Why Is Changan Auto's Global Expansion Worthy of Anticipation?

![]() 12/30 2025

12/30 2025

![]() 560

560

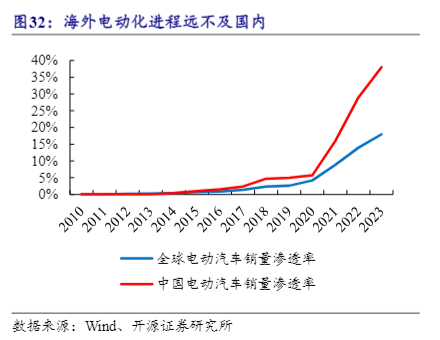

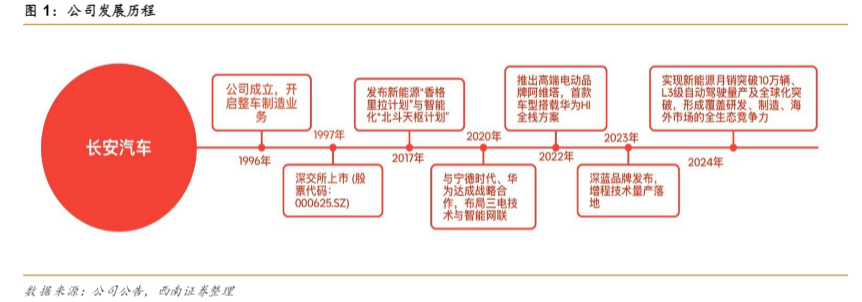

As the penetration rate of China's domestic new - energy vehicle market exceeds 50% and growth gradually decelerates, the vast overseas market has emerged as a crucial battleground for Chinese automakers aiming for sustained growth. Against this backdrop, the newly - integrated China Changan Automobile Group has announced its ambitious goal: by 2030, it aims to achieve production and sales of 5 million vehicles, with new - energy vehicles accounting for over 60% and overseas sales making up more than 30%. This goal has attracted significant attention.

Why is Changan Auto's path of global expansion worthy of anticipation? The answer lies in a systemic transformation driven by technology, ecology, and operational models.

01. Global Expansion: A Necessity for Changan

In the grand journey of global expansion for China's automotive industry, while industry attention is often focused on BYD's vertical integration and Chery's scale - first approach, Changan Auto's value is frequently underestimated. It doesn't excel merely in a single technological breakthrough or rely solely on impressive monthly export figures. Instead, its true strength lies in a strategic rhythm and organizational structure that are more closely aligned with the essence of a "globalized enterprise."

Strategically, Changan's overseas expansion represents a profound transformation of its "corporate identity." The company's credo of "No Globalization, No Changan" is not just a catchy slogan; it signifies a complete repositioning in overseas markets, shifting from a "Chinese automotive exporter" to a "local automotive company." This is evident in the fact that over 60% of its overseas market personnel are local, and it has systematically promoted local operational entities such as "Changan Europe" and "Changan Latin America." The depth of this organizational foundation enables Changan to respond more acutely to regional market regulatory and cultural differences. Rather than engaging in simple product dumping, it forms a symbiotic relationship with local industrial ecosystems.

Tactically, Changan has adopted a pragmatic "dual - line drive" approach for fuel and electric vehicles, along with a base - based expansion strategy. Unlike BYD's aggressive promotion of new - energy vehicles overseas or Chery's heavy reliance on fuel vehicle portfolios in certain regions, Changan demonstrates remarkable flexibility. In Southeast Asia and Europe, where the acceptance of electrification is high, it builds brand recognition with electric brands like Shenlan and Avita. In markets like Latin America and the Middle East, where fuel vehicles still dominate, it swiftly establishes sales foundations and channel networks using its mature fuel vehicle product portfolios. This "market - specific strategy" allows Changan to capture growth opportunities in both developed and emerging markets simultaneously, resulting in a more robust growth structure and stronger risk resistance.

Systematically, Changan's "Oceanic Inclusiveness" plan aims to establish a controllable and sustainable global operational system. Instead of pursuing explosive growth in a single market, it systematically builds a "Iron Quartet" that encompasses brand building, localized production, supply chain management, and after - sales service on a global scale. Its production capacity layout often involves joint ventures and partnerships with local entities, which helps reduce political and investment risks. This seemingly "slow" systematic construction is, in essence, building moats for future scale effects and long - term brand value.

