Investment in AI Glasses Poised for a Resurgence | An Industry Report Accessible to All

![]() 01/19 2026

01/19 2026

![]() 545

545

I. Core Event: Meta Boosts Production Capacity, Sending Strong Signals to the Industry

At the dawn of 2026, Meta, a tech behemoth renowned for its relentless innovation, partnered with EssilorLuxottica, the world's foremost eyewear manufacturer, to devise a capacity expansion strategy.

This move has once again thrust AI smart glasses into the limelight of capital attention.

Since the launch of the Ray-Ban Meta glasses, a collaborative effort between the two entities, sales have exhibited a steady upward trajectory, nearing the initial target of producing 10 million pairs annually by the end of 2026.

Consequently, the duo plans to elevate annual production capacity to 20 million pairs or more by the year's end; should market demand persist, it could further escalate to over 30 million pairs.

In 2025, Meta secured approximately a 3% stake in EssilorLuxottica for $3.5 billion, with intentions to augment its stake to 5% in the future.

II. Current State of the Sector: Technology-Driven + Giant Entry, Highlighting Growth Potential

(I) Increasing Technological Maturity, Gradually Reducing Barriers to Popularization

The transition of AI smart glasses from niche to mainstream owes much to the relentless breakthroughs and maturation of pivotal technologies.

In the realm of AI algorithms, strides in natural language processing, computer vision, and other technologies have rendered the interactive experience of smart glasses increasingly seamless and precise; advancements in battery life technology have alleviated concerns over range; miniaturization and integration of components have enabled AI glasses to pack more features while remaining lightweight.

(II) Market Landscape: Meta Leads with Significant Advantage, Industry Competition Heats Up

The current global AI smart glasses market can be characterized as 'one dominant force amidst multiple strong contenders.' Meta commands a leading position, leveraging its first-mover advantage and deep collaboration model.

According to Counterpoint data, in the first half of 2025, Meta accounted for a staggering 73% of the global AI smart glasses market. Its Ray-Ban Meta series has emerged as the market's mainstream choice, owing to its brand influence, product experience, and channel reach.

However, as the sector's potential unfolds, industry competition is intensifying.

In May 2025, Google forged a smart glasses partnership with the eyewear division of Kering SA, capitalizing on Kering's brand strengths and design prowess in the luxury sector to position itself in the high-end smart glasses market; following a reduction in its investment in the Vision Pro VR headset project, tech giant Apple also plans to reallocate resources to the AI glasses sector.

Looking ahead, as more players enter the fray, competition will extend beyond product functionality and technological innovation to encompass brand marketing, ecosystem construction, and other dimensions.

