From a former e-reader giant to years of consecutive losses, what happened to Hanwang Technology?

![]() 08/07 2024

08/07 2024

![]() 701

701

Author: Zhang Shiyu

Hanwang Technology, once renowned for its e-readers, was founded in 1993, with e-readers booming in the market in 2009. However, with the advent of the smartphone era, the company gradually transitioned into four major areas: text big data, intelligent pen interaction, biometrics, and AI smart terminals. Facing the AI wave in 2023, Hanwang Technology invested in large model technology trends, leveraging NLP technology advantages to deepen AI applications and strive for continuous development in the AI sector.

The constant changes also expose the instability in Hanwang Technology's business development. Despite keeping up with the times and striving for self-rescue through transformation, it cannot be denied that Hanwang Technology has long left behind its former glory, mired in unprecedented difficulties in recent years.

According to 2023 financial report data, the company faces dual challenges of intensified product market competition and cost pressures, experiencing consecutive years of losses with sales costs far exceeding R&D costs. Despite heavy investments in large model R&D, the market response has been tepid, failing to effectively drive business growth. Notably, Hanwang Technology has also frequently encountered setbacks, including insider executive share reductions and patent infringement lawsuits.

Hanwang Technology struggles with persistent losses

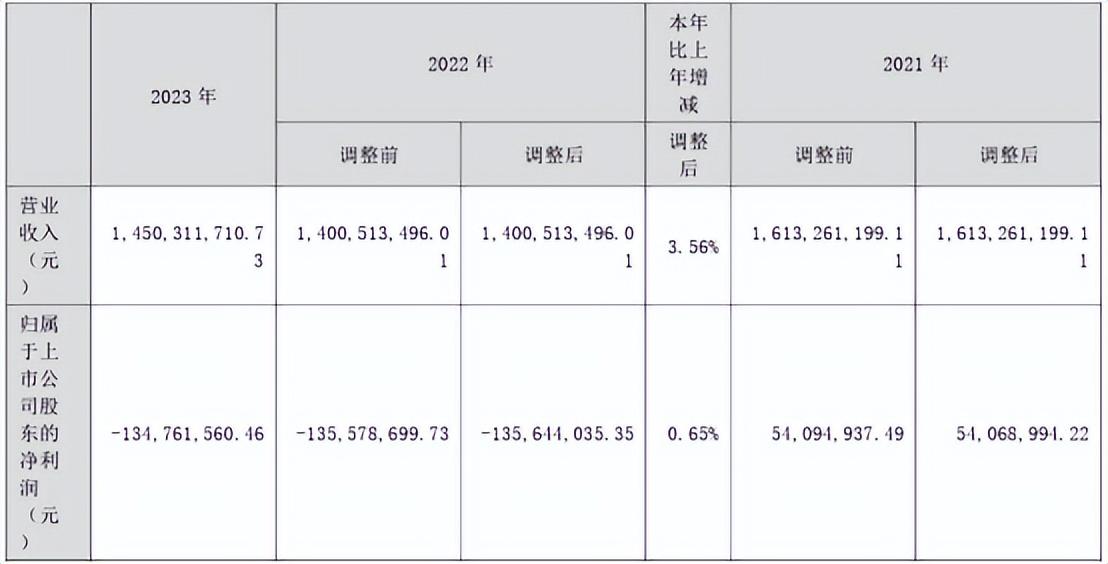

According to Hanwang Technology's 2023 annual report, the company achieved revenue of 1.45 billion yuan, a year-on-year increase of 3.56%, a relatively small growth. However, the company's total operating costs amounted to 1.575 billion yuan, exceeding revenue, resulting in massive losses for two consecutive years, with a net loss of 135 million yuan. Notably, sales costs accounted for nearly 30% of total operating costs and have continued to rise in recent years, while R&D expenses have grown at a much slower pace than sales expenses.

Specifically, Hanwang Technology's sales expenses in 2023 reached 430 million yuan, a year-on-year increase of 19.46%, while R&D expenses, though also growing, increased by only 23.21% to 246 million yuan. The surge in sales expenses did not translate into corresponding revenue growth, instead eroding the company's profit margins. This strategy of prioritizing sales over R&D has put Hanwang Technology at a disadvantage in market competition.

