Google: The Big Brother Goes Wild, Doubling Down on AI

![]() 02/05 2026

02/05 2026

![]() 356

356

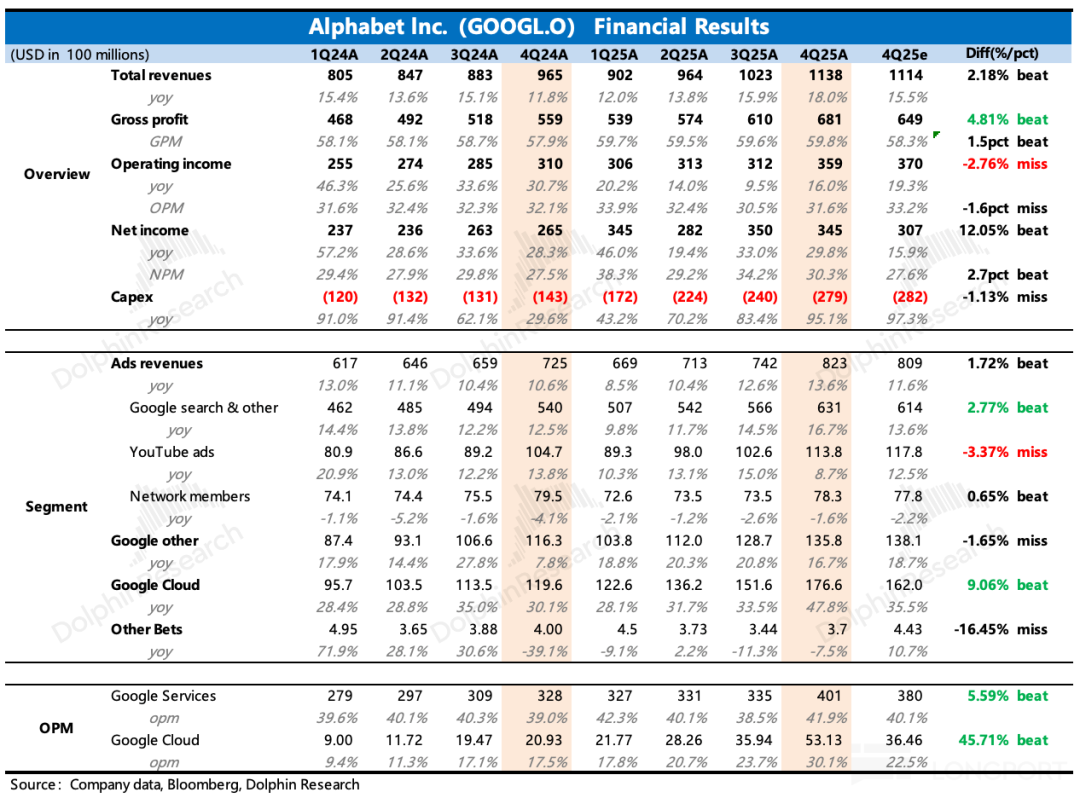

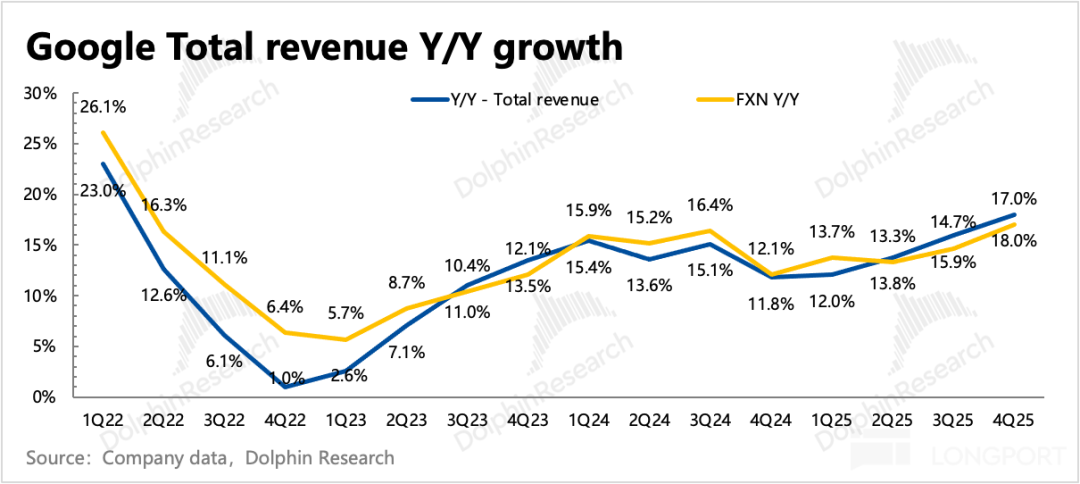

After market close on February 4 (Eastern Time), Alphabet, Google's parent company, released its financial report for the fourth quarter of 2025. Focusing solely on current performance, while results are mixed, the overall interpretation leans more toward positive signals. However, what startled the market was the staggering capital expenditure guidance—expected to double in 2026—raising concerns about whether demand can keep pace.

Key takeaways:

