DJI in 2025: Leading the Industry in Earnings, Facing the Toughest Challenges

![]() 01/19 2026

01/19 2026

![]() 604

604

Text/Guo Jiage

Edited by/Zhang Xiao

From an external viewpoint, DJI remains a company with few, if any, rivals:

It has set the standard for consumer drone product design, maintaining a global market share exceeding 70% in the consumer drone sector for a prolonged period. According to various media outlets, DJI's revenue for 2024 is estimated to have surpassed 50 billion yuan, with some even suggesting figures close to 80 billion yuan, and a net profit margin nearing 40%. Leiphone projects that DJI's total revenue could reach approximately 85-90 billion yuan by 2025.

For any hardware company, this represents an almost perfect example of commercial success.

However, such dominance also means that revenue from DJI's core business is nearing its peak.

The penetration rate of consumer drones has reached a high level. Once the market matures, further growth is not merely a technical issue but is constrained by market capacity, adoption rates, and the emergence of new application scenarios.

For a company with an absolute market share advantage and revenue in the billions, this implies that while the main business can remain stable, it is unlikely to drive another phase of exponential growth solely through drones.

Against this backdrop, DJI has started to make frequent appearances in industries beyond drones.

From panoramic cameras to robotic vacuum cleaners, from enhancing imaging hardware to investing in 3D printing, these moves may appear scattered but collectively indicate one fact: DJI is stepping out of its comfort zone, and this shift itself signals underlying anxiety.

And when a company that has long been without rivals starts actively seeking competitors, what exactly is it afraid of?

01

Drones haven't lost momentum; they've just reached their growth limits.

The industry often uses terms like 'monopolist' and 'absolute leader' to describe DJI's position in the drone sector.

From market share and technical standards to supply chain control, DJI has essentially defined the consumer drone market and is even seen as synonymous with the industry, making it a rare example of a Chinese tech company that has 'pushed hardware to its limits.'

However, if we shift our perspective from 'status' to 'growth,' another, more significant trend emerges.

Suppose we examine DJI's product development and revenue growth over the past decade. Consumer drones clearly experienced a phase of rapid expansion.

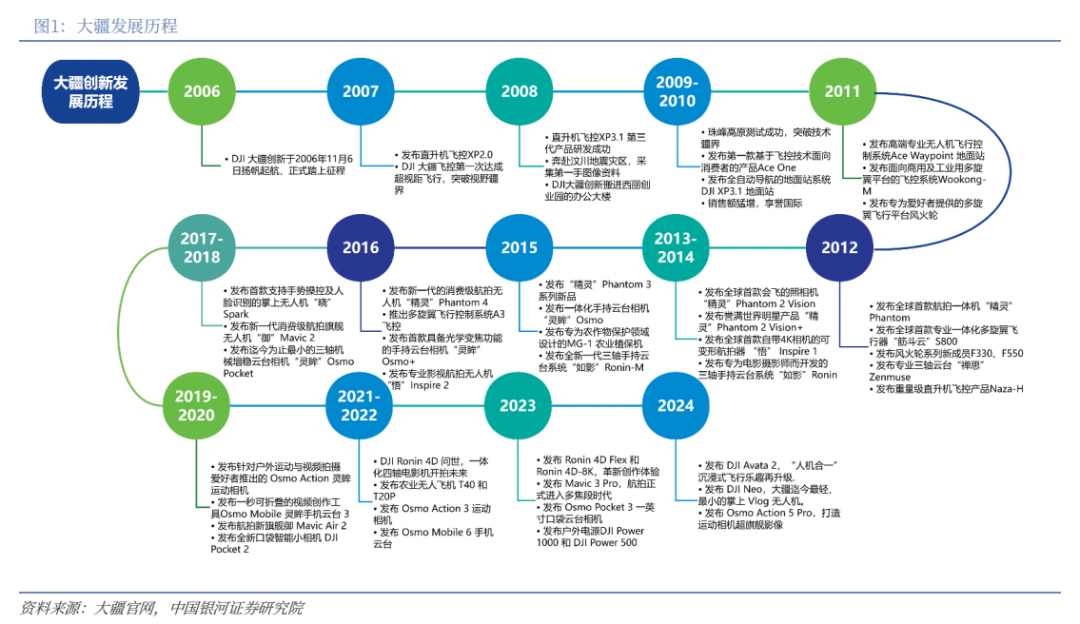

Figure/Galaxy Securities

Figure/Galaxy Securities

From 2013 to 2015, as demand for aerial photography surged, the consumer drone market saw annual compound growth exceed 100%. DJI, with product lines like Phantom and Mavic, captured nearly all of the global incremental market, easily achieving triple-digit annual growth. This was a classic period of technological innovation: every product upgrade expanded the market size.

