally, some netizens have found that the drone's accompanying goggles have a narrow field of view, significantly diminishing the first-person perspective experience.

Other early adopters have reported that the image transmission quality and signal are unstable, easily interrupted during urban flights. The 8K resolution appears little different from 1080P to the naked eye, making post-editing inconvenient and unfriendly to novice players.

Behind Instone A1's Initial Sales Failure

Based on various feedbacks, the reasons for Instone A1's initial sales failure can be roughly summarized as follows:

Firstly, its market positioning is vague. As a consumer drone primarily focused on the "panoramic" concept, it does not significantly outperform mature entry-level aerial photography drones in core parameters such as image quality and battery life. However, its price (over 6,000 yuan) positions it as a professional productivity tool.

Industry insiders point out that the current image quality of A1 is only equivalent to DJI's DJI Neo/entry-level Mini series. Although it claims 8K resolution, the actual output clarity is only 1080P.

However, the Neo and entry-level models are priced between 1,000-3,000 yuan, with the most expensive immersive bundle around 3,000+ yuan. In contrast, A1 is priced at over 6,000 yuan, with only 24 minutes of battery life. The truly usable exploration bundle costs up to 8,000 yuan.

DJI's product series priced over 5,000 yuan are already considered productivity tools, whereas A1 currently only possesses recreational toy attributes, lacking actual competitiveness in DJI's well-established drone market. This disparity between high pricing and product capabilities has led to consumer rejection.

Secondly, with insufficient strength, Instone attempted to challenge the industry leader, DJI, which already holds a 70% market share in the consumer drone market, by introducing a new category. This raised user expectations but failed to meet them.

During the Instone A1 launch event, the product manager consistently emphasized its differences from traditional drones, referring to mature solutions in the drone industry represented by DJI as "traditional" and positioning themselves as "innovative." However, the product falls short of consumer expectations.

We know that DJI has maintained a 70% market share in the global drone market for over a decade, thanks to its technological accumulation and maturation in both the consumer market and the industrial sector under the low-altitude economy. DJI's market success is not attributed to marketing but to its hands-on involvement, technological compounding, robust supply chain system, and solid engineer culture.

It is said that even if you were given all the components of a DJI drone and assembled them according to the product, you would not be able to replicate a drone with the same performance and capabilities. This highlights DJI's high technical barriers and its representation of software and hardware innovation.

If such a globally unparalleled drone manufacturer can be labeled as "traditional," then challengers are bound to face extremely high expectations from consumers. Ultimately, the product capabilities of Yingling A1 failed to support its marketing rhetoric, resulting in a high start but low trajectory, with declining shipments and second-hand prices, negatively impacting short-term profitability and stock prices, and serving as a flawed example of frivolous competition.

Three Major Challenges of Frivolous Marketing in the Hardcore Tech Sector

This provides us with an observational sample, revealing three major challenges faced by disruptors engaging in frivolous competition in the hardcore tech sector:

Firstly, the technical prowess challenge. For tech products to succeed, they must rely on substantial R&D investment and continuous iteration of product and technical capabilities. Both Huawei and DJI are representative examples with independent R&D systems and product iteration frameworks.

However, Instone is not such a case. As Instone's first panoramic drone, A1 was developed through third-party incubation, reflecting its immature drone technology system and reliance on third parties, with shallow foundations. Challenging the industry's top giant with shallow foundations is like an egg hitting a rock.

Secondly, the comprehensive cost challenge. Industry leaders often excel in cost optimization and control at the industrial chain and supply chain levels, enabling them to produce products with high configurations, superior experiences, and competitive pricing. This is DJI's advantage.

Later entrants lacking this advantage will face related comprehensive cost pressures. From the perspective of Yingling A1, it offers three combinations: standard version, standard endurance three-electric version, and long-endurance three-electric version. During the sales period, it enjoyed discounts and subsidies, with final prices of 6,799 yuan, 7,999 yuan, and 8,499 yuan after subsidies.

According to informed sources, the material costs may exceed 5,000 yuan, several times higher than the selling price of mature products. Under this pricing strategy, the product is not only difficult to profit from in the short term but also struggles to compete with leading rivals.

Thirdly, as previously mentioned, failing to meet high external expectations. Engaging in frivolous competition with a small investment and high-profile marketing raises external expectations. When reality falls short, high expectations can backfire on stock prices.

A classic saying in marketing is that if a company's product benchmarks against another, it's safer to buy the benchmarked product. The same applies to the drone market.

Over the past few years, Instone has achieved significant success in the panoramic camera market. However, the drone market, while vast, has extremely high technical barriers. After years of deep cultivation, DJI has established comprehensive barriers from core technologies to supply chains and brand recognition.

To survive in this market, one must not only deliver exceptional products but also excel in pricing, channels, services, and other aspects, with little room for error. Any shortcoming can be fatal.

This also serves as a reminder to industry latecomers. When product capabilities, technology, and pricing fall short of benchmarks, engaging in frivolous marketing will lead consumers to scrutinize your products more critically.

When external expectations are high, but the final product experience falls short, it has the opposite effect. Yingling A1's setback serves as a "poor precedent" of frivolous competition, warranting reflection from the tech industry.