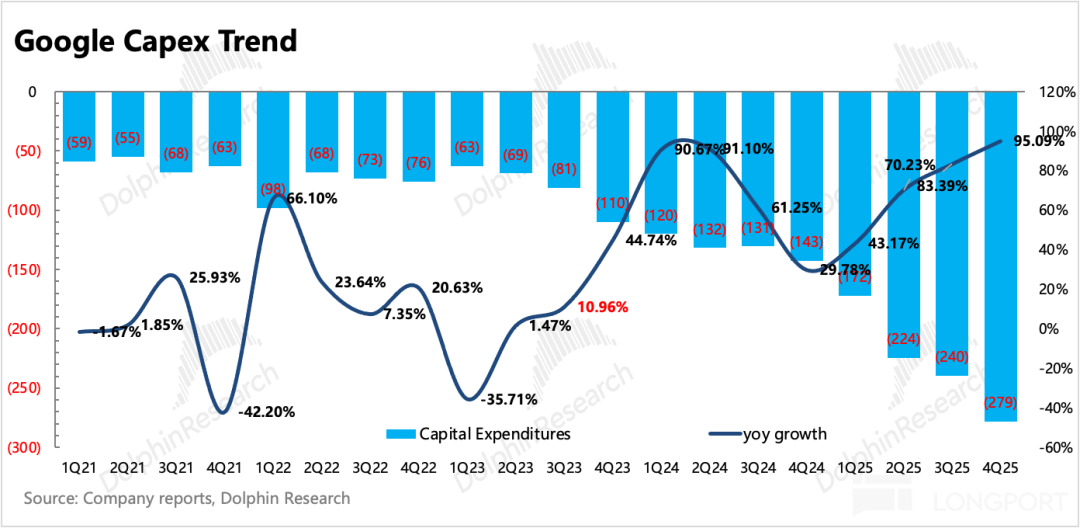

1. Staggering Capex: Guidance for 2026 stands at $175-185 billion, doubling year-over-year, compared to market expectations of only $130 billion! Initially, Meta's capital expenditures seemed substantial, but Google has now claimed the title of the truly deep-pocketed 'big brother.'

Although cash flow is adequate, it's not entirely abundant (last November, a $25 billion unsecured bond was issued). However, can such massive investments be supported by equally sustained performance acceleration?

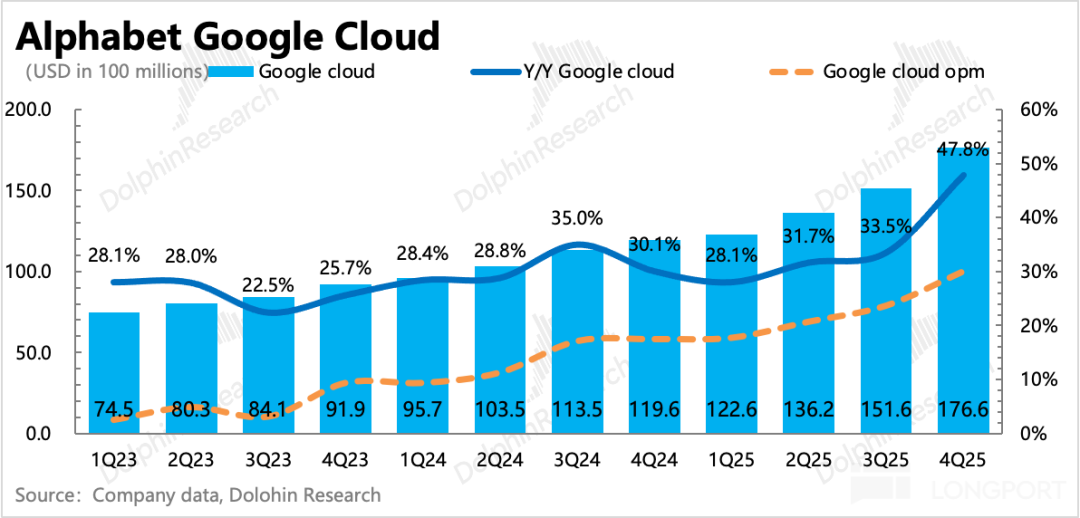

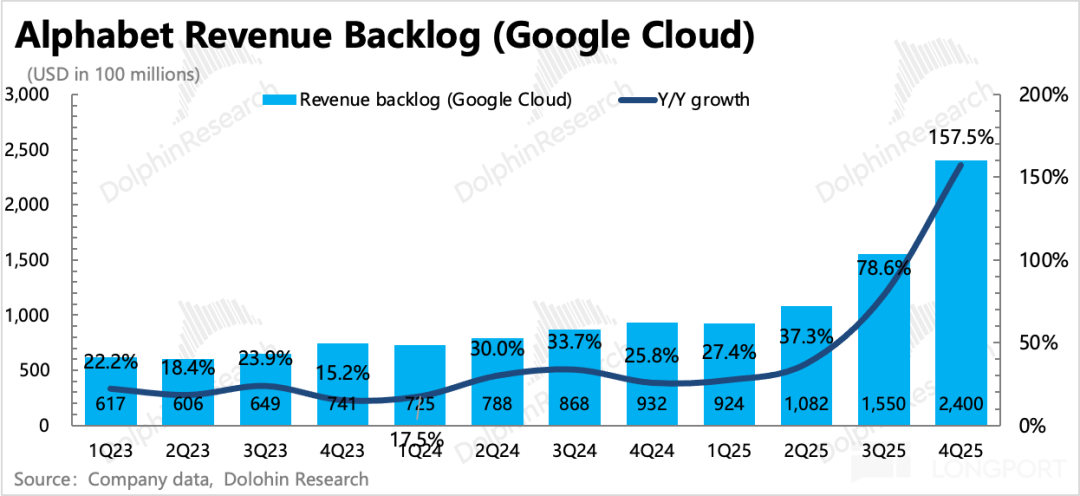

2. Explosive cloud growth: Q4 growth reached 48%, significantly exceeding expectations. Remaining contract obligations hit $240 billion, with a net increase of $85 billion quarter-over-quarter, even stronger than Q3, directly establishing short- to medium-term high growth. As the primary 'return' source for substantial capital investments, the cloud business remains reassuring. However, the originally strong positive was diluted by high Capex, potentially reigniting concerns among shorts about the sustainability of high growth.

3. Mixed advertising performance, but short-term issues are manageable. Attention should be paid to the commercialization of OpenAI and TikTok:

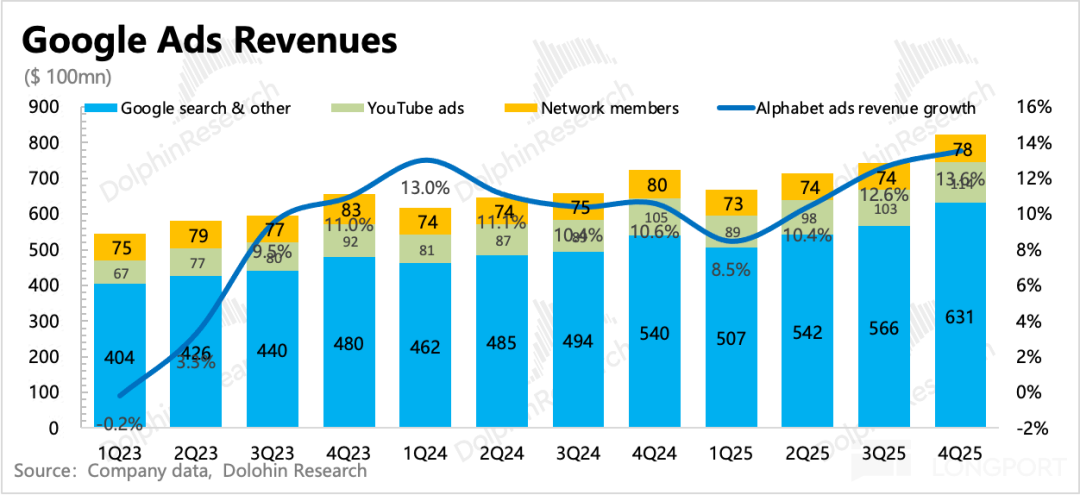

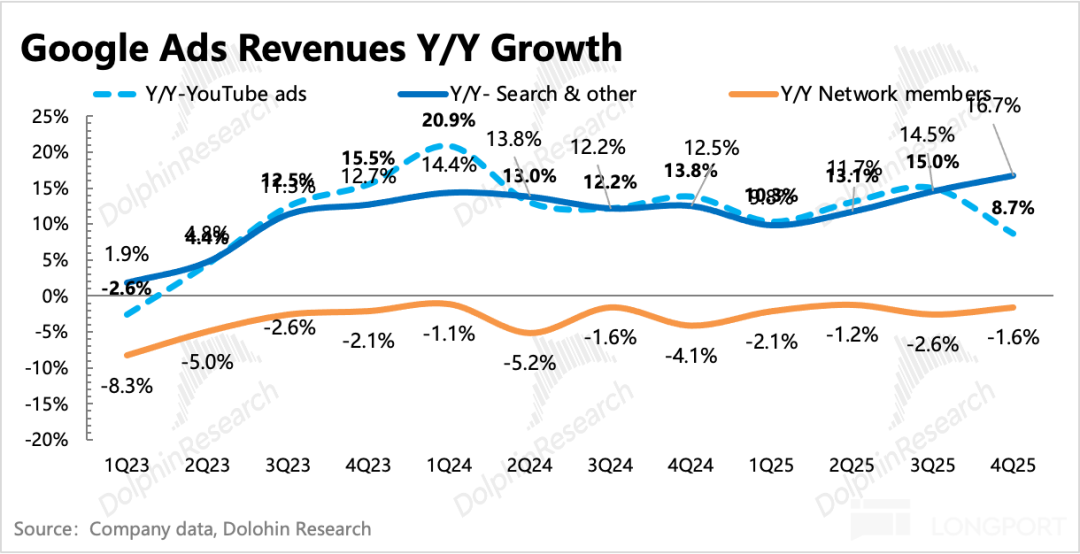

(1) Search remains robust: Q4 growth reached 16.7%, slightly exceeding expectations. The advertising industry performed well in Q4, with e-commerce and travel advertising standing out. AI-driven improvements in ad conversion have led advertisers to favor online performance ads over brand ads.

Despite potential risks of traditional search disruption, Gemini 3's strength and Google's decisive transition allow it to first enjoy the upgrade dividends from enhanced AI experiences before traditional search interactions fully collapse.

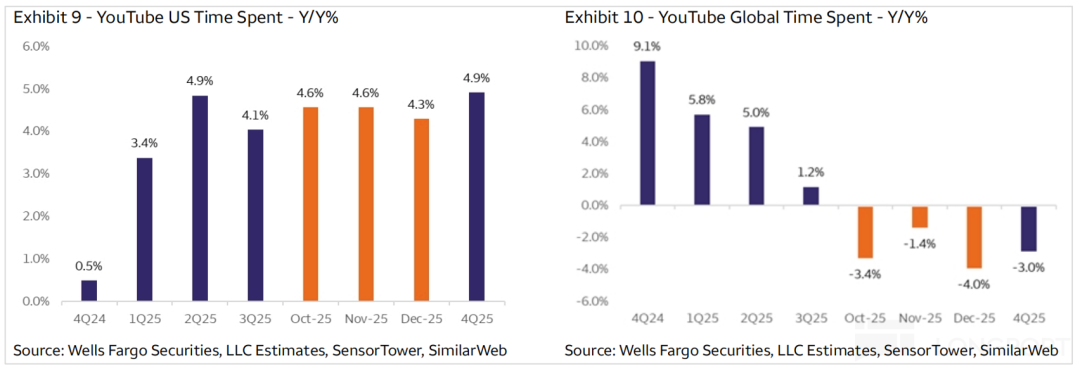

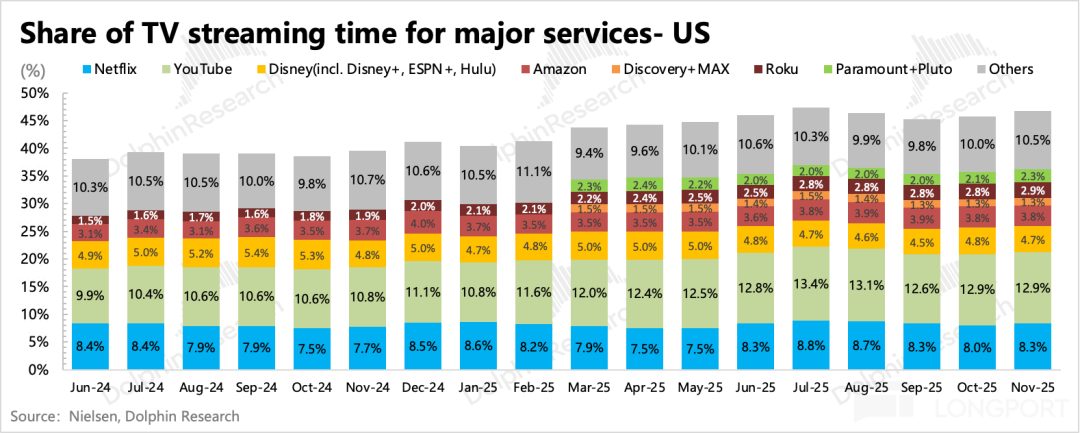

(2) YouTube unexpectedly weakened: Q4 ad growth on the platform fell below 9%, significantly lower than the consensus expectation of 12-13%, unable to withstand last year's high base pressure. Dolphin Research believes this is likely due to internal cannibalization from Shorts (which has yet to aggressively monetize) and unexpected pressure on YouTube TV's brand advertising.