But after 2020, this growth curve began to slow significantly.

According to Statista, the global consumer drone market reached $4.27 billion in 2024, up 7% year-over-year, with a projected five-year compound growth rate of 3.4%—a stark contrast to its previous double-digit growth.

For DJI, which has scaled its revenue to the billions, this figure has direct implications: even if it continues to dominate over 70% of the consumer market, its main business can no longer realistically double in size.

The issue isn't that DJI isn't performing well enough but that the market itself is becoming harder to expand.

The transition of aerial photography from a novelty to a mature product has coincided with shifts in user demand structures. As aerial content production becomes normalized, a group of dedicated users and professional pilots has emerged.

For most ordinary consumers, ease of operation and portability remain the most direct purchasing drivers. Factors like image clarity, transmission range, and battery life are considerations for professional pilots.

Today, aerial photography is no longer a rare experience. Ordinary consumers view drones more as occasional photography tools than high-frequency devices. Such demand is stable but inherently limited, as mid-to-high-end drones can easily last three to four years, resulting in long replacement cycles and low repurchase rates.

Macro data doesn't significantly translate to end-consumer behavior. On the demand side, professional pilot Han Rong hasn't sensed a weakening. He told Tech Insight that for media studios focused on aerial photography, drones are production tools, not consumer goods. They essentially 'must upgrade blindly' whenever DJI releases new products, 'given the improvements in image quality and safety.'

His impression is that DJI has intentionally separated the ordinary consumer market from the professional-grade user market in recent years.

This judgment is based on noticeable changes in DJI's product development. Series like Neo, Flip, and Mini have further lowered the barrier to entry for ordinary users, while product lines like Air and Mavic have iterated more densely toward professional and semi-professional users.

Before 2024, DJI's mid-range models roughly followed a one-to-one-and-a-half-year release cycle, with flagship lines updating every three to four years. Back then, DJI store sales could confidently tell customers, 'Buy a flagship model, and it won't be outdated for three to four years,' but that's no longer the case.

After 2024, especially in 2025, this pace visibly accelerated.

In September 2024, DJI released the ultra-compact entry-level Neo; in October, it launched the flagship-oriented Air 3S; in early 2025, the radically different Flip hit the market, featuring a foldable, fully enclosed protective structure and weighing under 249 grams. Within six months, entry-level, compact, and mid-range price points were sequentially filled. Subsequent leaks and announcements of new flagships like Mini 5 Pro and Mavic 4 Pro further compressed the high-end timeline.

On the surface, product releases are speeding up, but this is essentially a refined supply strategy after segmenting user structures rather than an expansion of total demand.

The consumer drone business remains healthy and profitable but is no longer the engine capable of sustained acceleration.

In contrast, industrial drones operate on a completely different track.

Agricultural plant protection, power line inspection, surveying and mapping, emergency rescue—these scenarios sound vast, but in practice, customers are mostly government or B2B entities, with procurement cycles constrained by budgets, policies, and regulations. Decision-making chains are long, and implementation is slow. This makes industrial drone demand inherently project-driven—stable growth but unlikely to achieve exponential scaling through mass-market rollouts.

In this sense, the role of drones in DJI's portfolio is shifting.

They remain the most stable foundation, with market share, brand recognition, and supply chain control at the industry's pinnacle, but increasingly unable to independently drive the next phase of large-scale expansion.

From a management perspective, this situation wasn't entirely unexpected. As early as 2016, Frank Wang judged that the overall drone market might peak at around 20 billion yuan. Years later, DJI's actual revenue has far surpassed this line, but the premise behind that judgment remains unchanged.

The ceiling will continue to rise with technological breakthroughs and new scenarios, but its existence is certain. Today's DJI has elevated drones to heights far beyond what was imagined back then, and anxiety has arrived as expected.

It's not about fearing a sudden collapse but recognizing that relying solely on this sector makes it difficult to propel the company to the next level.

