It's not that Honor is not trying hard

![]() 01/22 2026

01/22 2026

![]() 425

425

Written by Xu Wenwen

Edited by Zhang Xiao

"Some in the outside world say Honor is about to die... Of course, it's not dead, but reborn."

In late May of last year, after the launch event for Honor's new 400 series smartphones, Li Jian, who had just taken over the CEO baton from Zhao Ming four months earlier, said this during a media exchange.

At that time, Honor was at its first low point since becoming independent.

The low point stemmed from continuously declining sales. Honor had reached the peak of sales, with IDC data showing that in the first quarter of 2024, Honor tied with Huawei for first place in the Chinese smartphone market with a 17.1% market share, a year-on-year increase of 13.2%. Further back, in the second quarter of 2022 and the third quarter of 2023, Honor topped the Chinese market. However, the peak was short-lived, as Honor's market share in China dropped by 8.1% in 2024, falling out of the top five in the first quarter of last year.

The low point also stemmed from the uncertainty brought by internal organizational turmoil at Honor after Zhao Ming's departure.

Three days after Zhao Ming left Honor, Jiang Hairong, the former CMO of Honor's China region, and Zheng Shubao, the former head of sales for the China region, resigned on the same day. Subsequently, under the leadership of new CEO Li Jian, Honor initiated a round of high-level executive reshuffles, including adjusting six of the eight global regional leaders and reassigning 45% of the key positions in the China region, among other changes.

It's hard to pinpoint the exact reasons behind Honor's series of large-scale personnel changes in the first half of last year. For instance, there have always been voices in the outside world speculating that Zhao Ming's departure was to take the blame for the declining sales. Even within the Honor community, some believe that Honor's reshuffle was aimed at completely shedding Huawei's influence.

However, Honor's pace was indeed slowed down.

Before the launch of Honor 400, Honor only released two new products in the first half of 2025: Honor Power and Honor GT Pro—both mid-range series. In fact, the Honor 400 series was also positioned as mid-range. For comparison, in the first half of 2024, Honor released models including the Magic V2 RSR Porsche Design foldable screen, Magic6 series, Magic6 Ultimate Edition, Magic6 RSR Porsche Design Edition, and Honor 200 series.

Returning to the Honor 400 launch event, at that time, from the inside out, Honor was desperately trying to convey the signal that the pain brought by the transformation was over, and that starting with Honor 400, the company would regain its competitiveness.

Li Jian's notion of "rebirth" was reflected in his statement that Honor's most difficult period had passed. Wang Ban, President of Sales and Services at Honor, also expressed confidence in restoring growth and even returning to the top three in the second half of the year.

Unfortunately, things did not go as planned. By the end of 2025, Honor's sales had not seen a strong rebound:

In the market share statistics for the Chinese market from multiple research institutions, Honor did not make it into the top five. Counterpoint data showed that Honor had the worst performance in terms of shipment growth in the Chinese market in 2025, with a year-on-year decline of 12.6%. The second-worst performer, vivo, also saw a decline in shipments, but "only" by 6.7%.

01

Honor's biggest weakness is the lack of a distinct strength

Judging by Honor's recent frequency of new product releases, at least in the first quarter of this year, there is an opportunity for a strong rebound in sales.

From October 2025 to the present, Honor has released new products including the Magic 8 series, Honor 500 series, WIN series, Power2, Magic 8 Pro Air series, and Magic 8 RSR Porsche Design.

Judging by the battle reports posted by Honor executives on social media, despite the different positioning of these series, their initial sales performances have been quite good.

For example, the all-channel first-day sales volume of the Honor 500 series was 151% of that of the same period series, and the WIN series broke the first-day sales record for new Honor products within two hours of launch.

However, for Honor at present, a flood of new products may only provide a temporary solution rather than a fundamental cure.

It's not that Honor is not trying hard.

Currently, Honor's products have few obvious weaknesses; it's hard to find significant flaws in terms of configuration and specifications. In fact, Honor has become one of the most generous Chinese smartphone manufacturers in terms of component usage.