Moreover, Hanwang Technology's 2024 first-half performance forecast predicts a loss of 45-60 million yuan, compared to a loss of 51.8583 million yuan in the same period last year. The company attributes these losses to increased R&D expenses in AI and enhanced marketing efforts for AI products.

Traditional pen interaction hits a bottleneck, AI terminal development trends unclear

Hanwang Technology's product line encompasses intelligent pen interaction, text big data and services, and AI terminals. While intelligent pen interaction remains a traditional strength, growth has been limited in recent years, at just 0.18%. AI terminals have shown considerable growth at 30.36%, but their market share remains small. Text big data and services have maintained stable growth, but profit margins have declined.

In terms of product advantages, Hanwang Technology has technical accumulations and market reputation in intelligent pen interaction, but faces intense competition requiring improved product innovation and market responsiveness. AI terminals show potential, but trends remain unclear.

Riding the large model hype, failed to drive growth

Last year, renowned domestic tech companies unveiled their independently developed large models, including Baidu's ERNIE Bot, Alibaba Cloud's Tongyi Qianwen, Tencent's Hunyuan, Huawei's Pangu, SenseTime's Ririxin, iFLYTEK's Spark, and 360 Group's 360 Brain. Amid this heated "Hundred Models War," Hanwang Technology joined the fray with its Hanwang Universe large model in October 2022, covering ancient Chinese, law, education, and office applications. Touted as having five major commercialization capabilities: data privatization, low-cost computing power, deep specialization, real-time knowledge, and precise generation.

With the large model hype, Hanwang Technology saw seven consecutive trading limits last year, pushing its share price to a peak of nearly 17 yuan. However, over a year, as expected growth and technological innovations failed to materialize swiftly, Hanwang Technology's valuation underwent significant adjustments, reflecting capital markets' stringent requirements for tech firms' growth potential and investors' rational reassessment of value.

In my view, this can be attributed to two factors. Firstly, large model R&D requires long cycles, heavy investments, and high risks, necessitating strong technical and financial capabilities. While Hanwang Technology has invested in large model R&D, it lags behind industry leaders. Secondly, large model market applications require time and validation, with Hanwang Technology needing to strengthen marketing and user experience.

Furthermore, the timing of Hanwang Technology's large model launch was awkward. When it debuted, the market was already flooded with general and vertical large models, intensifying competition. While Hanwang Technology's model has unique features, it faces challenges in market acceptance and user awareness.

Insider executive share reductions, patent infringement lawsuit losses continue

Last year, Hanwang Technology also faced executive changes, particularly insider executives Xu Dongjian and Li Zhifeng's share reductions and resignations, casting a shadow over the market. Xu Dongjian planned to reduce his holdings by up to 140,000 shares due to personal financial needs, while Li Zhifeng intended to reduce his stake by around 170,000 shares. Both held senior positions with years of experience and influential connections, sparking concerns about the company's internal stability and future strategies.

On the other hand, Hanwang Technology's patent infringement lawsuit loss against ZKTeco further aggravated market worries. After a year-and-a-half battle, the National Intellectual Property Administration invalidated all involved patents, and Beijing Intellectual Property Court dismissed Hanwang Technology's suit. This outcome not only deprived the company of potential massive compensation but also questioned its technological prowess and patent portfolio quality. While Hanwang Technology holds over a thousand valid patents, about 800 are invalid, including those terminated due to unpaid annual fees, reflecting deficiencies in patent management.

Conclusion

Hanwang Technology, once a pioneering e-reader tech firm, has undergone a tumultuous transformation journey. From e-reader glory to venturing into text big data, intelligent pen interaction, biometrics, and AI smart terminals, Hanwang Technology has sought breakthroughs and self-rescue. However, with intensifying market competition and accelerating technological changes, Hanwang Technology faces significant challenges.

Years of losses and sales costs far exceeding R&D costs shackle the company's progress. Insider executive share reductions and patent infringement lawsuit losses further cloud its development, exacerbating market concerns about its future. Hanwang Technology's road to overcoming current difficulties is long and arduous. Chairman Liu Yingjian once expressed his aspiration for Hanwang to become a Fortune 500 company before retirement. Given Hanwang's current situation, this goal remains distant.