02

The extension of anxiety

In the summer of 2025, DJI made a significant move in the panoramic camera sector: its first panoramic camera, the Osmo 360, launched and captured approximately 49% of the Chinese e-commerce market share and 43% globally within three months, forcing the previously dominant Insta360 (which held 85-90% of the market) into a near '50-50' split.

Figure/DJI Official Website

Figure/DJI Official Website

For a company that could 'coast' on drones, such aggressive pricing and tactics resemble a defensive move for the future: against incremental tracks that 'might grow into threats,' you must first dismantle their foundations.

That same year, DJI's external activities noticeably increased.

In August 2025, DJI released its first robotic vacuum cleaner, the ROMO series, formally entering the highly competitive robotic vacuum market. In 3D printing, DJI chose a different approach. In November, consumer 3D printing company Intelligent Factory completed a billion-yuan Series B funding round, with DJI confirmed as an investor.

Figure/DJI Official Website

Figure/DJI Official Website

Plotting these three moves together reveals a coherent strategy.

The most obvious commonality is the transferability of technical expertise.

A drone is essentially a robotic system operating at high speed in complex environments. It demands strong environmental perception, stable motion control, rigorous structural design, and reliable hardware-software coordination within limited space.

This capability isn't exclusive to 'flight.'

Panoramic cameras must stabilize footage during intense motion and stitch together images from multiple lenses in real time; robotic vacuums must navigate around wires, furniture legs, and pets without collisions or getting stuck; consumer 3D printers must maintain nozzle path precision and structural consistency over long runs. These seemingly different products all test the same core issue: engineering system maturity.

In other words, DJI isn't entering entirely unfamiliar territories but applying proven engineering capabilities to new use cases.

But this is a necessary condition, not a sufficient reason.

More importantly, these sectors occupy a 'just right' zone in terms of scale and growth potential.

The robotic vacuum market is mature and highly competitive, but technological stratification in high-end product lines remains incomplete. By integrating drone-derived perception algorithms and motion control into an established category, DJI faces a familiar challenge: elevating a 'good enough' product to 'significantly better.'

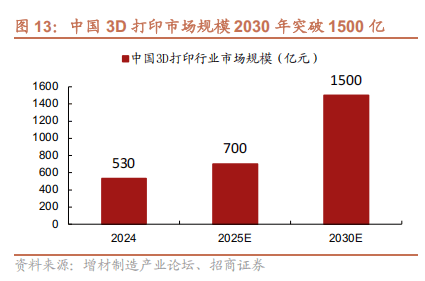

Meanwhile, 3D printing remains a niche market, with users concentrated among enthusiasts and professionals, far from true mass-market adoption. Its state closely resembles consumer drones over a decade ago: high technical barriers, significant experience disparities, and leading players yet to establish clear generational gaps.

Figure/China Merchants Securities

Figure/China Merchants Securities

DJI's choice to invest via equity rather than build its own brand serves dual purposes: cost control prevents internal resource dilution while allowing it to share in the sector's early growth, and it leaves room for deeper collaboration down the line.

This aligns with DJI's traditional ethos: positioning itself as the 'first mover.' These markets may not be vast yet, but all possess uncapped growth potential.

From a results standpoint, none of these businesses are likely to replicate the explosive growth of drones anytime soon, but collectively, they can thicken DJI's foundation. This likely reflects DJI's current mindset: not betting on a single future but securing more options for what comes next.

Which track will extend the farthest depends on whether technology can genuinely translate into user experience rather than lingering as mere specifications, and whether DJI is willing and able to invest long-term in channels and services for these non-drone categories.

A more pressing reason is that drones themselves are facing tighter constraints.