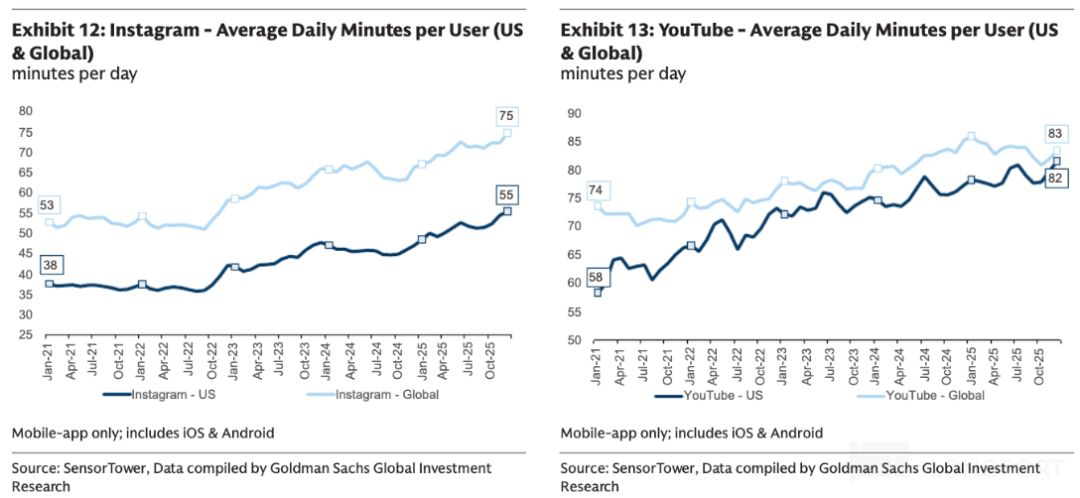

However, YouTube's user ecosystem remains healthy, with Sensor Tower data showing continued growth in user engagement, with per-user time spent increasing comparably to Instagram. Referring to Meta's increased ad load, Short could also boost monetization if needed.

4. Other revenue streams slightly missed expectations: Other income, primarily from YouTube membership subscriptions, Google Play, and Pixel hardware, grew by 17% in Q4. While still high, growth slowed significantly quarter-over-quarter compared to the lower base at the end of last year, falling short of the expected 19% year-over-year growth.

This may be partly due to the Pixel phone release schedule. Last year, the Pixel 10 was released and available for sale in August, causing revenue to be 'pre-counted' in Q3.

The company disclosed that Q4 growth was mainly driven by YouTube (with YouTube TV's viewership share consistently increasing) and Google One subscription revenue (driven by cloud storage and AI premium membership income). Currently, the combined global subscriber base for these two services has reached 325 million, up from just over 300 million last quarter.

5. Affiliate advertising slightly declined: Affiliate advertising can be seen as a casualty of search AI transformation, but Google effectively contained this impact within a certain range (decline under 5%). It fell by 1.6% year-over-year in Q3, nearing the end of adjustments.

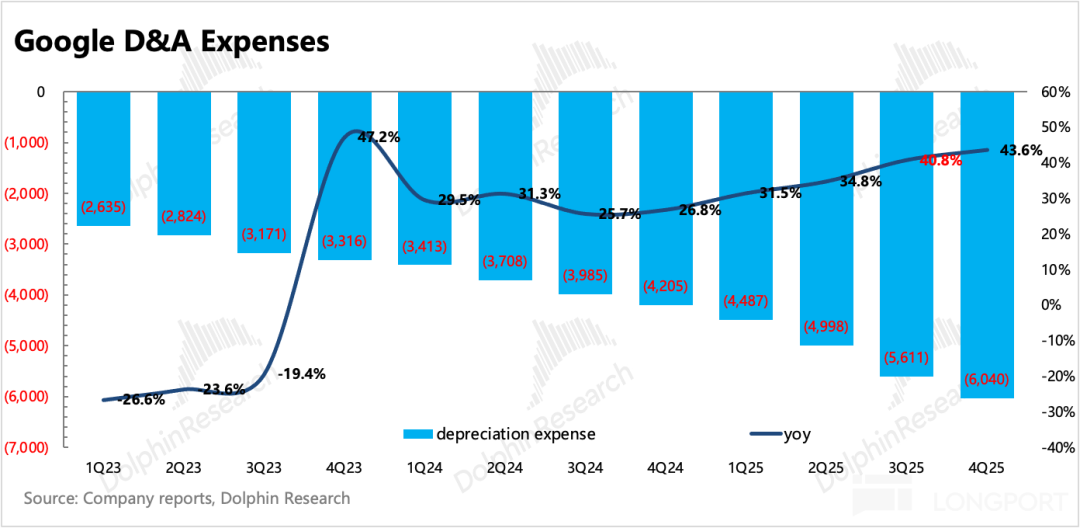

6. Impact of investments on profits not yet apparent: Q4 operating profit margin remained near 32%, with no significant sequential or year-over-year declines. The shortfall against expectations was due to additional employee incentives from Waymo's financing. However, depreciation expenses have been rising since Q3, with year-over-year growth exceeding 40%.

