Are the 'Five Little Dragons' of AIGC slimming down?

![]() 08/06 2024

08/06 2024

![]() 568

568

Throughout human history, every world-changing event has been supported and driven by advances in productivity and tools of production. As tools of production become increasingly advanced and technological, the intervals between revolutions continue to shrink, resulting in social, economic, and political effects that expand at a rate tens, hundreds, or even thousands of times faster.

Take, for example, the advent of the internet era at the end of the 20th century and the "All-Intelligent Era" that is now dawning, some 30 years later.

Recognizing the extraordinary significance of this trend, since late 2022, the AI wave has swept across the globe at an unprecedented pace, prompting significant investments and strategic layouts worldwide. The results have been positive feedback in generative AI fields like chatbots, exemplified by ChatGPT, Kimi, and iFLYTEK Spark.

In the realm of AI image generation, recently, domestic startup LiblibAI announced that it had completed three rounds of funding within a year, totaling hundreds of millions of Chinese yuan. This is reportedly the largest amount of funding raised in China's AI image generation sector to date.

How did LiblibAI, barely over a year old, gain capital recognition and whether it stands a chance of becoming the next dark horse?

The Next Dark Horse?

2023 is widely regarded as the inaugural year for the industrialization of AI, both domestically and internationally, particularly for AI applications that can directly interact with B2B and B2C customers. These applications were highly anticipated for their commercial prospects.

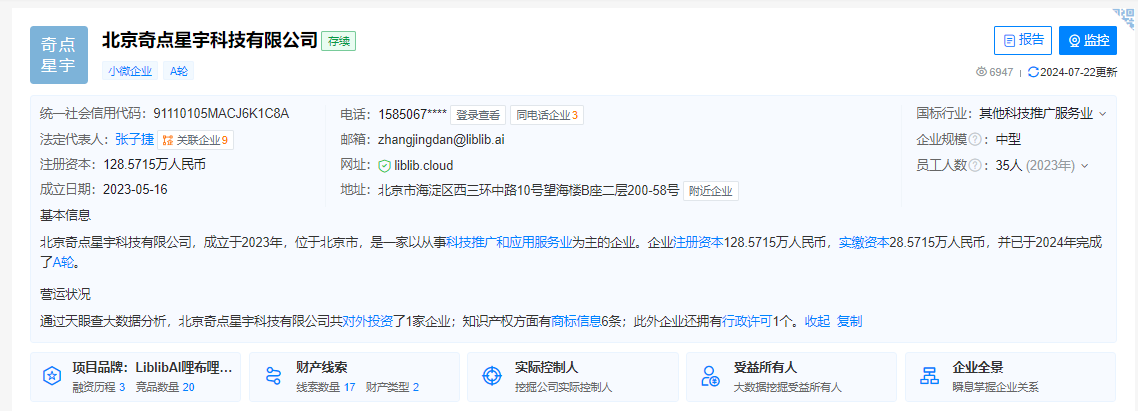

LiblibAI emerged precisely during this period. According to Tianyancha, LiblibAI is the core brand of Beijing Qidian Xingyu Technology Co., Ltd., founded in May 2023. As a typical startup, Qidian Xingyu is among the earliest domestic AI-native application companies.

As is well known, companies that can compete in the AI sector either have deep pockets or possess technological prowess or innovative ideas that attract external resources. So, which category does LiblibAI fall into?

Clearly, LiblibAI does not belong to the wealthy category, so it must be the latter.

Indeed, according to official sources, LiblibAI's Series A funding round secured the largest amount in China's AI image generation sector, with participation from several top venture capital firms. Its previous angel round included investments from Source Code Capital and Gaorong Capital, both of which had backed Moonshot Ventures, while its latest round was led by Matrix Partners China, which has invested in MiniMax.

Having attracted investors from two of China's "Four Little Dragons" of AI suggests that LiblibAI possesses some unique strengths among AI startups.

This can be glimpsed from LiblibAI's ongoing development trajectory. Officially, LiblibAI is an AI image generation enterprise that aims to revolutionize the creative processes of designers, artists, and self-media creators by leveraging AI technology, providing new AI-driven productivity for the content creation industry.

Currently, LiblibAI is the first AI community in China to be registered under the "Interim Measures for the Administration of Generative AI Services."

According to Xia Ling, partner at Matrix Partners China, LiblibAI's rapid rise to the forefront of the Chinese text-to-image field within just one year is attributed to its profound understanding of the pain points of professional users and the rapid iteration of its team and products.