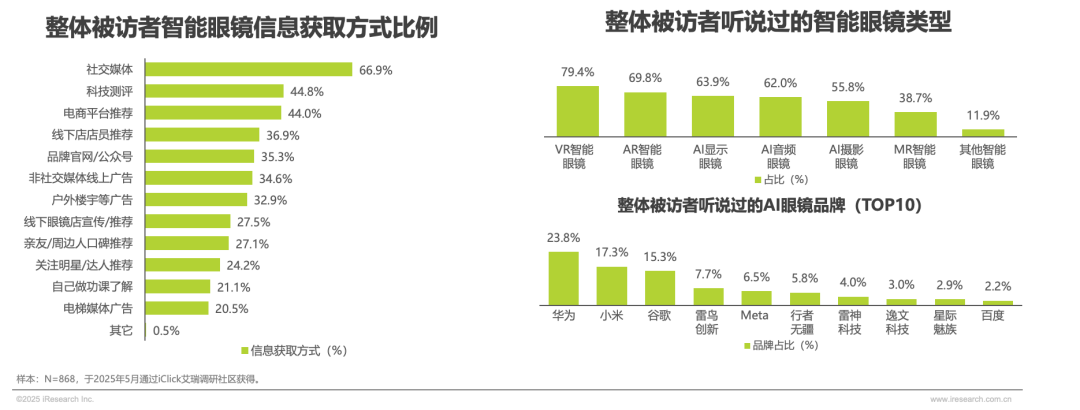

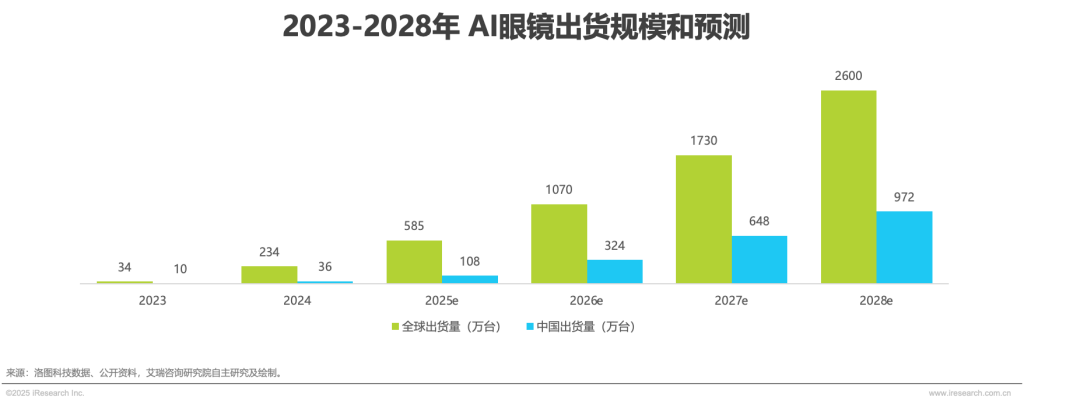

(III) Strong Growth Expectations, Becoming a New Blue Ocean in Consumer Electronics