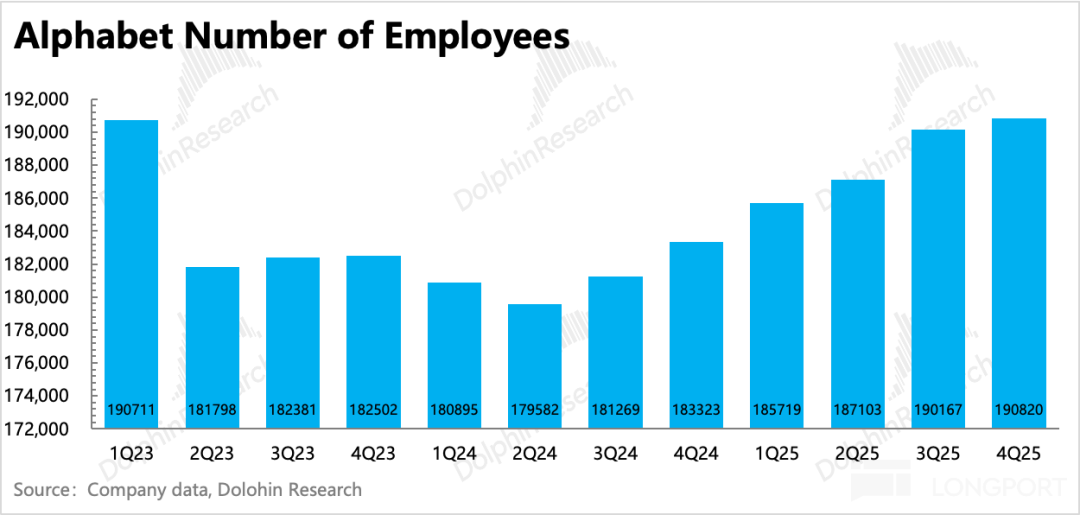

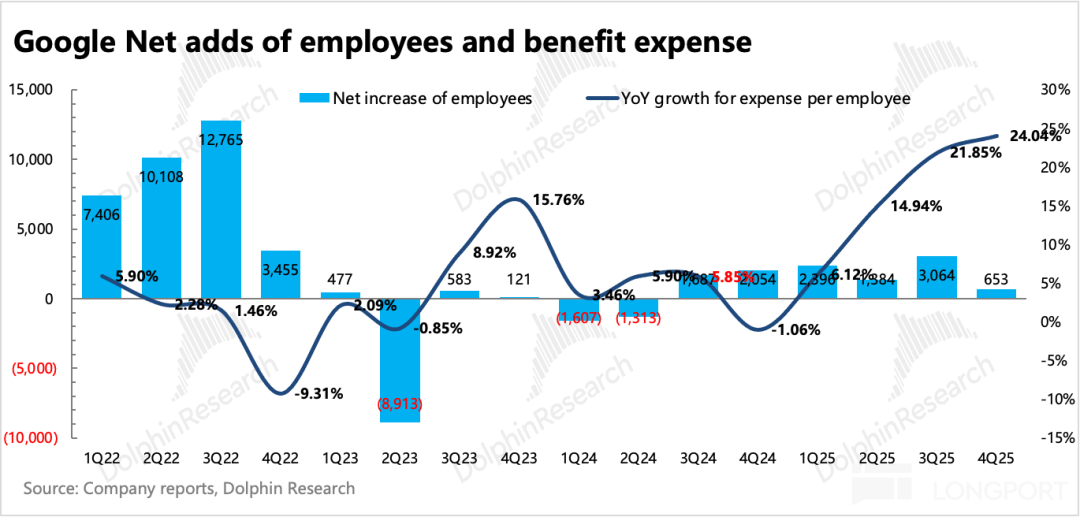

With the massive Capex expected in 2026, total expenses are set to surge if not controlled. Therefore, Google's workforce adjustments will continue, with Q4 net headcount growth significantly reduced to 650 compared to the first three quarters.

7. Share buybacks shrank: Likely to reserve funds for AI investments, only $5.5 billion in shares were repurchased in Q4, a further $6 billion reduction quarter-over-quarter. Actual dividends paid this quarter were $2.5 billion, remaining stable.

The company expects to pay a dividend of $0.21 per share based on Q4 performance, totaling approximately $2.6 billion. If 2026 buybacks reduce to Q4 levels + stable dividends = $33 billion, the annual shareholder return yield becomes negligible.

8. New round of Waymo financing: Notably, Waymo secured $16 billion in new financing this month, mostly from Google itself (reportedly 80%), with the remainder led by Dragoneer, Sequoia, and DST, valuing the company at approximately $126 billion. Due to the increased valuation, $2.1 billion in employee equity incentives were confirmed.

9. Comparison of key metrics against expectations

Dolphin Research's View

Doubling Capex reflects Google's determination to fully transition to AI and, to some extent, 'implicitly' signals significant future growth opportunities. Unlike Meta, which has a history of questionable spending, Google has not engaged in such blind 'wasteful' behavior before. Therefore, we believe this figure was carefully considered by management.

However, disagreements are likely to emerge at the current valuation of nearly 30x P/E for the year. Especially funds that have enjoyed valuation uplifts from 19x P/E may choose to take profits amid the burden of massive investments announced by management.

If we consider management's vision of sustained rapid business expansion, the additional investments could be absorbed by extra revenue growth: The $50 billion in additional Capex compared to market expectations, amortized over five years, would mean an additional $5 billion in profit absorbed in the first year and $10 billion annually thereafter.

Meanwhile, Q4's exceed expectations (better-than-expected) cloud performance could nearly offset the profit shortfall if consensus expectations for 2026 growth are raised from 35% to over 40%.

Given the $240 billion in remaining orders, while this includes many long-term contracts, based on historical structure (to be corrected after annual reports reveal short- and long-term contract ratios), over 40% cloud growth within a year remains highly plausible.

Therefore, compared to the 'surprise' on the investment side, we are more concerned about the commercialization impact of OpenAI and TikTok this year. While we were relatively confident in Q3 that Google could continue to enjoy valuation premiums, we now exercise more caution, closely monitoring macroeconomic and industry competitive changes.

