"Ghost stories" keep popping up, is there no bottom for US stock market losses?

![]() 08/06 2024

08/06 2024

![]() 618

618

NVIDIA's Blackwell chip, a pioneer in the US beef industry, may delay shipments due to design issues, while the lack of highlights in giant companies' financial reports has led to more negative than positive impacts. Warren Buffett significantly reduced his Apple holdings and cash positions hit a record high. Japan raised interest rates and the Bank of Japan took a hawkish stance, leading to sharp deterioration in US employment expectations and a surge in the yen exchange rate. This caused the collapse of arbitrage trades involving borrowing yen to buy Mag 7+AI stocks. Additionally, tensions between Israel and Iran have escalated. It seems that within less than a week, ghost stories in the stock market have erupted en masse, and the market has instantly shifted to "Risk Off" mode. During the fermentation of these ghost stories, the macro trigger was the depreciation of the yen, but the real fatal blow came on Friday evening when the US unemployment rate suddenly soared, causing market expectations for the US economy to plummet, turning directly into a recession trade. So, was Friday's US non-farm employment report really that bleak?

I. Has US employment already collapsed?

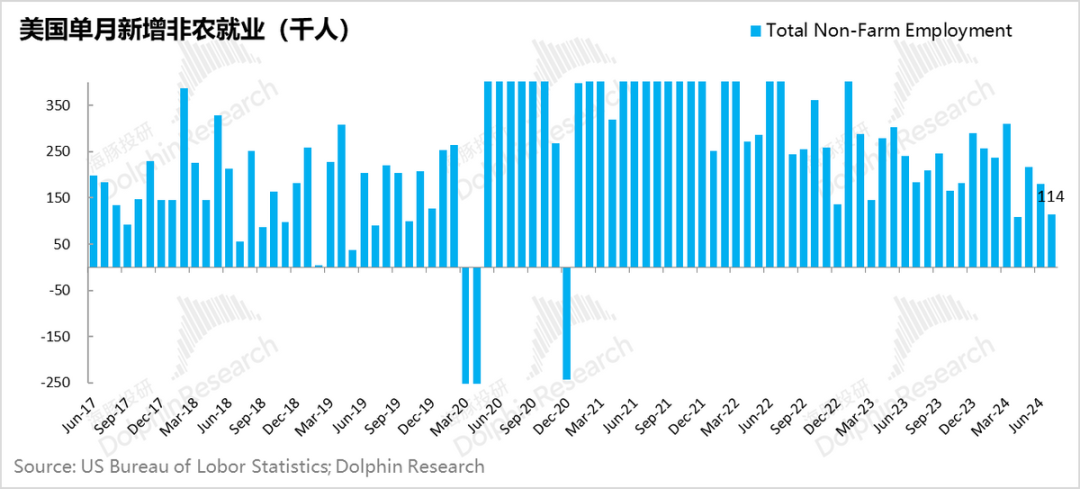

As soon as the July non-farm employment figures were released, the market was immediately shocked: both new non-farm employment and the unemployment rate underwent significant changes, indicating that the feared nonlinear inflection point in employment data had arrived. Coupled with the accelerating contraction in the manufacturing PMI, the market immediately transitioned to a recession trade. Indeed, the addition of 114,000 non-farm jobs in a single month is less than ideal compared to the pre-pandemic average of around 170,000-180,000 jobs per month. However, monthly fluctuations are common, and while the Labor Department stated that hurricane weather did not materially impact July data, some people may have faced issues reporting to work due to the hurricane last month, potentially affecting data statistics.