The core of Changan's overseas expansion story lies not in short - term data catch - up but in its attempt, as a large state - owned automotive group, to forge a globalization path distinct from that of private automakers. It emphasizes strategic patience, localization depth, and overall balance. Its performance will test the critical proposition of China's automotive industry transitioning from "opportunistic trade" to "systematic operation" in global markets.

02. Integration: Towards World - Class Status

Changan Auto's overseas expansion strategy has accelerated this year. The establishment of China Changan Automobile Group defies conventional "merger and acquisition" frameworks. This third central automotive enterprise, officially unveiled on July 29, 2025, with a registered capital of 20 billion yuan, assets of 308.7 billion yuan, and 110,000 employees, aims not simply to expand its scale but to address a more fundamental question: As the global automotive industry transitions from the mechanical era to the digital age, is "world - class" status merely a stack of sales volume and market share?

The answer lies in the logic of restructuring. The automotive industry chain has long suffered from fragmented technological resources and inefficient capital investments. Automakers often duplicate efforts in areas such as the three electric systems (battery, motor, controller) and intelligent driving, yet struggle to share research outcomes. The significance of the central enterprise platform lies in its ability to consolidate Changan Auto's existing technological accumulations and the research capabilities of affiliated units into a single "technological reservoir." It focuses efforts on breaking through core battlefields such as battery safety and intelligent driving assistance systems. This is not a resource integration driven by administrative directives but a more efficient organizational form trial in response to industry - wide pain points. When fragmented R&D investments are concentrated into strategic breakthroughs, the speed and depth of technological advancements will undergo a transformation.

The clarity of the technological roadmap determines the baseline of this experiment. Changan's "Shangri - La" plan constructs a dedicated new - energy vehicle platform in the three electric systems domain, while the "Beidou Tianshu" plan drives the implementation of intelligent driving, cabin, and computing architecture solutions. These two plans form the technological foundation supporting the three new - energy brands—Qiyuan, Shenlan, and Avita—which respectively target the mainstream, technology, and premium markets, forming a matrix rather than internal competition. The ingenuity of this layout lies in the cross - brand reuse of technological investments and the complementary market coverage among brands. The 2030 goal of 5 million vehicles is not a baseless projection but is built on the multiplicative effect of the technological foundation and brand matrix.

However, the true variable lies in the "Oceanic Inclusiveness" globalization plan. Changan is exporting an integrated local network of research, production, sales, and service rather than relying on simple KD (knocked - down) assembly. This touches upon the core proposition of Chinese automakers' globalization: Should they become cost centers in the global layout of multinational giants, or establish their own system standards? Changan's choice is clearly the latter.

The market often underestimates three key aspects. First, the institutional value brought by restructuring. The improved decision - making efficiency, resource synergy capabilities, and strategic execution of the new central enterprise represent long - term implicit value that may not immediately reflect in financial reports but will significantly alter the company's agility in responding to industrial transformations. Second, the explosive power of the new product cycle. The rapid improvement in sales volume and profitability of new - energy brands driven by new models may far exceed the iteration pace of traditional automakers. Third, the valuation reconstruction of intelligent layout. The deep collaboration with Huawei in intelligent driving and cabins, as well as forward - looking layouts in humanoid robots and flying cars, transforms the "technology company" attribute from marketing rhetoric into substantive businesses that may reshape the valuation system.

The catalyst landing rhythm is clear. The continuous exceeding of expectations in new model orders for Qiyuan, Shenlan, and Avita validates product competitiveness. The implementation of the L3 conditional autonomous driving access announcement translates technological leadership into commercial barriers. The release of the first in - vehicle component robot in the first quarter of 2026 and the subsequent unveiling of the humanoid robot prototype aim to establish dual capabilities in technology and commercialization in the embodied intelligence sector. These milestones are not isolated events but constitute the path from "automaker" to "technology company."

As the global automotive industry reshapes amid the tripartite variation of electrification, intelligence, and connectivity, the threshold for becoming "world - class" has evolved. It is no longer merely a competition of production capacity and market scale but a comprehensive contest of technological integration capabilities, organizational evolution speed, and strategic definition rights. The success or failure of this transformation will determine not only Changan's own stature but also the redefinition of Chinese traditional automakers' roles in the global industrial chain.

- End -