Below is a detailed financial report analysis

1. Google Overview

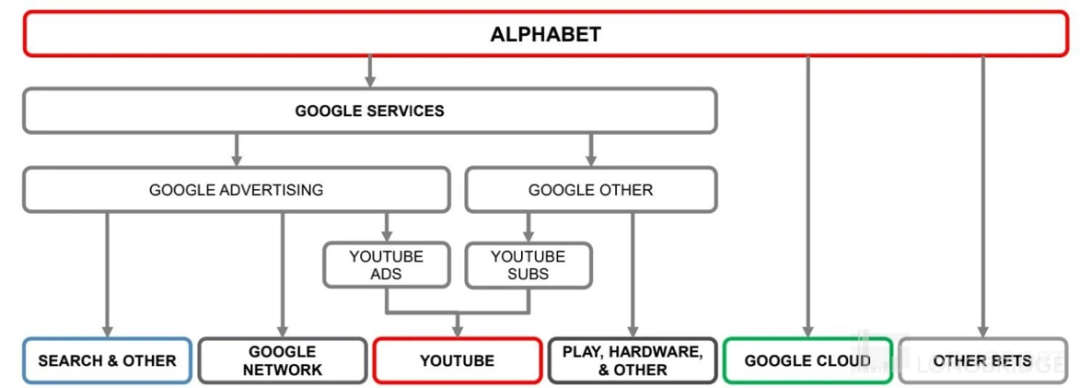

Alphabet, Google's parent company, has a diverse business portfolio and has undergone multiple changes in its financial reporting structure. For those unfamiliar with Alphabet, here's an overview of its business architecture.

Briefly outlining Google's fundamental long-term logic:

a. Advertising, as the primary revenue source, contributes the majority of the company's profits. Search advertising faces a medium- to long-term risk of erosion by feed advertising, with high-growth streaming platform YouTube serving as a replacement.

b. Cloud business represents the company's second growth engine, having turned profitable and showing strong recent contract momentum. As advertising continues to be weighed down by weak consumption, cloud business development becomes increasingly vital for supporting the company's performance and valuation potential.

2. Accelerating cloud business: The cornerstone supporting doubled Capex?

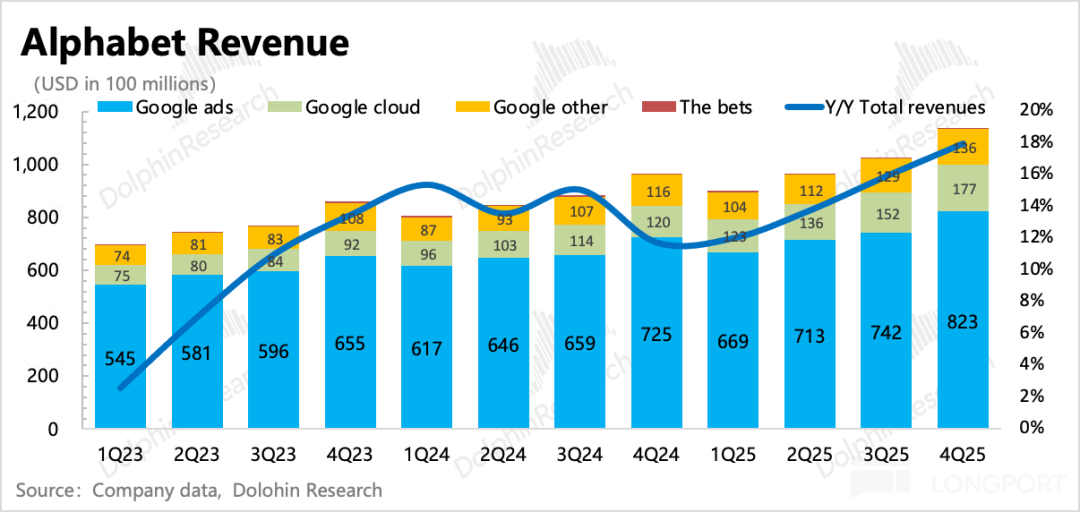

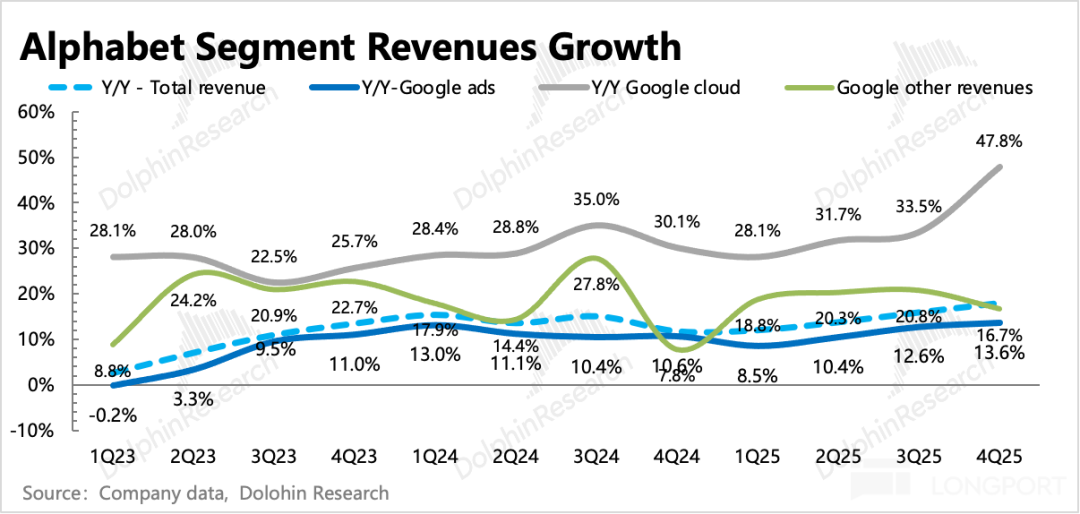

In Q4, Google's total revenue reached $113.8 billion, up 18% year-over-year (with a 1pct tailwind from currency exchange), exceeding consensus expectations. The core pillar, advertising, accounting for 70%, grew 13.6% year-over-year, accelerating sequentially, while cloud business performance was even more 'outstanding.'

Specifics:

(1) Advertising: Strong search, weak YouTube

Q4 advertising revenue reached $82.3 billion, up 13.6% overall. Core search continued to accelerate, reaching 16.7% growth. Powered by the strong Gemini 3, overall search continued to counter AI disruption theories. However, YouTube advertising unexpectedly slowed this quarter, likely due to Short's delayed monetization and pressure on YouTube TV's brand advertising in Q4.

Despite strong industry sentiment in Q4, especially in e-commerce retail and travel sectors, and AI-driven improvements in ad conversion leading advertisers to favor online performance ads over brand ads, brand advertising faced pressure throughout Q4 and the second half of last year.

However, with the World Cup, Winter Olympics, and U.S. midterm elections this year, brand advertising may rebound.