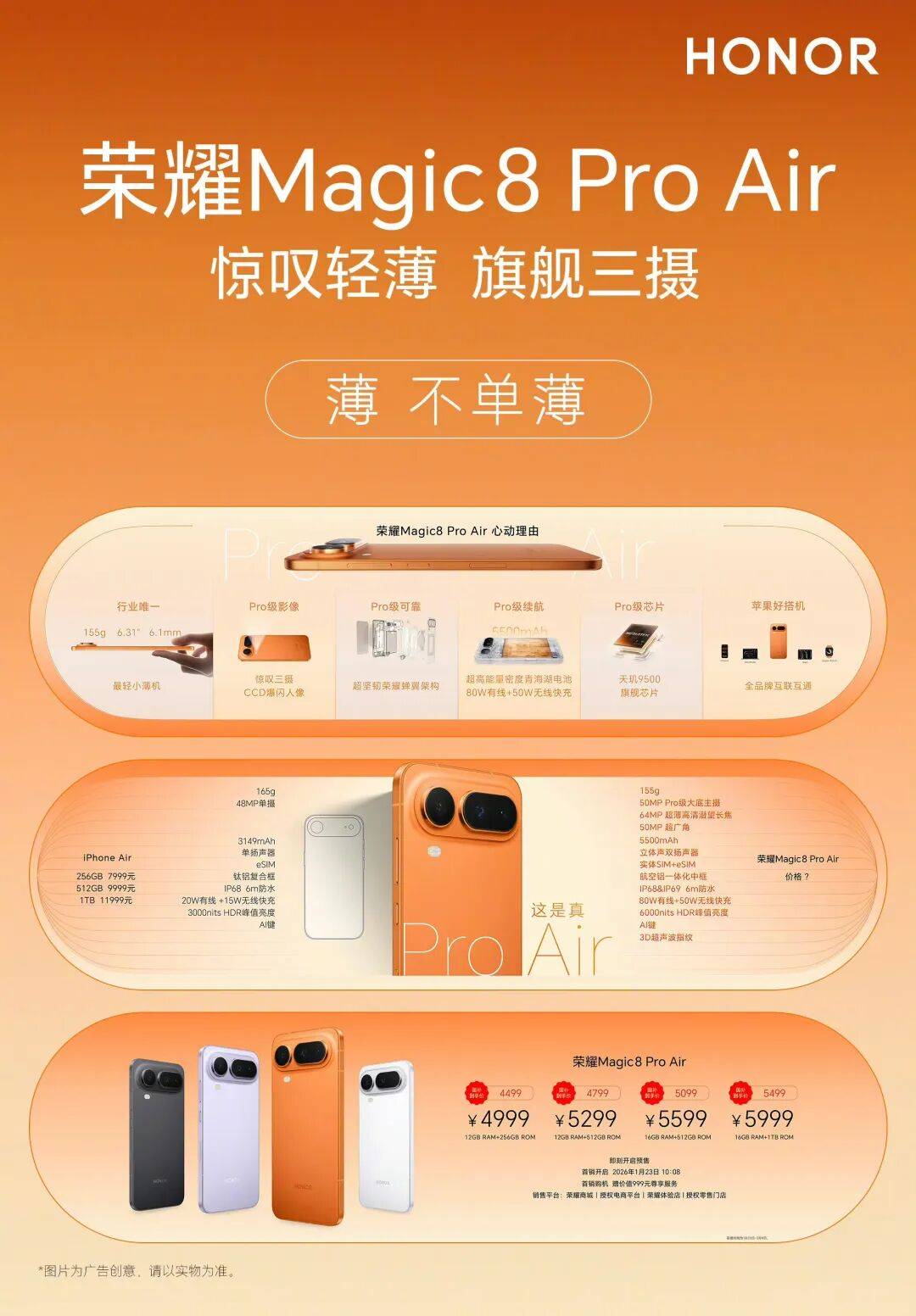

The Magic8 Pro Air, released by Honor on January 19, even surpasses the iPhone Air in terms of paper specifications:

It is 10g lighter than the iPhone Air, has a battery capacity more than 2000mAh larger, features a full-range triple-camera setup and dual speakers, supports eSIM and physical SIM quad-card dual standby, and is also cheaper than the iPhone Air—these are almost all the weaknesses that consumers have concentrated on since the iPhone Air's release.

Figure/Honor's official Weibo account

Figure/Honor's official Weibo account

Before the launch of the Magic8 Pro Air, Li Kun, the product line leader, even boldly claimed on social media, "There are two types of Android Air: Honor and others." In fact, to date, only Samsung and Honor have released Air series models in the Android smartphone camp. Previously, there were also market reports indicating that several domestic smartphone manufacturers have successively canceled the Air product line.

Other recently released Honor models also have clear positioning, and at least in terms of product strength, they seem quite sincere.

The Honor Power 2, positioned as an outdoor lightweight flagship, focuses on ultra-long battery life and communication, with a battery capacity of 10080mAh. The WIN series is positioned as an esports flagship, described by Honor as the "King of Esports," "King of Performance," "King of Battery Life," and "King of Cooling."

In addition, the Honor 500 series targets young people, claiming to be the first to feature a 200-megapixel camera in the 2000-yuan price range. To win over more young people, Honor also released a cross-border collaboration with Pop Mart on January 19: the Honor 500 Pro MOLLY 20th Anniversary Limited Edition.

Figure/Honor's official Weibo account

Figure/Honor's official Weibo account

According to a previous report by Caijing, the collaboration between Pop Mart and Honor took more than half a year to prepare. The two sides did not simply engage in "sticker" marketing; the Honor 500 series incorporated Pop Mart's core IP, MOLLY, into the ID design, system themes, boot animations, and ringtones, among other underlying experiences.