A high-quality startup team has always been a core factor in determining the potential of AI startups, as evidenced by Microsoft's investment in Moonshot Ventures and Alibaba's in MiniMax. LiblibAI is no exception.

LiblibAI's core members boast educational backgrounds from prestigious universities such as Tsinghua University, Peking University, and Carnegie Mellon University, along with work experience at internet and design companies like Tencent, Alibaba, ByteDance, Microsoft, and Ogilvy. Many of them have entrepreneurial experience, forming the core resource base of LiblibAI.

However, to become the next Moonshot Ventures or MiniMax, LiblibAI still has a long way to go.

The reasons can be traced to the current stage of industry development.

Amid the funding 'freeze,' LiblibAI needs strong self-validation

A retrospective analysis of global AI funding in 2023 reveals that the emergence and development of new things are rarely smooth sailing.

While riding the wind of a trend may seem advantageous, the number of failures at the fringes of a new trend often far exceeds those who successfully navigate it. The current AI sector is no exception.

From the global popularity of chatbots in 2022 to the continued investments by tech giants in AI in 2023, the apparent fervor belies an overall cooling and polarization in AI funding.

Surprisingly, despite the AI sector's fervor last year, the total funding for AI startups has significantly declined, with the number of funding deals hitting a new low since 2017. According to CB Insights, global AI startup funding in 2023 fell 10% year-on-year to $42.5 billion, while Chinese funding plummeted 70% to just under $2 billion.

In contrast to struggling small and medium-sized AI startups, AI unicorns have enjoyed exclusive capital favor in 2023.

OpenAI received a $10 billion investment from Microsoft, while Anthropic secured $6 billion from investors including Amazon. These two deals alone accounted for over 10% of annual AI venture capital funding in the US. Thanks to these massive funding rounds, the US was the only region to witness year-on-year growth in AI funding, at 14%.

The domestic situation is similar. While China's AI industry funding increased by nearly 51% to RMB 263.1 billion in 2023, the number of funding events decreased by 18.2% to 815. This suggests that capital markets are increasingly cautious about AI startups, making funding more challenging for them.

Hence, LiblibAI's funding of hundreds of millions of Chinese yuan stands out as the largest in China's AI image application sector.

However, such funding enthusiasm is crucial for AI startups that require significant investments. While LiblibAI is not purely focused on large model development, its vision of an AI creation community relies on algorithms, computing power, and reasoning capabilities, all of which demand substantial financial support.

Currently, the amount of funding secured by LiblibAI is insufficient to build a truly "China's largest AI image generation platform." Therefore, breaking the funding impasse requires careful consideration.

Profitability Determines LiblibAI's Future

The root of funding issues lies in the source. For startups, there are two main paths: funding-driven growth and internally generated revenue.

AI companies currently face a dilemma at this crossroads. On the one hand, technological innovation requires substantial funding. On the other hand, the nature of capital is profit-seeking, and most pure AI companies lack sufficient self-funding capabilities, making it challenging to attract investments and resulting in a profitability conundrum.

Recent examples include Perplexity AI, an AI search engine startup nearly a year old, planning to sell equity, and Stability AI, once valued at up to $1 billion, operating at a loss since inception and rumored to be actively seeking a sale. The list of AI startups struggling with profitability is long.

In reality, most profitable AI ventures are small-scale individual endeavors. Scaling these ventures into companies would likely prove unsustainable due to high operating and R&D costs.

A business model that maximizes profitability is crucial for AI startups like LiblibAI.

Midjourney, an AI drawing platform, offers valuable insights. Estimated to have generated around $300 million in revenue in 2023, Midjourney leverages the Discord gaming chat community to engage directly with creators, driving user acquisition and profitability through its subscription model.

Liblib AI employs a similar monetization strategy, building an AI-powered community for image generation and creation. It accumulates both model and image creators, forming a comprehensive ecosystem encompassing AI content creation, sharing, copyright, and sales.

To date, Liblib AI has amassed nearly 10 million professional AI image creators, over 100,000 original models, and facilitated the production and sharing of over 230 million AI images. This underpins Liblib AI's ability to secure investments from two of China's "Four Little Dragons" of AI.

As AI investment rationalizes, a viable profit model positions LiblibAI for a promising future. However, as the AI industry enters its rapid growth phase, whether LiblibAI can steadily progress remains to be seen.

Source: Pinecone Finance