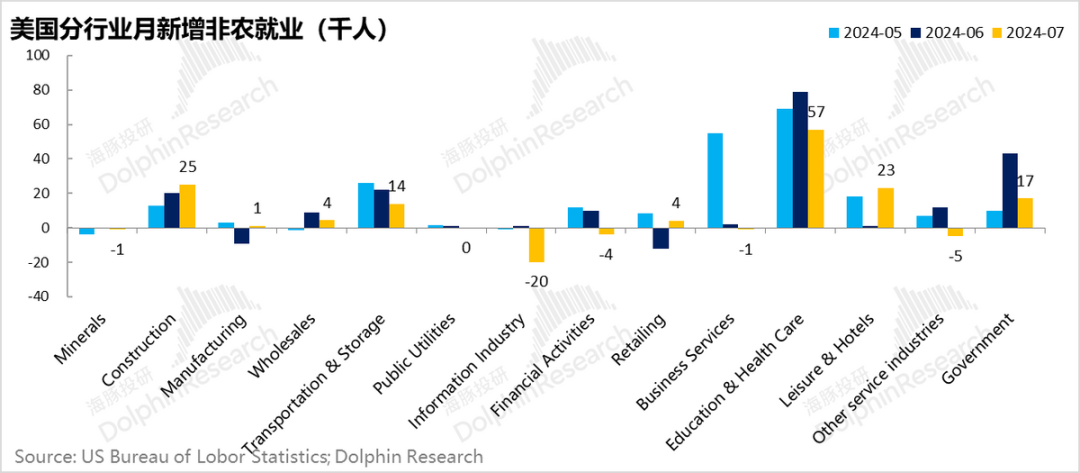

Another observation is that, from a sectoral perspective, the construction industry remained robust during this robust employment cycle, and even the manufacturing sector performed decently. The real marginal deterioration has been in the service sector, which Dolphin has been concerned about in recent months. However, the sudden deterioration in two sectors within the service industry is quite perplexing – information technology and finance. Various sub-sectors of the information technology industry, including film, music, publishing, advertising and media, telecommunications, and computing infrastructure services, have entered a full-scale layoff mode. Additionally, financial services have also entered a complete net layoff state. In the professional services sector, while temporary employment services were heavily impacted by layoffs last month, in July, not only did blue-collar jobs in this sector continue to deteriorate, but white-collar professional services such as accounting, scientific research, and advertising and media also saw deterioration.

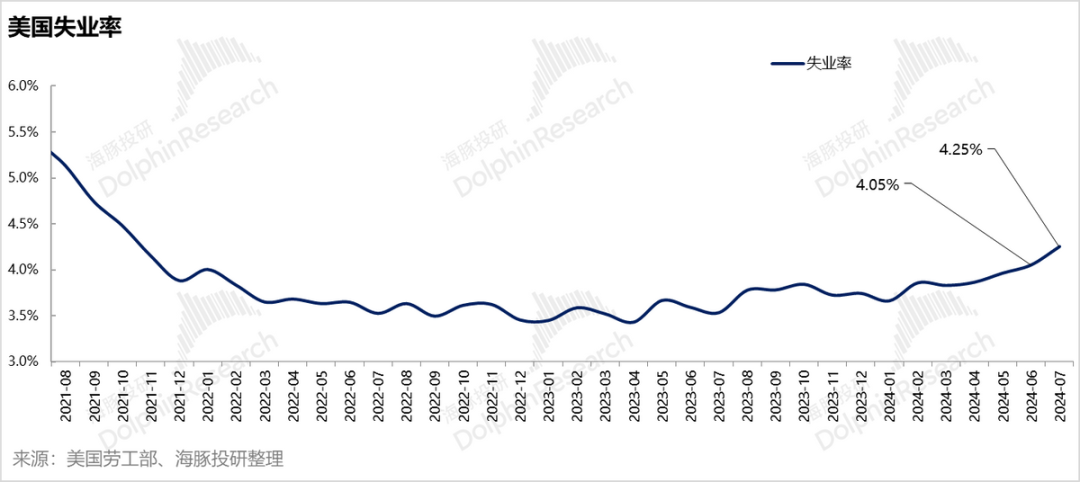

This information differs from the micro-level observations made by Dolphin, such as tech companies generally restarting hiring and media and entertainment companies like Netflix entering new investment cycles. The macro and micro-level perceptions are inconsistent, and given the abnormal weather conditions like hurricanes in July, Dolphin believes that the July data should not be taken at face value. Another factor is that the unemployment rate jumped from 4.05% to 4.25% in July, but upon closer inspection, this increase appears to be more related to excessive supply rather than a sharp drop in corporate hiring demand.