You can clearly see that Honor is now desperately trying to shape the differentiation of its various product lines—the Magic series aims for the high-end market, the number series targets young people, the WIN series, upgraded from the GT series, caters to the esports crowd, and the Power series focuses on light outdoor use.

However, at least at the current stage, these differentiations, which are more focused on the product side, have not yet formed a distinct brand imprint for Honor.

Take a simple example: when you think of Xiaomi, you think of cost-effectiveness; when you think of vivo, you think of portrait photography; when you think of Huawei, you think of HarmonyOS; when you think of Apple, you think of iOS; when you think of OPPO, you think of photography.

But when you think of Honor, whether it's flagship models, sub-flagship models, or mid-to-low-end models, it's hard to immediately identify its brand strengths. You might think of eye protection or battery life, which are certainly strengths, but they are far from enough.

Even from a product design perspective, Honor's design language lacks consistent continuity, shifting from early imitations of Huawei to current imitations of the iPhone, which is also not conducive to building brand recognition.

This is a unique "middle student" dilemma for Honor: its weaknesses have never been in its products, but when consumers want to buy a smartphone, it's hard for Honor to make it to the top of their priority list with more distinct strengths.

For a long time, Huawei served as its endorsement, but when Huawei made a strong comeback, it became a constraint for Honor.

In addition, every segmentation product line that Honor is now vigorously promoting is crowded with competitors. Without distinct strengths, it's hard to effectively break through.

In terms of imaging, this is already a dimension where smartphones cannot afford to have weaknesses. Honor only began to catch up in terms of imaging starting with the Magic 8 series, but its competitors have already established dedicated imaging product lines, with multiple iterations of their Ultra flagship models from Xiaomi, OPPO, and Vivo. In terms of esports, this is IQOO's comfort zone. Competing for young consumers, Xiaomi, OPPO, Vivo, Apple, and Huawei are all formidable opponents.

02

"The story" is too far away, with limited time and space

From the organizational turmoil at the beginning of the year to the regained confidence at the launch of the Honor 400 series in mid-year, and then to the harsh reality of becoming an "other" in terms of sales in the Chinese market by the end of the year, Honor's 2025 was overall a year of struggle.

However, from another perspective, if we tentatively refer to Honor after Li Jian took over as the "new new Honor," then in terms of group strategy in 2025, Honor has become more aggressive, clear, and determined.

The aggressive organizational adjustments at the beginning of the year marked the start of these changes, as Honor attempted to drive business growth through organizational changes. At that time, Li Jian himself said that the company should focus on "stabilizing its foundations," namely organizational and strategic adjustments.

The "Alpha Strategy" announced by Honor in March presented an even grander narrative. Honor stated that it would transform from a smartphone manufacturer to an AI terminal ecosystem company and proposed investing $10 billion over the next five years in AI terminal technology, ecosystems, and partnerships.

Specifically, the only keyword of the Alpha Strategy is AI.

For example, focusing on technological transformation, Honor established a new industry incubation department to explore AI terminal forms. At the same time, it adjusted its product and R&D departments, establishing new departments such as AIOS, AI hardware, and AI platforms. During a media briefing in May, Honor revealed that its AI and software departments already had as many as 2600 employees.

"To become a terminal ecosystem company in the AI era, I believe we have a lot of work to do. We have already started many practices and collaborations, and you will see Honor's tremendous transformation and changes," Li Jian said at the time.

At Honor's AI Terminal Ecosystem Conference last October, Honor's ecological ambitions continued to be revealed.

Honor announced the "13N" ecosystem strategy, aiming to create a cross-brand, cross-scenario, and cross-device intelligent interconnection ecosystem. Here, "1" refers to the HONOR AI Connet platform, which opens up Honor's AI capabilities to all ecological partners; "3" represents supporting partners through three models: "ecological empowerment," "channel empowerment," and "technological and brand empowerment"; and "N" represents that Honor will cover N industrial clusters, including education and office, smart home, audio and wearables, and toy companion pets.

Fang Fei, President of Honor's Product Line, said at the time that in the towering tree of the AI ecosystem, Honor should become the "trunk," integrating technological foundations downward and supporting scenarios and services upward.

Even with the name concealed, this ecosystem conference did not seem much like an ecosystem conference held by a smartphone manufacturer, which of course aligns with Honor's new self-positioning.

This is the most intuitive change that Li Jian has brought to the company—it is desperately trying to shed its "smartphone manufacturer" label and bring Honor into a grand AI narrative.

Honor is indeed making more explorations. For example, it has officially announced its plan to develop robots, with its globally first smartphone robot, the Honor ROBOT PHONE, expected to be released this year.

Objectively speaking, Honor needs such a "story." It has been accelerating its IPO process, signing an listing tutoring agreement with CITIC Securities in June last year, and is expected to complete the tutoring preparations by March this year.

However, the objective fact facing Honor is that its most urgent task at present is to solve its sales dilemma—

Before developing more second and third growth curves, the smartphone business, which is currently the most important mainstay, must hold up the bottom line.

Header image/Honor's official Weibo account