Looking at YouTube's user ecosystem, it remains healthy (with U.S. user engagement sustained growth [continuously growing]). Monetization could be increased similarly to Instagram by raising ad load. This is why we believe YouTube's current weakness is manageable. However, given that both OpenAI and TikTok will enter the main battlefield this year, cautious monitoring is warranted.

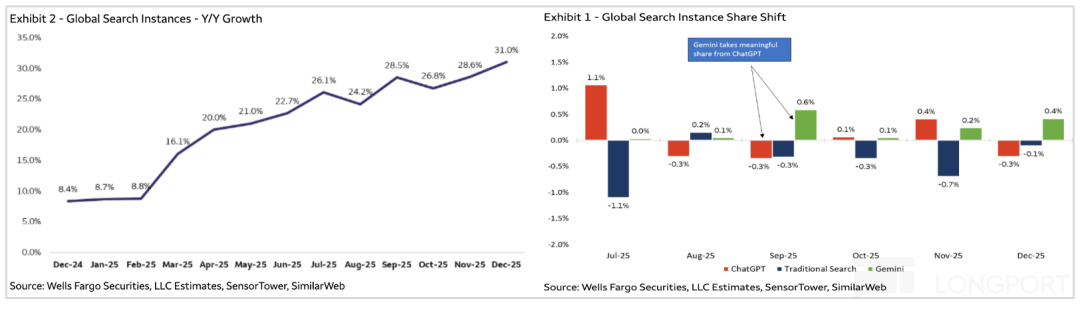

Regarding AI's substitutive impact on traditional search, Google has held its ground with the powerful Gemini 3 (significantly slowing ChatGPT's market share gains), currently enjoying a Dividend period [dividend period] of user migration before a complete collapse—driving improved overall search user experience, with user search queries accelerating over the past year.

(2) Cloud: Exceeded expectations, order backlog surged again

Cloud business is a critical support for Google's AI revaluation, with market attention focused on backlog growth from a forward-looking perspective.

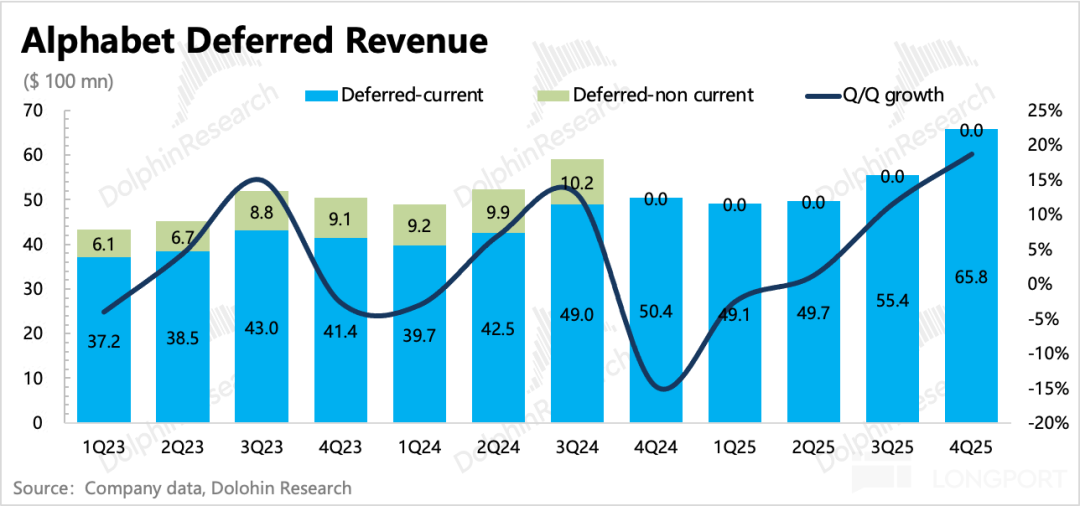

Q4 did not disappoint, with revenue recognition significantly exceeding expectations and remaining performance obligations accumulating to $240 billion, a net increase of $85 billion quarter-over-quarter (calculating new contract value at $102.7 billion), even more exaggerated than Q3's $47 billion net increase and $62 billion in new contracts.

Such abundant order 'inventory' is sufficient to sustain high cloud business growth for Google in the short term within a year.

(3) Other businesses: Driven by CTV & Google One

This revenue segment mainly comprises YouTube subscriptions (ad-free membership, TV, music, etc.), Google Play, Google One, hardware (Pixel phones and smart home appliances like Nest), etc.

Other income in the fourth quarter reached 13.6 billion, representing a year-on-year increase of 17%. The growth rate remains strong but has slowed down compared to the previous quarter. The growth was driven by YouTube memberships and Google One, which has been empowered by AI.

The company disclosed that as of the end of the fourth quarter, the total number of subscription users reached 325 million (up from just over 300 million in the previous quarter). Market estimates suggest that YouTube Premium + YouTube TV account for half of this total, with the other half coming from Google One.

According to Nielsen's data, the main drivers of growth are likely YouTube CTV and the subscription revenue growth of Google One. The deferred revenue situation also indicates a significant increase in advance subscription-based income.