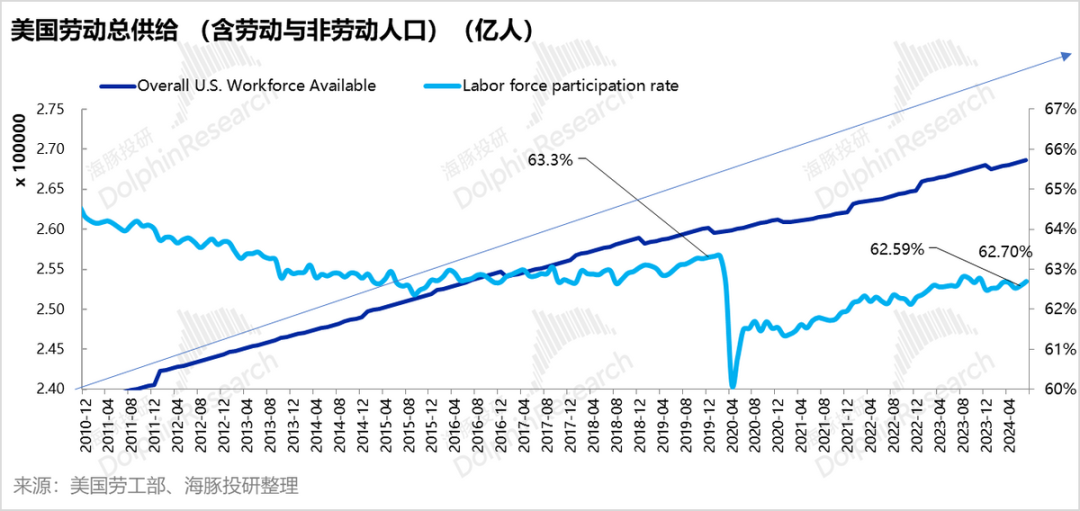

First, the total US labor force pool, including both labor force participants and non-participants, increased by a net 206,000 in July, the highest peak in the past eight months. Second, within this total pool, the labor force participation rate increased significantly from 62.6% in June to 62.7% in July, providing the market with 290,000 newly unemployed individuals.

As Dolphin previously mentioned, immigrants make up a significant portion of the new labor force in the US. As the employment market gradually balances, adjusting the flow of immigrants is much easier than preparing for labor supply 15 years in advance through increased fertility rates in endogenous population growth countries. Moreover, immigrants represent an additional source of aggregate demand in the society. An increase in unemployment due to supply factors is distinct from a reduction in labor demand caused by poor corporate profits and weaker expectations. Based solely on July's employment data, Dolphin believes it is premature to shout about a recession. Instead, Dolphin believes that employment and PMI data since July will merely bring forward the timing of interest rate cuts to September, which is already fully priced into the market. This aligns with Powell's statement at the July meeting that under continued good inflation and normal employment data, an interest rate cut in September is indeed possible. Market adjustments that do not threaten financial stability are not sufficient to quickly influence the Fed's decision-making mechanism.