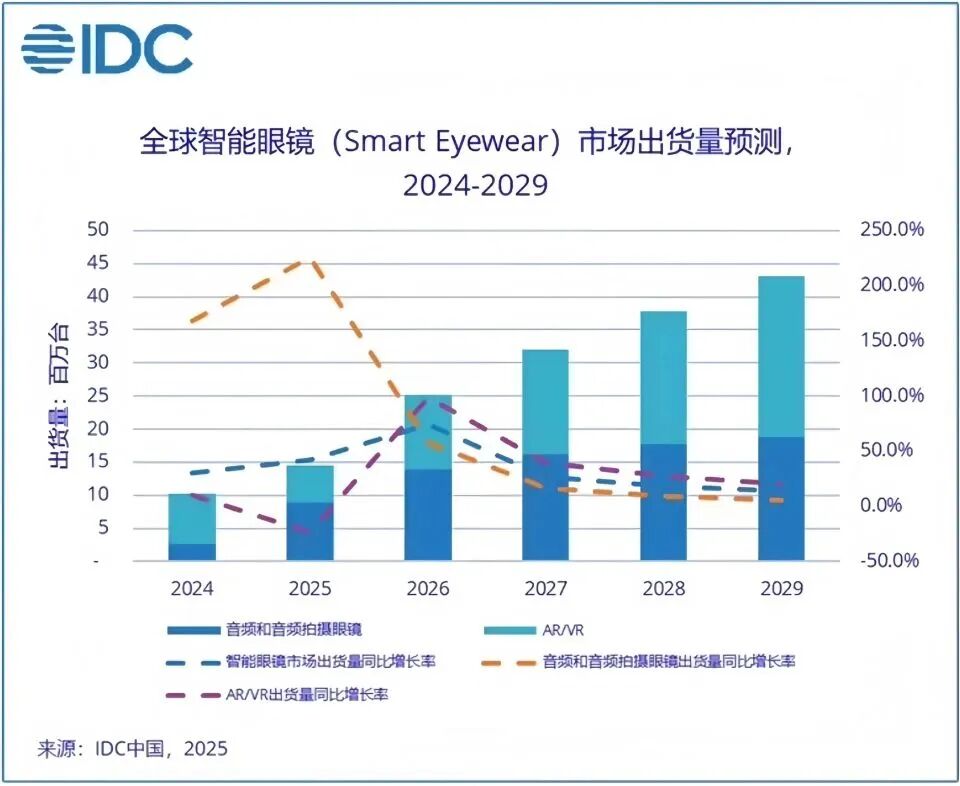

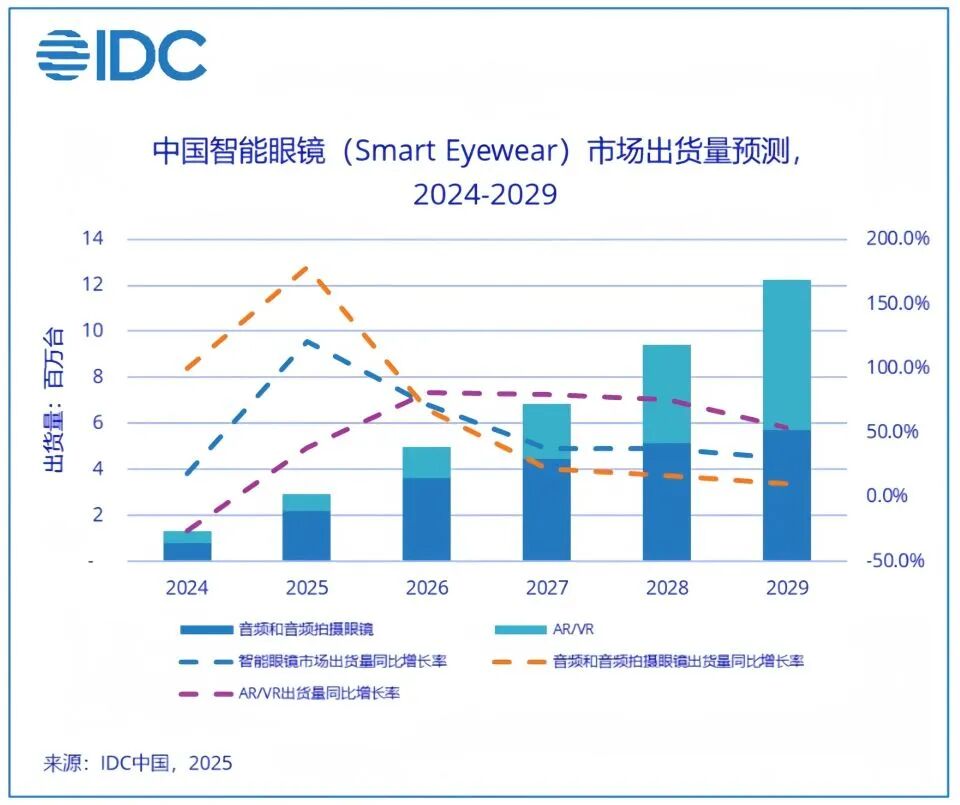

Driven by factors such as technological maturity, demand release, and increased investment from industry giants, the AI smart glasses market is poised for explosive growth.

Authoritative research institutions like Counterpoint forecast that by 2029, the AI smart glasses category will achieve a compound annual growth rate exceeding 60%, cementing its status as one of the fastest-growing sectors in the consumer electronics realm.

III. Supply Chain Analysis: Chinese Companies Dominate Key Links, Gradually Releasing Performance Elasticity

The AI glasses industry chain comprises three major segments: 'core components - complete machine assembly - software algorithms.' Chinese companies have already secured a dominant position in multiple key areas, leveraging their technological prowess and cost advantages. As global production capacity expands, supply chain enterprises are poised to seize definitive growth opportunities.

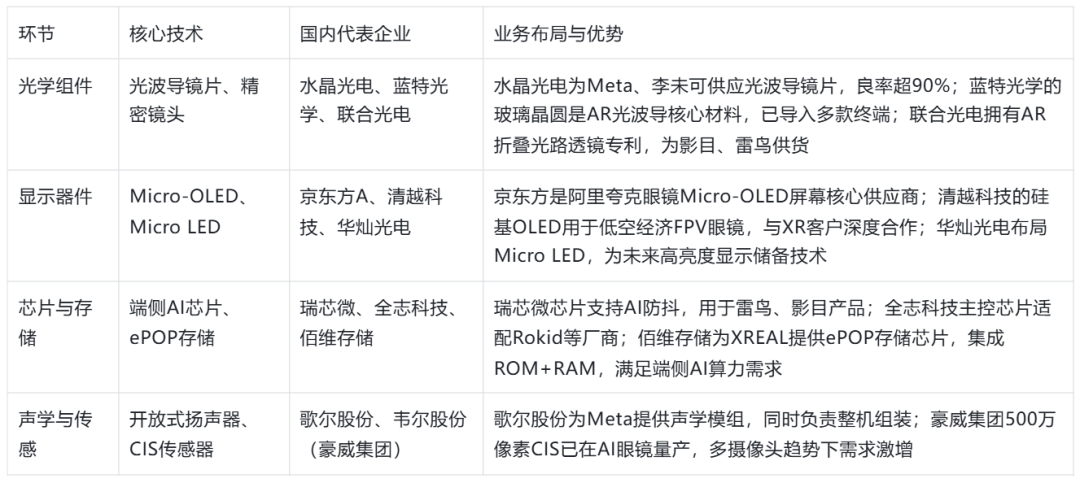

(I) Core Components: Optics, Displays, and Chips Become 'Bottleneck' Links, with Domestic Leaders Taking Positions

(II) Complete Machine Assembly and Manufacturing: Precision Manufacturing Capability Becomes Core, Leading Contract Manufacturers Share Orders

The complete machine assembly segment demands extremely high levels of 'precision + capacity.' Domestic contract manufacturers have emerged as core partners for global mainstream brands, drawing on their extensive experience in consumer electronics manufacturing:

1. Goertek: The exclusive contract manufacturer for Meta's Ray-Ban Meta, responsible for supplying optical waveguide modules and complete machine assembly. It also provides manufacturing services for domestic brands like INMO and Rokid. In 2025, revenue from its smart glasses-related business accounted for over 15%.

2. Lens Technology: The exclusive supplier of core structural components for Meta's new glasses. It also achieves mass production and delivery of complete machines for Alibaba's Kuake glasses, boasting advantages in precision structural components and assembly processes. Its order volume is expected to surge by over 80% in 2026.