III. Profitability: Unexpectedly Massive Capex

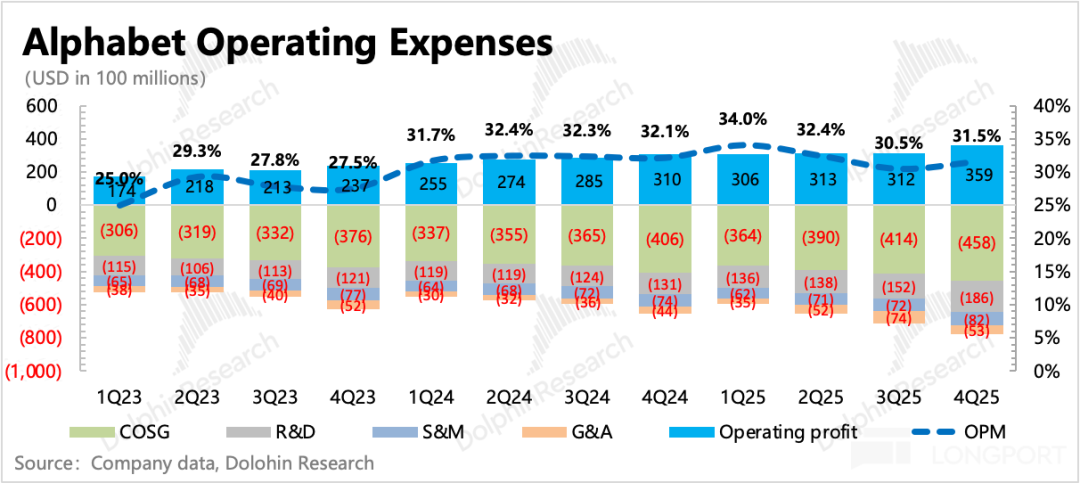

The operating profit of the core business in the fourth quarter was 35.9 billion, including 2.1 billion in employee stock-based compensation resulting from the increased valuation of Waymo. If added back, the core business's operating profit of 38 billion would exceed market expectations.

Under continuous AI investment, profit optimization mainly relies on revenue expansion. In terms of absolute spending, Q4 saw a 19% increase in total expenditures, a 13% rise in costs, and a 29% increase in expenses. Although the Q4 operating profit margin remained close to 32%, the sequential and year-on-year declines were not very significant.

However, depreciation expenses have been on the rise since Q3, with a year-on-year increase of over 40%. It is expected that with the massive Capex spending in 2026, total expenditures will eventually surge if not controlled. Therefore, Google's workforce adjustments will continue, as evidenced by the significant reduction in net new hires in Q4 to just 650 people, compared to the first three quarters.

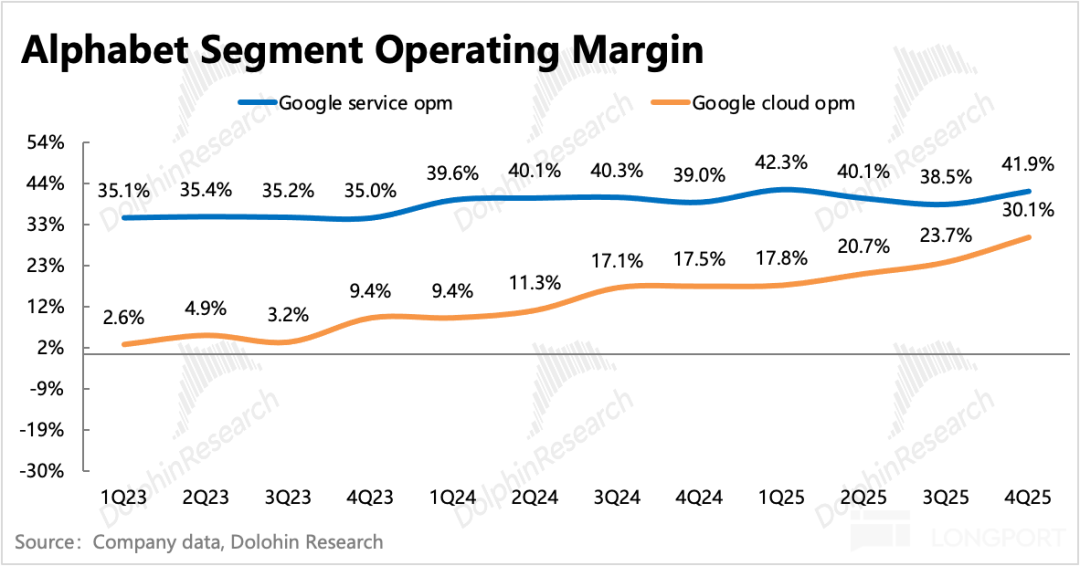

In terms of business segments, not only did Google Services see a sequential increase, but the profit margin of the cloud business also further improved to 30%, whereas the market had originally expected the profit margin to remain flat under investment pressure.

Capital expenditures in the fourth quarter were 28 billion, meeting market expectations. However, the company forecasts capital expenditures for next year to be in the range of 175-185 billion, far exceeding market expectations of 120-130 billion, representing a doubling in growth. While surprised by Google's sudden shift, considering management's limited history of blind investments, we have gained some confidence in the actual strong demand for Google's AI.

- END -

// Reprint Authorization

This article is an original piece from Dolphin Research. For reprint requests, please add WeChat: dolphinR124 to obtain authorization.

// Disclaimer and General Disclosure

This report is for general comprehensive data purposes only, intended for general reading and data reference by users of Dolphin Research and its affiliated institutions. It does not take into account the specific investment objectives, investment product preferences, risk tolerance, financial situation, or special needs of any person receiving this report. Investors must consult with independent professional advisors before making investment decisions based on this report. Any person making investment decisions using or referring to the content or information mentioned in this report does so at their own risk. Dolphin Research shall not be liable for any direct or indirect responsibilities or losses that may arise from the use of the data contained in this report. The information and data contained in this report are based on publicly available materials and are for reference purposes only. Dolphin Research strives to ensure but does not guarantee the reliability, accuracy, and completeness of the relevant information and data.

The information or views mentioned in this report shall not, under any jurisdiction, be regarded or construed as an offer to sell securities or an invitation to buy or sell securities, nor shall they constitute recommendations, inquiries, or endorsements of relevant securities or related financial instruments. The information, tools, and materials contained in this report are not intended for or proposed for distribution to jurisdictions where the distribution, publication, provision, or use of such information, tools, and materials conflicts with applicable laws or regulations, or to citizens or residents of jurisdictions where Dolphin Research and/or its subsidiaries or affiliated companies are required to comply with any registration or licensing requirements in such jurisdictions.

This report only reflects the personal views, insights, and analytical methods of the relevant creators and does not represent the stance of Dolphin Research and/or its affiliated institutions.

This report is produced by Dolphin Research, and the copyright is solely owned by Dolphin Research. Without the prior written consent of Dolphin Research, no institution or individual may (i) make, copy, reproduce, duplicate, forward, or create any form of copies or reproductions in any manner, and/or (ii) directly or indirectly redistribute or transfer to other unauthorized persons. Dolphin Research reserves all relevant rights.

Writing articles is tough. Click 'Share' to give me some energy~