II. The real bursting of the US stock market bubble, and the uncertain opportunities for Chinese stocks

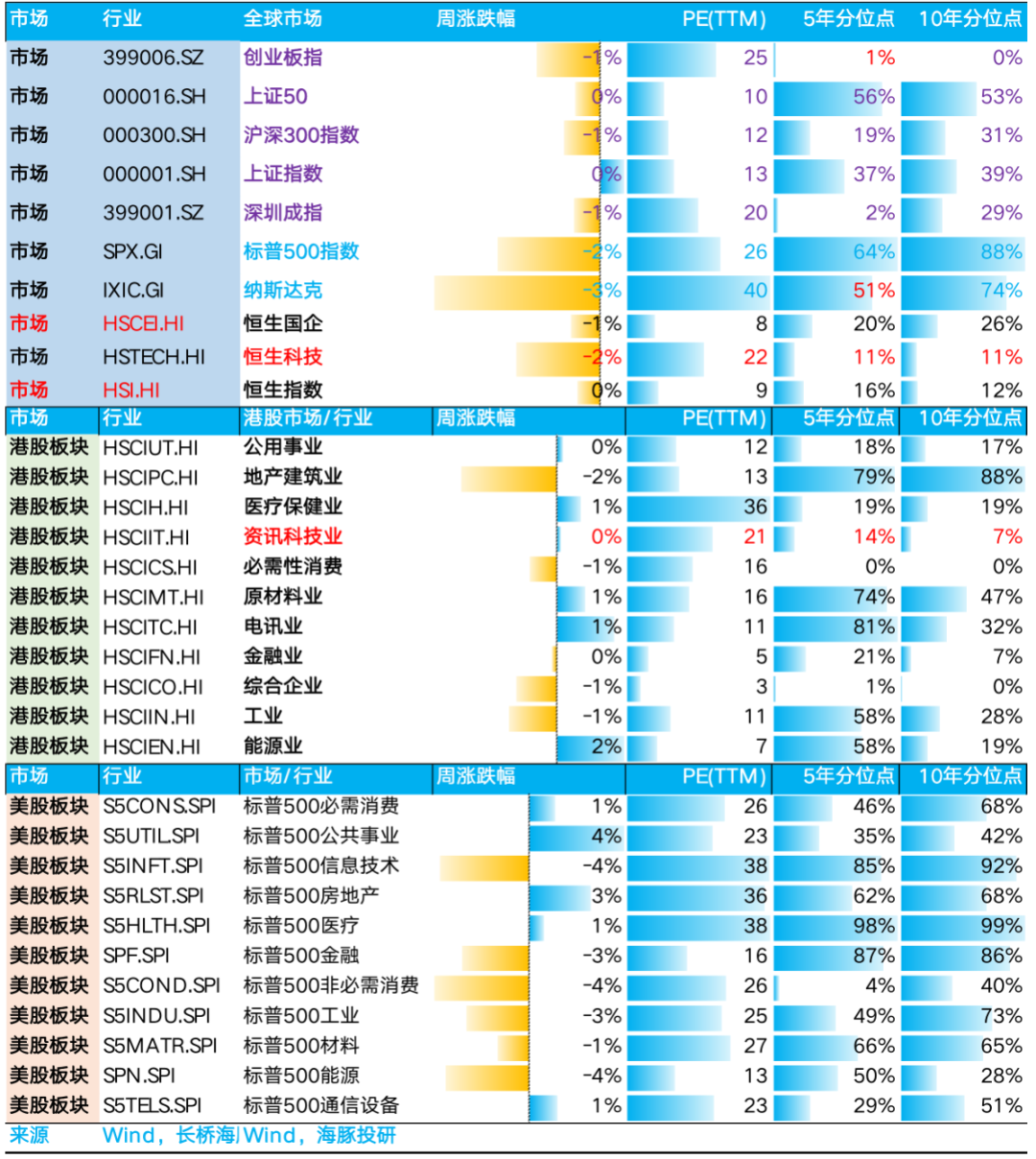

While the July employment data may not indicate an abrupt downturn, it does not support the current lofty valuations of US stocks, especially given the upward trend in CAPEX+OPEX and downward trend in revenue growth observed in the financial reports of leading US companies. Conversely, the valuations of the FAANG+MSFT stocks seem high, with two advertising stocks trading at over 20X PE despite weakening economic conditions, and PE ratios rising rather than falling in the first half of the year. Apple and Microsoft, with either single-digit or teens growth rates, are valued at over 30X PE. NVIDIA's valuation based on current earnings expectations may not seem high, but it implicitly assumes a mindless linear extrapolation of high growth, pricing in estimates up to two years in advance. This can lead to significant share price volatility even if output delays are due to supply issues rather than demand issues.

For Tesla, funds speculating on AI valuation expectations have ignored the poor fundamentals of the automotive business, especially as the deterioration in fundamentals is not solely due to product cycles and high macro interest rates but also to intensifying competition and narrowing gaps between Tesla and its competitors. In Dolphin's valuation logic, which encompasses both hardware and software stories, software narratives without a solid hardware foundation are easy to inflate but difficult to sustain. This is why Dolphin significantly reduced its Alpha Dolphin virtual holdings and shifted funds towards US Treasuries and gold when the US stock market began trading rate-sensitive stocks on the path to a soft landing in late July (see "Are the 'Glorious' US Small-Cap Stocks Nourished by Economic Fundamentals?" for details).

The recent trading in US stock market giants, in Dolphin's view, is more likely a result of the combined effects of negative earnings news in US stocks settling in, coupled with the yen's appreciation amidst Japanese interest rate hikes and a hawkish stance by the Bank of Japan, and the weakening of the US dollar. This led to significant fluctuations in exchange rates and the collapse of arbitrage trading, squeezing market liquidity. Among the three types of stock declines – “killing earnings,” “killing valuations,” and “killing logics” – Dolphin believes that the technology stocks it covers are primarily experiencing valuation declines. There are no fundamental issues with their earnings or logics; rather, the market has become overly excited, pricing in too much AI-related growth expectations ahead of time, without adequately considering the pressure on financial statements during the AI's upfront investment phase. Compared to the widespread valuation declines seen in US tech giants, most Chinese peers have already experienced significant valuation compression. Following significant liquidity-driven share price declines, investors may want to consider the potential for modest fundamental recovery as the US and, subsequently, China cut interest rates. In other words, during this period of significant market volatility, Chinese stocks may prove more resilient, and their elasticity may strengthen under the influence of domestic and international interest rate cut logics following the declines.