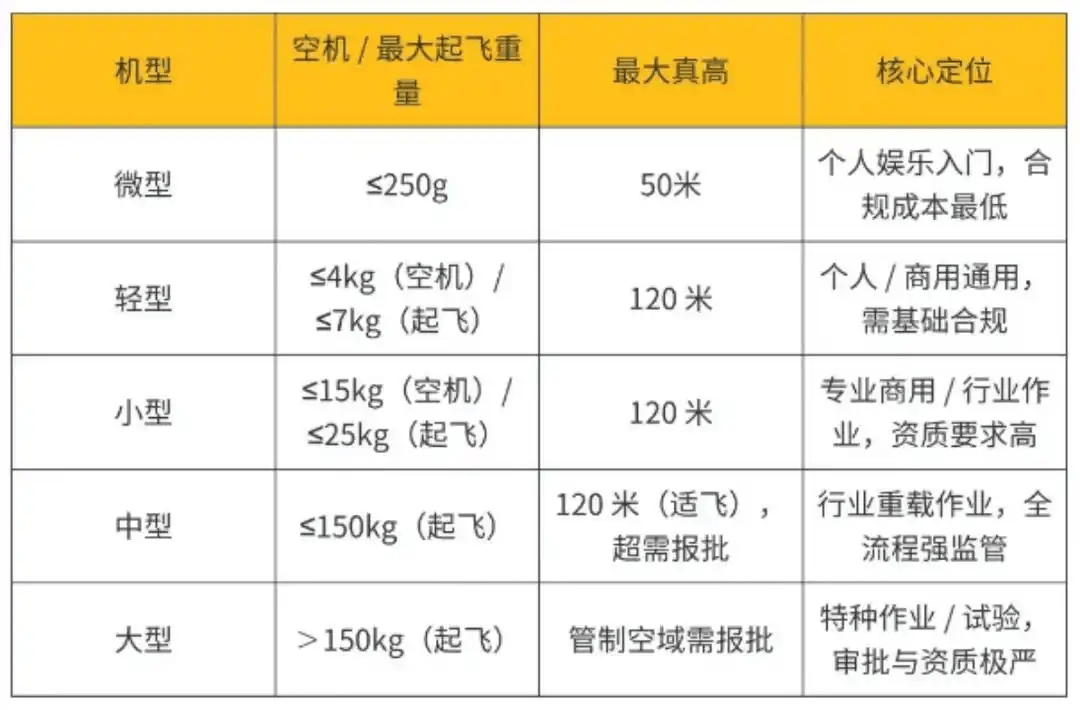

Starting January 1, 2026, China's drone sector will implement its strictest regulatory framework yet.

The new rules clarify legal penalties for 'unauthorized flights,' categorizing drones into five classes (micro, light, small, medium, large) based on empty weight and maximum takeoff weight, with compliance requirements escalating accordingly.

Figure/Qilu Evening News, used with permission

Figure/Qilu Evening News, used with permission

All drones must be registered in the UOM system, and after May 1, 2026, all must be equipped with and activate a unique product identification code. Except for models under 250 grams and light drones flying below 120 meters, all other models require filing 1.5 days in advance, with some scenarios necessitating pilot licenses, airspace approvals, and third-party liability insurance.

In Han Rong's view, the new rules will directly impact DJI's sales.

He lamented that light drones are popular among deep users, but 120 meters is rarely sufficient, and designated airspace is scarce, with approvals not guaranteed. 'There's no efficient filing process or clear review timelines. Uninformed buyers won't even know to file, and the software is hard to use. Essentially, the barrier to entry for consumer drones has been raised indefinitely.'

Figure/Provided by interviewee

Figure/Provided by interviewee

A DJI store salesperson admitted that post-regulation sales have dropped noticeably: 'I've barely sold any—just one Mini 5 in half a month.'

03

DJI under multi-front pressure

In public reports, Liu Jingkang, founder of Insta360, mentioned DJI at least four times on WeChat Moments over the past year.

When Insta360 launched its drone brand 'Yingling' in July 2025, Liu posted three Moments updates in two days with long reflections, using phrases like 'far more' to marvel at DJI's strength, expressing 'utmost respect' and admitting, 'When we made this decision five years ago, we anticipated this move would provoke DJI into countering with panoramic cameras. Even at that cost, we chose to proceed.'

Leaked WeChat Moments screenshot of Insta360 founder Liu Jingkang, used with permission

Leaked WeChat Moments screenshot of Insta360 founder Liu Jingkang, used with permission

The youthful general's audacity renders this post akin to a battle proclamation—a resolute declaration of recognizing one's adversary and charging into enemy territory with unbridled enthusiasm.

This period of calm persisted until October when DJI shifted its stance and opted to slash prices. Amidst the public uproar, Liu Jingkang took the initiative to shoulder the blame for DJI's price reduction, stating it was an act of "expressing apology." He even extended Insta360 vouchers worth 100 yuan to customers who had purchased DJI products.

Figure/From DJI's official website

Figure/From DJI's official website

However, within a mere few months, the tone took a drastic downturn.