3. Luxshare Precision: With its magnetic charging and micro-camera module technologies, it has become a potential contract manufacturer for Meta. It also provides manufacturing services for Huawei and Xiaomi's ecosystem products, promising to secure more orders from leading players.

4. Longcheer Technology and Huaqin Technology: Longcheer Technology undertakes R&D projects for domestic leading clients and will achieve mass production in 2026; Huaqin Technology participates in the manufacturing of the StarV series by Starry Meizu, rapidly responding to customer needs through its ODM model.

(III) Software and Algorithms: AI Empowerment Becomes Key to Differentiation, Technology Providers Bind to Ecosystems

Software and algorithms are pivotal in determining the 'intelligence level' of AI glasses. Domestic companies have forged competitiveness in the fields of 'operating systems + visual AI + large model adaptation':

1. Thundersoft: Provides a full-stack solution for AI glasses, ranging from underlying system optimization to upper-layer AI applications, adapting to brands like Meta and Thunderbird. Its intelligent operating system can enhance device battery life and response speed.

2. ArcSoft: Offers visual AI algorithms covering functions such as scene recognition, gesture control, and image optimization. In the first half of 2025, it signed contracts with multiple AI glasses brands, with an algorithm implementation rate exceeding 80%.

3. Alibaba and Baidu: Empower hardware through large models. Alibaba's Kuake glasses incorporate the Qianwen large model, while Baidu's Xiaodu AI glasses integrate Wenxin Yiyan, achieving a complete closed loop of 'voice interaction - content generation - service docking', strengthening ecosystem stickiness.

IV. Investment Logic: Hardware Carries AI Strategy, Long-Term Value Holds Promise

(I) An Inevitable Choice for Strategic Transformation by Industry Giants

Taking Meta as an example, its increased investment in AI smart glasses is not merely an expansion of its hardware business but a strategic move in its overall transformation.

In recent years, Meta has strived to implement its AI strategy through hardware products, constructing a new ecological entry point independent of smartphones.

As is well known, tech companies are heavily reliant on smartphone platforms. As a wearable device with (theoretically) the strongest interactivity and the broadest scene coverage, AI smart glasses are expected to become the next-generation core terminal.

For EssilorLuxottica, as the world's largest traditional eyewear manufacturer, cooperation with Meta also enables strategic transformation and business expansion.

(II) Market Demand Transitioning from 'Novelty' to 'Necessity'

The demand evolution in the AI smart glasses market is undergoing a transition from 'tech enthusiasts seeking novelty' to 'ordinary consumers' necessity,' albeit a potentially lengthy process.

Early smart glasses had limited appeal due to immature technology, single functionality, and high prices, attracting only tech enthusiasts. However, with technological upgrades and cost reductions, AI smart glasses now offer intelligent interaction, health monitoring, navigation and positioning, real-time translation, and more, with prices gradually decreasing to a range acceptable to ordinary consumers. For example, the Ray-Ban Meta series is priced at $459, offering good value for money.

(III) Industry Challenges and Opportunities Coexist, with a Clear Long-Term Development Logic

From a profitability perspective, RBC Capital Markets analysts point out that the gross profit margin of Ray-Ban Meta smart glasses is expected to be significantly lower than that of EssilorLuxottica's traditional eyewear products due to high component costs, R&D investment, and the lack of scale effects for AI smart glasses.

From a capacity perspective, increasing production capacity necessitates finding a balance between market demand, production costs, and supply chain matching to avoid resource waste and overcapacity caused by expansion.

IV. Summary: AI Glasses Become the Next Investment Hotspot, Continuously Releasing Industrial Value

Meta and EssilorLuxottica's increased production capacity is a clear signal that the AI smart glasses industry is entering a period of accelerated development.

Currently, the convergence of three core factors—technological maturity, demand explosion, and involvement of industry giants—has made AI smart glasses one of the most noteworthy investment sectors in the consumer electronics field.

In the short term, capacity expansion will directly drive demand growth throughout the upstream and downstream of the industry chain. Whether it's suppliers of core components like AI chips, sensors, and batteries, or links in production manufacturing and channel distribution, all will benefit from the expansion of the industry scale.

In the medium term, with the continued investment of more tech giants like Google and Apple, product innovation will accelerate further, application scenarios will continue to enrich, and market penetration will steadily increase.

In the long term, AI smart glasses are expected to gradually replace some smartphone functions, becoming new entry points for the mobile internet and constructing a complete ecosystem encompassing hardware, software, content, and services, fostering immense industrial value and investment opportunities.

For investors, now is a critical window period for positioning themselves in the AI smart glasses sector. They can focus on high-quality enterprises in core links of the industry chain, including suppliers of core components, technology solution providers, and terminal manufacturers with brand and channel advantages.

END