III. Portfolio Performance

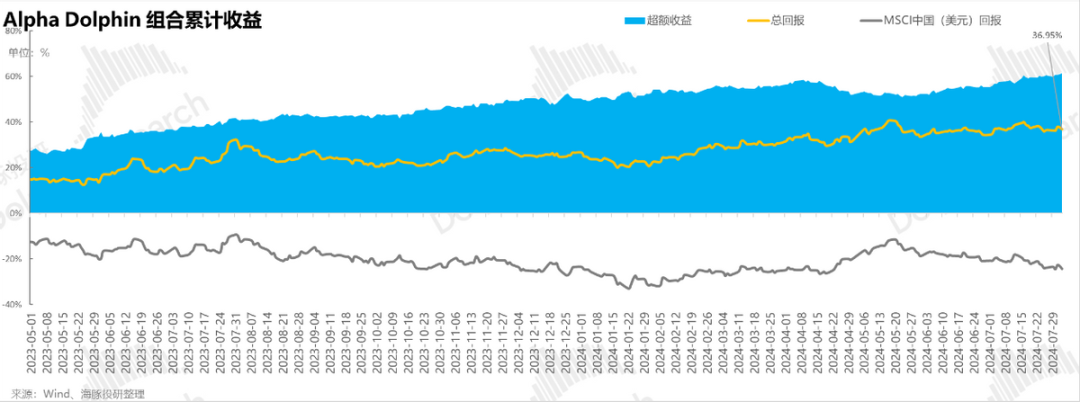

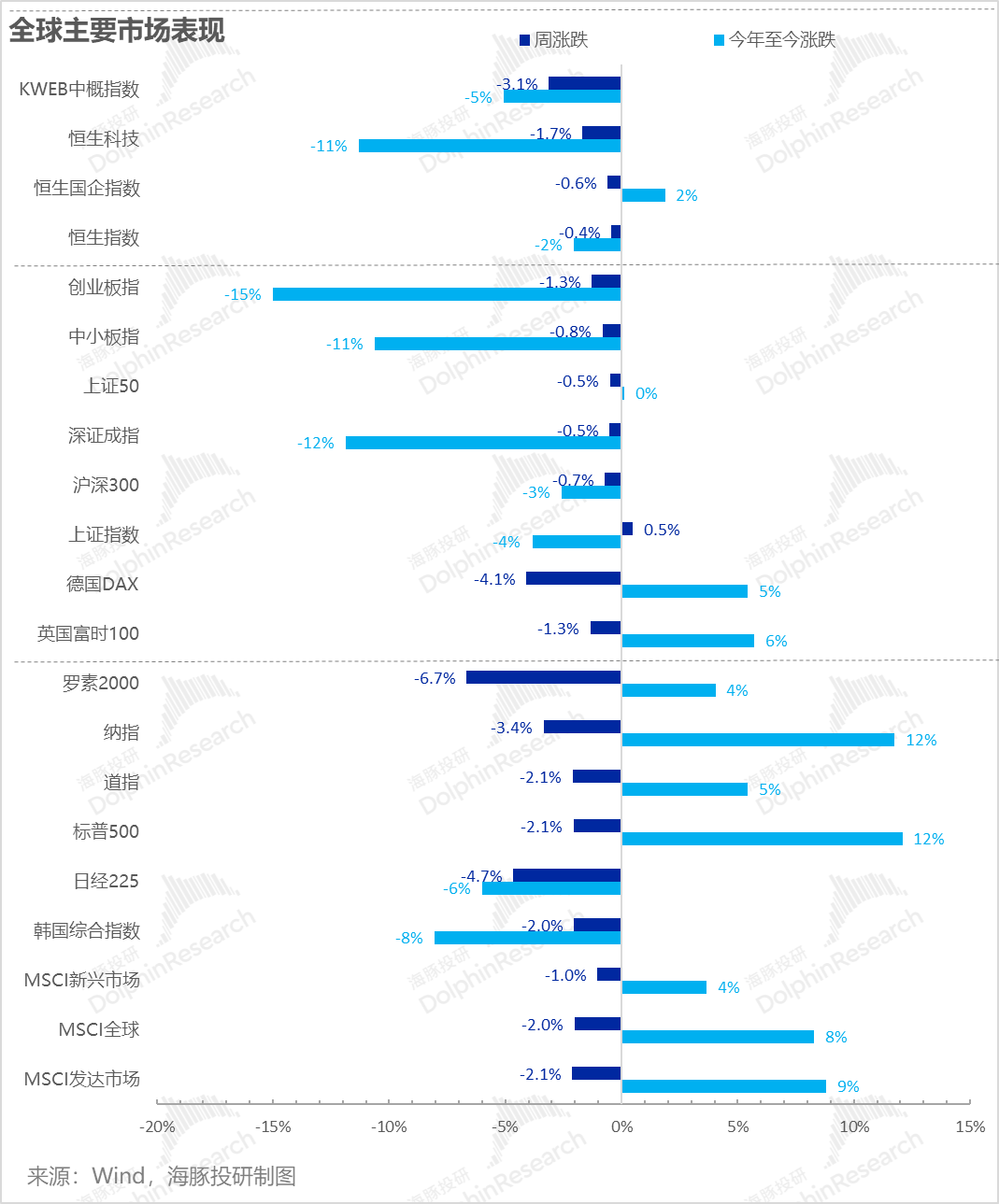

Following significant reductions in mid-July, Dolphin made no adjustments to the portfolio last week. For the week ended, the portfolio gained 0.3%, significantly outperforming major market indices such as the S&P 500 (-2.1%), MSCI China (-0.6%), Hang Seng Tech Index (-1.7%), and CSI 300 (-0.7%). This was primarily due to Dolphin's decision to unload positions ahead of the earnings season to avoid risk and increase bets on US Treasuries and gold. While Dolphin's equity holdings did experience some declines in line with the market, the positive performance of gold and Treasuries resulted in an overall positive return for the portfolio. Since the portfolio's inception for testing purposes, the absolute return has been 37%, with an excess return of 61.3% compared to MSCI China. In terms of net asset value, Dolphin's initial virtual assets of $100 million have risen to $139 million.

IV. Individual Stock Performance Contributions

Last week, with Japan raising interest rates and the US dollar weakening on expectations of lower PMI and employment data, the global market was generally down, with only variations in the magnitude of declines.