In mid-December, Liu Jingkang reposted 'The Supply Chain War Between DJI and Insta360' with the caption 'Fight to the bitter end, until death'; a few days later, he reposted the company's statement seeking leads on black PR activities, declaring 'The number of operatives dispatched in 2026 will skyrocket.'

Evidently, Liu Jingkang attributed the public backlash over the poor sales of the Yingling A1 to attacks orchestrated by DJI.

In this clash, one side frequently voiced its opinions on social media, while the other remained perpetually silent.

Throughout this entire ordeal, DJI never once publicly responded. Yet, its actions were far from sluggish.

On the very afternoon Insta360 announced its foray into the drone market, DJI officially unveiled its panoramic camera. A few months later, the Osmo 360 entered the market priced at 2,999 yuan, directly undercutting Insta360's X5 by 800 yuan in terms of specifications.

This 'incursion' may have unfolded faster and more fiercely than Liu Jingkang had anticipated.

Drones are not Insta360's forte; Insta360 needs to craft a narrative, to continually prove to the market that 'I am on the offensive'; DJI does not. It more closely resembles a seasoned player already seated at the poker table, selectively playing its cards, and more often than not, discerning whether a particular hand warrants a substantial bet.

Insta360 clearly felt the weight of this pressure.

In an internal letter, Liu Jingkang mentioned that in the six months preceding the release of the Yingling drone, multiple core suppliers faced 'exclusivity' pressures, involving key components such as optical lenses, structural parts, batteries, and chips. He refrained from naming specific companies, but within the industry context, the intended target was unmistakable.

Image source: Internet; rights reserved for removal

Image source: Internet; rights reserved for removal

Although DJI did not engage directly in verbal sparring, this does not imply it could simply rest on its laurels. According to a report by BaiJing Lab, over the past three to four years, Insta360 has lured away numerous individuals from DJI, with the core members of Insta360's drone business almost entirely hailing from DJI, including poaching half of a department from DJI.

And Insta360 is not the sole adversary compelling DJI to 'look up passively.'

Another source of pressure emanates from smartphone manufacturers.

If Insta360 can be deemed a 'melee among peers,' then the entry of smartphone manufacturers resembles a multi-pronged assault from entirely different species.

Over the past few years, DJI has carved out a highly profitable 'money-printing machine' business in the virtually non-existent niche market of handheld imaging with its Pocket series. By the end of 2024, VIVO took the lead in initiating a handheld gimbal camera project. By the end of the previous year, OPPO also confirmed the launch of a similar product, spearheaded by its core Find product planning department and personally led by Liu Zuohu. The timeline roughly indicates a concentrated market release in 2026.

Rumors have also circulated that Honor is set to launch its first robotic phone, the ROBOT PHONE, for mass production in the first half of 2026, featuring an AI+Pocket positioning.

For these smartphone manufacturers, the Pocket category is not uncharted territory; rather, it represents a natural extension of their smartphone imaging capabilities: on one hand, they have already invested heavily in image sensors and imaging algorithms for over a decade, pushing night photography, portraiture, and video stabilization to new heights; on the other hand, regarding the smartphone itself, the imaging experience has reached 'perceptual saturation,' making it challenging to justify charging users an additional one or two thousand yuan in premium.

At this juncture, integrating computing power, sensors, and algorithms 'into a more compact body better suited for video shooting,' and then binding it with the smartphone system, cloud storage, and editing apps, naturally gives rise to a new product category that can tell a compelling story and drive GMV.

Thus, we witness a scenario where upstream, aggressive new competitors like Insta360 are willing to go head-to-head; downstream, smartphone manufacturers are leveraging their ecosystems and channels to continuously erode the presence of standalone hardware; and in the middle, there is DJI, which has already reached its zenith but must continue to expand.

Figure/From Insta360's official website

Figure/From Insta360's official website

Regulations are tightening, competition is intensifying, and adversaries are multiplying.

It remains a formidable force, arguably still outperforming its peers across multiple dimensions; however, it can no longer rely solely on technological superiority to naturally achieve growth as it did in the past. New growth entails entering a noisier, more crowded, and less scrupulous battlefield.

Can DJI find new certainty? This is not a question that can be answered in the short term.

But what is certain is that when its core market no longer provides rapid growth, DJI can no longer rely solely on 'silence' to weather all storms. In the coming years, whether it will alter its communication style, product strategy, or even its attitude towards competition will itself become a pivotal window into observing the company's trajectory.

Header image/From DJI's official website