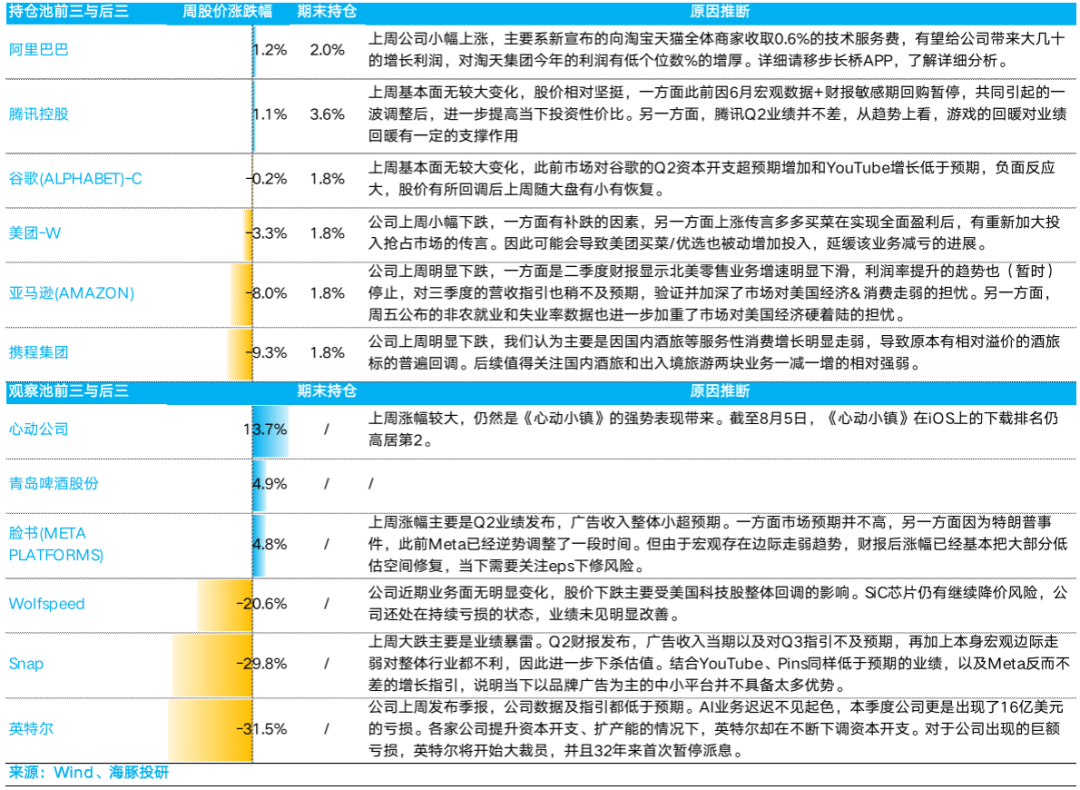

Dolphin provides the following explanations for the significant price movements in the stocks it follows last week:

V. Portfolio Asset Allocation

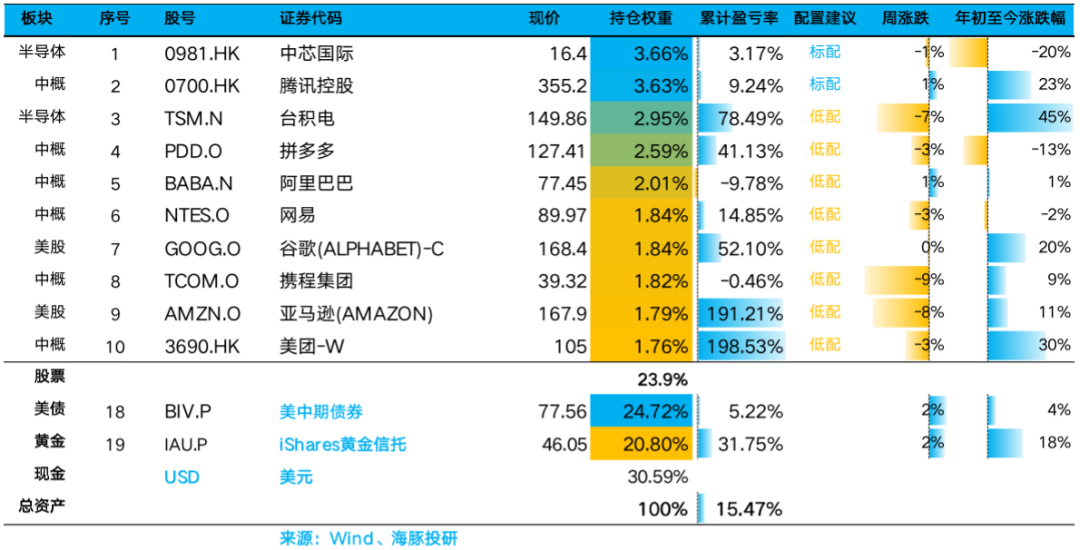

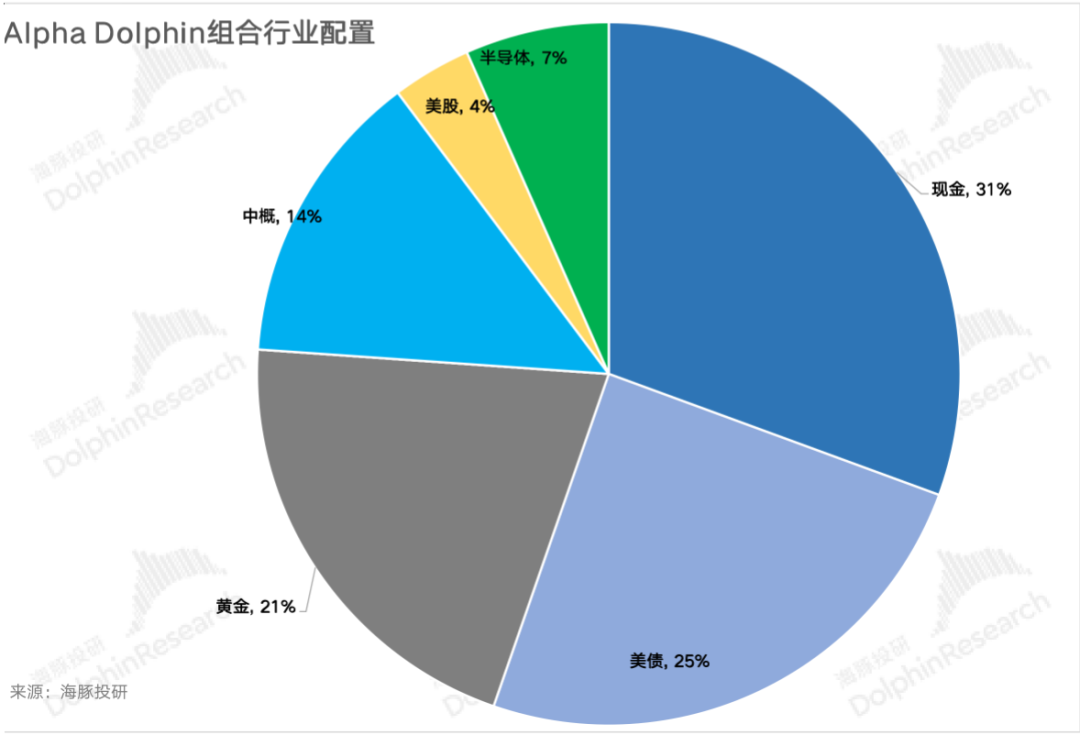

The Alpha Dolphin virtual portfolio holds a total of 10 individual stocks and equity ETFs, with two standard allocations and eight underweight equity assets. The remainder is allocated to gold, US Treasuries, and US dollar cash. As of last weekend, the Alpha Dolphin asset allocation and equity asset holdings weights were as follows:

VI. Key Events This Week

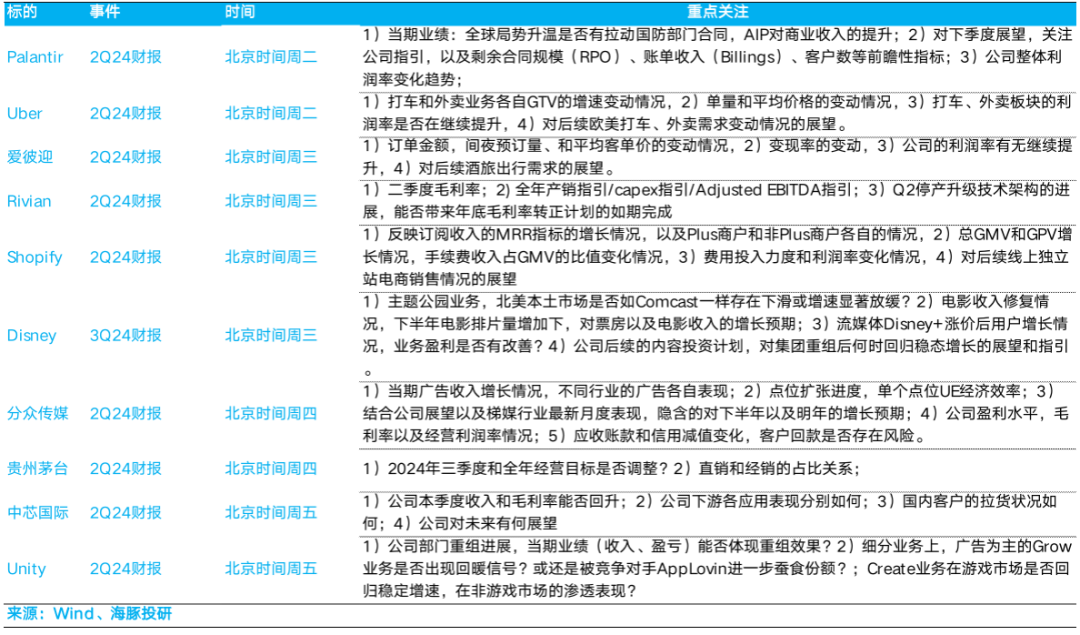

This week, the US stock market enters the stage of announcing earnings for smaller, niche companies. However, last week's significant drop in Roblox's share price following slightly disappointing guidance indicates the market's stringent stance towards such high-growth, high-valuation small-cap stocks. This week, as niche giants like Uber, Airbnb, Shopify, and Unity announce earnings, the market should be prepared for the risk of a second round of growth stock declines. Additionally, early earnings announcers from China include SMIC, Moutai, and Focus Media. Dolphin's key observations on these companies are as follows:

- END -

// Reprint Authorization

This article is original content from Dolphin Investment Research. For reprinting, please obtain authorization.